Australia

The Australian government actively encourages foreign investment, offering various incentives and support services to facilitate business establishment and growth. With a commitment to free trade, Australia has established numerous free trade agreements, reducing barriers and creating a more favorable business environment for investors.

Need more information about payroll, compliance and social security in Australia?

Talk To An Expert

Our free global insight guide to Australia offers up-to-date information on international payroll, income tax, social security, employment law, employee benefits, visas, work permits and key updates on legislative changes and more in 2024.

Basic Facts about Australia

Australia, the world's sixth-largest country by total area, is a diverse and vibrant nation known for its stunning natural landscapes, unique wildlife, and dynamic cities.

Situated in the Southern Hemisphere, it comprises the Australian mainland, the island of Tasmania, and numerous smaller islands.

With a history that spans over 60,000 years, Australia's rich cultural tapestry begins with its Indigenous peoples, the Aboriginal and Torres Strait Islanders, who are recognized for their deep spiritual connection to the land and their enduring cultures. European settlement began in 1788 when the British established a penal colony in New South Wales, leading to significant cultural and societal shifts. Over the centuries, Australia has evolved into a prosperous, democratic society with a strong economy, known for its commitment to the values of freedom, diversity, and respect. It plays an active role in global affairs, contributing to international peacekeeping efforts and fostering strong diplomatic and trade relationships worldwide.

- Full Name: Commonwealth of Australia

- Population: 26.005 million (World Bank, 2022)

- Capital: Canberra

- Largest City: Sydney

- Major Language: English

- Monetary Unit: 1 Australian dollar = 100 cents

- Main Exports: Ores and metals, wool, food and live animals, fuels and transport machinery

- GNI per Capita: US $65,100 (World Bank, 2022)

- Internet Domain: .au

- International Dialling Code: +61

Dates & Numbers in Australia

Dates are usually written in the day, month and year sequence. For example, 1 July 2024 or 1/7/24.

Numbers are written with a comma to denote thousands and a period to denote fractions. For example, AUD$ 3,000.50 (three thousand dollars and fifty cents).

Doing Business in Australia

Australia offers a robust, dynamic, and open market characterised by a strong economy, political stability, and a competitive business environment. Known for its strategic location, Australia serves as a gateway to the Asia-Pacific

Australia boasts a diverse and highly developed economy, with significant strengths in resources, technology, finance, manufacturing, and services sectors. The country's economic policies encourage innovation, entrepreneurship, and international trade, making it an attractive destination for investment. With a commitment to free trade, Australia has established numerous agreements with key global markets, further enhancing its appeal to businesses looking to operate on an international scale.region, providing businesses with unparalleled access to some of the world's fastest-growing markets.

Australia's legal and regulatory environment is designed to support fair trading, competition, and protection for both businesses and consumers. The Corporations Act 2001, administered by the Australian Securities and Investments Commission (ASIC), outlines the legal obligations for companies operating in Australia, ensuring transparency and integrity in corporate governance. Additionally, Australia's taxation system, managed by the Australian Taxation Office (ATO), is straightforward, with clear guidelines on tax obligations for businesses, including the necessity of obtaining an Australian Business Number (ABN) and a Tax File Number (TFN).

Australia's market is ripe with opportunities across various sectors. The country's strong focus on innovation and technology-driven industries, coupled with its rich natural resources, provides a fertile ground for businesses in renewable energy, biotechnology, mining, agribusiness, and more. Additionally, Australia's sophisticated consumer market is well-regarded for its demand for high-quality, innovative products and services, offering ample opportunities for businesses in retail, e-commerce, and consumer goods.

Doing business in Australia presents a promising opportunity for growth, innovation, and international expansion. With its stable economy, supportive regulatory environment, and rich market opportunities, Australia is an attractive destination for businesses worldwide. Success in this vibrant market requires a thorough understanding of the legal framework, market dynamics, and cultural nuances.

Why Invest in Australia

Australia boasts one of the world's most stable and resilient economies, with a track record of sustained economic growth. The country's economic stability is underpinned by a robust legal system, transparent regulatory environment, and a competitive business landscape. This stability offers businesses a secure environment for investment and operations.

Australia's geographic proximity to the rapidly growing Asia-Pacific region provides unparalleled access to emerging markets. The country serves as an ideal base for businesses aiming to tap into the vast consumer base and resources of Asia, enhancing opportunities for trade, investment, and collaboration.

Home to a highly skilled, multicultural workforce Australia excels in innovation and creativity. The country's emphasis on high-quality education and research fosters a talent pool that is well-equipped to drive business growth and technological advancement. Investing in Australia means access to this dynamic workforce, capable of propelling businesses forward in competitive global markets.

The Australian government actively encourages foreign investment, offering various incentives and support services to facilitate business establishment and growth. With a commitment to free trade, Australia has established numerous free trade agreements, reducing barriers and creating a more favorable business environment for investors.

The high standard of living in Australia, excellent healthcare system, and vibrant cultural scene make it an attractive destination for talent from around the world. This quality of life not only benefits employees but also contributes to a positive business environment, fostering innovation and productivity.

Australia's diverse economy provides a wide range of investment opportunities across various sectors, including mining and resources, agriculture, education, tourism, technology, and renewable energy. The country's natural resources, coupled with its commitment to sustainable development and innovation, offer unique investment prospects.

The Australian government offers a range of incentives to support business investment, including tax benefits, grants, and funding programs designed to encourage innovation, research and development (R&D), and international expansion. These initiatives provide a supportive framework for businesses to thrive.

Investing in Australia presents businesses with a strategic advantage in the global market, offering economic stability, access to skilled talent, a favorable business environment, and a high quality of life. Whether looking to expand into the Asia-Pacific region, tap into Australia's innovative workforce, or leverage the country's sectoral strengths, Australia stands out as a prime location for business investment.

Foreign Direct Investment in Australia

Foreign Direct Investment (FDI) plays a pivotal role in Australia's economic development, offering a gateway to the Asia-Pacific region and fostering a dynamic environment for international businesses. Australia's open market policies, coupled with a stable political and economic landscape, make it an attractive destination for FDI. The Australian government actively encourages foreign investment, recognising its importance in driving innovation, enhancing competitiveness, and creating jobs.

Government Incentives for FDI

The Australian government offers a range of incentives to attract and retain foreign investment, aimed at fostering a supportive environment for businesses:

- Tax Incentives: Various tax concessions are available to foreign investors, including reduced tax rates for innovation and research and development activities. The government also offers depreciation allowances for capital investments in specific sectors.

- Grants and Funding Programs: Investors can access grants and funding programs designed to support innovation, R&D, and expansion into international markets. These include the Export Market Development Grant (EMDG) and the Research and Development Tax Incentive.

- Free Trade Agreements (FTAs): Australia has established numerous FTAs with key global markets, reducing barriers to trade and investment and opening up new opportunities for businesses.

- Streamlined Regulatory Processes: Efforts to streamline regulatory approval processes for foreign investments, particularly in sectors deemed critical to the national interest, facilitate easier market entry and expansion.

- Investment Protection: Australia's legal framework provides strong protections for foreign investors, including agreements to protect against expropriation and discriminatory treatment.

Sector-Specific Opportunities

- Technology and Innovation: With a thriving startup ecosystem and a focus on technological advancement, Australia offers fertile ground for investments in tech and innovation.

- Agriculture and Agribusiness: Opportunities abound in sustainable agriculture, agtech, and food processing, capitalising on Australia's reputation for high-quality produce.

- Infrastructure: Significant investment is being directed towards infrastructure development, including transport, telecommunications, and urban development, presenting opportunities for foreign investors.

- Renewable Energy: Australia's commitment to renewable energy and sustainability opens up prospects in solar, wind, and other renewable energy projects.

FDI in Australia is supported by a combination of strategic advantages, including a stable economy, a skilled workforce, and access to Asian markets, alongside favorable government incentives. These incentives, aimed at promoting economic growth and innovation, position Australia as a compelling destination for foreign investors. By leveraging these opportunities, foreign investors can play a pivotal role in Australia's economic landscape, benefiting from the country's growth potential while contributing to its ongoing development and prosperity.

Business Banking in Australia

In Australia it is not mandatory to make payments to employees or the authorities from an in-country bank account.

Banks in Australia are typically open Monday to Thursday 9.30am to 4pm, Friday 9.30am to 5pm with some branches opening on a Saturday 9.30am to 1pm.

Registering a Company and Establishing an Entity in Australia

Starting a business in Australia is an exciting venture that opens up a world of opportunities. The process of registering a company and establishing a business entity is streamlined and efficient, designed to support entrepreneurs and businesses in their growth journey.

Types of Business Entities in Australia

Establishing a business presence in Australia, entities seeking to engage in commercial activities in the country must establish a legal presence, adhering to the regulations set forth by the Corporations Act 2001. This act is enforced by the Australian Securities and Investment Commission (ASIC), which plays a crucial role in regulating corporate behavior and ensuring compliance with corporate governance standards. For foreign companies looking to operate in Australia, the two most common strategies involve registering as a foreign entity or incorporating an Australian subsidiary. Each approach has distinct requirements and implications for operation within Australia's dynamic business environment.

Australian Branch of a Foreign Company

Establishing an Australian branch involves registering the foreign company with ASIC, a process that grants the entity an Australian Registered Body Number (ARBN). This registration necessitates the submission of certified identity documents for non-resident individuals and shareholders, ensuring transparency and legal compliance. Key obligations include:

- Registered Office Requirement: A physical office location within Australia must be established, serving as the branch's official address.

- Local Agent Appointment: The branch must appoint a local agent, an Australian resident individual or company authorized to act on behalf of the foreign entity.

- Public Officer for Tax Purposes: An Australian resident must be designated as the public officer, responsible for the entity's tax obligations.

- Financial Reporting: The branch is required to prepare audited financial statements annually and lodge them with ASIC, ensuring financial activities are transparent and compliant with Australian standards.

Australian Subsidiary Company

Incorporating an Australian subsidiary offers a distinct legal identity within Australia, regulated under ASIC's oversight. Upon incorporation, the subsidiary is assigned an Australian Company Number (ACN), marking its official registration. The subsidiary structure mandates:

- Shareholder and Director Requirements: At least one shareholder is required, and the company must have at least one director (two for public companies) who resides in Australia. Directors must secure a director identification number (ID) as part of governance and accountability measures.

- Registered Office: Similar to a branch, a subsidiary must establish a registered office within Australia.

- Public Officer for Tax Obligations: The designation of an Australian resident as the public officer for handling tax affairs is mandatory.

- Financial Reporting: Subsidiaries must prepare and submit audited financial reports to ASIC, though smaller entities may seek exemptions based on specific criteria.

- Incorporation Timeline: With all necessary information at hand, the incorporation process can typically be completed within one business day, facilitating swift entry into the Australian market.

Registering Your Business

The process of registering your business and establishing an entity in Australia involves several key steps:

- Choose Your Business Structure: Decide on the most suitable business structure based on your needs, considering factors like taxation, liability, and compliance requirements.

- Select a Business Name: Your business name should be unique and reflect your brand. Check the availability of your chosen name through the Australian Securities & Investments Commission (ASIC).

- Register for an Australian Business Number (ABN): An ABN is essential for all business activities in Australia. You can apply for an ABN via the Australian Business Register website.

- Register Your Business Name: Once you've secured your ABN, you can register your business name with ASIC. This registration is separate from your ABN application.

- Understand Your Tax Obligations: Depending on your business structure, you may need to register for Goods and Services Tax (GST), Pay As You Go (PAYG) withholding, and other taxes.

- Comply with Legal Requirements: Ensure that you comply with Australian laws regarding employment, health and safety, and industry-specific regulations.

- Open a Business Bank Account: A dedicated business bank account helps you manage your finances efficiently and is required for certain types of businesses.

- Obtain Necessary Licenses and Permits: Depending on your business type and location, you may need specific licenses and permits to operate legally in Australia.

Australian Business Number (ABN)

An Australian Business Number, commonly abbreviated as ABN, is an essential 11-digit identifier that distinctly represents your business within Australia. It serves as a foundational element for entities engaging in commercial activities within the country, facilitating efficient interactions with regulatory bodies and other businesses. Obtaining an ABN is a critical step for any entity operating in Australia; without it, transactions can become significantly more complicated. For instance, if a business does not provide its ABN in transactions, its clients or customers may be legally obligated to withhold a substantial 47 percent tax from payments as a precautionary measure against tax evasion.

When applying for an ABN, non-resident individuals and companies will be required to provide certified copies of certain proof of identity documents.

Tax File Number (TFN)

Parallel to the ABN, the Tax File Number (TFN) represents another pivotal component of Australia's taxation framework. Issued by the Australian Taxation Office (ATO), the TFN serves as a unique identifier for individuals and entities for taxation and superannuation purposes. It plays a vital role in various tax-related processes, including filing tax returns, applying for government benefits, and managing superannuation accounts.

Visas and Work Permits in Australia

Australia offers a range of visa types catering to different purposes, including work, study, tourism, and permanent residency. Below is an overview of some key visa types for businesses and employees and their application processes:

Temporary Skill Shortage Visa - Subclass 482

This visa allows skilled workers to live and work in Australia for up to four years in occupations where there is a shortage of Australian workers.

Applicants must be nominated by an approved Australian employer, possess the necessary skills for the nominated occupation, and meet English language requirements. The occupation must be listed on the Short-term Skilled Occupation List (STSOL) or Medium and Long-term Strategic Skills List (MLTSSL).

The process involves three stages:

- The employer lodges a nomination for a specific position

- The applicant then applies for the visa

- A skills assessment may be required.

Processing times vary but can take several months, depending on the occupation and completeness of the application.

Temporary Work (Short Stay Specialist) Visa - Subclass 400

This visa is for individuals undertaking short-term, non-ongoing, highly specialised work in Australia, generally up to three months, extendable up to six months in certain cases.

Applicants must have specialised skills, knowledge, or experience not generally available in Australia. It's not suitable for ongoing work or generic skilled labour.

Applicants must submit a visa application with evidence of their specialised skills and the nature of the work to be undertaken. The processing time can be relatively quick, often within weeks, but varies based on individual circumstances.

Employer Nomination Scheme - Subclass 186

This permanent visa allows skilled workers to live and work in Australia permanently and is part of the Australian Government’s Permanent Employer Sponsored Visa program.

The applicant must be nominated by an Australian employer and must possess the skills, qualifications, and English language proficiency for the nominated position. The occupation should be on the relevant list of eligible skilled occupations.

The process involves three stages:

- The employer lodges a nomination for a specific position

- The applicant then applies for the visa

- A skills assessment may be required.

Processing times can vary but generally take several months, depending on the stream and completeness of the application.

Business Innovation and Investment (Provisional) Visa - Subclass 188

This visa is for entrepreneurs and investors looking to establish business operations or invest in Australia. It has several streams, including Business Innovation, Investor, and Significant Investor, among others.

Applicants must be nominated by a state or territory government, meet investment requirements for the respective stream, and have a successful business or investment history.

The process begins with submitting an Expression of Interest (EOI) through SkillSelect. If nominated, the applicant then applies for the visa. Processing times vary greatly depending on the stream and can range from several months to over a year.

Visitor Visa - Subclass 600

This visa is for individuals who want to visit Australia for tourism, business visitor activities, or to visit family.

Applicants must have a genuine reason for visiting, sufficient funds for their stay, and must meet health and character requirements.

Applicants apply online, providing necessary documents to prove the purpose of their visit. Processing times are usually quick, often within a month, but can vary based on the applicant’s circumstances and the time of year.

Working Holiday Visa - Subclass 417

This visa is for young adults from eligible countries who want to have an extended holiday and work in Australia to fund their travels.

Applicants must be aged 18-30 (or 35 for some countries), hold a passport from an eligible country, have sufficient funds for their stay, and meet health and character requirements.

Applicants apply online and must meet all eligibility criteria. Processing times are typically fast, often within weeks, but can vary based on the volume of applications and individual circumstances.

The application process for each visa type generally includes filling out relevant forms, submitting necessary documents (like proof of identity, skill assessments, health checks), and paying applicable visa fees. The specific requirements can vary based on the visa type and individual circumstances.

Income Tax and Employment Tax in Australia

The Australian tax year runs from 1 July to 30 June. Corporation may apply to adopt a substitute year of income.

Australian resident individuals are taxable in Australia on their worldwide income. Temporary and non-resident individuals are only taxable in Australia on their Australian sourced income.

Individual Tax Rates

Both residents and non-residents are taxable in Australia on a progressive scale of marginal rates. The resident and non-resident marginal rates for the 2023-2024 and 2024 -2025 income years are outlined below:

Resident Individual 2023 – 2024

|

Taxable income |

Tax on this income |

|

0 – $18,200 |

Nil |

|

$18,201 – $45,000 |

19c for each $1 over $18,200 |

|

$45,001 – $120,000 |

$5,092 plus 32.5c for each $1 over $45,000 |

|

$120,001 – $180,000 |

$29,467 plus 37c for each $1 over $120,000 |

|

$180,001 and over |

$51,667 plus 45c for each $1 over $180,000 |

The above rates do not include the Medicare levy of 2%.

Non-Resident Individual 2023 – 2024

|

Taxable income |

Tax on this income |

|

0 – $120,000 |

32.5c for each $1 |

|

$120,001 – $180,000 |

$39,000 plus 37c for each $1 over $120,000 |

|

$180,001 and over |

$61,200 plus 45c for each $1 over $180,000 |

Non-residents are not required to pay the 2% Medicare Levy.

Resident Individual 2024 – 2025

We note that Australia’s stage 3 tax cuts will commence from 1 July 2024. The new individual marginal tax rates will be:

|

Taxable income |

Tax on this income |

|

0 – $18,200 |

Nil |

|

$18,201 – $45,000 |

19c for each $1 over $18,200 |

|

$45,001 – $200,000 |

$5,092 plus 30c for each $1 over $45,000 |

|

$200,001 and over |

$51,592 plus 45c for each $1 over $200,000 |

Residency

Australian Resident

Generally, an individual will be considered a resident of Australia for tax purposes where they:

- Ordinarily reside in Australia

- Are domiciled in Australia, unless they have a permanent place of abode outside of Australia

- Are present in Australia for more than one-half of the year, unless they have a usual place of abode outside of Australia and do not intend to take up residence in Australia

- Are a member of a government funded superannuation scheme

As part of the 2021 Federal Budget the Government announced it will replace and modernise the individual tax residency rules. However, draft legislation is yet to be released.

Temporary Australian Resident

An individual will be considered a temporary resident of Australia if:

- They hold an Australian temporary visa

- They are not an Australian resident within the meaning of the Social Security Act 1991

- Their spouse in not an Australian resident

Fringe Benefits Tax

The Australian Fringe Benefits Tax (‘FBT’) year runs from 1 April to 31 March. FBT is a tax imposed on both resident and non-resident employers who provide certain benefits (other than salary and wages) to employees and their associates in connection with their employment. These benefits include but are not limited to:

- Meals and entertainment

- Car parking

- The provision of motor vehicles (either directly or under a novated lease)

- Reimbursement or payment of personal expenses (including expenses such as health insurance, home internet, gym memberships ect.)

- Provision of personal travel

- Provision of housing or accommodation

- Living-away-from-home allowances

- Loans

The taxable value of fringe benefits is taxed at the rate of 47%.

The taxable value of certain fringe benefits provided to employees is also required to be disclosed on their annual Pay-As-You-Go payment summary for the financial year ended 30 June.

The due date for the lodgement and payment of all FBT returns with the ATO is 25 June.

Payroll Tax

Payroll tax is a tax levied on employers on the payment of wages and benefits (including superannuation) to employees and some contractors. Each State or Territory Revenue Office levies and collects payroll tax from eligible businesses employing employees in that State or Territory. Payroll tax is generally administered consistently by each State or Territory and is levied on the wages and benefits paid to employees that exceed the relevant State or Territory’s threshold. The threshold is the level of ‘grouped’ Australian wages which are not liable to payroll tax in the relevant State or Territory.

The rate of tax as well as the exemption threshold limits differ from State to State, the general threshold and rates are summarised below:

|

State or Territory |

Rate of tax |

Annual threshold |

|

Australian Capital Territory |

6.85% |

$2,000,000 |

|

New South Wales |

5.45% |

$1,200,000 |

|

Northern Territory |

5.50% |

$1,500,000 |

|

Queensland |

Up to 4.95% |

$1,300,000 |

|

South Australia |

Up to 4.95% |

$1,500,000 |

|

Tasmania |

Up to 6.10% |

$1,250,000 |

|

Victoria |

4.85% |

$700,000 |

|

Western Australia |

Up to 6.50% |

$1,000,000 |

Payroll tax returns need to be lodged on either a monthly, 6-monthly or annual basis. Irrespective of the lodgement frequency, all entities must lodge an annual reconciliation in each State or Territory. The annual reconciliation is generally due for lodgement by 21 July following the end of financial year and needs to reconcile an employer’s total wages including:

- Salary and wages

- Fringe Benefits

- Employee Share Scheme income

Corporate Taxes in Australia

The Australian tax system is administered by the Australian Taxation Office (‘ATO’). The standard Australian tax year ends on 30 June; however, companies can apply for a Substituted Accounting Period (‘SAP’) with the ATO to align its financial year with that of a foreign owner.

An Australian resident company is liable to pay Australian tax on its worldwide income at the applicable corporate tax rate.

A non-resident company is only liable to pay Australian tax on its Australian sourced income, at the applicable corporate tax rate.

Corporate Tax Rates

The standard corporate tax rates for the 2023 - 2024 financial year are:

|

Income category |

Rate (%) |

|

Base Rate Entities (‘BRE’) |

25.00 |

|

Otherwise |

30.00 |

A BRE is a company that satisfies both of the following requirements:

- Has an aggregate turnover of less than $50m and

- 80 percent or less of its assessable income is base rate entity passive income. Base rate entity passive income includes dividends, royalties, rents, interest, capital gains and certain distributions.

Key Tax Considerations

Capital Gains

Australian resident companies will generally incur a tax liability on the capital gain derived on the disposal of a capital asset, at their relevant corporate tax rate.

Capital gains derived by a non-resident on the sale of shares in Australian companies are not subject to tax in Australia where the assets of the company are not predominantly comprised of taxable Australian property.

Tax Consolidation

Australia has a tax consolidation regime which provides wholly owned groups with the option to consolidate for income tax purposes. Forming a tax consolidated group results in a group of entities being treated as a single entity for income tax purposes and lodging a single income tax return. Transactions between members of the consolidated group are then ignored for income tax purposes.

Tax Losses

Tax losses incurred by a taxpayer are available to be carried forward indefinitely and offset against income in future years subject to satisfying the Continuity of Ownership Test (‘COT’) or the Similar Business Test (‘SBT’).

Eligible corporate entities with a turnover of less than AUD$5 billion can carry back and apply losses in previous periods. Under the loss carry back provisions, losses made in the 2019–20, 2020–21, 2021–22 or 2022-23 income years, can be applied to a prior year's income tax liability in the 2018–19, 2019–20, 2020–21 or 2021-22 income years.

Transfer Pricing

Australia has robust transfer pricing provisions based on the rules developed by the Organisation for Economic Cooperation and Development (‘OECD’). These provisions are aimed to ensure that transactions between overseas related parties are conducted at “arm’s length”.

Where cross-border related party dealings exceed AUD2 million, details of the transactions are required to be disclosed in the international dealings schedule of the company’s annual income tax return.

Foreign companies conducting business in Australia need to carefully consider the pricing and documentation requirements of Australia’s transfer pricing provisions.

Thin Capitalisation

Australia’s thin capitalisation provisions operate to limit the level of debt deductions available Australia, where a taxpayer is considered ‘thinly capitalised’. The thin capitalisation rules apply where debt deductions for a particular financial year exceed AUD2 million and the entity’s debt-to-equity ratio exceeds the relevant threshold. The calculations to determine the maximum allowable debt are complex, however broadly the amount is based on 60% of the average assets of the Australian entity or a debt-to-equity ratio of 1.5 to 1.

Double Tax Agreements

Australia has Double Tax Agreements (‘DTA’) with more than 40 tax jurisdictions. These DTA’s apply to prevent double taxation and fiscal evasion, and foster cooperation between Australia and other international tax authorities.

Non-Resident Withholding Taxes

Australia imposes dividend (30%), royalty (30%) and interest (10%) withholding taxes on payments to non-residents. The withholding tax rates may be reduced under a DTA or as a consequence of exceptions under domestic legislation.

Key Incentives

Depreciation

Taxpayers are entitled to claim a deduction for the decline in value (or depreciation) of capital assets used in their business. This deduction is calculated over the assets useful life using either a straight line or diminishing value method.

Eligible businesses can claim an immediate deduction for the business portion of the cost of a capital asset in the year the asset is first used or installed ready for use. As a result of the Governments post COVID-19 investment incentives, eligibility criteria and threshold amount for immediate deduction have changed. Current eligibility criteria are:

|

Eligible business |

Date range |

Asset cost threshold |

|

Less than AUD5 billion |

6 October 2020 to 30 June 2023 |

No Threshold |

Research and Development Tax Incentive

The Research and Development (‘R&D’) tax incentive is the Australian Governments key incentive to stimulate investment in R&D in Australia. The R&D tax incentive is available to companies that are:

- Incorporated in Australia

- Foreign company that is an Australian resident for income purposes

- Foreign company that is a resident of a country with which Australia has a DTA

Entities undertaking eligible R&D activities are entitles to:

- For companies with an aggregated turnover below $20 million, the refundable R&D tax offset will be a premium of 18.5 percentage points above the claimant's company tax rate; or

- For companies with an aggregated turnover of $20 million or more, there is a two-tiered premium that ties the rates of the non-refundable R&D tax offset to the incremental intensity of the R&D expenditure as a proportion of total expenditure for the year. The rates are the claimant's company tax rate plus:

- 5 percentage points for R&D expenditure up to 2 per cent R&D intensity

- 5 percentage points for R&D expenditure above 2 per cent R&D intensity.

Eligible entities must register their R&D activities with the Department of Industry, Science, Energy and Resources within 10 months after the end of their financial year. The entity will then lodge an R&D schedule in its annual income tax return to quantify the eligible tax offset.

Other Taxes in Australia

Goods and Services Tax

Goods and Services Tax (‘GST’) is a consumption tax on the supply of goods and services, similar to the value added tax models adopted by most countries around the world. GST is levied at a flat rate of 10 percent of the value of goods and services consumed in Australia (including imports). Businesses carrying on an enterprise in Australia, must register for GST when their GST turnover exceeds AUD75,000. Registered businesses are entitled to claim an ‘input tax credit’ for GST that has been paid on goods and services consumed in carrying on their enterprise.

Non-resident businesses may be required to register for GST if they are selling goods that are connected with Australia. Goods may be connected with Australia where:

- They are delivered or made available to a purchaser in Australia

- They are removed from Australia

- They are brought to Australia and the seller either imports the goods or installs or assembles the goods in Australia

GST is a self-assessed tax and is reported to the ATO in an entities Business Activity Statements (‘BAS’).

In order to minimise the GST compliance requirements of non-resident business, certain non-resident businesses may be eligible to register for simplified GST. Simplified GST registration is available to non-residents who make sales of:

- Online services and digital products to Australia

- Goods valued at AUD1,000 or less

Businesses that register for simplified GST are not entitled to claim Australian GST credits for purchases. Simplified GST can be lodged and paid on an online portal.

Stamp Duty

The various State and Territory Governments in Australia impose stamp duty (or ‘transfer duty’) on various transactions, predominantly the transfer of assets, businesses and real estate.

Each State and Territory Government has their own stamp duty provisions outlining the relevant tax rates, thresholds and exemptions available.

Land Tax

Land tax is an annual tax imposed by the State and Territory Governments on landowners in Australia. Land tax is generally calculated by applying the relevant rate of tax to the aggregated value of all land held.

Each State and Territory Government has their own land tax provisions outlining the relevant tax rates, thresholds and exemptions available.

New Employees in Australia

Employers are required to register a new start by sending a TFN declaration form to the ATO – this is done electronically through the payroll software. The employee must provide the employer with their TFN declaration within 14 days of starting to avoid paying increased tax of 47.5%. If an employee does not provide this declaration within 14 days, the employer is required to lodge one on the employee’s behalf and withhold tax at the highest rate.

When employing a new start, an employer should request/file the employee’s personal information. The information you should request should include, but is not limited to the following:

- Name

- Residential address (Australian)

- Email address

- Phone number

- Date of birth

- Start date

- Completed and signed TFN Declaration Form

- Completed superannuation choice form

- This form identifies the employees nominated superannuation fund

- If no fund is nominated by the employee, a ‘default’ fund should be offered to the employee.

Expat employees must be registered within 14 days of receipt of document.

Reporting Tax in Australia

Payroll Tax

- Monthly, quarterly or annual

- This must be submitted to each State revenue office by the 7th of the following month

- Annual reconciliation to be lodged by the 21st of July following the end of the financial year

- Will require completion of any relevant reportable fringe benefits or ESS income

Fringe Benefits Tax

-

Annual lodgement and payment to be completed by 25 June following the end of the FBT year

Employee Share Schemes

- Provide an ESS statement to their employees by the 14th of July following the end of the financial year

- Lodge an ESS annual report with the ATO by the 14th of August following the end of the financial year

Employee Year End

- Employees will have their annual earnings finalised by the 14th of July. Payment Summaries are no longer issued and instead, employees will be able to see a “Tax Ready” status against their employer details in their individual myGov portal

- The payroll vendor submits the reports to the ATO on behalf of the client through STP

GST and PAYG Withholding

- Report GST and PAYG Withholding in either the monthly or quarterly BAS depending on the taxpayer

- The forms are submitted by the employer to the ATO (or their nominated in country accountant)

- The client is required to sign the form prior to lodgement

Leavers in Australia

Leavers must receive their final payment within the following payment cycle at the latest or at a date mutually agreed between the employer and employee. This can vary and may be stated in the award or EBA specific to that employer or industry.

Payroll in Australia

It is legally acceptable in Australia to provide employees with online payslips. Payslips must be issued to each employee within one working day of pay day in electronic or hard copy.

Single Touch Payroll

The Australian Government has legislated to simplify business reporting obligations via a concept known as single touch payroll (‘STP’).

Businesses familiar with the United Kingdom RTI (Real Time Information) process for reporting employee wages and taxes will note that the STP system will be very similar. The most significant difference will be the lack of Tax Code adjustments in STP. Key points:

- STP requires electronic reporting of the employee salary, PAYG (pay as you go) withholding and superannuation to the ATO at the time the salary is paid to the employee

- When the superannuation obligation is paid by the employer – the relevant fund will notify the ATO. This will prevent employers from delaying in remitting superannuation for the employees as is an issue at present.

- No year-end payment summaries will be required if all income has been reported through STP

- The employer can choose to remit the PAYG at the same time as paying the salary but is able to continue to pay as they are currently doing

Reports

Payroll reports must be kept for at least seven years. The records can be kept electronically as long as the records can be printed out on request.

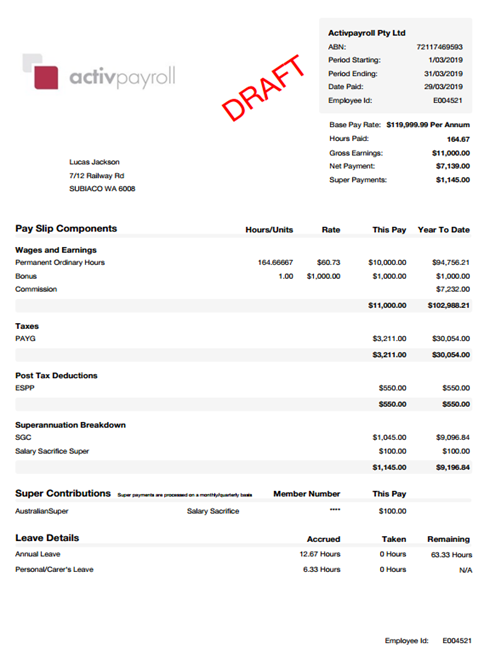

Australian Payslip Example

Employment Law in Australia

Holiday Accrual and Calculations in Australia

Each employee is entitled (under the NES) to 4 weeks paid Annual Leave or five weeks if the employee is a shift worker. Annual leave accrues progressively during a year of service according to the employee’s ordinary hours of work and accumulates from year to year. If applicable under a specific award or contract leave loading will be paid at a % in addition. The annual leave balance and accrual is normally shown in an hourly balance on an employee pay slip.

Maternity Leave in Australia

Under the National Employment Standards female employees are entitled to 12 months unpaid maternity leave which can begin up to six weeks before the expected date of birth. This cannot be taken in conjunction with the partners 12-month paternity leave entitlement. A written request for the entire 24-month period to be taken by one parent can be submitted to their employer who has the right to refuse, however the 12 months cannot be refused.

There is no paid legal requirement by the company (there is a Government Paid Parental scheme in place)

Paternity Leave in Australia

Under the National Employment Standards employees are entitled to 12 months unpaid paternity leave if they are expecting a child or are adopting. This cannot be taken in conjunction with their partners 12-month maternity leave entitlement. There is no paid legal requirement by the company (there is a Government Paid Parental scheme in place).

From 6 April 2024, paternity leave can be taken as two separate one-week blocks within 52 weeks after birth or adoption, with only 28 days’ notice required.

Government Paid Parental Leave in Australia

The Australian Government offers a paid parental leave system to employees who meet the following criteria:

- Be the primary carer of a newborn or newly adopted child

- Have individually earned less than $168,865 or less in the 2023 financial year

- Not be working during the PPL period except for allowable reasons

- Have met the work test

- Have registered or applied to register the child’s birth with the state or territory birth registry, if they are a newborn.

Parental Leave Pay for a child born or adopted from 1 July 2023 is based on the national minimum wage. Your family can get up to 20 weeks, which is 100 payable days.

The current payment for Parental Leave Pay is $176.55 a day before tax, or $882.75 per 5 day week. This is based on the weekly rate of the national minimum wage.

Employees will nominate their employer when applying for PPL. Centrelink will contact employer to inform them of the application, which employers will accept through Business Hub online services. Business Hub online is accessed through PRODA here.

As part of the employer registration process, Centrelink will collect information such as the employees pay frequency, pay date and the employers bank account details. Payment that is owed to the employee is always aimed at being with the employer in time for the normal payrun that covers the employee’s period of PPL. Employers are not required to make payment to the employee prior to funds being received.

Further information for employers can be found here.

Sick Leave in Australia

Personal and Carer’s Leave – incorporating sick leave, carer’s leave and compassionate leave. Each year of service the employee is entitled to 10 days of paid personal/carer’s leave which is cumulative.

An employee is entitled to 2 days of unpaid carer’s leave for each permissible occasion when a member of the employees’ immediate family or household requires care or support because of an illness.

An employee is entitled to 2 days compassionate leave for each occasion when a member of the employee’s immediate family or member of the household contracts or develops a life-threatening illness or dies.

Payment is made for personal leave based on the above at the base rate of pay for the employees’ ordinary hours of work in the period.

National Service in Australia

Military national service in Australia ended in 1972.

Employees are entitled (under the National Employment Standards) to take leave to carry out certain community service activities such as jury service or voluntary emergency management activity. There is no requirement to pay employees whilst they are absent as a result of Voluntary Emergency Management Activity, there is no set limit on the amount of time an employee can be absent due to this. When absent due to Jury Duty, the employer is required to pay the employee’s base rate of pay for the employee’s ordinary hours of work in the period of leave.

National Minimum Wage in Australia in 2024

As of 2024, the national minimum wage in Australia is $23.23 per hour, which translates to $882.80 per week for a standard 38-hour workweek. This represents an 8.6% increase from the previous rate.

This minimum wage rate applies to employees not covered by an award or registered agreement, providing a base pay rate under the Fair Work Act 2009. The rate is reviewed each year by the Fair Work Commission and adjusted based on various economic factors

Working Days and Working Hours in Australia

A standard working week in Australia is typically Monday to Friday totalling 38 hours.

The working day for commercial offices is typically from 8:30AM to 5:00PM. Lunch breaks range from 30 minutes to one hour.

Statutory National Holidays in Australia 2024

There are multiple statutory holiday schedules within Australia, which can be different regionally. Below are the statutory national and regional holidays in Australia for 2024.

| Holiday Name | Date | Weekday | States/Territories Observed |

|---|---|---|---|

| New Year's Day | 1 January | Monday | National |

| Australia Day | 26 January | Friday | National |

| Adelaide Cup Day (SA) | 18 March | Monday | South Australia |

| Canberra Day (ACT) | 11 March | Monday | Australian Capital Territory |

| Labour Day (WA) | 4 March | Monday | Western Australia |

| Labour Day (VIC) | 11 March | Monday | Victoria |

| Eight Hours Day (TAS) | 11 March | Monday | Tasmania |

| Good Friday | 29 March | Friday | National |

| Easter Monday | 1 April | Monday | National |

| Anzac Day | 25 April | Thursday | National |

| May Day (NT) / Labour Day (QLD) | 6 May | Monday | Northern Territory, Queensland |

| Reconciliation Day (ACT) | 27 May | Monday | Australian Capital Territory |

| Western Australia Day (WA) | 3 June | Monday | Western Australia |

| Queen's Birthday | 10 June | Monday | National except WA |

| Bank Holiday (NSW) | 5 August | Monday | New South Wales |

| Picnic Day (NT) | 5 August | Monday | Northern Territory |

| Royal Queensland Show (QLD) | 14 August | Wednesday | Queensland |

| Labour Day (SA) | 7 October | Monday | South Australia |

| Labour Day (NSW, ACT) / Queen's Birthday (WA) | 7 October | Monday | NSW, ACT, WA |

| Melbourne Cup Day (VIC) | 5 November | Tuesday | Victoria |

| Christmas Day | 25 December | Wednesday | National |

| Boxing Day / Proclamation Day (SA) | 26 December | Thursday | National |

Employee Benefits and Withholding in Australia

Superannuation

Generally, an employer will be liable to pay Superannuation Guarantee Contributions (‘SGC’) to eligible employees and certain contractors, where that employment is undertaken in Australia. An individual’s SGC obligation is calculated by applying 11.00% to the total Ordinary Time salary or wages paid by the employer to the employee for the quarter.

We note that the SGC rate will increase to 11.50% on 1 July 2024 and progressively increase to 12.00% as outlined in the table below:

|

Period |

SGC Rate |

|

1 July 2022 – 30 June 2023 |

10.50% |

|

1 July 2023 – 30 June 2024 |

11.00% |

|

1 July 2024 – 30 June 2025 |

11.50% |

|

1 July 2025 – 30 June 2026 and onwards |

12.00% |

An employer’s superannuation liability is capped at a maximum contribution base per quarter. The maximum contributions base (and subsequent superannuation liability) for the years ended 30 June 2023 and 30 June 2024 are:

|

Income year |

Income per quarter |

SG Contribution per quarter |

|

2023–2024 |

$62,270 |

$6,849.70 |

|

2022–2023 |

$60, 220 |

$6323.10 |

Every company must register with one fund that is their ‘Default Fund’ and ensure that they provide each employee with a ‘Superannuation Choice form’ giving employees the option to use a fund of their own choice, or the employers default fund. Employees who do not provide details for their individual fund will have their SGC contributions paid into the employer’s default fund.

SGC contributions are payable into a complying Australian superannuation fund for each employee on a minimum quarterly basis. The quarterly cut off dates for making payments are as follows:

|

Quarter |

Cut-off date |

|

1 July – 30 September |

28 October |

|

1 October – 31 December |

28 January |

|

1 January – 31 March |

28 April |

|

1 April – 30 June |

28 July |

Employee

SGC contributions are subject to a rate of tax of 15%. However, an additional tax of 15% is payable where an employee’s combined income and SGC contributions exceed AUD250,000 (Division 293 assessment).

SGC contributions are not assessable income in the hands of the employee for Australian tax purposes unless an employee exceeds the concessional contributions cap or chooses to pay their Division 293 assessment with their personal funds.

A concessional contribution is one that is before-tax, as an income tax deduction is usually available to be claimed. Examples of these are:

- Compulsory SG contributions made by your employer

- Salary sacrificed contributions

- Any personal contributions for which you are allowed a tax deduction

The concessional contributions cap from 1 July 2021 is AUD 27,500 per year. However, under the carry forward rule you may be able to contribute additional concessional contributions. Any unused concessional contributions can be carried forward for up to 5 years.

Where an employee exceeds their concessional contributions cap, the excess concessional contributions (‘ECC’) will be included in the employee’s assessable income and taxed at their marginal tax rate.

Short-term Visits

There is currently no exemption from SGC in respect of temporary or short-term visits to Australia and as such, the liability arises regardless of whether the employee is resident or non-resident of Australia for tax purposes. Where an employee has derived SGC while on an Australian temporary visa, they can apply to have the superannuation paid to them as a Departing Australia Superannuation Payment (‘DASP’).

However, where a bilateral social security agreement between Australia and the employee’s country of residency provides that the employer is not subject to Australian SGC in respect of the salary and wages paid to the employee, no Australian SGC obligation will arise. Australia currently has bilateral social security agreements addressing superannuation coverage with the following countries:

|

Austria |

Belgium |

Croatia |

|

Chile |

Czech Republic |

Finland |

|

Germany |

Greece |

Hungary |

|

Ireland |

Japan |

Korea |

|

Latvia |

Republic of Macedonia |

Netherlands |

|

Norway |

Poland |

Portugal |

|

Slovak Republic |

Switzerland |

United States of America |

Employee Share Schemes

It is common for employers to offer employees the opportunity to acquire shares in their employer. The share purchase plans or Employee Share Schemes (‘ESS’), generally offer the opportunity to acquire shares, units or options in the employer at a discount. This is usually achieved through a share issue, company loan or salary sacrifice arrangement.

Where ESS interests are granted to an employee at a discount, there are Australian income tax and capital gains tax consequences which need to be considered. Depending on the nature of the scheme, these tax issues may arise at the time of issue of ESS interests or may be deferred to a taxing point sometime in the future.

Employers who provide ESS interests to their employees have certain reporting requirements to their employees and the ATO. Employers are required to provide an ESS statement to their employees by the 14th of July following the end of the financial year, to assist employees complete their annual income tax returns. The employer must also lodge an ESS annual report with the ATO by the 14th of August following the end of the financial year. We note that there is no requirement for an employer to withhold tax on ESS, except where the employee has not provided their TFN.

It is important for an employer and employee to be aware of the benefits and consequences of implementing an ESS in Australia. We recommend discussing the tax consequences of implementing and operating an ESS with a tax professional prior to the issue of any interests under an ESS in Australia. Australia’s ESS rules are unique and tax outcomes of the ESS in Australia may differ to those of the host countries.

Pay-As-You-Go Withholding

Employers are required to withhold Pay-As-You-Go (‘PAYG’) Withholding from all employee’s salary and wages and remit it to the ATO. PAYG Withholding is calculated in line with ATO tax rates and is generally based on whether the employee is a resident or Non-resident of Australia.

Employer’s must register for PAYG withholding with the ATO in order to report their withholding obligations. Due dates for paying and reporting withheld amounts depend on whether the employer is a small, medium or large withholder.

An employer is a small withholder where they:

- Withhold $25,000 or less a year

- Pay withholding amounts to the ATO on a quarterly basis

- Report withholding on activity statements on a quarterly basis

An employer is a medium withholder where they:

- Withhold $25,001 to $1 million a year

- Pay withholding amounts to the ATO on a monthly basis

- Report withholding on activity statements on a monthly basis

An employer is a large withholder where they:

- Withhold amounts totalling more than $1 million in a previous financial year, or is part of a company group that has withheld more than $1 million in a previous financial year

- Amounts withheld are paid, and sent electronically to the ATO, twice a week

- The date for payment depends upon the day withholding took place.

Workers Compensation

Workers Compensation Insurance is a worker’s rehabilitation and compensation scheme that is run by either the State Governments in Australia or private insurance companies. All Australian businesses that are employing are required to register for work cover and pay a certain amount as work cover levy each year or maintain a worker’s compensation insurance policy. A separate policy must be in place for each state where employee’s are based.

The amount that is paid under the work cover scheme or the insurance policy is then used to compensate any worker in the business that may get injured while at work.

Expenses

Expenses

Expenses are not an employee benefit in Australia.

Expenses incurred on behalf of the employer can be reimbursed to the employee by either of the following options:

- Through the employer’s accounts department where, upon submitted claim, the money is paid directly to the employee

- Through the payroll system by way of submitted claim paid as an after-tax addition to the employees pay. This does not attract tax or super

Car mileage can be paid to the employee by the following methods:

- A per km claim, paid as an expense

- A car/fuel allowance

Payment method would be specific to the employee’s individual requirements and if paid as an allowance may incur tax obligations.

Company cars would not typically affect a payroll however may attract fringe benefits tax. This would appear on the individual’s payment summary at the end of each financial year. This may differ of course, dependent on the client’s company car policy.

Key updates for 2024 in Australia

In Australia, there are several key legislative changes for 2024 in the areas of income tax, social security, and employment law:

Superannuation in the National Employment Standards (NES)

- From 1 January 2024, the NES will include a right to superannuation contributions, allowing for the enforcement of unpaid or underpaid superannuation under the Fair Work Act.

Minimum Wage Rates

- Modern award rates of pay will increase by 5.75% from 1 July 2023.

- The national minimum wage for adults working full time (38 hours per week) has increased from $812.60 to $882.80 per hour from 1 July 2023.

Changes to Unfair Dismissal Protection Thresholds

- The high-income threshold for unfair dismissal protection under the Fair Work Act has increased from $162,000 to $167,500 from 1 July 2023.

Paternity Leave

- From 6 April 2024, paternity leave can be taken as two separate one-week blocks within 52 weeks after birth or adoption, with only 28 days’ notice required.

Carer's Leave

- From 6 April 2024, employees with caring responsibilities for a dependant will have the right to take one week’s unpaid carer’s leave per year.

Protection from Harassment

- In October 2024, the Equality Act 2010 will be amended to introduce a duty on employers to take “reasonable steps” to prevent sexual harassment of their employees.

Changes to Working Time Regulations

- From 1 January 2024, the requirement for employers to keep a separate record of daily working hours of workers will be removed, provided they can demonstrate compliance with the Working Time Regulations (WTR) in other ways.

Transfers of Undertakings Requirements for Small Businesses

- From 1 July 2024, businesses with fewer than 50 employees, or transfers involving fewer than 10 employees, will be allowed to consult with employees directly and not undertake collective consultation as part of the transfer process, where there are no existing representatives in place.

Minimum Service Levels in Strikes

- The government has published regulations setting out minimum service levels for rail, ambulance, and fire services during strikes.

These changes reflect a significant update in various areas of employment law and taxation in Australia.

Notes

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

Want to learn more about payroll, tax, social security and more?

Register free today to get the latest up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Let’s Partner

Talk to a specialist today and find out how we support the growth of over 500 businesses with a range of activpayroll solutions designed to help your global payroll and people operations succeed.