Denmark

The Danish Government welcomes inward investment, providing various incentives to foreign multinational countries. Denmark has an established infrastructure and provides political stability, making it an attractive country for business investment and expansion.

Need more information about payroll, compliance and social security in Denmark?

Talk to a specialist

Our free global insight guide to Denmark offers up-to-date information on international payroll, income tax, social security, employment law, employee benefits, visas, work permits and key updates on legislative changes and more in 2024.

Basic Facts About Denmark

General Information

- Full Name: Kingdom of Denmark

- Population: 5.903 million (World Bank 2022)

- Capital: Copenhagen

- Primary Language: Danish

- Major Religion: Christianity

- Monetary Unit: Danish Krone

- Main Exports: Machinery and equipment, foodstuffs and chemicals

- GNI per Capita: US $73,200 (World Bank, 2022)

- Internet Domain: .dk

- International Dialling Code: +45

How Do I Say in Danish?

- Hello: Hej

- Good morning: Godmorgen

- Good evening: Godaften

- Do you speak English?: Taler du engelsk?

- Good bye: Farvel

- Thank you: Tak

- See you later: Vi Ses

Doing Business in Denmark

Denmark stands out as an attractive destination for businesses aiming to expand or establish their presence in the European market. Renowned for its robust economy, innovative business environment, and high standard of living, Denmark offers a compelling blend of opportunities for companies looking to thrive.

At the heart of Denmark's appeal is its stable economy, characterised by low inflation and a sound fiscal position. The nation's economic strengths are underpinned by a competitive corporate tax rate, a transparent regulatory system, and a commitment to free trade, positioning Denmark as an ideal gateway to the Scandinavian and broader European markets. These economic fundamentals not only ensure a predictable business environment but also offer a platform for sustainable growth and profitability.

Innovation and technology are the linchpins of the Danish business landscape. Denmark's emphasis on research and development (R&D) is evident in its world-class infrastructure and the strong collaboration between research institutions, businesses, and the government. This collaborative ecosystem fosters a culture of innovation, making Denmark a breeding ground for cutting-edge technologies and a hub for industries such as renewable energy, life sciences, and information technology.

The Danish labour market is another cornerstone of its business attractiveness. Renowned for its highly skilled, proficient in English, and motivated workforce, Denmark offers businesses a pool of talent that is adept at driving productivity and innovation. The flexible Danish labour model, known as "Flexicurity," provides a balance of flexibility for employers and security for employees, facilitating a dynamic and adaptable labour market.

Denmark's strategic location in Europe, coupled with its efficient infrastructure, including modern transport and logistics systems, ensures seamless access to other European markets. This connectivity, with the country's digital prowess and the widespread proficiency in English, makes Denmark not just a gateway but a strategic hub for international businesses.

Overall, Denmark's strong economy, commitment to innovation and sustainability, skilled workforce, and strategic position in Europe make it an appealing destination for businesses looking to enter or expand in the European market. The nation's business-friendly climate is designed to support companies in achieving growth, innovation, and a competitive edge in the global market. Whether you're looking to tap into advanced industries, leverage a highly skilled workforce, or benefit from a stable and transparent business environment, Denmark offers the foundations for success and growth.

Investment in Denmark

Denmark is known for its proactive approach to fostering a business-friendly climate, with the government offering a number of investment incentives to support companies across various sectors.

The Danish government provides attractive investment schemes, including substantial grants, favourable tax conditions, and financial support for research and development (R&D) projects. These initiatives are particularly prominent in industries prioritised for growth, such as green energy, biotechnology, and information technology. For instance, the Innovation Fund Denmark invests in ambitious and strategic projects that create value and growth for society by promoting the development of innovative and sustainable solutions. Moreover, Invest in Denmark, a part of the Ministry of Foreign Affairs, offers specialised, tailor-made solutions for foreign companies looking to set up a business in Denmark, including comprehensive advice on operational costs, regulatory framework, and access to a vast network of partners.

These government-backed investments and resources not only reduce the initial barriers to entry but also underscore Denmark's commitment to nurturing a thriving, innovation-driven business ecosystem. Leveraging such support can be a game-changer for businesses aiming to capitalize on the opportunities within the dynamic Danish market.

Business Banking in Denmark

It is not mandatory to make employee salary payments and third-party authority payments from an in-country bank account. The largest banks in Denmark are Danske Bank, Nordea, Jyske Bank, Nykredit, and Sydbank.

Registering a Company and Establishing an Entity in Denmark

Registrations are required to conduct business in Denmark. All registrations are carried out by the Commercial Agency (Erhvervsstyrelsen).

Registration application forms can be completed and submitted online but must (normally) be signed on paper. The foreign company’s registration certificate is necessary for enclosure and the process takes approximately six to eight weeks. Upon approval, a Danish company certificate is issued with a Danish CVR number.

Historically, the registered device would then be provided with a Nem-ID, but this has been phased out. Before the summer of 2023, all Nem-ID became obsolete, and Mit-ID is used instead.

Mit-ID is a Digital Signature Employee Certificate and is used for identifying yourself as an employee/agent of a particular company or organization. An application is made by appointing a Mit-ID administrator for the company who can act on the company’s behalf regarding issuing and administrating other Mit-ID signatures. These signatures grant access to information from the Danish authorities including matters of outstanding tax and outstanding social security contributions.

A foreign entity providing services in Denmark is also required to register in the RUT registry, which is the Danish Government's official report of foreign service. Registration in the RUT register entails an obligation to pay AFU contributions.

Further information can be found on the following governmental web pages:

Income Tax in Denmark

Denmark is normally recognized for its world record high tax level on salary income, although the actual average taxation never reaches that level. The system is based on a progressive scale, which reaches 52.07% on the last earned salary above DKK 588,900 (2024). There are a variety of deductions and tax levies that affect this calculation.

The income year (tax year) runs from 1 January to 31 December.

The Danish Tax Administration will issue an annual tax return, which the individual is obliged to review to verify that the reported information is correct. If an individual has any special circumstances (e.g., foreign income, foreign properties, etc.), the individual must submit an extended tax return.

Income Tax

Below are the tax rates for 2024:

|

Type |

Tax rate |

|

State: Bottom Bracket Tax Rate – “Bundskat” |

12.09% |

|

State: Top Bracket Tax Rate – “Topskat” |

15% |

|

Local: Labour Market Tax |

8% |

|

Local: Municipal Income Tax (Average) |

25.1% |

|

Personal Allowance (Tax–Free) |

DKK 49,700 |

Employers withhold Danish taxes and labour market contributions (“AM-bidrag”) when paying salaries to employees. The deadlines for paying tax and labour market contributions are dependent on the size of the company paying the salary:

- For large companies (labour market contributions over DKK 250,000 and/or taxes over DKK 1,000,000), payment should be done by the last weekday of the month of account.

- For small and medium-sized companies (labour market contributions less than DKK 250,000 and/or taxes less than DKK 1,000,000), payment should be done by the middle of the month following the month of account.

Besides the standard progressive taxation, Denmark has several flat-rate taxation regimes designed and applied for special purposes.

Social Security in Denmark

Employees conducting work in Denmark are covered by social security in Denmark, provided that certain requirements are fulfilled.

Individuals conducting work in a foreign country must obtain an A1 certificate which confirms that an employee is covered by social security in one country when conducting work in another country. The employee must apply for this certificate online, but the employer can apply on the employee’s behalf.

Social security contributions are required for the following:

-

Mandatory Pension Scheme (ATP)

-

Employers' Education Contribution (AUB)

-

Occupational Insurance for the Labour Market (AES)

-

dk (Maternity Fund)

-

Financing contribution (FIB)

-

Labour Market Fund for Expatriates (AFU)

-

Administration of Holiday Funds (administrationsbidrag)

-

Specialised Employers' Education Contribution (Læreplads-AUB)

Below are the employer contribution rates for 2024:

|

Type |

Employer Contribution (DKK) |

|

Mandatory Pension Scheme (ATP) |

297.00 per month (max) |

|

Employers' Education Contribution (AUB) |

3,148.00 per year |

|

Occupational Insurance for the Labour Market (AES) |

8,425.00 per year (max) |

|

Barsel.dk (Maternity Fund) |

1,350.00 per year |

|

FIB Finansieringsbidrag |

109.25 per quarter |

|

Labour Market Fund for Expatriates (AFU) |

0 |

|

Administration of Holiday Funds (administrationsbidrag) |

5 per quarter |

|

Specialised Employers' Education |

Depending on employees |

These social security contributions are collected via Samlet Betaling. The Mandatory Pension Scheme (ATP) contribution depends on the actual hours worked. The Occupational Insurance (AES) contribution depends on the type of work and the related risks to the employee.

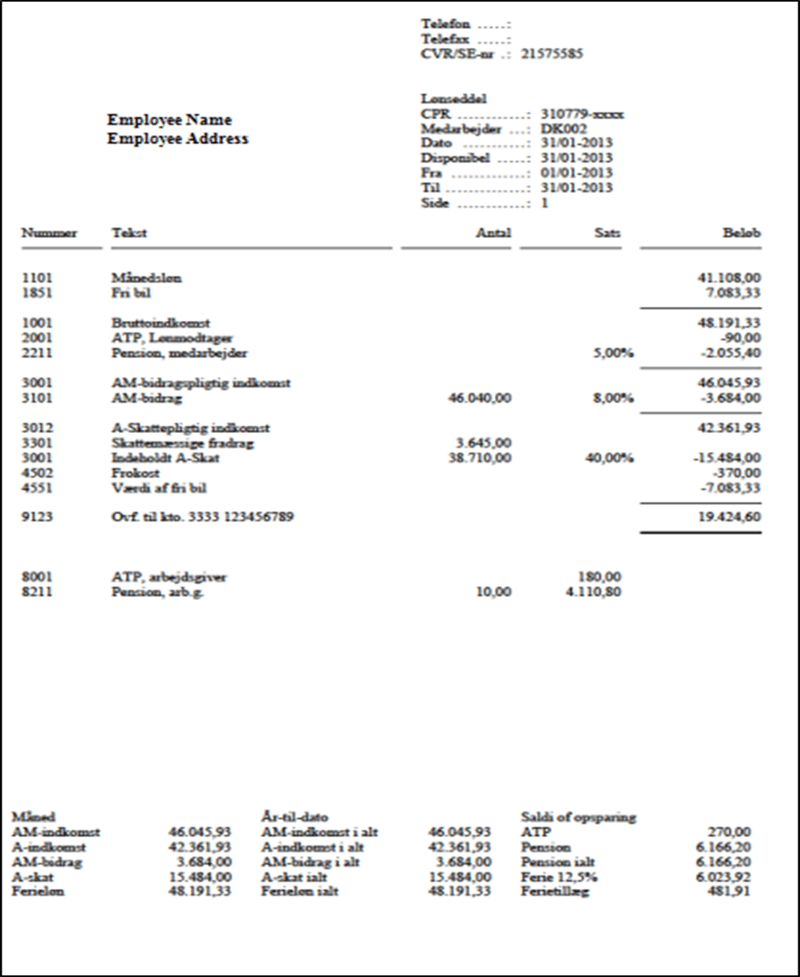

Payroll in Denmark

Danish payrolls run on a monthly basis. Each month the employer is required to obtain the recent tax information from the tax card of the employees. A tax card is a digital document, stating the tax rate and deductions of an employee, based on their registration, and issued by the Danish Tax Administration. Furthermore, the monthly payroll information must be uploaded to the Danish Tax Authorities site to pay withheld taxes and report the current month’s details.

The Danish Tax Administration is the main entry point for several reports, which they communicate to the applicable authorities (social security, etc.). Pension reports are dealt with using a separate process.

Payslips must be issued for each month of payroll, which describe the month's salary in detail.

If shares/stock options/warrants are awarded, vested, or exercised as part of the employment, identification of the shares, time of award/vest/exercise must also be reported to the Danish Tax Authorities. This report is submitted separately from the payroll reports.

Reports

Payroll reports must be kept for at least five years.

Digital Mailbox

Correspondence with a Danish authority takes place through an online Digital Mailbox (“Digital Postkasse”). All companies/entities registered with a Danish CVR-number are obligated to gain access to the Digital Mailbox. This is done by obtaining a Mit-ID.

All expenses relating to social security are invoiced through the Digital Mailbox.

Danish payslip example

Reporting in Denmark

Payroll reports are submitted via the Tax Authorities’ online portal, “E-indkomst” (E-income), and can be submitted manually or via file upload.

Each month a report must be made to “E-indkomst”, which in detail explains the current month’s tax information. Social security, holidays, and the amount of work are also reported through this system, which is then passed on to the respective authorities.

There is no additional annual report since the annual information is submitted on the monthly reports.

New Employees in Denmark

When hiring a non-Danish employee, an employer shall inform the Danish Tax Administration by submitting a specific form or by online form.

There are no requirements for providing information regarding employees to the authorities when hiring a new employee provided the employee is already registered with the Danish tax authorities. If the employee is not registered with the Danish Tax Authorities, the authorities must be informed.

Expat new employees are required to provide the following documentation:

- Work Visa

- Copy of Passport (or other ID cards)

- Copy of Marriage Certificate

- Local Bank Account Details

- File Preliminary Tax Assessment

Leavers in Denmark

When an employee’s employment is terminated, there are generally not many requirements for the employer to comply with. The employer is required to pay any outstanding holiday accrual to the Holiday Fund (FerieKonto) when the employee ceases their employment (end of the notice period).

Visas and Work Permits in Denmark

Citizens in the European Union (EU)

- EU citizens are not required to have a work permit or visa when entering Denmark. Individuals within Europe can carry out work in Denmark unlimitedly and do not need to apply for a work permit

- Individuals are obligated to register with the Danish Tax Administration to pay Danish taxes and social security

- If the stay of the individuals exceeds three (3) months, the employer must register with the Danish authorities to apply for a permit

Non-EU Citizens

- Non-EU citizens are required to have a visa before entering Denmark to obtain a work permit

- To obtain a work permit, an application to the Danish authorities is required

- The authorities’ decision is based on the character of the work and the availability of qualified workers already in Denmark or the European Union

Citizens of Nordic Countries

- Citizens of the Nordic countries (Finland, Island, Norway, and Sweden) can work, stay, and study in Denmark without any permit

- Citizens can enter Denmark, without a passport, but must be able to identify themselves, if needed

Citizens of the UK after Brexit

- Individuals that have not obtained a stay in Denmark based on the EU rules before the 31st of December 2020 will, depending on the final agreement, must apply for a work- or residence permit.

Employment Law in Denmark

Holiday Accrual

Employees are entitled to a maximum of 5 weeks of holiday leave per year. For each month in the year the individual is employed, they are entitled to 2.08 days’ vacation paid by the employer. Employees are entitled to at least 25 days of holiday leave, regardless of how many days of holiday leave an employee has earned based on their employment.

Under the Danish Holiday Act (2020), employees can now earn ‘concurrent holidays’ where they can take their holiday leave the month after they earn the leave. They can also take paid holiday leave in advance of qualifying for all the leave with an agreement between the employer and employee.

Maternity Leave

Employees are entitled to 14 weeks of maternity leave and can commence maternity leave 4 weeks before the birth date.

The maximum refund rate from Barsel.dk (The Danish Maternity Fund) is DKK 185.79 per hour. The contribution rate to the Danish Maternity Fund is DKK 950,00 per full-time employee per year - DKK 79.17 per month.

Paternity Leave

Employees are entitled to 14 days of paternity leave following the birth date. Additionally, the parents share 32 weeks of leave following the birth, which they can freely distribute between themselves. It is, however, normal that the mother takes 6 months of maternity leave.

It is possible to obtain a refund from barsel.dk or DA-barsel by an application if certain criteria are met. Unless agreed there is no requirement to pay salary during the leave.

Sickness

White-collar employees are entitled to paid sick leave. Illness does not normally have an impact on the employee’s salary rights. If certain criteria are met, the employee will be entitled to a special payment called “sygedagpenge”.

Employees are entitled to “sygedagpenge” (sick benefits) from the State if they’ve been employed for at least 26 weeks consecutively and have at least 240 hours of work. Employees are entitled to “sygedagpenge” from the employer if the employee has been employed for at least 8 weeks and has at least 74 hours of work.

The employer is obligated to pay sygedagpenge for the first 30 days, and the State will be obligated after the 30 days. If the employee is entitled to payment during sickness, the employer can claim a deduction from the State for the difference between the employee’s salary and the rate of the sygedagpenge.

National Service

In Denmark, the minimum age for compulsory and voluntary military service is 18 years of age.

Working Days and Working Hours in Denmark

The working week in Denmark is Monday to Friday and working hours for commercial and public offices are usually 37-40 hours per week.

The working day is usually between seven and eight hours long, typically from 0800 or 0900 hours to 1600 or 1700 hours.

Lunch breaks range from half an hour to one hour.

Minimum wage in Denmark in 2024

In Denmark, there is no legally mandated minimum wage. Wages are typically determined through collective bargaining in different sectors. Despite the absence of a statutory minimum wage, you can expect a minimum wage in Denmark of about DKK 110 per hour based on employer responsibilities and established practices.

However, on a monthly basis, the minimum salary after tax in Denmark in 2024 is around €2,000 (approximately 15,300 DKK). Please note that the exact minimum wage might vary based on the specific sector or industry of employment.

Statutory National Holidays in Denmark 2024

There are multiple statutory holiday schedules within Canada. Below are the statutory national holidays in Canada for 2024.

| Date | Day | Holiday |

|---|---|---|

| January 1 | Monday | New Year's Day |

| April 28 | Sunday | Maundy Thursday |

| April 29 | Monday | Good Friday |

| May 1 | Wednesday | Easter Sunday |

| May 2 | Thursday | Easter Monday |

| May 27 | Monday | Ascension Day |

| June 6 | Thursday | Whit Sunday |

| June 7 | Friday | Whit Monday |

| December 25 | Wednesday | Christmas Day |

| December 26 | Thursday | St. Stephen's Day |

Employee Benefits in Denmark

Expenses

Employee benefits are taxable as income to the employee. That is, however, only if the value exceeds DKK 1,300 (2024). Private benefits, which are linked to employment, are taxed whenever the value exceeds DKK 7,000 (2024).

Typical benefits provided in Denmark could be the following: -

- Free internet and telephone (Taxable value: DKK 3,200 (2024))

- Housing

- Free car

- Credit card

- Employee benefits that are not linked to their employment/work and under certain circumstances are not taxed based on their value.

- Gifts from Employers (DKK 1,300, or DKK 900 when considering Christmas gifts (2024)

- Other benefits with some private elements e.g., clothes, vaccines, etc. (DKK 7,000 (2024)

Normally, the employee benefits are taxable and should be processed through payroll. However, the treatment of any specific benefit in terms of reports to the Danish Tax Authorities and withholding of taxes vary significantly.

The taxable value of the benefit is the market value unless otherwise specified by the tax law.

Key updates for 2024 in Denmark

For 2024, the tax rate in Denmark for individuals under the ordinary tax scheme will be up to 52.06%. If you include the AM tax, the rate can be as much as 55.89%.

As of January 2024, the former public holiday of Great Prayer Day has been abolished and employers must add 0.45% allowance to the salary. The allowance is mandatory for all employees for whom the work time is increased with the abolishment of Great Prayer Day, and the allowance is calculated based on the annual salary of the individual with an addition of employer pension.

Denmark has introduced tax liability for individuals working offshore when the work is connected to Energy Islands or similar.

Notes

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

Want to learn more about payroll, tax, social security and more?

Register free today to get the latest up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Let’s Partner

Talk to a specialist today and find out how we support the growth of over 500 businesses with a range of activpayroll solutions designed to help your global payroll and people operations succeed.