Austria

With an investor friendly tax system and very few restrictions on foreign investment, it’s no wonder that over 1,000 international companies benefit from having operations in Austria.

Need more information about payroll, compliance and social security in Austria?

Talk To An Expert

Our free global insight guide to Austria offers up-to-date information on international payroll, income tax, social security, employment law, employee benefits, visas, work permits and key updates on legislative changes and more in 2024.

Basic Facts about Austria

Austria is one of the richest and most stable countries in the globe, making it a very sought-after location in which to invest in. Located in Central Europe and landlocked between Germany and the Czech Republic to the north, Hungary and Slovakia to the east, Italy and Slovenia to the south and Liechtenstein and Switzerland to the west, Austria is a strategically positioned business hub for many investors. All European capital cities can be reached within less than three hours from Vienna International Airport.

- Full Name: Republic of Austria

- Population:9.041 million (World Bank 2022)

- Capital: Vienna

- Major Languages: German

- Currency: Euro

- Main Exports: Machinery, vehicles, pharmaceuticals, chemicals, iron, steel and foodstuffs

- GNI per Capita: $67,830 USD (World Bank, 2022)

- Internet Domain: .at

- International Dialling Code: +43

How Do I Say in German?

- Hello: Hallo

- Good Morning: Guten Morgen

- Good Evening: Guten Abend

- Do You Speak English?: Sprichst du Englisch?

- Goodbye: Auf Wiedersehen

- Thank You: Dankeschön

- See You Soon: Bis bald

Dates

Dates are usually written in the day, month and year sequence. For example, 1 July 2021 or 1.7.2021. Numbers are written with a period to denote thousands and a comma to denote fractions. For example: 1.234,56 € (One thousand two hundred and thirty-four euros and fifty-six cents.

Doing Business in Austria

With an investor friendly tax system and very few restrictions on foreign investment, it’s no wonder that over 1,000 international companies benefit from having operations in Austria. The country also boasts a highly educated workforce with its universities ranking among the best in the world, resulting in a very skilled and productive workforce.

Austria is renowned for its high quality of life and in 2019, Vienna was ranked number one in the Mercer Group ‘Quality of Living Survey’ for the 10th year in a row, this is reflected in the low crime rates, a very stable political system and a high level of social security.

Although the Austrian government is very encouraging of foreign investment, it favours investment targeted towards the high-tech sector. Local and foreign investors are treated equally with government investment incentives offered to both, including loans, grants and tax incentives. The Austrian government is so encouraging of foreign investment that foreign investors can also claim government support measures if they have been affected by the COVID-19 pandemic.

Why Invest In Austria

Austria is one of the richest and most stable countries in the globe, making it a very sought-after location in which to invest in. Located in Central Europe and landlocked between Germany and the Czech Republic to the north, Hungary and Slovakia to the east, Italy and Slovenia to the south and Liechtenstein and Switzerland to the west, Austria is a strategically positioned business hub for many investors. All European capital cities can be reached within less than three hours from Vienna International Airport.

With an investor friendly tax system and very few restrictions on foreign investment, it’s no wonder that over 1,000 international companies benefit from having operations in Austria. The country also boasts a highly educated workforce with its universities ranking among the best in the world, resulting in a very skilled and productive workforce.

Austria is renowned for its high quality of life and in 2019, Vienna was ranked number one in the Mercer Group ‘Quality of Living Survey’ for the 10th year in a row, this is reflected in the low crime rates, a very stable political system and a high level of social security.

Although the Austrian government is very encouraging of foreign investment, it favours investment targeted towards the high-tech sector. Local and foreign investors are treated equally with government investment incentives offered to both, including loans, grants and tax incentives. The Austrian government is so encouraging of foreign investment that foreign investors can also claim government support measures if they have been affected by the COVID-19 pandemic.

Business Banking in Austria

Banks in Austria operate Monday to Friday from 08:00 to 12:30 then from 13:30 to 15:00, depending on the bank or branch, they may remind open over lunchtime.

Most banks are open until 17:00 on a Thursday.

Banks are not open on a Saturday, Sunday or on holidays.

Registering a Company and Establishing an Entity in Austria

Provided an expatriate is a citizen of the EU, the EEA, Switzerland or they hold a residence permit for Austria, they can set up a company in the country with relative ease, however they must apply for a trade licence before proceeding. Personal details, business name, location and type of business must all be provided to the local district authority in order to obtain a trade licence. In addition, expatriates will also have to register with the Commercial Register. It takes approximately four weeks to complete the company registration process.

When setting up a company in Austria, the expatriate must decide which legal entity is most suitable and there is a wide variety of legal entities to choose from, these include:

Limited Liability Company

This type of company is the most common type of legal entity in Austria and is referred to locally as GmbH. The company must consist of at least one shareholder and one director and they can be of any nationality or residency, however the company must have a legally registered address in Austria. A minimum share capital of EUR 35,000 is required and the company will be subject to Value Added Tax (VAT) if annual turnover is expected to be above EUR 35,000.

General Partnership

This type of company (also referred to as OG) is one of the non-corporate company forms in Austria and the only formal requirement to set one up is a trading licence and registration in the Austrian Commercial Register. No minimum capital stock is required and two or more natural persons are required in order to set up. These persons must take personal liability for the company’s debts and obligations.

Limited Partnership

This type of company (also referred to as KG) does not differ from the General Partnership when it comes to the formal requirements for setting up, however the rights and duties are different. At least two partners must be involved, one is liable with a chosen amount of capital (also referred to as a silent partner) and the other assumes unlimited liability.

Visas and Work Permits in Austria

Anyone who is not a national of Austria and wishes to work in the country must obtain a visa, the only exception is for nationals of the European Union (EU) and European Economic Area (EEA). To apply for a visa, a foreigner must physically visit the closest Austrian embassy or consulate general.

Austria is one of the 26 European countries within the Schengen area and all foreigners who are not exempt from applying for a visa must apply for a Schengen visa. Depending on the foreigner’s situation, there are various categories in which they can fall under.

Red-White-Red card

The Red-White-Red Card is a specialized residence permit designed for skilled non-EU/EEA nationals who wish to work in Austria. This card facilitates the immigration of qualified workers and their families based on personal and labor market criteria. It streamlines the process for businesses looking to hire skilled foreign nationals or send their employees to Austria for work. Applicants are assessed based on a points system that considers qualifications, work experience, language skills, and age. The card is valid for two years and can be renewed under certain conditions. It allows holders and their families to integrate into the Austrian labor market and society more efficiently, as it grants free access to the job market without the need for additional work permits. This makes it an ideal solution for businesses seeking to employ foreign talent in Austria, ensuring a smoother transition for both the company and the employee.

Application Process:- Apply at an Austrian embassy/consulate or through the employer in Austria.

- Check by the Public Employment Service for eligibility.

- Provide health insurance, valid travel documents, proof of accommodation, and an employment contract.

Validity: 2 years, renewable based on conditions.

Family Members: Can obtain a “Red-White-Red Card plus” with labor market access

Six month residential visa

The Six-Month Residential Visa in Austria is designed primarily for individuals who need to reside in Austria for a specific short-term purpose, such as job seeking or engaging in a temporary work assignment. This visa caters to those who are not immediately eligible for long-term residency permits like the Red-White-Red Card. The application process typically involves the submission of documents to an Austrian embassy or consulate, or directly by the employer in Austria. It's important for applicants to determine their place of residence in Austria beforehand, as this impacts the responsible immigration authority. Family members of the visa holder may also apply for a Residence Permit for Family Reunification. This visa offers flexibility for businesses and individuals seeking temporary residency in Austria for professional reasons, providing a gateway for further employment opportunities within the country.

Application Process:

- Application submitted by the employer to the Immigration Authority or by the individual at an Austrian embassy/consulate.

- Decide the place of residence in Austria as it affects the responsible authority.

- Family members may apply for Residence Permit – Family Reunification.

Special Notes: Different rules apply for Visa D holders and those requiring a Residence Permit.

Business Visa for Austria

The Austria Business Visa is essential for individuals from non-visa-exempt countries who plan to engage in business activities in Austria. This visa is suitable for those attending meetings, conferences, or participating in short-term training sessions without undertaking gainful employment. The application process involves submitting a comprehensive set of documents, including a visa application form, valid passport, recent identity pictures, proof of professional status, a letter of invitation from the Austrian business, bank statements, and a detailed itinerary. The visa fee varies, with different rates for adults and citizens of certain countries. This visa allows business professionals to legally conduct their activities in Austria, offering an opportunity to explore and engage with the Austrian business environment effectively.

Application Process:

- Determine Eligibility: Check if your country requires a visa for business travel to Austria.

- Gather Documents:

- Visa Application Form: Complete and attach to other papers.

- Valid Passport: Ensure it's valid during your stay and has two empty pages.

- Recent Identity Pictures: Complying with Schengen photo rules.

- Previous Passports: If issued in the last 7 years.

- Proof of Professional Status: Employment contract, school records, business license, or proof of pension fund.

- Letter of Invitation: From the Austrian business company.

- Bank Statements: Recent and no older than 6 months.

- Pay Visa Fee: The fee varies based on nationality and age.

- Submit Detailed Itinerary: Outline your trip's agenda.

- Submit Application: To the Austrian embassy/consulate in your country.

- Await Processing: The duration varies. Contact the embassy/consulate for specifics.

This process ensures that business professionals have the necessary authorisation for their activities in Austria, aiding in smooth and compliant business engagements.

Income Tax in Austria

The tax year runs from 1 January to 31 December.

Individual Income Tax

All persons residing in Austria are subject to income tax on any worldwide income they earn. All non-residents are taxed on income from sources in Austria alone.

Tax returns are due by 30 April or 30 June if filing electronically; however, they should only be filed if an individual earns over a minimum amount from sources other than their employment or if they are employed by two or more employers at the same time.

The personal income tax rates can be found in the table below:

|

Annual income (eur) |

Tax rate |

|

Up to 12,816 |

0% |

|

12,816 – 20,818 |

20% |

|

20,818 to 34,513 |

30% |

|

34,513 to 66,612 |

40% |

|

66,612 to 99,266 |

48% |

|

99,266 to 1,000,000 |

50% |

|

Above 1,000,000 |

55% |

Social Security in Austria

Any individual employed by a company or self-employed in Austria is legally required to contribute a percentage of their wage to social security, up to a maximum income threshold. The other percentage is paid by the employer. Social security includes health insurance, pension insurance, accident insurance, unemployment insurance and other (this normally includes things such as housing).

Social security contributions are as follows:

|

insurance type |

Employer Contribution |

Employee Contribution |

Total |

|

Health |

3.78% |

3.87% |

7.65% |

|

Pension |

12.55% |

10.25% |

22.80% |

|

Accident |

1.20% |

0.00% |

1.10% |

|

Unemployment |

3.00% |

3.00% |

5.90% |

|

Other |

0.70% |

1.00% |

1.70% |

|

Total |

21.23% |

18.12% |

39.35% |

Reporting Tax in Austria

We are currently updating this section. Please come back soon

New Employees in Austria

Unlike many other countries, a written contract of employment between employer and employee is not necessary when taking on a new job in Austria, instead many employers will choose to finalise the employment contract verbally or through a collective agreement.

If no written employment contract exists, the employer must provide the employee with a written statement which outlines their rights and responsibilities.

There is often a one-month probationary period for new employees, both employee or employer can terminate the contract of employment without explanation during this time.

Leavers in Austria

An employee can have their employment terminated immediately if the employer has good reason for the dismissal, this would normally involve any form of gross misconduct. Similar to the hiring of employees, the termination can be carried out verbally or in writing.

Upon resignation, the employer should provide the employee with a certificate of employment, employment papers of salary statement, deregistration from the health insurance fund, confirmation of work and remuneration, payslip and a testimonial. The employer must also pay any outstanding payments to the employee.

Payroll in Austria

In Austria, payroll reports should be kept for seven years.

Generally, salaries are paid monthly and must be paid by the end of each month.

Many businesses in Austria give their employees a 13th month salary which is divided between two instalments, one in June and the other in November.

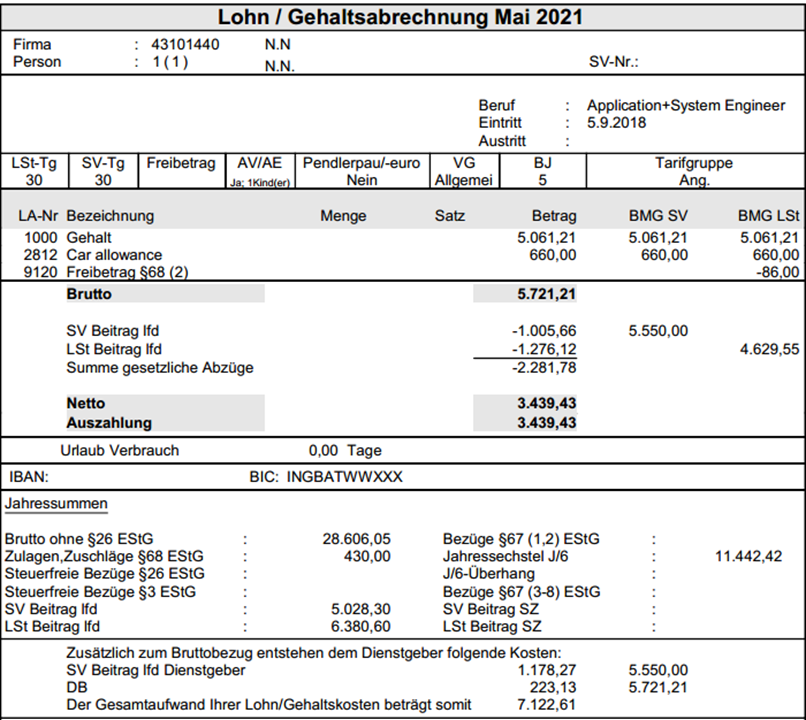

Austrian payslip example

Working Days and Working Hours in Austria

The working week in Austria is Monday to Friday and a normal work week consists of eight hours per day and 40 hours per week (unless otherwise stated).

Most offices operate from 08:00 to 17:00 with one hour for lunch.

Employment Law in Austria

Holiday Accrual

Employees with fewer than 25 years of service are entitled to 25 days of paid annual leave. Employees who have been with the same company for 25 years or more are entitled to 30 days of paid annual leave.

Each employee, regardless of service length, is entitled to 13 paid public holidays each year. By law, employers must pay their employees their holiday pay before the holiday period begins.

Maternity Leave

Employed women in Austria, regardless of nationality or residence, receive a cash benefit (also known as Wochengeld) of their average earnings as maternity leave benefit. Women who have been employed for three months or more are insured under the social security system to receive 100% of their average salary during maternity leave.

Expectant employees are not allowed to work beyond the eighth week prior to the expected delivery date. The employee must then take eight weeks off after the baby is born, this is extended up to 12 weeks for multiple, premature or caesarean births.

Paternity Leave

Employees are entitled to take unpaid paternity leave for one month following the birth of a child. The leave must be taken during the period that the mother is legally prohibited from working. The leave is only available to fathers that live in a joint household with the child.

Sickness

If an employee has to miss work due to sickness or injury, by law, they are entitled to sick pay from their employer. Statutory sick pay covers the employee for six to 12 weeks of full pay plus four weeks of half pay, dependent on the employees’ length of service. Should the employee need additional time off once the statutory sick pay period ends, they are then entitled to sickness benefit from the social security system. This sickness benefit is equal to 50% of the employee’s previous pay, this may increase to 75% if the employee has dependents.

Insurance

Employers must provide social security insurance (health, unemployment, accident, pension) for their employees.

Minimum Wage in Austria in 2024

In Austria, and as of 2024, there isn't a legislated federal minimum wage, an effective minimum wage of €1,500 per month is generally applicable.

This arrangement emerged from collective bargaining agreements across various sectors, spearheaded by major social partner organizations. This consensus, achieved in 2017, ensures that workers in Austria receive a base salary that aligns with European standards. The minimum wage includes core salary components, with variations for different types of workers in line with respective collective agreements. This was fully implemented across all sectors by 2020.

Statutory National Holidays in Austria in 2024

There are multiple statutory holiday schedules within Austria. Below are the statutory national holidays in Austria for 2024.

| Holiday Name | Date | Weekday |

|---|---|---|

| New Year's Day | 2024-01-01 | Monday |

| Epiphany | 2024-01-06 | Saturday |

| Easter Monday | 2024-04-01 | Monday |

| National Holiday | 2024-05-01 | Wednesday |

| Ascension Day | 2024-05-09 | Thursday |

| Whit Monday | 2024-05-20 | Monday |

| Corpus Christi | 2024-05-30 | Thursday |

| Assumption of Mary | 2024-08-15 | Thursday |

| National Day | 2024-10-26 | Saturday |

| All Saints' Day | 2024-11-01 | Friday |

| Immaculate Conception | 2024-12-08 | Sunday |

| Christmas Day | 2024-12-25 | Wednesday |

| St. Stephen's Day | 2024-12-26 |

Thursday |

Please note that these dates are based on the Gregorian calendar and standard Austrian public holidays.

Employee Benefits in Austria

In addition to a very generous annual leave entitlement, many companies also provide their employees with a 13th month or 14th month bonus. Each bonus is equal to one month’s salary and is a common benefit in Austria, typically paid to employees before the Christmas period and upon the annual leave period (often in summer). Companies are not legally required to pay this bonus, they are however required to pay this bonus if it is stated in the employment contract or collective bargaining agreement upon employment.

Some companies also offer their employees additional benefits such as car allowances, however this varies depending on the company.

Key updates for 2024 in Austria

In Austria, key changes to income tax rates for 2024 include adjustments to the tax brackets. The tax-free threshold has been raised, meaning that income below a certain amount is not taxed. The tax rates for various income brackets have also been adjusted, with the changes applying to different income ranges.

The tax-free threshold and income tax rates in Austria for 2024 are as follows:

|

Annual income (eur) |

Tax rate |

|

Up to 12,816 |

0% |

|

12,816 – 20,818 |

20% |

|

20,818 to 34,513 |

30% |

|

34,513 to 66,612 |

40% |

|

66,612 to 99,266 |

48% |

|

99,266 to 1,000,000 |

50% |

|

Above 1,000,000 |

55% |

This table shows the tax rates applicable to different income brackets, with the tax-free threshold being income up to 11,693 EUR, where no income tax is levied.

Notes

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

Want to learn more about payroll, tax, social security and more?

Register free today to get the latest up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Let’s Partner

Talk to a specialist today and find out how we support the growth of over 500 businesses with a range of activpayroll solutions designed to help your global payroll and people operations succeed.