Canada

Canada’s political stability and highly skilled workforce provide many investment opportunities for companies considering expanding their operations in the country.

Need more information about payroll, compliance and social security in Canada?

Talk to a specialist

Our free global insight guide to Canada offers up-to-date information on international payroll, income tax, social security, employment law, employee benefits, visas, work permits and key updates on legislative changes and more in 2024.

Basic Facts about Canada

Canada stretches from the Atlantic Ocean on its eastern coast, to the shores of the Pacific Ocean in the west, and shares the world’s longest land border with the United States to the south.

Second only to Russia in terms of landmass, Canada is vast - covering almost 4 million square miles - and is made up of ten provinces and three territories.

Despite its size, Canada is relatively sparsely populated - with dense concentrations of inhabitants occupying its major urban centres like Montreal, Ottawa, Toronto, Edmonton and Vancouver.

Since achieving full autonomy from Britain in 1982, Canada has become one of the world’s leading economic powers, with a transparent democratic and parliamentary government system and impressive growth.

Canada’s climate varies dramatically: the Rocky Mountains and western provinces experience extremely harsh winters, while its eastern and western-most regions are wetter and milder.

General Information

- Full Name: Canada

- Population: 38,929,902 million (World Bank, 2022)

- Capital: Ottawa

- Largest City: Toronto

- Major Languages: English, French (both official)

- Major Religion: Christianity

- Monetary Unit: 1 Canadian Dollar = 100 Cents

- Main Exports: Machinery and Equipment, Automotive Products, Metals and Plastics, Forestry Products, Agricultural and Fishing Products, Energy Products

- GNI Per Capita: US $57,760 (World Bank, 2022)

- Internet Domain: .ca

- International Dialling Code: +1

How Do I Say in French?

- Hello: Bonjour

- Good Morning: Bonjour

- Good Evening: Bonsoir

- Do You Speak English?: Parlez-Vous Anglais

- Good Bye: Au Revoir

- Thank You: Merci

- See You Later: à plus tard

Dates

Dates can be written in the day, month and year sequence, or the month day and year sequence.

For Example:

- 1 July 2012 or 1/7/12

- July 1 2012 or 7/1/12

Quebec - Year/Month/Date, For Example 2012/01/01

Numbers are written with a comma to denote thousands and a period to denote fractions, for example, $ 3,000.50 (three thousand Canadian dollars and fifty cents).

Doing Business in Canada

Canada is the largest country in North America with borders stretching from the Atlantic Ocean in the east to the Pacific Ocean in the west.

As one of the world’s wealthiest nations, and its 11th largest economy, Canada’s financial landscape is diverse: natural resources, including oil and timber, play a significant part in the country’s economic profile but the manufacturing, automotive, and aerospace industries are also important.

Canada is a hub for technological innovation: it is a net exporter of energy and hosts some of the world’s leading software entertainment production centres.

Canada’s GDP reached an estimated $1.741 trillion in 2019, with a growth rate of 1.7%.

A developed parliamentary democracy, Canada is closely economically integrated with the United States with relatively open borders allowing tariff-free trade between the two countries.

Canada is a member of NATO, the UN, the G7, the G20, and the United States-Mexico-Canada Agreement. In 2019, the World Bank ranked Canada 23 on its Ease of Doing Business Survey.

Why invest in Canada

The Canadian Government welcomes inward investment in Canada with attractive incentives being available for foreign investors. Canada’s political stability and highly skilled workforce provide many investment opportunities for companies considering expanding their operations in the country. Both Forbes and Bloomberg rated Canada as the best place to do business in the G20 while, from 2006-2015, Canada led the G7 in terms of economic growth.

Canada also has the lowest tax rates, and the lowest cost of doing business (for R&D based organisations) of the G7 countries.

With the Comprehensive Economic Trade Agreement coming into effect in 2016, Canada now enjoys access to the diverse markets of both Europe and North America (through NAFTA).

Business Banking in Canada

It is not mandatory to make payments to both employees and the authorities from a Canadian bank account. Core banking hours for the public are from 9.00 am to 5.00 pm.

Registrations and Establishing an Entity in Canada

Any company wishing to operate in Canada must decide whether operations will occur within a single province or throughout Canada. If business will be conducted all over the country, the corporation must register both federally and within the individual provinces that the business will be conducted in.

All businesses operating in Canada are required to register with the Canadian Revenue Agency to receive a business number. This number will allow the business to pay or claim Sales Tax, Income Taxes and Payroll Taxes.

In addition to registering a business number, some entities may be required to register with provincial Workers Compensation boards, provincial heath tax boards or other applicable provincial agencies.

Please refer the provincial government requirements for specific details.

Visas and Work Permits in Canada

Depending upon the foreign worker’s country of citizenship, a Temporary Resident Visa may also be required in order to enter Canada.

Before a Canadian Work Permit request will be considered or processed a written job offer from an employer to the potential future employee is required to be submitted.

Once a potential future employee receives a written job offer in most cases it is then subject to confirmation by Human Resources and Skills Development Canada (HRSDC) who will assess the likely impact of employing a foreign national in the position in question, to ensure that the employment is genuine and that it will not impact negatively on the domestic labour market.

With the exception of persons who have been granted protected person status and of those who are applying for refugee status, all applicants must meet the following requirements:

- Have a valid passport or other travel document issued by their country of residence

- Be in good health (a medical exam may be required)

- Provide proof that they have sufficient funds to support their stay in Canada

- Demonstrate that their stay in Canada is temporary

- Not have a criminal record, nor be considered a security risk

In addition, other employer specific criteria may apply.

In most cases, foreign workers must have obtained a labor market opinion from their potential employer before applying for a Work Permit.

Tax in Canada

The tax year runs from 1 January to 31 December.

There is no requirement for a third party to be licensed in order to make any tax filings on the behalf of a client. Although a license is not required, a Power of Attorney or Government Authorization form for the business is required.

The penalty for failing to distribute T4 slips to a recipient is $25.00 per day for each failure with a minimum penalty of $100.00 and a maximum penalty of $2,500.00.

Canada has multiple remittance frequencies for a variety of Federal and Provincial statutory tax deductions that will be outlined in this document. Remittance frequencies and rates are generally provided by the Ministries based on company’s gross payroll earnings.

The key payroll submission dates are as follows:

|

Description |

Deadline |

|

Federal tax slip summary |

End of February of the following year |

|

Quebec tax slip summary |

End of February of the following year |

|

Workers Compensation |

Various date between end of February and end of March of the following year |

|

EHT |

On or before March 15 of the following year |

|

QHSF & CNT & WSDRF |

End of February of the following year |

|

HET |

Ministry may request annual filing |

Taxation

Canadian employers are responsible for calculating, withholding, reporting, and remitting all employee and employer tax deductions based on their employees’ gross payroll to all applicable government parties.

Canadian workers will see their federal income-based taxes increase in 2024 due to rising payroll taxes.

Federal Remittance Types

Federal Tax: based on employees’ taxable gross calculated on the employees’ earnings tax bracket.

For 2024, the federal tax rates and income thresholds are:

|

Annual taxable income ($) from |

Annual taxable income ($) to |

Federal tax rate, R |

Constant ($), K |

|

0.00 |

55,867.00 |

0.1500 |

0 |

|

55,867.01 |

111,733.00 |

0.2050 |

3,073 |

|

111,733.01 |

173,205.00 |

0.2600 |

9,218 |

|

173,205.01 |

246,752.00 |

0.2900 |

14,414 |

|

246,752.01 |

and over |

0.3300 |

24,284 |

Provincial tax (excluding Quebec)

Provincial tax is based on employees’ taxable gross calculated on the employees’ earnings tax bracket.

For 2024, the provincial income thresholds, the personal amounts, and the tax reduction amounts have been indexed. They have been changed based on changes in the consumer price index. The indexing factor as of January 1, 2024 is 4.5%. For 2024, the Ontario tax rates and income thresholds are:

|

Annual taxable income ($) from |

Annual taxable income ($) to |

Provincial tax rate, V |

Constant ($), KP |

|

0.00 |

51,446.00 |

0.0505 |

0 |

|

51,446.01 |

102,894.00 |

0.0915 |

2,109 |

|

102,894.01 |

150,000.00 |

0.1116 |

4,177 |

|

150,000.01 |

220,000.00 |

0.1216 |

5,677 |

|

220,000.01 |

and over |

0.1316 |

7,877 |

Quebec Remittance Types

Provincial Tax: based on employees’ taxable gross calculated on the employees’ earnings tax bracket

Canadian Pension Plan and Quebec Pension Plan

Remittances to the Canadian Pension Plan (CPP) are remitted based on the remittance frequency.

Employers must also contribute the same amount of CPP or QPP (if in Quebec) that you deduct from your employee’s remuneration. This is contributed until the salary or wages paid to the employee for the year reach the maximum pensionable salary or wages for the year. CPP (excluding Quebec) is based on employees’ pensionable earnings. Employee and employer premiums required.

QPP is based on employees’ pensionable earnings. Employee and employer premiums required.

Effective January 1, 2024, a higher second earnings ceiling of $73,200, known as the Year’s Additional Maximum Pensionable Earnings (YAMPE), will be implemented and used to determine second additional CPP contributions (CPP2). This CPP2 is part of the CPP enhancement.

As a result, pensionable earnings between $68,500 and $73,200 are subject to CPP2 contributions.

|

2024 |

CPP |

CPP2 |

QPP |

QPP2 |

|

Yearly Maximum Pensionable Earnings |

$68,500.00 |

|

$68,500.00 |

|

|

Year’s Additional Maximum Pensionable Earnings (2nd Ceiling) |

|

$73,200.00 |

|

$73,200.00 |

|

Annual Exemption |

$3,500 |

n/a |

$3,500 |

n/a |

|

Annual Maximum Contributory Earnings |

$65,000.00 |

$4,700.00 |

$65,000.00 |

$4,700.00 |

|

Contribution Rate |

5.95% |

4.00% |

6.40% |

4.00% |

|

Annual Maximum Contribution (Employee/Employer) |

$3,867.50 |

$188.00 |

$4,160.00 |

$188.00 |

Employment Insurance

EI (excluding Quebec) is based on employees’ insurable earnings. Employee and employer premiums required.

|

Description |

EI Employee Maximum 2024 |

EI Maximum Employer 2024 |

|

EI Maximum Earnings |

$63,200.00 |

$63,200.00 |

|

EI Contribution Rate (%) |

1.66% |

2.324% |

|

Max. EI Contribution |

$1,049.12 |

$1,468.77 |

Ontario Employer Health Tax

Employer paid, calculated based on employee gross earnings. An exemption may be applicable if the company qualifies based on EHT ruling.

|

Total Ontario remuneration |

Rate |

Remittance Frequency |

|

Up to $200,000.00 |

0.98% |

Annual returns are due March 15th of the following calendar year |

|

$200,000.01 to $230,000.00 |

1.101% |

Annual returns are due March 15th of the following calendar year |

|

$230,000.01 to $260,000.00 |

1.223% |

Annual returns are due March 15th of the following calendar year |

|

$260,000.01 to $290,000.00 |

1.344% |

Annual returns are due March 15th of the following calendar year |

|

$290,000.01 to $320,000.00 |

1.465% |

Annual returns are due March 15th of the following calendar year |

|

$320,000.01 to $350,000.00 |

1.586% |

Annual returns are due March 15th of the following calendar year |

|

$350,000.01 to $380,000.00 |

1.708% |

Annual returns are due March 15th of the following calendar year |

|

$380,000.01 to $400,000.00 |

1.829% |

Annual returns are due March 15th of the following calendar year |

|

Over $400,000.00 |

1.95% |

Annual returns are due March 15th of the following calendar year |

|

Over $1.200,000 |

1.95% |

Monthly due on the 15th of the month after the payroll was paid |

Quebec Health Service Fund

Employer paid, calculated based on employee gross earnings. An exemption may be applicable if the company qualifies based on QHSF ruling.

The 2023 Total Quebec Remuneration is as follows:

|

Total Quebec remuneration→ |

LESS THAN $1,000,000 |

$1,000,000.01 to $7,499,999.99 |

$7,500,000 or more |

|

Employers whose total payroll is more than 50% attributable to activities in the primary and manufacturing sectors |

1.25 |

|

4.26 |

|

All employers other than public sector employers and employers whose total payroll is more than 50% attributable to activities in the primary and manufacturing sectors |

1.65 |

1.2290 + (0.4210 × TP/1,000,000) |

4.26 |

|

Public-sector employers |

4.26 |

||

Manitoba Health and Post-Secondary Education Tax Levy (HET)

Employer paid, calculated based on employee gross earnings.

|

Total Manitoba remuneration |

Rate |

Remittance Frequency |

|

$2,250,000.00 or less |

Exempt |

- |

|

Between $2,250,000.01 and $4,500,000.00 |

4.3% in excess of $2,250,000.00 |

Monthly due on the 15th of the month after the payroll was paid |

|

$4,500,000.01 or more |

2.15% |

Monthly due on the 15th of the month after the payroll was paid |

Newfoundland Health and Post-Secondary Education Tax (HAPSET)

Employer paid, calculated based on employee gross earnings. An exemption may be applicable if the company qualifies based on HAPSET predetermination.

|

EXEMPTION |

Rate |

Remittance Frequency |

|

$2,000,000.00 |

2% |

Monthly due on the 20th of the month after the payroll was paid |

British Columbia Employer Health Tax

Employer paid, calculated based on employee gross earnings. An exemption may be applicable if the company qualifies based on EHT ruling.

|

Total British Columbia remuneration |

TAX PAYABLE |

Remittance Frequency |

|

$500,000.00 or less |

Exempt |

- |

|

Between $500,000.01 and $1,500,000.00 |

(Assessable remuneration less $500,000.00) x 2.925% |

Annually

Quarterly

|

|

Over $1,500,000.00 |

Assessable remuneration x 1.95% |

Quarterly installments required by the 15th of the following month |

Reporting Tax in Canada

Reporting & Remittance Frequency

The Workers’ Compensation Board is funded solely by employers. The board’s responsibility is preventing disability. They do that by providing compensation, service and support to workers injured on the job. They also promote workplace safety through training, inspection and compliance and investigations.

|

Province |

Description |

Annual Maximum |

Remittance Frequency |

Calculation Description |

|

British Columbia |

Worksafe |

$116,700 |

Annually/ Quarterly based on Premium owing |

Based on industry rate & actual assessable earnings |

|

Alberta |

WCB |

$104,600 |

Installments based on Premium owing |

Based on industry rate & estimated assessable earnings for the coming year |

|

Manitoba |

WCB |

$160,510 |

Annually/ Quarterly/ FlexPay |

Based on industry rate & estimated assessable earnings for the coming year |

|

Ontario |

WSIB |

$112,500 |

Annual, Quarterly, Monthly |

Based on industry rate & actual assessable earnings |

|

Quebec |

CNESST/CSST |

$94,000 |

Same as RQ remittance frequency |

Based on industry rate & actual assessable earnings |

|

New Brunswick |

WorksafeNB |

$76,900 |

Annually/ Monthly |

Based on industry rate & actual assessable earnings for the year |

|

Nova Scotia |

WCB |

$72,500 |

Varies. Usually same as CRA remittance frequency |

Based on industry rate & actual assessable earnings |

New Employees in Canada

Employees must be eligible to work in Canada and are required to have a valid Social Insurance Number. Employees must be registered on the payroll upon receipt of their Social Insurance Number (SIN).

The information required for setting up a new employee is as follows:

- Name

- Date of Birth

- Citizenship/Legal Status

- Residential Address

- Telephone Number

- SIN Number

- Bank Account Details (Void Cheque/Direct Deposit slip)

- Employee’s employment contract information

- Collective Agreement information (If applicable)

- Employee Tax Details (TD1/TP-1015.3-V forms)

- Benefit/Pension Enrolment or Waiver forms (If applicable)

- Electronic Pay Statement, T4/RL1 Authorization form

- Work Location/Province of Employment

Employers are required to ensure new employees are aware that they have to complete a TD1.

Leavers in Canada

Employees whose employment is terminated must be paid within a certain number of days from their last day worked, particularly if their employment was terminated by the employer. Final payment date will be driven by provincial legislation. Most companies simply pay at the next pay date.

For terminated employees the requirements are to detail the reason for termination, the effective date and provide clarification and payment if there are any outstanding items such as bonuses or days due for vacation.

The employer must issue a Record of Employment (ROE) within provincially driven calendar days after the end of the pay period that the interruption of earnings occurred. Failure to do so could result in a fine of up to $2,000.00 and / or imprisonment of up to six months.

Payroll in Canada

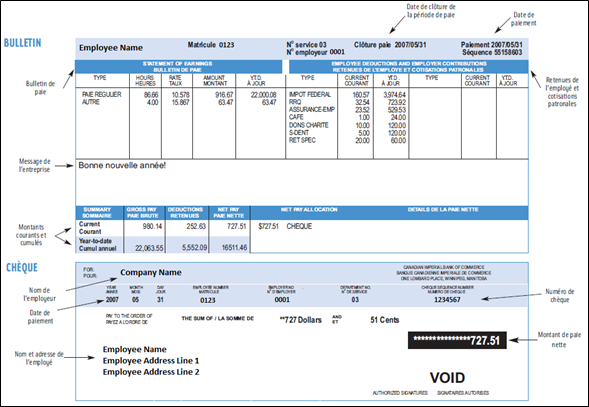

It is legally acceptable in Canada to provide employees with online pay slips providing acceptance received from the employee. You are required to provide the pay slips in the employee’s language of choice (English or French).

Reports

Payroll and other employment records must be kept for at least 36 months.

Canadian payslip example

Employment Law in Canada

Holiday Accrual and Calculations in Canada

Vacation entitlement (also known as Holiday Accrual) varies by province, but paid vacation is typically accrued based on a percentage of earnings.

Provincial standards entitlement for vacation entitlement are as follows:

|

PROVINCE |

VACATION ENTITLEMENT |

|

British Columbia |

|

|

Alberta |

|

|

Ontario |

|

|

Quebec |

|

|

Nova Scotia |

|

|

Manitoba |

|

|

Federal Government |

Employees are entitled to:

Holiday pay is:

|

Maternity and Parental Leave

Every jurisdiction has legislation regarding maternity/pregnancy leaves. Some jurisdictions also legislate parental, paternal, adoption and child care leaves. Maternity leave, also called pregnancy leave in some jurisdictions, can only be taken by the birth mother. Parental, adoption and child care leaves can be taken by natural or adoptive mothers and fathers.

Maternity (Pregnancy) leave ranges from 16-17 weeks based on jurisdiction. Paternal leave ranges from 35 - 77 weeks based on jurisdiction, and in some cases based on whether pregnancy leave was taken.

Payments for this leave are issued by the Service Canada (Employment Insurance) office. The employer has the option to top up the employee’s maternity leave but this is not an obligation.

Some jurisdictions also allow paid or unpaid pregnancy leave in the case of a stillbirth or miscarriage.

Sick Leave

In Federal jurisdiction, Manitoba, New Brunswick, Northwest Territories, Nova Scotia, Prince Edward Island, Québec, Saskatchewan and the Yukon, employees are allowed unpaid sick leave from three days to 26 weeks based on the jurisdiction.

British Columbia: Effective January 1, 2022, you can take up to 5 days of paid leave per year for any personal illness or injury. Your employer may request reasonably sufficient proof of illness.This entitlement is in addition to the 3 days of unpaid sick leave currently provided by the Employment Standards Act.You must have worked with your employer for at least 90 days to be eligible for the paid sick days.

Quebec: Employees receive up to two paid sick days per year and up to 26 weeks unpaid job-protected leave in a 12-month period.

The remaining jurisdictions rely on employer sick leave policies or general/emergency leave provisions in their legislation to cover individuals who are absent due to illness. This is specific to the employer.

National Service

There is no mandatory National Military Service in Canada.

National Minimum Wage in Canada in 2024

Employers in Canada are required to pay their employees at least the minimum wage rate set by the province or territory where the work is performed. These rates are often reviewed and adjusted to reflect changes in economic conditions and cost of living.

|

Province/Territory |

Minimum Wage |

|

Alberta |

CAD 15.00 per hour |

|

British Columbia |

CAD 15.65 per hour |

|

Manitoba |

CAD 15.30 per hour |

|

New Brunswick |

CAD 14.75 per hour |

|

Newfoundland and Labrador |

CAD 15.00 per hour |

|

Northwest Territories |

CAD 16.05 per hour |

|

Nova Scotia |

CAD 15.00 per hour |

|

Nunavut |

CAD 19.00 per hour |

|

Ontario |

CAD 16.55 per hour |

|

Prince Edward Island |

CAD 15.00 per hour |

|

Quebec |

CAD 15.25 per hour |

|

Saskatchewan |

CAD 14.00 per hour |

|

*Saskatchewan as of 01-Oct 2024 |

CAD 15.00 per hour |

|

Yukon |

CAD 16.77 per hour |

Working Days and Working Hours in Canada

The standard business week in Canada is Monday to Friday, generally working 40 hours per week (8 hours per day).

Statutory National Holidays in Canada 2024

There are multiple statutory holiday schedules within Canada. Below are the statutory national holidays in Canada for 2024.

|

Holiday Name |

Weekday |

Date |

|

New Year's Day |

Monday |

January 1 2024 |

|

Provincial Holiday - Day after New Year |

Tuesday |

January 2 2024 |

|

Family Day |

Monday |

February 19 2024 |

|

Good Friday |

Friday |

March 29 2024 |

|

Easter Monday |

Monday |

April 1 2024 |

|

Victoria Day |

Monday |

May 20 2024 |

|

Provincial Holiday - St John Baptiste Day |

Monday |

June 24 2024 |

|

Canada Day |

Monday |

July 1 2024 |

|

Civic Holiday |

Monday |

August 5 2024 |

|

Labour Day |

Monday |

September 2 2024 |

|

National Day for Truth and Reconciliation |

Friday |

September 30 2024 |

|

Thanksgiving |

Monday |

October 14 2024 |

|

Remembrance Day |

Monday |

November 11 2024 |

|

Christmas Day |

Wednesday |

December 25 2024 |

|

Boxing Day |

Thursday |

December 26 2024 |

Employee Benefits in Canada

Typical benefits provided in Canada include the following:

- Health Care Plans – Taxable Benefit in Quebec

- Dental Care Plans – Taxable Benefit in Quebec

- Disability Coverage – Can be taxable (depends on the coverage)

- Life Insurance – Taxable Benefit in Canada

- Accidental Death & Dismemberment – Taxable Benefit in Canada

- Registered Retirement Savings Plan – Pension Adjustment

- Tax free Savings Account

- Pension (Define Contribution or Define Benefit) – Pension Adjustment

Employers generally contribute a portion of the premiums (usually at least 50%). Certain employer paid benefits are considered a taxable benefit to the employee and statutory and source deductions must be calculated on the benefit cost. The taxable benefits must be reported on the Canadian tax slips (T4, T4A, RL1, RL2…) in the applicable boxes.

Key updates for 2024 in Canada

In 2024, Canada is seeing several key updates in the areas of income tax, social security, and employment law:

Income Tax Changes

- There will be significant changes to the Alternative Minimum Tax (AMT) calculation. This includes an increase in the basic exemption from $40,000 to $173,000 and a rise in the AMT rate from 15% to 20.5%.

- The capital gains inclusion rate will be 100%, and the employee stock option benefit will be fully included.

- Deductions are being limited to 50%, affecting various expenses such as employment expenses, Canada Pension Plan contributions, moving expenses, child care expenses, and disability supports deduction.

- Most non-refundable tax credits will be reduced to 50%, with some exceptions like the Special Foreign Tax Credit, which will be allowed in full.

Social Security Changes

- The Canada Pension Plan (CPP) is seeing changes, including new T4 boxes for both CPP and Quebec Pension Plan (QPP) for the new contributions starting in 2024.

- There will be adjustments in maximum pensionable earnings and second earnings ceiling for CPP contributions.

Employment Law Updates

- Federally regulated employers with 10 or more employees must publish their pay equity plan by September 3, 2024, as per the Pay Equity Act and Pay Equity Regulations. This includes creating a pay equity committee for employers with 100 or more employees and unionized employers.

- Nova Scotia is expanding workers’ compensation coverage starting September 1, 2024, for people who experience significant stress over time due to work.

- The Northwest Territories is enhancing its health benefits policy for low-income residents, effective April 1, 2024

- Nunavut is increasing its minimum wage from $16 to $19 per hour effective January 1, 2024, which will be the highest rate in Canada.

- Ontario is implementing new regulations for temporary work agencies and recruiters, requiring a license to operate from July 1, 2024.

- Quebec is introducing stricter language criteria for its immigration program for temporary foreign workers or foreign students who have graduated in Quebec, effective November 23, 2024.

These changes reflect Canada's ongoing efforts to adapt its tax, social security, and employment systems to current economic conditions and social needs.

Notes

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

Want to learn more about payroll, tax, social security and more?

Register free today to get the latest up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Let’s Partner

Talk to a specialist today and find out how we support the growth of over 500 businesses with a range of activpayroll solutions designed to help your global payroll and people operations succeed.