Greece

Greece is a hub of diverse emerging markets, with strong demands in consumer goods, infrastructure and modernisation, technology and innovation networks, energy and tourism development.

Need more information about payroll, compliance and social security in Greece?

Talk to a specialist

Our free global insight guide to Greece offers up-to-date information on international payroll, income tax, social security, employment law, employee benefits, visas, work permits and key updates on legislative changes and more in 2024.

Basic Facts about Greece

Greece is located on the Mediterranean Sea with the Ionian Sea to the west, and the Aegean Sea to the east - and shares land borders with Albania, Macedonia, Bulgaria and Turkey.

Long regarded as the cradle of western civilisation, Ancient Greece developed many of the foundations of language, culture, mathematics, science and philosophy which endure to this day.

As an empire, Greece’s influence stretched across much of Europe, but the country was eventually absorbed into the Roman Empire around 200 BC.

Today much of Greece’s ancient heritage still influences global culture, and the country itself has become a developed parliamentary republic, with strong political and economic ties to the rest of the world.

Characterised by hilly and mountainous landscapes, Greece has the longest coastline in the Balkans and boasts numerous idyllic beaches and coastal beauty spots. With a hot, sunny Mediterranean climate, Greece attracts holidaymakers and tourists from around the world, who arrive for warm, beach-friendly weather, or to explore a variety of historic sites.

General Information

- Full Name: The Hellenic Republic

- Population: 10.42 million (World Bank, 2022)

- Capital: Athens

- Major Language: Greek

- Major Religion: Christianity

- Monetary Unit: 1 euro = 100 cents

- Main Exports: Textiles and clothing, food, oil products

- GNI Per Capita: US $21,740 (World Bank, 2022)

- Internet Domain: .gr

- International Dialling Code: +30

How Do I Say in Greek?

- Hello: Geia sas

- Good morning: Kalimera

- Good evening: Kalispera

- Do you speak English?: Milate Agglika?

- Good bye: Antio

- Thank you: Efharisto

- See you later: Tha ta poume meta!

Doing Business in Greece

Greece, with its strategic location at the crossroads of Europe, Asia, and Africa, offers a unique blend of opportunities for businesses looking to establish or expand their presence in the region. Known for its rich history, vibrant culture, and significant economic reforms, Greece is emerging as a promising destination for international business ventures.

At the core of Greece's appeal is its dynamic economy, marked by a series of structural reforms aimed at fostering a more business-friendly environment. The country's commitment to economic revitalisation is evident in its improved fiscal stability, modernised labour laws, and enhanced digital infrastructure. These efforts have streamlined business operations, offering a reliable and efficient business environment for both local and foreign investors.

Greece's strategic geographical position provides unparalleled access to key markets in the EU, the Balkans, and the Eastern Mediterranean, making it an ideal hub for trade and investment. The country's extensive port infrastructure, notably the Port of Piraeus, one of the largest in the Mediterranean, further bolsters its role as a gateway for international commerce. With its membership in the European Union and the Eurozone, Greece offers businesses the advantage of a vast, integrated market and a stable currency.

The tourism sector, a cornerstone of the Greek economy, presents abundant opportunities, drawing on the country's renowned historical sites, beautiful landscapes, and Mediterranean climate. However, Greece's potential extends far beyond tourism. The nation is making significant strides in sectors such as energy, particularly in renewable energy sources, information and communication technology, and agri-food, tapping into its rich natural resources and technological advancements.

Greece is dedicated to nurturing talent and innovation. The country boasts a highly educated workforce, with a strong emphasis on tertiary education and language skills, particularly in English. This human capital is a crucial asset for companies seeking a skilled and adaptable workforce to drive their operations.

Overall, Greece's strategic location, economic reforms, diverse market opportunities, and skilled workforce make it an attractive destination for businesses aiming to enter or expand in the European and Mediterranean markets. The country's ongoing commitment to improving the business climate, coupled with its potential in various key sectors, provides a solid foundation for companies seeking growth, innovation, and a competitive edge in the global market.

Why Invest in Greece?

Investing in Greece offers a compelling array of advantages, positioning it as an attractive destination for businesses and investors aiming to capitalise on the opportunities within its dynamic market. The convergence of recent economic reforms, strategic geographic positioning, and a commitment to fostering a growth-oriented environment underscores the many benefits that Greece presents to the global investment community.

Central to Greece's allure is its strategic geographic location, serving as a crossroads between Europe, Asia, and Africa. This prime positioning is complemented by an extensive coastline and well-developed port infrastructure, particularly the Port of Piraeus, which stands as one of the busiest in the Mediterranean. Such assets provide efficient logistics and trade routes, solidifying Greece as an ideal hub for businesses looking to penetrate the European, Balkan, and Mediterranean markets.

Greece's integration into the European Union and the Eurozone further augments its investment appeal. The nation has undertaken substantial economic reforms aimed at cultivating a more business-friendly climate, ensuring political stability, and providing access to a vast, integrated market under the umbrella of a stable currency. Investors are reassured by a regulatory framework that aligns with EU standards, offering a level of transparency, predictability, and security that is critical in today's economic landscape.

Beyond its famed tourism industry, Greece's economy is on a diversification trajectory, spotlighting significant growth sectors such as renewable energy, information and communication technology (ICT), and the agri-food sector. Greece's initiatives in harnessing its climatic advantages for renewable energy, fostering a tech-savvy and multilingual workforce for the ICT sector, and leveraging its rich biodiversity for the agri-food sector, present vast opportunities for forward-thinking investors.

The human capital in Greece is a standout asset, characterised by a highly educated and skilled workforce. The emphasis on tertiary education and multilingual proficiency, particularly in English, equips businesses with a competent and adaptable talent pool, primed to drive innovation and growth.

Moreover, the Greek government is proactive in rolling out investment incentives, including tax reliefs, grants, and subsidies, especially in areas pivotal to the country's economic expansion, such as technology, energy, and infrastructure development. The commitment to bolstering digital infrastructure and nurturing a start-up-friendly ecosystem further catalyses an environment conducive to innovation and entrepreneurial success.

Lastly, the investment experience in Greece is enriched by the nation's rich cultural heritage, breath-taking landscapes, and high quality of life. These factors not only enhance the living and working environment but also serve as a magnet for attracting and retaining top-tier talent, adding another layer of appeal to investing in Greece.

Greece's blend of strategic advantages, bolstered by ongoing economic reforms, sectoral diversity, and a skilled workforce, creates a fertile landscape for investment and business growth. The nation's dedication to fostering a welcoming and supportive environment for investors cements its status as an enticing destination for businesses poised to make their mark in the European and global markets,

Foreign Direct Investment in Greece

Foreign Direct Investment (FDI) in Greece has been gaining momentum, reflecting the country's growing appeal as a destination for international investors. The Greek government's commitment to economic reform and creating a business-friendly environment has significantly contributed to this positive trend. Greece's strategic location, rich cultural heritage, and ongoing efforts to modernise its economy are key factors driving FDI inflows, signalling confidence in the country's potential for sustainable growth and profitability.

The Greek government has undertaken a series of structural reforms aimed at enhancing the investment climate. These reforms include simplifying the legal and regulatory framework, improving the efficiency of public administration, and fostering a more competitive market environment. These initiatives have been instrumental in reducing bureaucratic hurdles and creating a more transparent and predictable business landscape, thereby increasing Greece's attractiveness to foreign investors.

Greece's strategic position as a gateway to the European, Balkan, and Mediterranean markets is a significant draw for investors. The country's advanced infrastructure, particularly in logistics and telecommunications, provides an excellent foundation for businesses looking to expand their operations in the region. The Port of Piraeus, one of the largest in the Mediterranean, serves as a key logistics hub, offering efficient access to international trade routes and markets.

Sector-specific developments have also played a crucial role in attracting FDI. The renewable energy sector, for instance, has seen significant investment, driven by the country's commitment to sustainability and its abundant natural resources. The tourism sector continues to be a major recipient of FDI, capitalising on Greece's renowned historical sites, beautiful landscapes, and favourable climate. Additionally, the technology and innovation sectors are burgeoning, supported by a highly educated and skilled workforce, along with government incentives aimed at fostering research and development.

The Greek government's proactive approach in offering investment incentives further bolsters FDI. These incentives include tax reliefs, financial grants, and support for research and development activities, particularly in high-growth sectors such as energy, technology, and infrastructure. Such measures not only enhance the country's competitive edge but also demonstrate the government's commitment to supporting and facilitating foreign investment.

Despite the challenges faced in the past, the resilience and potential of the Greek economy are evident in the increasing FDI inflows. Investors are recognising the long-term value and opportunities presented by Greece's dynamic market, strategic location, and ongoing economic revitalisation. As Greece continues on its path of economic reform and modernisation, it solidifies its position as an attractive and promising destination for foreign direct investment.

Foreign Direct Investment in Greece is on an upward trajectory, driven by the government's dedication to creating a favourable investment climate, strategic initiatives across key sectors, and the country's inherent advantages as a cultural and economic hub. These factors collectively underscore Greece's potential as a lucrative and strategic destination for international investors looking to capitalise on the opportunities within the European and global markets.

Business Banking in Greece

Usually, banks are open Monday to Thursday 8am to 3.00pm and 8am to 2:30pm on Fridays.

It is not mandatory for employees to be paid via Greek bank account, it is however mandatory for the authorities (income tax and social contributions) to be paid via a Greek bank account.

Registering a Company and Establishing an Entity in Greece

In order to process payroll in Greece, a company must have a legal entity set up. The estimated completion of this process will depend on the type of company (e.g. IKE, Ltd, A.E.) and it will take approximately two months to complete.

In order for a company to start processing payroll in Greece, a company will need a tax number (obtained from the tax authorities) and an AME number (obtained from the social contributions authorities). It is estimated that registering with the tax and social contributions authorities will take five working days.

No license is necessary before making any tax/social security fillings on behalf of a client. A proxy will be required; however, the client can provide the authorization for this.

Visas and Work Permits in Greece

EU National

All EU nationals must apply for a “Registration Certificate” once they have spent three months in Greece. The Registration Certificate replaces the “Residence Permit” and is obligatory. The new certificate is open dated and will not need to be renewed.

In the case of a working person, the following documents are required when applying for a registration certificate:

- The passport used when the applicant entered Greece

- A statement by the applicant’s duly certified by the local Labour Inspectorate, or a statutory declaration (Ypefthini Dilosi) in Greek specifying the nature and duration of the work to be done by the applicant and confirming local health cover

In the case of the workers family, the following documents are required:

- The passport used when the applicants entered Greece.

- A document issued by the appropriate authority of the country of origin showing their relationship, for example marriage/birth certificates, which will need to be translated into Greek or, alternatively, applicants may sign a statutory declaration (Ypefthini Dilosi) in Greek to confirm the relationship

The “Permanent Residence Certificate” is an optional certificate available to EU nationals. This certificate may be suitable for EU nationals who are married to a Greek citizen or to EU nationals who have made Greece their permanent home. If anyone wants to obtain this certificate, they must prove that they have been a permanent resident of Greece for over five years.

Applications for any of the above certificates should be made to the local Aliens Police or to the local police station closest to the employee’s residence.

Non-EU Citizens

Any non-EU citizen that plans to stay in Greece for more than three months and work must obtain an entry visa. This visa must be obtained before arriving in Greece, usually from the Greek Embassy or Consular in the applicant’s country of residence.

The documents required for applying include;

- A valid passport

- Employment contract

- Proof of adequate medical insurance coverage whilst in Greece

- Criminal background check from the police station nearest the applicant’s residence

Within 30 days of arrival in Greece, the visa holder must apply in person for a residence/work permit at the local municipal office or police station. The type of permit needed will depend on the applicant’s circumstances. It can be valid from one year up to five years.

Before applying for a residence permit, applicants must obtain a tax number and a social security (AMKA).

Application forms for residence permits can be obtained at and submitted to the local municipal office. Applications must be submitted in Greek either in person or by a certified lawyer that has been granted power of attorney.

The documents required to obtain a residence permit include:

- Visa

- Passport (plus photocopies)

- At least two passport photographs

- Certificate of Medical Insurance

- Health Certificate from a state hospital (declaration that the applicant does not have any serious communicable diseases)

- Proof of local address (title deed or rental contract)

- Proof of ability to support oneself - job or resources

- Proof of payment of the required fee to the national tax office (Eforia)

Once the application has been submitted, the applicant will receive a blue form (bebaiosi) as receipt that the application is being processed. The applicant may begin working at this time.

Income Tax in Greece

The tax year in Greece runs from 1 January to 31 December each year.

Income Tax

The employer is responsible for contributing to Solidarity Tax, Income Tax and Social Security Contributions (EFKA formally known as the IKA).

An individual is subject to income tax on his/her total net income in Greece and abroad. Net income that is sourced in Greece is taxed irrespective of the place of residence of the individual. Income arising abroad is taxed if the individual is a resident of Greece. For income tax purposes, the income derived by individuals is divided into certain categories. Taxable income is calculated based on the rules of each category and the total taxable income of the individual is the aggregate of the categories.

Employment and Pension Income

|

INCOME BRACKET (EURO) |

Tax Rate (%) |

|

0 - 10,000 |

9 |

|

10,0001 - 20,000 |

22 |

|

20,0001 - 30,000 |

28 |

|

30,0001 - 40,000 |

36 |

|

Over 40,000 |

44 |

Income tax contributions must be made by the end of each month.

The penalty for late submission/payments is 10% of the total amount payable.

Every second month, the employer is obligated to pay the amount of taxes withheld from the employees’ salaries until that time by submitting the appropriate statement.

Social Security in Greece

All salaries are subject to social insurance deductions. There are a number of different social insurance foundations. Each foundation is responsible for a different working specialty.

EFKA

EFKA is the largest, most common social security body in Greece. The EFKA replaced the IKA. The EFKA covers those in dependent employment in Greece or abroad for an employer who is based in Greece, as well as those who offer full-time or part-time personal labour on commissioned work agreements and are not insured with any other main insurance agency. EFKa covers certain groups of people who offer their labour to various employers at various times and whose insurance is realised through their unions or insurance associations, (e.g. porters, news-stand vendors, slaughterhouse workers etc.) or through special provisions (e.g. exclusive nurses)

As of January 1st 2024 the social insurance contributions are as follows

|

EFKA |

Tax rate |

|

Employee |

13.87% |

|

Employer |

22.29% |

All percentages are calculated on the gross salary with a pre-set limit of deductions.

The employer is obliged to calculate and remit all social security deductions to the Greek authorities at the end of the month following the current one. In the event of late payment, a 3% surcharge would be incurred for the first month and a 1% for each additional month thereafter.

In addition, the employer is also obligated to submit a statement with the employees’ complete personal, working and financial data at the end of month following the end of each quarter. In the event of not meeting the deadline, the employer is fined with a percentage of 10% for the first month of delay and a percentage of 30% for every additional month of delay. All percentages are calculated on the total social insurance deductions for the quarter.

TEKA

ΤΕΚΑ refers to the "Ergatiko Kefalaio". It is a form of employee benefit or fund, essentially a type of severance pay, designed to provide financial support to workers upon termination of their employment under certain conditions.

The primary purpose of TEKA is to offer a financial safety net for employees when they leave a company, whether due to retirement, redundancy, or other reasons not attributed to employee misconduct. TEKA accrues over the duration of an employee's tenure with an employer. It's calculated based on the employee's salary and the length of their service. Employers are responsible for contributing to TEKA, ensuring that the fund is adequately maintained to meet its obligations to employees upon their departure from the company. Both employee and employee must contribute 3% of gross salary.

Reporting Tax in Greece

Monthly

At the end of each month, there are a number of documents that must be submitted to the authorities. These include; APD file (EFKA file) (Social contributions), income tax declaration and any extra contribution file. Submissions can be made online, or if they are last minute, they must be done in person.

Yearly

The annual Company Income Tax Statement must be submitted via the relevant internet service each year. The deadline varies each year.

Employee’s annual statements will include the annual gross and net income of the employees and any withheld tax and social security amounts. The annual statements are generated and provided by 31 March of the following financial year.

New Employees in Greece

All new employees must be registered with the Tax Office and EFKA. They must obtain an AMKA (Social Security Number) in person. New starts must be registered before the date of recruitment otherwise, there will be fines.

For any expat new starts, the following documentation is required:

- ID card/passport

- Completion of form M1 and M7

- Utility bill

- Employer confirmation for his/her recruitment

- AMKA confirmation

- A copy of the employee’s Greek bank account details

- Employee insurance documentation (A1 documentation in Europe)

The information regarding expat employees must be submitted before their recruitment date otherwise there fines will be applicable.

In order to work in Greece, each employee must have a VAT number. If employees do not have one they must obtain one from the Greek authorities.

Leavers in Greece

When there is a leaver, a termination form must be submitted to the local authorities no later than four days after the employee’s termination.

If the leaver has been terminated, then payment should be on their last day. If the leaver has resigned, payment will depend on the deadline for each allowance.

Payroll in Greece

It is legally acceptable to provide employees with online payslips in Greece.

Reports

Payroll reports must be kept for at least 10 years.

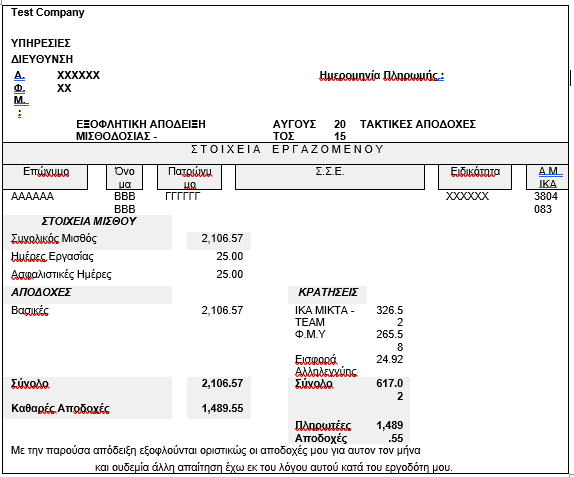

Greece Payslip Example

Working Days in Greece

The working week in Greece is Monday to Friday, with the weekend being Saturday and Sunday.

Employment Law in Greece

Holiday Accrual

Every employee is entitled to 20 days paid holidays in their first year of service, 21 days in the second year and 22 days in their third year.

If the employee completes 10 continuous working years with the same employer, they are entitled to 25 days paid holiday.

If the employee has a total of 12 or more working years’ experience, they are also entitled to 25 days paid holiday. If the employee has a total of 25 years’ experience they are entitled to 26 days paid holidays.

Maternity Leave

A mother to be has the right to 56 days of leave before the estimated date of the birth and 63 days of leave after it. The employer has to cover the salary as well as the insurance of the employee for the first 30 days of leave if the employee has completed one year of service in the company and 15 days of leave if the employee has not completed one year of service in the company. The rest of the days are covered by the Social Insurance Institution.

The mother also has the right to nine months leave after the end of the 63 days. During that time, her compensation and insurance are only covered by the state. A new mother cannot be laid off for at least 18 months after she has given birth. Furthermore, when she returns to her working duties, she has the right to a reduced shift. Specifically, she can work an hour less each day for two and a half years or - if the employer agrees - she could work two hours less a day for a year and an hour less for half a year.

Paternity Leave

When the baby is born, the father is entitled to take 14 working days off which is paid by the employer.

Sickness

In case of an absence because of illness, the employee has to visit a doctor approved by the Social Insurance Institute so that a formal document can be issued stating the days the employee requires to recover. The employer covers half the amount of the salary and the insurance of the first three days of recovery. For any additional day, the employee will get a portion of their salary from the Social Insurance Institution and the remaining from their employer.

National Service

Greek males between the ages of 19 and 45 are required by Greek law to perform military service for at least nine months. This applies to any individual whom the Greek authorities consider to be Greek, regardless of whether or not the individual considers himself Greek, has a foreign citizenship and passport, or was born or lives outside of Greece.

Employers are not required to pay the employee whilst they undertake national service.

Minimum wage in Greece in 2024

The national minimum wage is Greece in 2024 is 910 euros per month.

Statutory National Holidays in Greece 2024

There are multiple statutory holiday schedules within Greece. Below are the statutory national holidays in Greece for 2024.

|

Holiday |

Date |

Weekday |

|

New Year's Day |

1 January |

Monday |

|

Epiphany |

6 January |

Saturday |

|

Clean Monday |

18 March |

Monday |

|

Greek Independence Day |

25 March |

Monday |

|

Labor Day / May Day |

1 May |

Wednesday |

|

Orthodox Good Friday |

3 May |

Friday |

|

Orthodox Easter Sunday |

5 May |

Sunday |

|

Orthodox Easter Monday |

6 May |

Monday |

|

Orthodox Pentecost |

23 June |

Sunday |

|

Holy Spirit Monday |

24 June |

Monday |

|

Dormition of the Virgin Mary |

15 August |

Thursday |

|

The Ochi day |

28 October |

Monday |

|

Christmas Day |

25 December |

Wednesday |

|

Synaxis of the Mother of God |

26 December |

Thursday |

Employee Benefits in Greece

The taxable income in Greece will be established by deducting the following expenses; Social Security Contributions, interest paid for buying a house for the first time and medical care expenses where applicable.

Key updates for 2024 in Greece

In 2024, Greece introduced several significant changes to its tax regulations and legislation, affecting personal income tax, social security, and employment law:

- Prohibition of Cash Payments Over EUR 500: There's a new measure to curb tax avoidance involving cash transactions. Cash payments over EUR 500 between clients and businesses are prohibited. Any violation of this rule results in a fine double the amount received in cash.

- POS Systems and Electronic Transactions: All self-employed professionals and businesses, regardless of their registered tax identification number, must install a POS (Point of Sale) system to accept card payments for retail transactions. This includes the integration of cash register machines (CCMs) with POS systems to automatically record transactions when paying by card. For non-retail transactions, all expenses must be declared electronically in the MyDATA system.

- Taxation of Personal Businesses and Freelancers: There are specific changes in the taxation of personal businesses and freelancers, including a 50% reduction in entrepreneurial duty, determination of minimum imputed net income, and provisions for the transfer of losses.

- Abolition of Solidarity Contribution: As of January 1, 2023, the special solidarity contribution on individual income was abolished. This contribution, first imposed in 2010, was based on a progressive tax scale and was incorporated into the Greek Income Tax Code (ITC) in 2016.

These changes are part of Greece's efforts to modernize its tax system, encourage digital transactions, and combat tax evasion.

Notes

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

Want to learn more about payroll, tax, social security and more?

Register free today to get the latest up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Let’s Partner

Talk to a specialist today and find out how we support the growth of over 500 businesses with a range of activpayroll solutions designed to help your global payroll and people operations succeed.