Colombia

Foreign investment is strongly encouraged by the Government of Colombia, with the country quickly becoming one of the best markets in Latin America in which to invest.

Need more information about payroll, compliance and social security in Colombia?

Talk to a specialist

Our free global insight guide to Colombia offers up-to-date information on international payroll, income tax, social security, employment law, employee benefits, visas, work permits and key updates on legislative changes and more in 2024.

Basic Facts about Colombia

General Information

- Full Name: Republic of Colombia

- Population: 51.87 million (World Bank, 2022)

- Capital: Bogotá

- Main Exports: Crude petroleum and coal briquettes, coffee and spices, gems and precious materials, plastics, fruit and nuts.

- Main Language: Spanish

- Monetary Unit: Colombian peso

- GNI Per Capita: $12,869 (World Bank 2022)

- Internet Domain: .co

- International Dialling Code: +57

How Do I Say In Spanish?

- Hello: Hola

- Good Morning: Buenos Días

- Good Evening: Buenas Noches

- Do You Speak English?: Habla Inglés

- Good Bye: Despedida

- Thank You: Gracias

Dates

Dates are usually written in the day, month and year sequence. For example, 1 April 2020 or 01/04/2020. Roman numbers are often used to represent the month. For example, 01/IV/2020.

Numbers are written with a period to denote thousands and a comma to denote fractions. For example, $ 3.000,50.

Foreign Direct Investment in Colombia

Foreign investment is strongly encouraged by the Government of Colombia, with the country quickly becoming one of the best markets in Latin America in which to invest.

The country has political stability and an attractive emerging economy. The country relies heavily on its natural resources (including oil, coffee and gold), its competitive workforce and booming tourism sector.

Colombia has the advantage of being the only country in South America with coastline on the Pacific and Atlantic Ocean which helps improve access to the global market.

Despite Spanish being the official language of Colombia, English is also widely spoken, especially in larger cities such as Bogotá and Medellín.

Why Invest in Colombia

Foreign investment is strongly encouraged by the Government of Colombia, with the country quickly becoming one of the best markets in Latin America in which to invest. The country has political stability and an attractive emerging economy. The country relies heavily on its natural resources (including oil, coffee and gold), its competitive workforce and booming tourism sector.

Colombia has the advantage of being the only country in South America with coastline on the Pacific and Atlantic Ocean which helps improve access to the global market. Despite Spanish being the official language of Colombia, English is also widely spoken, especially in larger cities such as Bogotá and Medellín.

Business Banking in Colombia

It is mandatory to make payments to both employees and the authorities from an in-country bank account.

Generally, banks are open to the public from 09:00 to 16:00 Monday to Friday in Bogotá and from 08:00 to 11:30 and 14:00 to 16:30 in the rest of the country. Banks close at noon on the last working day of the month. Some banks are open from 9:00 to noon on a Saturday.

Company Registrations and Establishing an Entity in Colombia

In Colombia a company is required to have a legal entity established in order to process a payroll.

The most common forms of entity in Colombia are:

- Limited Liability Companies (LTDA)

- Corporations (SA)

- Simplified Stock Companies (SAS)

Limited Liability Companies (LTDA)

The company should typically be incorporated by a public deed and must have a minimum of two shareholders with a maximum of 25 shareholders. There is no requirement for a Limited Liability Company to have a board of directors, however the social purpose for the business must be clearly defined. The capital of the company must be paid in full at the time of incorporation.

Required documentation:

- Approved Bylaws by a Board's resolution

- Legalised and apostilled copies of the documents of the governance of shareholders

- PoA

Required local registrations:

- Notary Public Office

- Local Chamber of Commerce

- National Tax Authority

- Municipal Tax Authority

Corporations (SA)

The company should be incorporated by a public deed and must have a minimum of five shareholders, each shareholder is liable for the amount of capital contribution represented by negotiable shares.

Required documentation:

- Approved Bylaws by a Board's resolution

- PoA

Required local registrations:

- Notary Public Office

- Local Chamber of Commerce

- National Tax Authority

- Municipal Tax Authority

Simplified Stock Companies (SAS)

The SAS is the most popular type of entity in Colombia and is particularly popular with both large and small businesses. The company can be incorporated by a public deed or private document and only one shareholder is required. Unlike the two mentioned above, a SAS is not required to state the purpose of their entity, leaving a business free to conduct any lawful business activity.

Required documentation:

- Approved Bylaws by a Board's resolution

- PoA

Required local registrations:

- Local Chamber of Commerce

- National Tax Authority

- Municipal Tax Authority

Visas and Work Permits in Colombia

To work in Colombia, all business visitors must obtain a work visa. There are three visa options available:

- Visitor “V” type visa: For the visitor who wants enter the country without permanent establishment

- Migrant “M” type visa: For those who want to enter the country and live there on a temporary basis

- Resident “R” type visa: For those who want to establish themselves in Colombia permanently

Only holders of visa M or R have permission to work in Colombia and visas are relatively easy to obtain once a person has accepted a job offer from a local employer.

Once the worker has signed a contract, they can begin the application process. In order to apply for a visa, the below documents are required:

- Summary of the employment contract. The visa authorities may ask for the original if they need more information.

- Letter of motivation from the employer

- Six months of bank statements

- Photocopy of the first page of the applicant’s passport

- Passport-style photo with a white background that is 3 cm wide and 4 cm tall.

Income Tax in Colombia

The tax year runs from 1 January to 31 December.

Individual Income Tax

Colombia residents are taxed on worldwide income no matter where it is generated. An individual is considered a resident of Colombia if they spend longer than 183 days in the country during the tax year. The first UVT (Tax Value Unit) 1,090 in individual earns is considered tax free. As of 1,090 UVT it is taxed as follows:

|

UVT Ranges |

Marginal Rate |

Tax |

|

|

From |

To |

||

|

> 0 |

1.090 |

0% |

0 |

|

>1.090 |

1.700 |

19% |

(Taxable Base in UVT minus 1.090 UVT) x 19% |

|

>1.700 |

4.100 |

28% |

(Taxable Base in UVT minus 1.700 UVT) x 28% + 116 UVT |

|

>4.100 |

8.670 |

33% |

(Taxable Base in UVT minus 4.100 UVT) x 33% + 788 UVT |

|

>8.670 |

18.970 |

35% |

(Taxable Base in UVT minus 8.670 UVT) x 35% + 2.296 UVT |

|

>18.970 |

31.000 |

37% |

(Taxable Base in UVT minus 18.970 UVT) x 37% + 5.901 UVT |

|

>31.000 |

|

39% |

(Taxable Base in UVT minus 31.000 UVT) x 39% + 10.352 UVT |

Non-residents are only taxed on their income from Colombia. An individual is considered a non-resident if they spend less than 183 days in Colombia during the tax year.

Corporate Income Tax (CIT)

Companies incorporated in Colombia are taxed on their income worldwide. Currently, the CIT rate for the 2023 tax year is onwards:

|

TAX REGIME |

RATE |

|

Ordinary regime |

35% |

|

Special regime |

0-10%(*) |

|

Simple regime |

(**) |

(*)Valid only for non-governmental entities that develop meritorious activities accredited by the Colombian government for such purpose. If the profits are reinvested in the economic activity of the entity, no income tax will be paid.

(**)Depending on the economic group in which the company develops its activity and its income level, a differential rate established in article 908 of the tax statute applies.

Social Security in Colombia

Colombia has a mandatory social security system, employers and employees are both required to contribute to the system. Employers in Colombia must register with different entities that are part of the social security system. The below outlines the entities and the contributions paid by the employee and employer:

|

|

Employee Contribution |

Employer Contribution |

|

Mandatory Health Plan (EPS) |

4% |

8% |

|

Mandatory Pension Fund (AFP) |

4% |

12% |

|

Family Compensation Fund (CCF)* |

0% |

4% |

|

Occupational Risk (ARL) |

0% |

0.52% - 6.96% |

|

Family Welfare (ICBF)* |

0% |

3% |

|

National Occupational Training Service (SENA)* |

0% |

2% |

* The percentages may decrease depending on the characteristics of the company

Reporting in Colombia

According to the economic activity of the companies, the following are the minimum reports that an entity must submit to the local control entities:

|

ENTITY |

RESPONSIBILITY |

PERIODICITY |

|

DIAN (National Taxes and Customs Directorate) |

Sales tax (VAT) |

Bimonthly - Quarterly |

|

Income Tax |

Annual |

|

|

Exogenous Information |

Annual |

|

|

Electronic Documents |

Permanently |

|

|

Withholding at source |

Monthly |

|

|

Annual Transfer Pricing Statement |

Annual |

|

|

Declaration of assets abroad |

Annual |

|

|

Unique registry of beneficial owners |

Annual |

|

|

Consumption Tax |

Bimonthly |

|

|

Superintendencies |

Financial Information Report |

Quarterly- Semiannual- Annual |

|

Bank of the Republic |

Exogenous exchange information |

Quarterly |

|

Exchange information |

Permanently |

|

|

Secretary of Finance by municipality |

Industry and commerce tax |

Annual-Bimonthly |

|

Withholding tax at source |

Bimonthly |

|

|

Property tax |

Annual |

|

|

Vehicle tax |

Annual |

|

|

DANE (National Administrative Department of Statistics) |

Monthly service tax Monthly |

Monthly |

New Employees in Colombia

When a new employee is hired, a written contract is created by the employer, following this they will be enrolled in the social security system. The employee will choose from a variety of health insurance plans and pension entities and must be enrolled in a labour risk entity for professional risk and workers insurance. The final step is for the employer to enroll the employee in the welfare entity.

The above may seem straightforward, however this is where the complexity of hiring a new start begins. All of the above registrations must be completed on the same day that the new employee commences employment with the company. All documents must be signed in person and on paper, no digital signatures are allowed when submitting documents to the social security office.

In addition to the above, the employee must have a mandatory medical exam by a doctor (provided by the company) three days prior to commencing employment.

Colombia has a somewhat open view to hiring foreign employees and they have the same rights as Colombian employees. The Colombian migration policy promotes the entry of foreign employees with the skills to contribute towards the development of economic, scientific, cultural or educational activities that can benefit the country.

If you are an employer and wish to hire a foreigner, you must follow the below steps:

- The employee must acquire a visa that allows you to develop the activity, occupation or authorised trade.

- Obtain an Alien Identity Card when your stay is equal to or greater than three months.

- Inform the Migration Colombia Administrative Unit in writing about the connection, hiring or admission and its withdrawal or termination of the contract, within 15 calendar days following the initiation or termination of work.

It is important to keep in mind that in the country there are some regulated professions which require a Special Temporary Enrollment granted by the Professional Councils for the exercise of the profession of each area of knowledge.

The employer or contractor must bear the return expenses of the foreign worker and his family or beneficiaries as long as the foreign worker is hired abroad to carry out an activity in Colombia.

Leavers in Colombia

Payment for leavers must be made within 10 consecutive days of the employee’s last day. If it is a pre-determined contract, payment must be made by the next working day after the last day worked.

The employer may terminate the employment relationship without just cause. An employee discharged without just cause must be given advanced notice. If the employee is paid weekly or at shorter interim's, 8 days’ notice is required. If the employee is paid less often than weekly or has been with the employer for longer than one year, a minimum of 30 days’ notice is required, with 3 more days added for each additional year of service at the company up to a 90-day prior notice.

During the period of notice, employees may take leave for up to two hours a day with pay. If the employer fails to give the required notice, the employee is entitled to be paid his or her regular salary for the period of required notice.

Discharge for a just cause does not require an advanced notice.

The authorities must be notified of any leavers.

Payroll in Colombia

It is legally acceptable in Colombia to provide employees with online payslips.

Reports

Payroll reports must be kept for a minimum of 20 years.

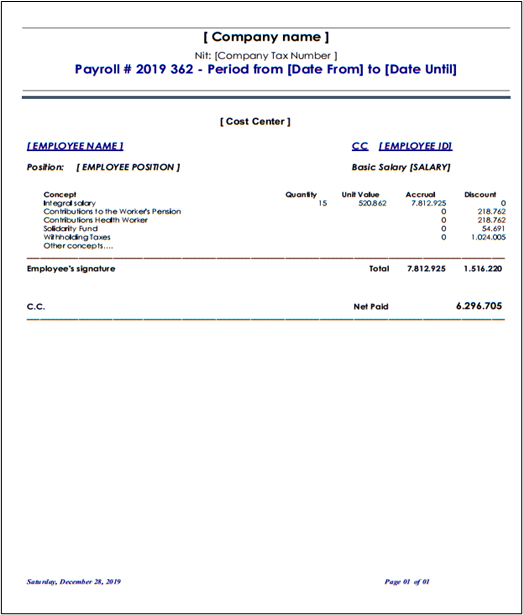

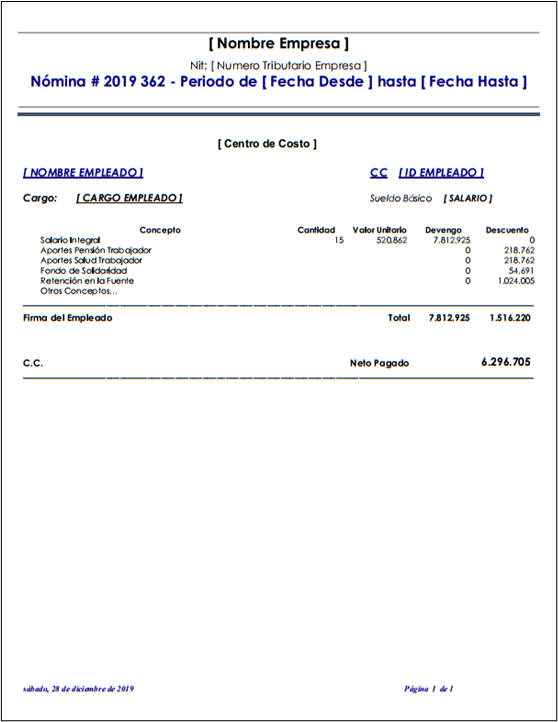

Colombian Payslip Example

English Language

Local language example

Employment Law in Colombia

Holiday Accrual

In Colombia, an employee is entitled to 15 days of paid vacation per year once they have completed one year of service. In case of resignation or dismissal, the number of days to which the employee has the right must be calculated and paid (approaching the largest integer).

Example

3 months = 15 x 90/360 = 3.75 4 days of holidays

6 months = 15 x 180/360 = 7.5 8 days of holidays

9 months and 10 days = 15 x 280/360 = 11.6 12 days of holidays

There are 18 national holidays every year in Colombia, anyone who works on an official holiday will receive overtime compensation.

Maternity Leave

According to Decree 2126 of 2023, Maternity leave consists of 18 consecutive weeks and Law 2114 of July 29, 2021, modified Article 236 of the Substantive Labor Code, which introduced the "Shared Parental Leave", where part of the maternity leave can be shared with the father.

The fathers may freely distribute among themselves the last six (6) weeks of the mother's leave, as long as they comply with the conditions and requirements set forth in this article. This leave, in the case of the mother, is independent of the breastfeeding leave.

The distribution of the leave must be in common agreement between father and mother, by signing a document to be submitted to the respective employer.

Paternity Leave

Employees are entitled to 14 days (continuous days) of paid paternity leave when their spouse or partner gives birth to or adopts a child.

Sickness

Workers are entitled to 2/3 of their salary for the first two days of work they miss due to illness and this is paid by the employer. From day three onwards, the employer can claim payment back from the social security system. A medical authorization from a Colombian social security entity must be obtained in order for the employee to be paid for their sick leave.

If an employee is injured while working, he/she is eligible for 100% of their salary for the duration of their absence.

National Service

There is no national service in Colombia

Minimum Wage in Colombia in 2024

In 2024 there will be a 12% increase. The new minimum salary will be 1.3 million Colombian pesos per month, which represents an increase of 140,000 pesos with respect to the previous year, and a 15% increase in the transportation allowance to $162,000.

This increase comes against the backdrop of high inflation and the economic challenges facing the country.

Working Week in Colombia

By law, the maximum a person can work in Colombia is 48 hours per week, usually between Monday to Friday or Monday to Saturday.

If an employee has to work between the hours of 22:00 and 06:00, the rate of pay must be 35% more than the equivalent daytime salary. If agreed between the employee and employer, the employee can have a flexible schedule. No more than 10 hours must be worked in one day, four of which must be during the daytime.

Statutory National Holidays in Colombia 2024

| Name of the Holiday | Day of the Week | Date |

|---|---|---|

| New Year's Day | Monday | 01-01 |

| Epiphany (Three Kings' Day) | Monday | 08-01 |

| Saint Joseph's Day | Monday | 25-03 |

| Maundy Thursday | Thursday | 28-03 |

| Good Friday | Friday | 29-03 |

| Labor Day | Wednesday | 01-05 |

| Ascension of the Lord | Monday | 13-05 |

| Corpus Christi | Monday | 03-06 |

| Sacred Heart | Monday | 10-06 |

| Saints Peter and Paul's Day | Monday | 01-07 |

| Declaration of Independence | Saturday | 20-07 |

| Battle of Boyacá | Wednesday | 07-08 |

| Assumption of the Virgin | Monday | 19-08 |

| Columbus Day | Monday | 14-10 |

| All Saints' Day | Monday | 04-11 |

| Independence of Cartagena | Monday | 11-11 |

| Christmas Day | Wednesday | 25-12 |

Employee Benefits in Colombia

General expenses, fuel, performance bonuses, food bonuses, health bonus, among others can be managed as direct payment from the company or as payment to the employee. Only extra payments that do not exceed 40% of all payments made to the employee should be verified.

Legally in Colombia a worker is entitled to the payment of social benefits and social security:

|

SOCIAL BENEFITS |

AMOUNT |

PERIODICITY |

|

Service Bonus (June-December) |

50% Salary |

Semiannual |

|

Severance pay |

1 Salary |

Annual |

|

Severance Interests |

12% of Severance |

Annual |

|

Vacation |

15 days per year |

Annual |

|

SOCIAL SECURITY |

RESPONSIBLE FOR PAYMENT |

PERIODICITY |

|

Health |

Employer (8.5%)/ Employee (4%) |

Monthly |

|

Pension |

Employer (12%)/ Employee (4%) |

Monthly |

|

Arl |

Employer (depending on the level of risk associated) |

Monthly |

|

PARAFISCALS |

RESPONSIBLE FOR PAYMENT |

PERIODICITY |

|

Family Compensation Fund |

Employer (4%) |

Monthly |

|

Sena |

Employer (2%) |

Monthly |

|

ICBF |

Employer (3%) |

Monthly |

Key updates for 2024 in Colombia (Effective as of tax reform 2022)

In 2024, Colombia introduced significant changes to its tax legislation and regulations, affecting income tax, corporate income tax, capital gains, dividends, wealth tax and other areas, according to the Tax Reform Law (Law 2277). Here is a summary of the main changes:

Corporate Income Tax (CIT)

- General corporate tax rate: It remains at 35%.

- Minimum effective tax rate (METR): A 15% METR applies to companies resident in Colombia, with some industry-specific exceptions.

- Surcharges: Additional surcharges apply to financial institutions, natural resource extraction, hydroelectric power generation companies, and certain segments of the crude oil and coal extraction and production industry.

- Specific industries: New or adjusted corporate income tax rates for certain industries, including hotels, tourism theme parks, agrotourism, and hydroelectric power generation.

- Capital Gains Tax (Capital Gains Tax)

Capital Gains Tax (Capital Gains Tax)

- The capital gains tax rate is increased from 10% to 15%.

- Adjustments in the limits of exempt capital gains for life insurance claims, inheritances, donations and home sales.

Tax on dividends

- Dividend income of tax residents is now combined with other income and subject to ordinary tax rates of up to 39%.

- Increase in income tax and withholding tax rates for non-residents on dividend distributions to 20%.

- Adjustments to withholding tax rates and introduction of a new tax credit for certain dividend income for tax residents.

Wealth tax

- Introduction of a new wealth tax for individuals whose net worth exceeds certain thresholds.

- Progressive tax rates ranging from 0.5% to 1.5%, applicable to global wealth for tax residents and to wealth held in Colombia for non-tax residents.

Other noteworthy changes

- The introduction of a digital services tax for certain digital services.

- Reintroduction of the national stamp tax on real estate transactions.

- Introduction of taxes on single-use plastics, ultra-processed beverages and food products, and carbon emissions.

- Adjustments to taxation of free trade zones, with specific rules for industrial users related to export tax revenues.

- Changes to tax deductions, benefits and credits, including limitations on certain exempt income and special deductions, and an increase in the research and development (R&D) tax credit.

Notes

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

Want to learn more about payroll, tax, social security and more?

Register free today to get the latest up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Let’s Partner

Talk to a specialist today and find out how we support the growth of over 500 businesses with a range of activpayroll solutions designed to help your global payroll and people operations succeed.