Guatemala

Guatemala's strategic location – functioning as a conduit between North and South America – offers a significant advantage for businesses seeking to expand their operations. The nation boasts a Free Trade Agreement with the United States, the Dominican Republic, and several other Central American nations.

Need more information about payroll, compliance and social security in Guatemala?

Talk to a specialist

Our free global insight guide to Guatemala offers up-to-date information on international payroll, income tax, social security, employment law, employee benefits, visas, work permits and key updates on legislative changes and more in 2024.

Basic Facts about Guatemala

Guatemala is a Central American republic bordered to the north by Mexico, to the northeast by Belize, and to the east and southeast by Honduras and El Salvador.

Guatemala is the third largest country in Central America with a landmass that stretches from the Caribbean Sea on its east coast, to the southern Pacific Ocean on its west.

Defined by mountainous regions, Guatemala is regarded as the birthplace of the Mayan civilisation and numerous historic and cultural sites are located throughout the country.

General Information

- Full Name: Republic of Guatemala

- Population: 17.3 million (World Bank, 2022)

- Capital: Guatemala City

- Major Languages: Spanish

- Monetary Unit: Quetzal

- Main Exports: Coffee, sugar, petroleum, apparel, bananas, fruits and vegetables, cardamom

- GNI per Capita: USD $10,600(World Bank, 2022)

- Internet Domain: .gt

- International Dialing Code: +502

How Do I Say in Spanish?

- Hello: Hola

- Good Morning: Buenos Días

- Good Evening: Buenas Noches

- Do You Speak English?: Habla Inglés

- Good Bye: Despedida

- Thank You: Gracias

- See You Later: Hasta Luego

Dates

Dates are usually written in the day, month and year sequence. For example, 1 July 2024 or 1/7/24.

Doing Business in Guatemala

Regarded as the most populous country in Central America, Guatemala offers businesses a promising market with engaging economic dynamics. The heart of global commerce beats significantly in these Central American economies, with Guatemala shining with its cost-efficiency and investor-friendly rules.

Guatemala's strategic location – functioning as a conduit between North and South America – offers a significant advantage for businesses seeking to expand their operations. The nation boasts a Free Trade Agreement with the United States, the Dominican Republic, and several other Central American nations. This grants a local entity access to a wider market base, singling Guatemala out as a desirable location to set foot in.

Navigating the local norms of Guatemala is just as essential as any global endeavour. Adherence to country-specific rules, local regulations, labor laws, and statutory compliances becomes a part of the entire process of setting up a business. Any entity looking to establish its footprint should deeply understand labor code, fiscal laws, and import-export tariffs to ensure smooth operation.

Why Invest In Guatemala

Investing internationally often offers businesses the boon of diversification, and selecting Guatemala brings an investor right to the doorsteps of a diverse economy. Flourishing sectors such as agriculture, manufacturing, extractive industries, and diverse services lend a buoyancy to the economy that's an attractive prospect for investors.

Guatemala’s economy is dominated by the private sector, which generates around 90% of GDP. Guatemala has the largest economic market in Central America, occupies the tenth position in Latin America and its GDP represents a third of the region. This economic growth continues based on a state policy to promote development; an approach that has encouraged the simultaneous efforts of the public and private sectors, in this way facilitating the economic boom and access to key global markets.

Agriculture is a traditional strong suit of the Guatemalan economy. With considerable exports fulfilling global demands for agricultural outputs such as bananas, coffee, and vegetables, this sector is laden with potential growth for investment. The Manufacturing industry in Guatemala is marked by production of textiles and apparel, furniture, chemicals, pharmaceuticals, iron and steel, giving the investors an opportunity to tap into an extensive sewer of options.

Guatemala's investment environment is known for its legal security and freedom for foreign and domestic investors. Investors enjoy the same rights, obligations and promotes investment including provisions that recognise and protect private property rights, both for domestic and foreign investors regardless of nationality, with clear processes laid out by the Ministry of Economy's Invest in Guatemala program.

Businesses benefit from Guatemalan laws that favor foreign investment by virtue of providing attractive incentives for investment, such as the “Ley de Inversión Extranjera” (Decreto 9-98), “Ley de Libre Negociación de Divisas” (Decreto 94-2000), “Ley de Zonas Francas” (Decreto 65-89), “Ley de Alianzas para el Desarrollo de Infraestructura Económica” (Decreto 16-2010).

Foreign Direct Investment in Guatemala

Foreign Direct Investment (FDI) has long been a driving force behind Guatemala's economic growth. By fostering progress and integrating the country into the global economy, FDI plays a pivotal role in shaping Guatemala's business landscape. Notable sectors that have seen substantial FDI-flows are electricity, manufacturing, commerce, and agriculture.

The electricity sector in Guatemala is rapidly increasing with considerable potential for renewable energy. Guatemala's bid to enhance its numerous hydroelectric, biomass, and geothermal sources presents a lucrative opportunity for FDI. Manufacturing underpins Guatemala's growing economy, contributing a significant stake to its Gross Domestic Product (GDP). It offers a fertile field for foreign direct investors looking for scalable investment opportunities.

The commerce sector is instrumental to Guatemala's economic output. With a marked growth in retail businesses, commerce in Guatemala invites foreign capital eager to establish a foothold in the emerging commerce sphere. A cornerstone of Guatemala's economic framework, agriculture engages FDI towards sectors such as farming, forestry, and fishing ventures.Foreign Direct Investment in Guatemala has been increasingly attractive due to various factors. Guatemala's proactive approach in crafting an environment conducive to FDI is characterised by a macroeconomic policy framework and access to international financial support.

Foreign Direct Investment in Guatemala has been increasingly attractive due to various factors. The types of FDI available in Guatemala span a range of economic sectors, some of which are highlighted below:

- Energy Sector: With a focus on renewable and sustainable energy sources such as hydroelectric, solar, and wind energy, the country is ripe for FDI intended for green energy projects.

- Manufacturing: The manufacturing sector, especially textiles, apparel, and agro-industry, continues to be a prominent receiver of FDI, backed by a growing production capacity and export opportunities under trade agreements like DR-CAFTA.

- Infrastructure: Investment in infrastructure, particularly in transportation, telecommunications, and construction, has been pivotal in developing the country's capabilities and is open for FDI.

- Tourism: Guatemala's rich cultural heritage and natural beauty make the tourism sector appealing for foreign investors looking to tap into hospitality and related services.

- Agriculture: As the backbone of Guatemala's economy, the agriculture sector – including coffee, sugar, bananas, and vegetables – is a traditional recipient of FDI.

- Financial Services: The banking sector and financial services are becoming increasingly important to the economy, with room for FDI to strengthen these domestic markets.

These avenues represent the main channels for FDI into the country, backed by the Guatemalan government's commitment to maintaining an agreeable investment climate.

Business Banking in Guatemala

It is mandatory in Guatemala to have an in-country bank account to process payroll.

Banks typically open 9am to 5pm from Monday to Friday and 9am to 1pm on Saturdays.

Registering a Company and Establishing an Entity in Guatemala

In Guatemala, there are several types of business entities that can be established, each with its unique set of characteristics, benefits, and obligations:

- Sole Proprietorship (Empresa Individual de Responsabilidad Limitada - EIRL): This is a type of company operated by a single owner who is solely responsible for its obligations.

- General Partnership (Sociedad Colectiva): This consists of two or more individuals who share the management, profit, and liability of the business.

- Limited Partnership (Sociedad en Comandita Simple): This type of entity consists of one or more "active" partners responsible for the management and liabilities of the business, and one or more "silent" partners who are liable only up to their investment in the company.

- Stock Corporation (Sociedad Anónima - S.A.): This is a common commercial business entity. It can be established by two or more individuals who are only responsible for the business up to the amount of their contributions. They can freely transfer their shares which are represented by stock certificates.

- Limited Liability Company (Sociedad de Responsabilidad Limitada - S.R.L.): Similar to a corporation but with a cap on the number of shareholders (maximum 20). The shares aren't openly transferable, providing restrictions on capital flow but providing an extra layer of security to the shareholders.

It's crucial for businesses seeking to establish a presence in Guatemala to understand the specific requirements and regulations associated with each type of entity. The chosen business form shapes the key issues of control, liability, management structure, and taxation considerations.

Establishing a business entity in Guatemala involves a multi-step process that, while straightforward, necessitates a keen understanding of local regulations and formalities. The journey begins with drafting the articles of incorporation for your company. Then, you must register the company with the Mercantile Registry, receive approval for the company's name, publish the act in the Official Gazette, and finally, register with the tax authorities (SAT), among other steps which are detailed below:

Registering a local corporation in Guatemala

- A minimum of two persons, individual or corporate, is necessary to form a corporation

- There are no restrictions on the origin of the parties

- The charter of the corporation must be executed in a public deed

- The deed must be submitted for registration in the Commercial Registry for legal authorization within 20 days after the registration of the corporation

The procedure of registering a company is as follows

- Check the proposed company name online and obtain a letter from a Guatemalan notary public. It takes one day to open a bank account.

- With the name already investigated, request a letter from a Guatemalan attorney to open a bank account in the name of the company

- Select a person who will be the legal representative of the company

- Deposit the subscribed capital in a bank and get a receipt, this will take one day and will not be charged, this management must be done personally by the legal representative

- An attorney will issue the public deed of the constitution of the company and must be signed by each partner in Guatemala

- Complete the forms required by the Commercial Registry and the tax authority then pay the registration fees online. This is an online procedure of less than one day.

- Obtain the provisional registration of the new company before the Mercantile Register; the Tax Identification Number; the Edict; the registration of the legal representative appointment

- Publication of the edit in the “Diario Oficial de Centro América”, and opposition to the provisional registration of the company by affected third parties

- Obtain the definitive registration, the commercial license

- Register with the “Superintendencia de Administración Tributaria” to obtain the Company Tax Identification Number (NIT); authorization for accounting books and authorisation to print invoices

Visas and Work Permits in Guatemala

All individual who are not Guatemalan nationals and wish to work in Guatemala must obtain a Residence Visa and Work Permit. Both documents are valid for one year and are renewed in Guatemala. The Temporary Residence in the country must be managed first.

The work permit can only be obtained if the Guatemalan employer agrees to sponsor the employee, backing them up and being their guarantor before the Migration and Labor Ministry of Guatemala and paying the $400 fee.

The documents required from the employer to support the employee’s work permit are as follows:

- Sworn Declaration of Responsibility

- Sworn Guarantee

- Job offer letter

- Act from Board of Directors

- Accounting certification/tax return forms

An employee and their family must provide the following documents to make the Work Permit application:

- Complete copies of the passport and the passports of each dependent

- An up to date CV in Spanish

- Two passport style photographs

- Job title and description of duties in Guatemala

- Criminal and police records, extended from your country of origin

- Police record of cood Conduct for the employee with legalization at the Consulate of Guatemala in the countries where he/she has resided for the last five year.

- Certificado de Validez y Vigencia. This is a letter or certificate from the passport issuing authority, which verifies the passport's validity and certifies that it is a true document. The certificate must then be legalized at the Consulate of Guatemala.

Income Tax in Guatemala

According to Guatemalan law, taxable income is all income generated by capital, property, services, and rights invested or used in the country as well as income derived from any type of activities taking place in Guatemala.

All individuals, corporations and businesses, domiciled or not in Guatemala, are subject to income tax.

The presentation of income tax ISR to profits must be presented 90 days after the end of the accounting year. For companies, the fiscal year ends in December.

The income tax is defined under 2 modalities, either on the basis of income or on profits obtained in a period;

- If it is defined that it will be on the income, the rate is of 5% from $1 to $4000 and if it is higher than this last amount the rate changes to 7%

- If it is defined that it is taxed on the utility, the rate is of 25% on the net gains

In the case of the 12% VAT (Value Added Tax), the pay is monthly and the maximum is paid at the end of the month, which corresponds to the previous month. The typical fine for late payment of taxes is a 50%.

Income tax contributions on monthly income will be paid to the tax authority on the 10th of each month and for those who choose income tax on income, the payments are quarterly.

For the mercantile companies, it is obliged to pay 1% of the ISO Solidarity Tax, and its payment is quarterly and it is defined according to the results of the previous year, either on the income or its assets, the value that is greater and this Tax can be creditable to income tax

Income tax deduction applies whenever a person earns more than US$535.00 per month.

Each individual has the right to deduct from his/her income tax an annual maximum of $1,600.00 that may be credited for the Value Added Tax paid in personal expenses, for purchases of goods or acquisition of services, during the final annual liquidation period.

Employees are paid 14 salaries a year. You must also pay the labor benefits of law such as indemnification, vacations, bonus 14 and bonuses.

Calculation Example

|

Additions |

|

|

Total Paid |

143,000* |

|

Exemptions (Bonus) |

23,000* |

|

Income |

120,000* |

* Guatemalan quetzales

|

Deductions |

|

|

Annual Deduction |

48,000** |

|

Social Security 4.63% X 120K |

5,796* |

|

Insurance Premiums |

0* |

|

Taxable Income |

89,204* |

|

Tax Would Be 5% |

4,460* |

|

Vat on Personal Purchases |

500* |

|

Tax to be Paid |

3,960* |

*This example is for an average salary of Q10,000 x 14 (12 salaries plus a Christmas and a midyear bonus)

** Guatemalan quetzales

Social Security in Guatemala

Social insurance system covers all employees, including agricultural workers. Public sector employees are covered by a separate program. The pensions for old age, survivorship, and disability are funded by a small contribution from employees and larger contribution from employers, while 25% is covered by the government.

Retirement is set at 62 years of age with at least 216 months (18 years) of contributions to social security.

Cash and medical benefits are provided for sickness and maternity for employees of firms with more than three workers. Free medical care is provided for those receiving pensions.

Social Security Contributions

- Social security employer contribution - 12.67%

- Social security employee withholding - 4.83%

Employers must contribute to the social security system (IGSS) with an overall percentage of:

- Social security - 10.67%

- INTECAP - 1.00%, entity in charge of the Training and Training of Workers

- IRTRA - 1.00%, entity responsible for providing Recreation and Space to workers and their families

Monthly Social Security contributions are to be paid to the local authority on the 20th of each month, what corresponds to the previous month.

Reporting Tax in Guatemala

Monthly

Every month, the IGSS worksheet must be submitted, a list of all salaries paid subject to social security has to be presented. This list determines the amount to be paid to social security from employer and retained and employees.

Yearly

- In March of each year, the Ministry of Labour must submit an annual statistical report of the employed workers that contains a list of all employees. This should be presented to the Ministry of Labour with total salary and positions.

- In March of each year, a liquidation of income tax for employees has to be presented before the tax office.

New Employees in Guatemala

Every worker to be hired must sign an individual work contract, which defines the conditions of hiring and their salary, this must be submitted to the Ministry of Labor to be valid and is endorsed by the entity, the contracting of the employee.

For social security purposes, employees are simply added to the monthly report sent to the social security. New employees that have never been reported to social security have to apply for identification and a social security ID number and it will be the same as your Personal Identity Identification number DPI.

For income tax withholdings, the employee is subject to taxes whenever the person starts to earn above US$250 a month, in which case if applicable a withholding is made and sent to the tax office. Every employee earning above US$500 a month has to apply on its own for a tax ID number.

The following Information is required to register a new employee:

- Company name

- Employee name

- Social security number of Personal Identity Identification DPI of every employee

- Salary amount

- Start date

- Payments during the month (every 15 days, weekly or monthly)

Leavers in Guatemala

The social security is informed of any leaver by simply stating in the monthly list sent to them that the person has left the company.

Payroll in Guatemala

It is legally acceptable in Guatemala to provide employees with online payslips.

Reports

For social security purposes, the payroll reports are required to be held indefinitely.

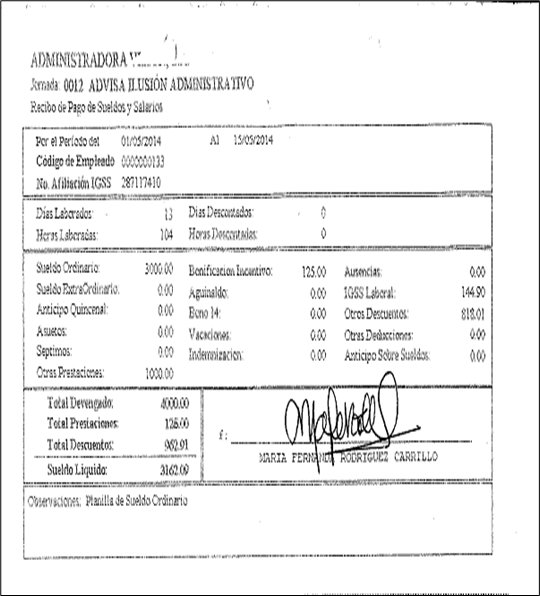

Guatemalan Payslip Example

Employment Law in Guatemala

Holiday Accrual and Calculations

In Guatemala, full time, permanent employees are entitled to an annual paid vacation of 15 consecutive days after completing one year of continuous service with the same employer. This leave is in addition to the national holidays.

If an employee is required to work on a public holiday, they are entitled to a double wage for the hours or days worked. This serves to compensate for their time and acknowledge their dedication.

Additionally, it's worth noting that unused annual leave days cannot be accumulated. If not taken by the end of the respective year, these vacation days would unfortunately be forfeited.

Maternity Leave

In Guatemala, a female employee is entitled to 84 days of maternity leave. This leave breaks up into 30 days before the birth and 54 days after. The days that she cannot enjoy before childbirth will be accumulated to be enjoyed in the postpartum stage, in such a way that the working mother enjoys eighty-four (84) effective days of rest during that period. This period may be altered if deemed necessary for the health of the mother or the baby, upon presentation of a medical certificate.

During this time, the mother is entitled to her full salary, which is paid by the Guatemalan Social Security Institute (IGSS). The employer continues paying the portion of the salary corresponding to the quotas for the IGSS. To access this benefit, the employee needs to have contributed to IGSS for at least 4 months during the last 6 months before the leave.

Paternity Leave

New parents are granted two days paid paternity leave upon the birth which is paid by the Guatemalan Social Security Institute (IGSS).

Sickness

For any sickness the company pays 1/3 of the salary and the social security pays the other 2/3. This benefit starts from the fourth day of the illness and lasts up to a maximum of 26 weeks. In the case of tuberculosis or mental illness, the benefit can be extended up to 39 weeks.

If the worker is not protected by the correlative benefits of the Institute, or if the employer's responsibility is not otherwise established by legal provisions, the Guatemalan Labor Code provide license to the worker, until his total recovery, provided that his recovery occurs within the indicated period, and in accordance with the following rules:

- After continuous work of more than two months and less than six, he must pay you half a salary for one month

- After continuous work of six or more months but less than nine, he must pay you half salary for two months

- After continuous work of nine or more months, he must pay you half salary for three months

Sickness leave can vary depending on the company, making it important to check the company policy.

National Service

There is no compulsory national service in Guatemala.

Working Week and Working Hours in Guatemala

Some companies work from Monday to Friday and others to Saturday noon to complete 44 working hours.

There are 3 types of working schedules in Guatemala.

Daytime Schedule

Daytime work is the one that runs between six and eighteen hours of the same day. It cannot be more than eight hours a day, nor exceed a total of forty-eight hours a week

Night Schedule

Night work is the one that runs between eighteen hours of one day and six hours of the next day. The night time cannot be longer than six hours a day, nor exceed a total of thirty-six hours a week.

Mixed Schedule

This is the one that runs during a time that covers part of the day period and part of the night period. The effective work hours cannot be more than seven hours a day or exceed a total of forty-two hours a week. However, if the person works more than 4 hours in the night; it will be considered as a night schedule.

In 2019, Part-Time Work Convention (No. 175) (ILO) was issued, which establishes that full or part-time staff can be hired, respecting and complying with the provisions of the law. This is still in effect in 2024.

Government offices generally open from 8am to 4pm, Monday through Friday.

Minimum wage in Guatemala in 2024

The minimum wages in Guatemala for 2024 are set differently for various sectors and regions. In the Department of Guatemala (Economic District 1), the daily and monthly wages differ for the agricultural, non-agricultural, and textile factory sectors, including an incentive pay. Similarly, in all other departments (Economic District 2), there are distinct wage rates for these sectors, again including incentive pay. The rates are specified in Guatemalan quetzales (Q).

Department of Guatemala (Economic District 1) minimum wage

|

Employment sector |

Day shift |

Mixed shift |

Night shift |

Daily pay |

Monthly pay |

Incentive pay |

Monthly total |

|

Agricultural |

Q.13.39 |

Q.15.30 |

Q.17.85 |

Q.107.11 |

Q.3,266.86 |

Q.250.00 |

Q.3,516.86 |

|

Non-agricultural |

Q.13.88 |

Q.15.86 |

Q.18.50 |

Q.110.97 |

Q.3,384.59 |

Q.250.00 |

Q.3,634.59 |

|

Textile factory |

Q.12.68 |

Q.14.49 |

Q.16.90 |

Q.101.41 |

Q.3,093.01 |

Q.250.00 |

Q.3,343.01 |

All other Departments (Economic District 2) minimum wage

|

Employment sector |

Day shift |

Mixed shift |

Night shift |

Daily pay |

Monthly pay |

Incentive pay |

Monthly total |

|

Agricultural |

Q.12.81 |

Q.14.64 |

Q.17.08 |

Q.102.44 |

Q.3,124.42 |

Q.250.00 |

Q.3,374.42 |

|

Non-agricultural |

Q.13.23 |

Q.15.12 |

Q.17.64 |

Q.105.83 |

Q.3,227.82 |

Q.250.00 |

Q.3,477.82 |

|

Textile factory |

Q.11.98 |

Q.13.69 |

Q.15.97 |

Q.95.80 |

Q.2,921.90 |

Q.250.00 |

Q.3,171.90 |

Statutory National Holidays in Guatemala 2024

There are multiple statutory holiday schedules within Guatemala. Below are the statutory national holidays in Guatemala for 2024.

|

Holiday |

Date |

Weekday |

|

New Year's Day |

1 January |

Monday |

|

Maundy Thursday |

28 March |

Thursday |

|

Good Friday |

29 March |

Friday |

|

Easter Saturday |

30 March |

Saturday |

|

Easter Sunday |

31 March |

Sunday |

|

Labor Day |

1 May |

Wednesday |

|

Mothers’ Day (Working Mothers Only) |

10 May |

Friday |

|

Army Day |

30 June |

Sunday |

|

Army Day Holiday |

1 July |

Monday |

|

Assumption of Mary (Guatemala City only) |

15 August |

Thursday |

|

Independence Day |

15 September |

Sunday |

|

Dia de la raza |

12 October |

Saturday |

|

Revolution of 1944 |

20 October |

Sunday |

|

All Saints' Day |

1 November |

Friday |

|

Christmas Eve |

24 December |

Tuesday |

|

Christmas Day |

25 December |

Wednesday |

|

New Year's Eve |

31 December |

Tuesday |

Employee Benefits in Guatemala

Benefits for Employees in the Dependency Relationship

Expenses or services paid or incurred during the fiscal year that are necessary for their personal support, provided they are supported by legal documentation (Invoices authorised by SAT).

Individuals in a dependent relationship can deduct as a maximum of their net income, $1600.00 that they can credit for the Value Added Tax paid in personal expenses, for purchases of goods or acquisition of services, during the final annual liquidation period. For this purpose, the VAT return must be presented, containing the detail of the invoices and it must be filed with the Superintendency of Tax Administration, within the first 10 business days of the month of January, and obtain the accounting to be valid. and must present to his employer, to be considered in the settlement of the final tax.

Benefits for Companies

All expenses or services paid or incurred during the fiscal year that are necessary to produce the generation of income or for the Sale of Services or Products are deductible, are deductible from gross income, provided they are backed by legal documentation (Invoices authorized by SAT).

Banking as established in Decree 20-2006 introduced the figure of Banking in Tax Matters to the Guatemalan fiscal framework. It must be complied with in that all transactions that are carried out and that give rise to deductible costs and expenses or tax credits, when they are for amounts greater than thirty thousand Quetzales, the respective payments must be made using the means made available by the banking system, this in order to identify the seller of goods or service provider, should be made only by checks, credit card, transfers, cash payments are not accepted, it is important to indicate that all transactions in a company must be evidenced and supported by bank accounts.

Travel expenses within or outside the country are deductible, as long as the purpose of such travel is related with the production of taxable income. These expenses must be properly supported with invoices whether if paid locally or abroad. The law does not rule specifically these types of expenses if the travel expenses are included in the payroll; they are subject to income tax. In some cases, companies pay travel expenses by way of reimbursements to avoid paying taxes.

13th and 14th Month Salary Payment

13th and 14th month salary are designed to help employees with the additional expenditures that often come during the middle and end of the calendar year, such as school fees, holiday celebrations, and other increased costs during these periods. It is obligatory for the employer to pay workers an annual bonus and employers must factor these payments into their yearly budgeting plans, as they represent additional employment costs.

The employer is legally obligated to fund both the 13th and 14th salaries in their entirety. This is stipulated in Decree No. 42-92, the Law of the "Bono 14" and in Decree No. 76 - 78, the Law of the "Aguinaldo". The mandates require employers to grant these additional payments as a form of bonus to employees.

The 13th salary, or "Bono 14," is usually disbursed in July, while the 14th salary, also known as "Aguinaldo," is typically paid in December.

The calculation for each of these payments is based on the employees' average earnings over the past year, resulting in each bonus being equivalent to a regular month's wage.

Key updates for 2024 in Guatemala

In 2024, Guatemala has specific regulations and legislation for personal income tax, which are important to be aware of:

- Personal Income Tax Rates: Guatemala applies progressive tax rates to personal income. The tax rates are structured as follows:

- For taxable income up to GTQ 300,000 (Guatemalan Quetzales), the tax rate is 5%.

- For the portion of income exceeding GTQ 300,000, the tax rate is 7%.

- Tax Administration and Returns:

- The tax year for individuals in Guatemala runs from January 1 to December 31.

- Taxes are governed by the Ley del Impuesto sobre la Renta (Income Tax Law) and its related regulations.

- The Tax Office of Guatemala (Superintendencia de Administración Tributaria) administers the law.

- It is important to note that joint tax returns are not permitted for husbands and wives in Guatemala.

- Income tax must be withheld from various sources such as salaries, rentals, royalties, fees for services, etc.

These regulations provide a framework for individuals and businesses to understand their tax obligations in Guatemala for the year 2024.

Notes

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

Want to learn more about payroll, tax, social security and more?

Register free today to get the latest up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Let’s Partner

Talk to a specialist today and find out how we support the growth of over 500 businesses with a range of activpayroll solutions designed to help your global payroll and people operations succeed.