Costa Rica

Costa Rica is one of the most attractive countries in Latin America in which to conduct business. Not only is Costa Rica a naturally beautiful country with vast rain forests and coastlines, it also has a relatively stable economy and political environment.

Need more information about payroll, compliance and social security in Costa Rica?

Talk to a specialist

Our free global insight guide to Costa Rica offers up-to-date information on international payroll, income tax, social security, employment law, employee benefits, visas, work permits and key updates on legislative changes and more in 2024.

Basic Facts about Costa Rica

Costa Rica is a democratic Central American country bordered by Nicaragua to the north and by Panama to the south, with the Caribbean Sea running along its eastern coastline and the Pacific Ocean along its west.

General Information

- Full Name: Republic of Costa Rica

- Population: 5.180 million (World Bank, 2022)

- Capital: San José

- Major Languages: Spanish

- Monetary Unit: Costa Rican Colón (₡)

- GNI Per Capita: US $12,670 (World Bank 2022)

- Main Exports: Bananas, tropical fruits, coffee, medical instruments & rubber tires

- Internet Domain: .cr

- International Dialling Code: +506

How Do I Say in Spanish?

- Hello: Hola

- Good Morning: Buenos Días

- Good Evening: Buenas Noches

- Do You Speak English?: Habla Inglés

- Good Bye: Despedida

- Thank You: Gracias

Dates

Dates are usually written in the day, month and year sequence. For example, 1 July 2024 or 1/7/24.

Numbers are written with a comma as the decimal point, for example three thousand would be written 3.000,00.

Doing Business in Costa Rica

Costa Rica, known for its stunning natural beauty and commitment to sustainability, is also a vibrant hub for business and innovation.

Strategically located as a bridge between North and South America, Costa Rica offers a unique blend of economic stability, high-quality life, and a progressive business environment. The country's economy is diverse, with strong sectors including eco-tourism, agriculture, medical devices, and information technology.

The government of Costa Rica actively supports business development with incentives such as a competitive tax regime, free trade zones, and robust intellectual property protections. The workforce is highly educated, bilingual, and skilled, particularly in the tech and services sectors, making Costa Rica an attractive destination for businesses looking for talented human resources.

Costa Rica's commitment to sustainability and renewable energy is not just a national ethos but also a business advantage. Companies investing in green technologies and sustainable practices find a supportive environment and a receptive market. Whether you're an entrepreneur looking to tap into the innovation ecosystem or a multinational seeking a strategic location with access to global markets, Costa Rica offers a dynamic and forward-thinking business landscape.

Why invest in Costa Rica

Costa Rica's investment climate is known by openness, stability, and a strategic location that offers easy access to international markets.

Costa Rica is one of the most attractive countries in Latin America in which to conduct business. Not only is Costa Rica a naturally beautiful country with vast rain forests and coastlines, it also has a relatively stable economy and political environment. Since abolishing the Army in the late 1940’s, the country has been governed peacefully and democratically, earning it the nickname “Switzerland of Central America”.

The country's political stability, robust legal framework, and commitment to sustainability make it an attractive destination for foreign investment.

Key sectors that attract investment include eco-tourism, renewable energy, medical devices, and information technology, all supported by a tradition of innovation and a highly skilled workforce.

Investors in Costa Rica benefit from various incentives, including tax exemptions in free trade zones, a competitive corporate tax regime, and government support for research and development. The country's commitment to sustainability opens up opportunities for investment in green energy, environmental conservation, and sustainable agriculture.

Real estate investment, particularly in commercial properties and tourism-related developments, offers attractive returns, supported by Costa Rica's growing reputation as a premier eco-tourism destination.

Costa Rica's thriving tech scene and supportive ecosystem for startups provide ample opportunities for venture capital and private equity investments.

Foreign Direct Investment in Costa Rica

Costa Rica is a welcoming destination for foreign direct investment (FDI), with a clear strategy to attract and retain international businesses. The country's strategic location with its commitment to sustainability and innovation, makes it an ideal choice for FDI.

FDI in Costa Rica is diverse, covering various sectors, some of which include:

- Eco-Tourism and Hospitality: Leveraging its natural beauty and biodiversity, Costa Rica offers significant opportunities for investment in eco-friendly hotels, resorts, and tourism services.

- Renewable Energy: As a global leader in renewable energy, Costa Rica is an attractive destination for investments in green technologies, including hydro, wind, and solar power.

- Medical Devices and Life Sciences: With a thriving life sciences sector, Costa Rica is home to several leading medical device manufacturers, offering opportunities for investment in manufacturing and research.

- Information and Communication Technology: The country's growing tech industry, supported by a highly skilled workforce and modern infrastructure, presents opportunities for investment in software development, cybersecurity, and digital services.

- Agriculture and Agribusiness: Building on its agricultural heritage, Costa Rica offers investment opportunities in sustainable agriculture, organic farming, and agro-industrial projects.

The Costa Rican Investment Promotion Agency (CINDE) provides comprehensive support to foreign investors, offering assistance with site selection, regulatory guidance, and connections to local networks and suppliers.

Costa Rica presents a compelling environment for doing business, investing, and attracting foreign direct investment. With its strategic location, commitment to sustainability, and supportive policies, Costa Rica stands out as a prime destination for companies and investors seeking growth and success in a dynamic and responsible market.

Registrations and Establishing an Entity in Costa Rica

Businesses are required to set up an entity in Costa Rica. There are two main types of business entities in Costa Rica:

- Corporations (Sociedad Anónima)

- Limited Liability Companies (Sociedad de Responsabilidad Limitada)

Corporations (Sociedad Anónima)

Often referred to as S.A., a corporation must be governed by a board of at least three directors. These three members must take the roles of President, Secretary and Treasurer and all capital within the business is divided into shares. Once registered, the corporation can have any number of shareholders, regardless of their citizenship. Should the legal representative not live in Costa Rica, an attorney must be appointed as the resident agent to receive notifications on behalf of the company.

Limited Liability Companies (Sociedad de Responsabilidad Limitada)

This type of entity is often popular with foreign investors. Companies will have to appoint one director and two shareholders in order to proceed and they can be of any nationality. They must have a registered office in Costa Rica and maintain all statutory and accounting records in Spanish at the registered office address.

The personal assets of investors are fully protected for both corporations mentioned above.

Once a corporation has been opened, it is necessary to be registered with the Public Registry (Registro Publico).

All Costa Rican companies must keep three legal record books:

-

Shareholder Assembly Acts

-

Board of Directors Minutes

-

Shareholder Registration

Visas and Work Permits in Costa Rica

All individuals who are not Costa Rican Nationals and wish to work in Costa Rica must obtain a Residence Visa and Work Permit.

Obtaining a work permit in Costa Rica is very difficult for a foreign worker, the government is very protective of the Costa Rica labour force and would rather hire a local employee than a foreign employee.

Costa Rica does offer temporary residence permits for those wishing to live in the county for longer than three months, however this does not automatically mean you are authorized to work in the country.

A work permit will only be issued when those wishing to work in Costa Rica demonstrate that they have a skill set that is difficult to find in local workers. Before a work permit is granted, the following information must be provided to the Department of Immigration:

- A letter from the employer stating why the foreigner is suitable for the job and what services the employee will be able to provide

- Proof the employer can pay the employee (financial statements, business earnings etc.)

- A copy of the employees’ passport and birth certificate

- Fingerprinting process (must be carried out in Costa Rica)

- Work permits with permanent or temporary residence

Business Banking in Costa Rica

It is mandatory in Costa Rica to have an in-country bank account in order to run business.

Banks are typically open Monday to Friday from 9 am to 3 pm. Banks located within malls are often open on Saturdays from 9 am to 12 noon.

Income Tax in Costa Rica

The Costa Rica tax year runs from 1 January to 31 December for individuals and corporations.

The key legislative authorities in Costa Rica are:

- Costa Rican Social Security Fund (Caja Costarricense del Seguro Social)

- National Insurance Institute (Instituto Nacional de Seguros)

- Ministry of Finance (Ministerio de Hacienda)

A person must be licenced in order to make any tax and/or social security filing on behalf of a client.

Income Tax

All individuals in employment, corporations and businesses, domiciled or not in the country, are subject to income tax. Income tax rates for individuals and companies is calculated depending on gross income on a progressive scale. Income tax ranges from 5% to 30% for companies and from 0% to 25% for individuals.

The below sets out the corporate and individual income tax brackets and rates for the period 1 January 2024 to 31 December 2024.

Corporate Income Tax

|

Taxable income |

Tax on this income |

|

up to CRC 5,761,000 |

5% |

|

over CRC 5,761,000 up to 8,643,000 |

10% |

|

over CRC 8,643,000 up to 11,254,000 |

15% |

|

over CRC 11,524,000 |

20% |

Legal entities whose gross income exceeds CRC 122,145,000 must apply a fixed tax rate of 30%.

Individual Employment Income Tax (monthly)

|

Taxable income per month |

Tax on this income |

|

up to CRC 941,000 |

0% |

|

over CRC 941,000 up to 1,381,000 |

10% |

|

over CRC 1,381,000 up to 2,423,000 |

15% |

|

over CRC 2,423,000 up to 4,845,000 |

20% |

|

over CRC 4,845,000 |

25% |

Individual Business Income Tax (annually)

|

Taxable income |

Tax on this income |

|

up to CRC 4,181,000 |

0% |

|

over CRC 4,181,000 up to 6,244,000 |

10% |

|

over CRC 6,244,000 up to 10,414,000 |

15% |

|

over CRC 10,414,000 up to 20,872,000 |

20% |

|

over CRC 20,872,000 |

25% |

Social Security in Costa Rica

Social security fees are paid between the employer and the employee. The division is made as follows:

- Employees pay 10.67 % of their own salary

- Employers pay 26.67 % of their employees´ salary

This payment is made once a month to the Caja Costarricense de Seguro Social, the Instituto Nacional de Seguros (National Insurance Institute) and different retirement funds. The employer must deduct the percentage varying according to the employee, and adds it to their own payment at the end of the month.

Reporting in Costa Rica

Monthly

- Tax reports must be submitted before the 15th of each month.

- Social security contributions must be paid from the 26th to the 6th of the following month.

New Employees in Costa Rica

An employer must report any new employees to the Social Security Office within the first eight day of employment. The first 30 days of employment is generally used as a probation period whereby the employer or employee can terminate employment without any notice. Probation periods should last no longer than three months.

An employer must issue an employment contract listing the terms of employment and it should be signed by both the employer and employee and sent to the government within 15 days of employment. The employment contract must cover the following information:

-

Names, nationality, age, sex and marital status

-

Address of the contracting parties

-

Identity card number

-

Accurate detail of the worker’s residence

-

Duration of the contract

-

Working hours

-

Salary to be received by the worker and details related to the form, period and place of payment

-

The quantity and quality of the material, the state of the tools and the employer’s tools, if any, that will be provided to execute the work

-

The place or places where the service must be provided or the work executed

-

Other stipulations to which the parties agree

-

The place and date of the conclusion of the contract

Leavers in Costa Rica

An employer must always have reasonable cause (disobeying company regulations, stealing etc.) to dismiss an employee on the spot. The employer must provide the employee with a dismissal letter clearly stating why they were dismissed.

If the employer does not have reasonable cause to dismiss an employee or if the employee quits for a reasonable cause, the employee is entitled to severance pay, this is paid on their final day of employment.

If an employee has worked for a company for more than three months but less than six, they are entitled to seven days’ worth of wages.

If an employee has worked for a company from six months to one year they are entitled to 14 days’ worth of wages.

If an employee has worked for a company for more than one year, the following schedule applies:

|

Number of Years Worked |

Days of Severance Pay |

|

1 |

19.50 |

|

2 |

20 |

|

3 |

20.5 |

|

4 |

21 |

|

5 |

21.24 |

|

6 |

21.50 |

|

7 |

22 |

The Social Security Office and the company’s pension operator must be notified of any leavers.

Payroll in Costa Rica

The Costa Rica tax year runs from 1 January to 31 December for individuals and corporations.

It is legally acceptable in Costa Rica to provide employees with online payslips, however employees must reply via email confirming that the payment was received.

Reports

Payroll reports must be kept for five years.

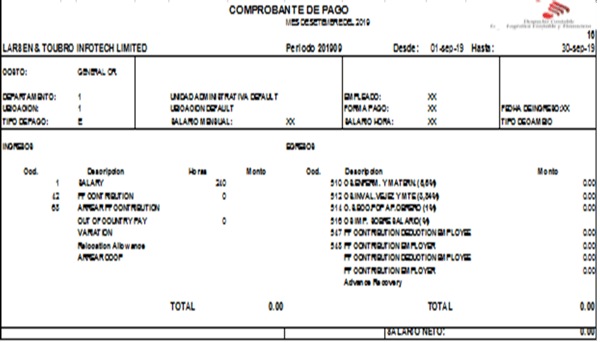

Costa Rican Payslip example

Employment Law in Costa Rica

Holiday Accrual/Calculations

Full-time employees are entitled to a minimum of two weeks paid vacation for every 50 weeks of continuous service. If employment is terminated before completing 50 weeks, the employee should receive vacation payment equal to one workday for each month worked.

There are two days of unpaid leave for national holidays and eight paid national holidays:

|

Unpaid |

Paid |

|

2nd August |

New Year's Day |

|

12th October |

Juan Santamaria Day |

|

|

Easter Week |

|

|

Labor Day |

|

|

Annexation of Guanacaste Day |

|

|

Mother's Day |

|

|

Independence Day |

|

|

Christmas Day |

If the date falls on a Tuesday, Wednesday, Thursday or Friday, the holiday should be taken on the following Monday.

Maternity Leave

In Costa Rica, maternity leave policies are designed to ensure the health and well-being of both the mother and the child during the prenatal and postnatal periods.

A pregnant employee is entitled to a total of four months of paid maternity leave. This period is divided into one month before the expected date of childbirth and three months following the birth. This structure ensures that the mother has adequate time for preparation, childbirth recovery, and initial childcare.

The three months of maternity leave following childbirth are also considered the minimum period for breastfeeding. If medically prescribed, this breastfeeding period can be extended, ensuring the child's health and well-being. Employers should be flexible and supportive of any medically advised extensions.

Through contributions to social security, the mother is entitled to maternity insurance. This insurance covers a range of services, including prenatal care (medical and pharmaceutical) and obstetric care during childbirth. It's essential for employers to ensure that their employees are registered and contributing to social security to access these benefits.

Maternity leave is paid leave. Employers are responsible for continuing the employee's salary during the one month of prenatal leave and the first three months of postnatal leave. The National Insurance Institute (INS) reimburses the employer for the salary paid during this period, as long as the employer and employee have been contributing to social security.

Paternity Leave

Costa Rica recognises the importance of the father's role in the early stages of a child's life. As a result, fathers are entitled to paternity leave to support their partner and bond with their newborn.

Fathers are granted 8 days of paid paternity leave, which can be taken around the time of the child's birth. This allows the father to be present during the childbirth and provide support during the initial postnatal period.

The salary during paternity leave is typically covered by the employer, and it's crucial for businesses to facilitate this leave and ensure that fathers can take this time off without any obstacles.

Sickness

For the first three days an employee is off sick, the employer must pay at least 50% of the employee’s sick leave with the Social Security System paying the remaining 50%.

From the fourth day of sick leave onwards, the Social Security System pays 60% of the salary.

The employer is under no obligation to pay anything to the employee.

In order to receive payment from the Social Security System, the employee must submit a medical certificate.

National Service

There is no national service in Costa Rica, the military was abolished in 1948 following the civil war.

December 1st is known as Military Abolition Day in Costa Rica.

Minimum wage in Costa Rica in 2024

The minimum salaries across various sectors in the private industry experienced a collective increase of 1.83%. It's important to note that the minimum wage varies depending on the specific sector.

Please see below a table containing the national minimum wage by sector in Costa Rica for 2024:

| Worker Type (English Translation) | Salary in CRC |

|---|---|

| Unskilled Worker (TNC) | ₡11,953.65 |

| Semi-Skilled Worker (TSC) | ₡12,998.72 |

| Skilled Worker (TC) | ₡13,395.72 |

| Generic Specialized Worker (TE) | ₡15,613.90 |

| Generic Unskilled Worker (TNCG) | ₡358,609.52 |

| Generic Semi-Skilled Worker (TSCG) | ₡3,821,413.34 |

| Generic Skilled Worker (TCG) | ₡403,461.52 |

| Generic Specialized Worker (TEG) | ₡460,686.25 |

| Technician - Diversified Education (ED) | ₡422,798.93 |

| Technician - Higher Education (EDS) | ₡521,053.17 |

| Technician - Higher Education Diplomas (DES) | ₡562,756.89 |

| Technician - University Bachelor (Bach) | ₡638,299.51 |

| Technician - University Graduate (Lic) | ₡765,985.66 |

| Superior Specialization Worker (TES) | ₡22,448.32 |

Working Days and Working Hours in Costa Rica

Working hours vary across the country, however working hours normally extend to eight hours a day with no more than 48 hours worked a week.

Provided the work will not affect the health of an employee, some employers extend working hours to nine hours a day, this is common in the retail industry.

Statutory National Holidays in Costa Rica 2024

There are multiple statutory holiday schedules within Costa Rica. Below are the statutory national holidays in Costa Rica for 2024.

|

Holiday Name |

Weekday |

Date |

|

New Year's Day |

Monday |

1 January |

|

Maundy Thursday |

Thursday |

28 March |

|

Good Friday |

Friday |

29 March |

|

Battle of Rivas |

Thursday |

11 April |

|

Labor Day / May Day |

Wednesday |

1 May |

|

Annexation of Guanacaste |

Thursday |

25 July |

|

Suspend half day Prior to Our Lady of the Angels Day |

Thursday |

1 August |

|

Our Lady of Los Ángeles |

Friday |

2 August |

|

Mother's Day |

Thursday |

15 August |

|

National Parks Day |

Saturday |

24 August |

|

Day of the Black Person and Afro-Costa Rican Culture |

Saturday |

31 August |

|

Suspend half a day prior to National Independence |

Saturday |

14 September |

|

Independence Day |

Sunday |

15 September |

|

All Souls' Day |

Saturday |

2 November |

|

Teacher's Day |

Friday |

22 November |

|

Day of Abolition of the Army |

Sunday |

1 December |

|

Feast of the Immaculate Conception |

Sunday |

8 December |

|

Christmas Day |

Wednesday |

25 December |

|

New Year's Eve |

Tuesday |

31 December |

Employee Benefits in Costa Rica

Expenses

Many employers offer additional benefits to their employees, including vehicle allowance, education payments and bonuses. These all vary depending on the company and the payment of additional benefits is reported in the monthly form submitted to the Social Security Office.

Thirteenth Month Bonus

Referred to locally as ‘Aguinaldo’, every worker in Costa Rica has the legal right to receive the thirteenth month bonus. Employees are paid an additional month of wages by the employer as a year-end Christmas bonus. The bonus is normally paid to the employee between 1 December and 20 December. If employment is terminated before December, the employee will receive a proportional payment of the bonus.

Risk Labor

Occupational Risk Insurance (RT) is a mandatory insurance in Costa Rica that offers protection to workers against work risks.

Health Insurance

Employers can provides comprehensive medical insurance, encompassing primary care, specialized treatments, imaging diagnostics, clinics, and a range of high-quality services tailored for individuals and families.

Life Insurances

Employees can enjoy the advantages of a life insurance plan, receiving subsidies for themselves and their families in the unfortunate event of death or chronic illness.

Additionally, the plan offers support in case of disability and includes agreements for preventive care.

Key updates for 2024 in Costa Rica

As of 2024, Costa Rica has implemented several key changes to its income tax, social security, and employment laws. Below is a summary of the most significant changes:

Income Tax Brackets for Salaried Employees, Retirees, and Pensioners

- Tax-Free Threshold: Incomes under CRC 941,000 per month are not subject to salary tax.

- 10% Rate: Applied to monthly incomes between CRC 941,000 and CRC 1,381,000.

- 15% Rate: For incomes between CRC 1,381,000 and CRC 2,423,000.

- 20% Rate: Incomes between CRC 2,423,000 and CRC 4,845,000.

- 25% Rate: Applied to incomes over CRC 4,845,000.

Tax Rates for Profitable Activities for Individuals and Legal Entities

- 5% tax on net profits up to CRC 5,761,000.

- 10% for net profits between CRC 5,761,000 and CRC 8,643,000.

- 15% for net profits between CRC 8,643,000 and CRC 11,254,000.

- 20% for net profits above CRC 11,254,000

- 30% for gross profits over CRC 122,145,000.

Independent Professionals

- Exemption for net profits up to CRC 4,181,000.

- 10% tax on net profits between CRC 4,181,000 and CRC 6,244,000.

- 15% for net profits between CRC 6,244,000 and CRC 10,414,000.

- 20% for net profits between CRC 10,414,000 and CRC 20,872,000.

- 25% for net profits over CRC 20,872,000.

Additionally, tax credit amounts for family members have been updated. Individuals, whether employees or independent, can now apply a monthly tax credit of CRC 1,730 per child and CRC 2,620 for the spouse.

These tax bracket updates apply from January 1, 2024. Employers should note these changes for compliance with the Ministry of Finance's regulations, as they are jointly responsible for their employees' salary tax obligations.

Notes

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

Want to learn more about payroll, tax, social security and more?

Register free today to get the latest up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Let’s Partner

Talk to a specialist today and find out how we support the growth of over 500 businesses with a range of activpayroll solutions designed to help your global payroll and people operations succeed.