France

France is a founding member of the European Union and is also a member of the UN, NATO, the G7, the OECD, and the WTO. In 2022 France's GDP was $2.782 billion, a 5.91% decline from 2021.

Need more information about payroll, compliance and social security in France?

Talk to a specialist

Our free global insight guide to France offers up-to-date information on international payroll, income tax, social security, employment law, employee benefits, visas, work permits and key updates on legislative changes and more in 2024. Our guide to France in 2024 is currently being updated and will be published soon.

Basic Facts about France

France lies at the western edge of continental Europe, on the shores of the Atlantic ocean. Annexed by Rome in 51 BC, France grew to become the dominant European power, with a monarchy which lasted until the French Revolution of the 18th century.

Under its famous leader, Napoleon, France established a powerful empire, and in the 21st century its global influence endures, with overseas territories in locations across the world.

Long considered an epicentre of philosophy, art and science, France ranks consistently high in global standards of education, life expectancy, and healthcare, and, as a member of the European Union and the United Nations Security Council, is also a significant political power.

France shares land borders with numerous of European countries, including Belgium, Germany, Switzerland, Italy, and Spain, while its topography includes alpine mountain ranges, fertile valleys, Mediterranean beaches, and deep forests.

France’s climate varies from wet and cool in the north, to hot and dry in its southern regions.

General Information

- Full name: French Republic

- Population: 67.97 million (World Bank, 2022)

- Capital: Paris

- Major language: French

- Major religion: Christianity

- Monetary unit: 1 euro = 100 cents

- Main exports: Machinery and transport equipment, agricultural products, including wine

- GNI per Capita: US $45,860 (World Bank, 2022)

- Internet domain: .fr

- International dialling code: +33

How Do I Say in French?

- Hello: Bonjour

- Good morning: Bonjour

- Good evening: Bonsoir

- Do you speak English?: Parlez-vous anglais

- Good bye: Au revoir

- Thank you: Merci

- See you later: à plus tard

How Do I Write the Date in France?

Dates are usually written in the day, month and year sequence. For example: 1 July 2024 or 1/7/2024.

Numbers are written with a period to denote thousands and a comma to denote fractions. For example: €1.234, 56 (one thousand, two hundred and thirty four euros and fifty-six cents). The euro symbol appears before the numeric.

Doing Business in France

France's position as a leading global economy is bolstered by its strong industrial base, innovation, and access to the European market. The country's legal and regulatory framework is designed to support business growth, offering a conducive environment for both startups and established enterprises. France's investment in digital infrastructure and commitment to sustainable practices opens up opportunities in sectors like technology, green energy, and biotech.

Success in the French market requires an understanding of its business culture and regulatory norms. France offers various incentives for businesses, including tax credits for research and development and subsidies for employment. However, navigating the labour laws and tax system demands careful planning and local knowledge. Establishing local partnerships can be a key strategy for international businesses looking to thrive in this market.

France is a founding member of the European Union and is also a member of the UN, NATO, the G7, the OECD, and the WTO.

Why Invest in France?

France's economy is marked by its diversity, with strengths in manufacturing, services, and agriculture. The government's focus on innovation and sustainability has fostered a supportive environment for investments in renewable energy, digital transformation, and healthcare. France's strategic initiatives aim to attract foreign investment by offering a stable and attractive investment climate.

France provides a range of incentives for investors, including tax benefits, competitive labour costs, and support for research and development. The French government has streamlined administrative procedures to facilitate investment and business operations. Furthermore, agencies like Business France are instrumental in assisting foreign investors through the investment process, offering guidance and resources to navigate the French market effectively.

Foreign Direct Investment in France

France actively seeks Foreign Direct Investment (FDI) in key growth sectors such as digital technology, automotive, aerospace, and renewable energy. The country's strategic location, advanced infrastructure, and skilled workforce make it an attractive destination for foreign investors. France's policy environment is conducive to FDI, with measures to protect investor interests and promote innovation. FDI opportunities include:

- Renewable Energy: Projects focusing on solar, wind, and other sustainable technologies.

- Digital and Information Technology: Investment in software development, artificial intelligence, and cybersecurity.

- Automotive and Aerospace: Opportunities in manufacturing, R&D, and supply chain enhancements.

- Biotechnology and Pharmaceuticals: Research, development, and production in one of Europe's leading healthcare markets.

Business Banking in France

It is not mandatory to make payments to employees or French authorities from an in-country bank account.

Generally, banks are open from Monday to Friday 09.00AM to 6.00PM. Some banks are open from Tuesday to Saturday 09.00AM to 5.00PM.

Visas and Work Permits in France

This information is currently being updated for 2024.

Individuals who are citizens of a country within the European Union (EU) or European Free Trade Association (EFTA) do not require a work permit.

Short Term Vida or Visa De Court Sejour

- This type of visa is for tourist trips, business trips or for family visits.

- This visa allows its holder to participate in short training courses, internships or conferences, company meetings, or carry out a paid activity.

- Duration does not exceed 90 days.

Long Term Vida or Visa De Long Sejour

- This visa is for an extended tourist trip, carry out professional activity, purse education or to join family members.

- They are often required to be combined with a residence permit (VLS-TS visa)

- The duration of this visa must be between three months and one year.

Talent Passport or Passeport Talent

- This is a multi-year residence permit for skilled professionals, such as employees of innovative companies, highly skilled workers, researchers, and more.

EU Blue Card

- Aimed at highly-qualified non-EU nationals, providing the right to live and work in France and other EU countries

Registering a Company and Establishing an Entity in France

This information is currently being updated for 2024.

A company is not required to have a legal entity established in order to process a payroll in France, however it is recommended.

To set up a business in France, you must decide on a legal structure, such as SARL (LLC), SAS (simplified stock company), SA (corporation), or SNC (general partnership), which influences taxation, liability, and business requirements. Key steps include:

- Drafting Articles of Association: Legal documents outlining the company's structure and rules.

- Registering with the Commercial Court: To obtain a registration certificate and a SIREN number, a unique identifier.

- Opening a Business Bank Account: Necessary for financial transactions.

- Publishing a Notice of Incorporation: In a legal journal.

- Completing Formalities at the Centre de Formalités des Entreprises (CFE): The CFE streamlines the process, handling registrations for tax, social security, and labor purposes.

For payroll, businesses must register with French social security (Urssaf) to manage employee contributions for health, retirement, and unemployment. Compliance with French labor laws—covering work hours, leave, and health insurance—is mandatory. This comprehensive approach ensures legal and regulatory compliance, facilitating business operations in France.

Income Tax in France

This information is currently being updated for 2024.

The tax year runs from 1 January to 31 December.

Income Tax

From January 2019, personal income taxes are withheld on payslips.

The current system of income tax collection is replaced by a withholding tax “PAS” (“prélèvement à la source”). It covers the vast majority of incomes: salaries and wages, pensions, replacement income, self-employment income and property income.

Therefore, the employer will become a collector and third party payer of personal income taxes.

Apprenticeship and Training Tax in France

These taxes are due when the client has a permanent establishment in France only. This excludes the liaison offices.

- They are paid every year before March 1st

- Depending on the size of the company, it is possible to deduct training expenses or trainees wages and indemnities

- When the company decides to provide training to employees, the company can receive grants from the institution

When it comes to paying contributions to tax authorities, the deadline depends on the size of the company; however, contributions should be paid by the 5th each month for companies with more than 50 employees and by the 15th for companies with less than 50 employees.

Social Security in France

This information is currently being updated for 2024.

The social security ceiling for 2021 is still €3,428 per month, and consequently to €41,136.00 a year.

When preparing payslips, salary bracket 1 now extends to €3.428, bracket 2 is the portion of salary between €3,428 and €13.712.

Regarding social security contributions, the contribution rate based on the total wage is for the employee equal to 22 %, for the employer 45 % of the gross wage.

The family allowance contribution rate is based on the total wage and varies depending of the remuneration from 3.45% to 5.25%.

Supplementary pension contributions are 10.02% (4.01% employee, 6.01% employer) on T1 and for T2 24.29% (9.72% employee, 14.57% employer).

The apprenticeship tax is 0.68% and the contribution to training tax is 0.55% or 1.00% according the size of the company, of the total remuneration.

Every January 1st, the work accident contribution rate is modified (a letter from the CARSAT is informing you of the new rate) including the transport tax, in some cases. NB: the transport tax is only required by some municipalities and only from companies with more than eleven employees. You will find the rate that your municipality charges on URSSAF’s website.

Lastly, the FNAL (national housing aid fund) contribution is 0.10% or 0.50% according to the number of employees, contributions are only for the employer based on the total wage.

URSSAF & Social Security

(Sickness, old age, basic pension, accidents at work, etc.). The organisation responsible for collecting social security contributions from employers; employees; CSG; CRDS contributions; unemployment and various taxes.

Deadlines for the payment of the contributions are:

- For companies with more than 50 employees, on the 5th of the following month

- For the companies with less than 50 employees, the 15th of the following month

In case of Sickness, Company Accident, Maternity and Paternity the institution can reimburse the wage (capped) and there is a payroll treatment in order to get the reduction of contributions (Gross up).

Unemployment Insurance in France

This compulsory contribution maintains approximately 57% of the gross wage, in case the employee loses his job (except resignation). The duration of the coverage depends on the seniority and the reason for unemployment. Employees may have a maximum of 23 months and more may be retained for employees over 55 years of age.

The unemployment contributions are paid to the URSSAF, except for expatriates.

Compulsory Life Insurance in France

The life and death insurance is compulsory for all managers (Cadres).

In case the company does not grant the compulsory life insurance to its executives, and in case of decease, the company will have to pay the sums to the heirs (3 x the annual Social Security ceiling).

The collective labor agreement can oblige the company to implement a life and death insurance for all categories of employees.

Medical Insurance in France

Medical insurance is set up in order to complete the medical expenses that are not reimbursed by the Social Security.

Since January 2016, it is compulsory to offer medical insurance to all employees (from the first employee).

Some collective labour agreements have imposed a compulsory medical coverage but it is rare and market specific.

Additional Pension Scheme in France

Not mandatory in all cases, but a collective bargaining agreement can make it mandatory. Also an employer can decide to grant it.

There might be a benefit in kind when social security limits are reached. Monthly social security contributions are paid quarterly.

Reporting Tax & Social Security in France

This information is currently being updated for 2024.

Employers are required to file monthly DSNs (Nominative Social Declaration) to the DGFiP (Public Finances General Directorate). The DSN return can be filed using payroll software or directly online. A DSN submission can be issued up to 1 month in advance and up to 3 months late, but late submissions attract penalties. Employees must be formally told that their personal data is transmitted via DSN.

The DSN return is a consolidated return which covers the following:

- DUCS Urssaf - summary statement of contributions and annual summary

- DUCS for Agirc and Arrco complementary pension funds

- DUCS for pension funds and contribution slips for Mutuelles and insurance companies

- UAD-DADS — substitution was effective from January 2018 for companies issuing DSNs from January 2017 salary slips)

- DMMO / EMMO - the declaration and investigation of labour movements

- Salary certificate for the payment of 'daily allowances' in the event of sickness maternity, paternity, accident at work and occupational disease (IYDD)

- Employer certificate for Pôle emploi (AE)

- Cancellation of collective agreements for supplementary health, welfare and supplementary pension organizations

- the formalities of the special schemes: IEG, SNCF civil aeronautics, etc

- Monthly Mission Statement (MMR) for temporary employment agencies (ETTs)

- MSA contribution declarations

The DSN return includes a periodic return of pay and social security contributions data known as the Declaration Unifiee de Cotisations Sociales (DUCS return). The DUCS return acts as one unified return for all the social insurance organisations to which the contributions are paid. The return covers the following:

- Number of employees

- Contribution base for each deduction for each employee

- Amount of employee contribution

- Amount of employer contribution

New Employees in France

This information is currently being updated for 2024.

A new starter that has a social security number will require a Hiring Declaration (DPAE). A social security number is mandatory for anyone starting any employment. The Declaration Prealable de L'Embauche (DPAE) is a key document that all employers must file for each new hire in the 8-day period before the employee commences work.

The purpose of the DPAE is to:

- Declare that the employee is about to work for the company

- Apply to register the employee for general social security

- Apply to register the employee for unemployment insurance

- Apply to register the employee with the occupational health service (DDTEFP)

- Prompt the arrangement of the compulsory medical examination required on commencing employment

- Add the employee to the expected list of records on the annual DADS (Declaration Annuelles des Donnees Sociales) return.

The DPAE can be submitted electronically, either from payroll software or by direct input.

Leavers in France

This information is currently being updated for 2024.

There is no specific timescale for leavers to receive their final payment. Final documents must be returned at the end of the following month.

No specific notification has to be made to authorities in the event of a leaver; however, an ASSEDIC wage certificate has to be filled in on the website of the unemployment agency.

Payroll in France

The financial year in France runs from 1st January – 31st December.

An employer must provide a pay slip (legal obligation); paper or electronic pay slips are very common in many workplaces. From January 2017, electronic pay slips were authorised in France, unless the employee is opposed.

Reports

Payroll reports must be kept for at least five years. The records can be kept electronically as long as the records can be printed out on request.

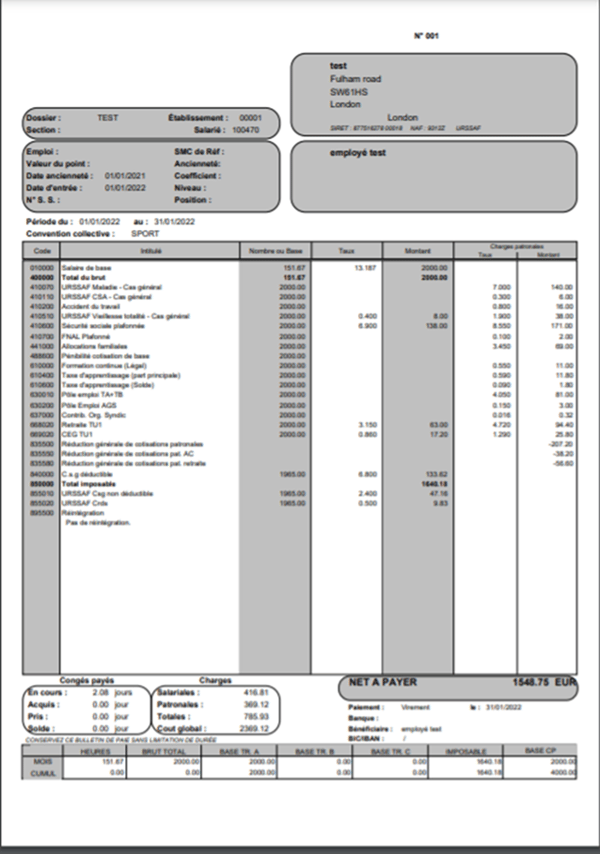

French Payslip Example

Employment Law in France

This information is currently being updated for 2024.

Holiday Accrual and Calculations in France

Employees are entitled to up to 5 weeks of annual leave per year. The 'holiday' year runs from 1 June - 31 May unless the employer has another fixed period year. When annual leave entitlement is not a whole number, it should be rounded up to the nearest whole number.

Annual leave payment is due on the same date as wage payments and the allowance used must appear on payslips.

Maternity Leave

Employees are entitled to at least 16 weeks of maternity leave. Female employees must take maternity leave for at least 8 weeks before and at least 6 weeks immediately after the birth date.

The duration of maternity leave is dependent on the number of expected births and number of children in the household. For a:

- Single 1st birth, 16 weeks maternity leave with 6 weeks to be taken before, and 10 weeks to be taken after the birth date.

- 2nd or 3rd birth, 26 weeks maternity leave with 8 weeks to be taken before, and 18 weeks to be taken after the birth date.

- Twin birth, 34 weeks maternity leave with 12 weeks to be taken before, and 22 weeks to be taken after the birth date.

- Triplet birth or more, 46 weeks maternity leave, 24 weeks to be taken before, and 22 weeks to be taken after the birth date.

Employees cannot be dismissed during pregnancy, maternity leave and ten weeks thereafter. Employers are obligated to pay maternity leave. Legislation on maternity leave is set out in the Labor Code (Code du Travail).

Paternity Leave

The duration of paternity leave is dependent on the number of expected births. For a:

- Single birth, 28 days of paternity leave.

- Twin birth or more, 32 days of paternity leave.

Employees must take 3 working days of birth leave commencing on the birth date, paid by the employer. Employees must then take 4 consecutive calendar days of paternity leave immediately after birth leave, paid by Social Security. During these periods, it is forbidden to employ the employee.

Employees are entitled to a further, optional, 21-day or 28-days of maternity leave, respectively. This is paid by Social Security. During paternity and birth leave, the employment contract is suspended. Legislation on paternity leave is set out in the Labor Code (Code du Travail).

Sick Leave

An employee is obliged to notify their employer of their absence with a medical certificate within 48 hours. An employee must also provide a medical certificate for an extension of their absence. It is recommended that the employee sends their medical certificate by registered letter with acknowledgement receipt.

During sick leave, an employee's employment contract is suspended. Sick leave allowance is paid by daily social security allowances and the employer simultaneously which is determined from a collective agreement.

Social security allowance is paid after the third day of sick leave. Employees must pay:

- 90% of gross salary for the first 30 days of sick leave.

- 66% of gross salary from the 31st day and beyond.

The duration of sick allowance increases by 10 days every 5 years after an employee has worked 5 years of service. For example, from 6 years of service, an employee will receive 90% of gross salary for the first 40 days.

National Service

There are no national service obligations in France.

National Minimum Wage in France 2024

The minimum wage in France for 2024 has been set at €11.65 per hour, which translates to €1,766.92 gross per month based on a legal working week of 35 hours, effective from January 1, 2024.

This adjustment represents a 1.13% increase from the previous rate.

Working Days and Working Hours in France

This information is currently being updated for 2024.

The working week in France is Monday to Friday. The legal duration of work is 35 hours per week. The duration can be annualised to 1607 hours or 218 days. In that case, the time at work can be modulated depending on high or low seasons.

In counterpart of these annual rules, employees are granted RTT (working time reduction days), extra hours are paid or “recovery days” are granted. It depends on the collective agreement or a corporate agreement.

National Statutory Holidays in France 2024

There are multiple statutory holiday schedules within France. Below are the statutory national holidays in France for 2024.

|

Date |

Day |

Holiday |

|

1 January |

Monday |

New Year's Day |

|

29 March |

Friday |

Good Friday * |

|

1 April |

Monday |

Easter Monday |

|

1 May |

Wednesday |

Labour Day |

|

8 May |

Wednesday |

Victory Day |

|

9 May |

Thursday |

Ascension Day |

|

19 May |

Sunday |

Whit Sunday |

|

20 May |

Monday |

Whit Monday |

|

14 July |

Sunday |

Bastille Day |

|

15 August |

Thursday |

Assumption Day |

|

1 November |

Friday |

All Saints' Day |

|

11 November |

Monday |

Armistice Day |

|

25 December |

Wednesday |

Christmas Day |

|

26 December |

Thursday |

St Stephen's Day * |

*Note: Good Friday and St Stephen's Day are observed in specific regions only.

Employee Benefits in France

This information is currently being updated for 2024.

Expenses

General expenses should be refunded only on receipt and are not subjected to social charges.

If a company car is also for private use it must be considered as a benefit in kind, subjected to social charges and income taxes.

Benefits In Kind

The luncheon vouchers called “Ticket Restaurant “entitles the beneficiary to purchase, in whole or in part a meal or, food preparation. These are supported partly by the employer and can be used during the calendar year of issue. The amount of the luncheon vouchers is freely determined by the employer and the company funds 50% of their value at least and 60% maximum.

According to French law, the part paid by the company may be exempted from social security contributions- but only if the distribution of vouchers is strictly justified (no double payment with reimbursement of expense report, etc.).

The distribution of luncheon vouchers by the employer is not mandatory for the companies who have catering premises at their employee’s disposal.

Any employee (including temporary workers) can receive one luncheon voucher per meal included in their daily work schedule. Part-time employees whose daily work schedule does not include the lunch hour are not entitled to luncheon vouchers. This quantity of vouchers may be reduced if the employee is on sickness leave or if he is having a business lunch and being refunded through expense report.

Key updates in 2024 in France

As we step into 2024, there are several significant changes in the French regulatory environment that businesses and individuals must be aware of. Here’s a concise summary of the updates:

Social Security Changes in France

France's social security system saw a pivotal reform with the publication of the Social Security Financing Law for 2024. This law, established after French Constitutional Court validation, includes several important provisions.

Income Tax Developments in France

The Finance Law for 2024, which was published in France's Official Journal, introduces adjustments to income tax bands.

Income tax bands in France have increased by 4.8% based on income received in the 2023 year, which may lead to tax benefits for households due to a potential offset against inflation rates

Employment Law Alterations in France

Increase in France's minimum wage (SMIC), which rose to €11.65 per hour. This change affects the monthly minimum wage pre-tax for a full-time position, setting it at €1,766.92, which approximately amounts to just under €1,400 after taxes.Notes

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

Want to learn more about payroll, tax, social security and more?

Register free today to get the latest up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Let’s Partner

Talk to a specialist today and find out how we support the growth of over 500 businesses with a range of activpayroll solutions designed to help your global payroll and people operations succeed.