Indonesia

The digital economy in Indonesia is among the fastest-growing in the world, propelled by widespread internet adoption and a booming startup ecosystem. The government’s support for digital infrastructure and innovation, coupled with a large online consumer base, presents vast opportunities in fintech, e-commerce, edtech, and other digital services.

Need more information about payroll, compliance and social security in Indonesia?

Talk to a specialist

Our free global insight guide to Indonesia offers up-to-date information on international payroll, income tax, social security, employment law, employee benefits, visas, work permits and key updates on legislative changes and more in 2024.

Basic Facts about Indonesia

The Republic of Indonesia is one of Southeast Asia’s largest and most populous countries. An island archipelago of thousands of individual landmasses, Indonesia’s neighbours include Australia to the southeast, Papua New Guinea and the Philippines to the east and north, and Malaysia to the west.

Indonesia has always been an important location for Southeast Asian civilisation: Hindu and Buddhist kingdoms flourished there in prehistory, while European traders and colonial powers arrived in the late 15th century. Today, Indonesia is home to a spectrum of ethnic groups and societies, from highly urbanized populations, to remote farming and tribal communities.

Lying on the equator, Indonesia experiences a tropical climate, and hosts a wide range of natural environments, from mountainous volcanic regions, to lush rainforests. The country also hosts a vast range of biodiversity and is home to over 2000 endemic species.

General Information

- Full Name: Republic of Indonesia

- Population: 275. million (World Bank 2022)

- Capital: Jakarta

- Language: Indonesian

- Major religion: Islam

- Monetary Unit: 1 Rupiah (USD 1 = IDR 15,000 as of November 2023)

- Main Exports: Oil, gas, palm oil, coal, electrical appliances, plywood, rubber, and textile

- GNP per Capita: $4,580 (World Bank 2022)

- Internet Domain: .co.id

- International Dialling Code: +62

How Do I Say in Indonesian?

- Hello: Halo

- Good morning: Selamat pagi

- Good evening: Selamat sore

- Do you speak English?: Apakah Anda bias bahasa Inggris?

- Good bye: Selamat tinggal

- Thank you: Terima kasih

- See you later: Sampai ketemu nanti

Dates and Numbers

Dates are usually written in the day, month and year sequence. For example 01.07.2024

Numbers are written with a comma to separate thousands and a period to denote fractions. For example, IDR 3,050 (three thousand and fifty Rupiah).

Doing Business in Indonesia

Indonesia, the largest economy in Southeast Asia, presents a vibrant landscape for entrepreneurs and businesses looking to tap into the region's dynamic market. With a population exceeding 270 million people, Indonesia offers a vast consumer base, rich natural resources, and a strategic geographic location that serves as a critical hub for international trade. Here's what you need to know about embarking on a business venture in this burgeoning economy.

Indonesia's economy is a diverse mix of modern industries and traditional agriculture. It's a market with significant potential for growth in sectors such as manufacturing, services, agriculture, and digital technology. The country's GDP has been steadily growing, making it an attractive destination for foreign investment.

Straddling key international shipping lanes, Indonesia offers unparalleled access to ASEAN markets and beyond. Its location provides businesses with the opportunity to engage not only with the domestic market but also with other emerging economies in the Asia-Pacific region.

The Indonesian government has been actively working to improve the business climate by simplifying regulatory processes, enhancing the ease of doing business, and offering incentives for foreign investors. Recent reforms aim to attract more FDI by opening up previously restricted sectors and simplifying investment procedures. Indonesia offers a range of incentives to encourage foreign investment, including tax holidays, import duty exemptions, and land-related incentives, particularly for investments in special economic zones (SEZs) and certain high-priority sectors.

Doing business in Indonesia comes with its set of challenges, including navigating the complex regulatory environment, dealing with bureaucracy, and understanding the diverse cultural landscape. However, with careful planning and local guidance, these challenges can be managed effectively.

Indonesia offers a compelling mix of opportunities and challenges for businesses looking to expand in Southeast Asia. With its large market, strategic location, and government support for investment, Indonesia is positioned as a key player in the region's economic landscape. By navigating the regulatory environment and embracing the cultural diversity of the Indonesian market, businesses can unlock significant potential for growth and success in this vibrant economy.

For those considering Indonesia as their next business destination, the time to explore the possibilities is now. With the right approach and local partnerships, doing business in Indonesia can be a rewarding venture that opens doors to the vast Southeast Asian market.

Why Invest in Indonesia?

Indonesia, with its sprawling archipelago, rich cultural heritage, and burgeoning economy, stands out as a beacon of opportunity in Southeast Asia. From a business perspective, the country offers a compelling case for investment, driven by its demographic dividends, growing economy, strategic location, and reform-driven government. Here’s why businesses are looking towards Indonesia as their next investment destination.

Indonesia boasts a large and youthful population, with over half of its 270 million people under the age of 30. This demographic presents a dual advantage: a sizable workforce and a burgeoning consumer market. The young population is increasingly urban and tech-savvy, driving demand in sectors such as digital services, e-commerce, education, and consumer goods.

The digital economy in Indonesia is among the fastest-growing in the world, propelled by widespread internet adoption and a booming startup ecosystem. The government’s support for digital infrastructure and innovation, coupled with a large online consumer base, presents vast opportunities in fintech, e-commerce, edtech, and other digital services.

Thriving with abundant natural resources, including minerals, oil, gas, and palm oil, Indonesia offers investment opportunities in extraction, processing, and related sectors. The country’s commitment to sustainable and responsible resource management opens avenues for green investments and renewable energy projects.

Indonesia’s diverse culture and market landscapes offer a rich testing ground for products and services. Businesses that successfully navigate this diversity can tap into niche markets and consumer segments, tailoring their offerings to meet varied preferences and needs.

While challenges such as bureaucratic complexity and infrastructural gaps exist, they also present opportunities for businesses to offer solutions and innovations. The government’s focus on infrastructure development and digital transformation is creating demand in construction, technology, and services sectors.

Investing in Indonesia is not merely a venture into a single market but an entry point into a dynamic region with vast potential. The combination of a large, young consumer base, economic resilience, strategic location, and a pro-investment climate makes Indonesia an attractive destination for businesses aiming for long-term growth and regional expansion.

For businesses eyeing global diversification and growth, Indonesia offers a landscape filled with opportunities waiting to be explored. The key to success lies in understanding the market, leveraging government incentives, and embracing the rich cultural tapestry that defines this vibrant nation.

Foreign Direct Investment in Indonesia

Indonesia's commitment to becoming a prime destination for Foreign Direct Investment (FDI) is evident in its wide array of opportunities across various sectors and the comprehensive incentives designed to attract and facilitate foreign investments. The Indonesian government, recognise the importance of FDI for the country’s economic growth and development, and have laid out a conducive ecosystem for investors.

FDI Opportunities in Indonesia

Indonesia's diverse economy presents numerous opportunities for foreign investors, with particular focus on sectors that leverage the country's strategic assets, including its large population, abundant natural resources, and growing digital economy. Key sectors include:

- Manufacturing: Automotive, electronics, textiles, and garments are areas with established foreign investment, with increasing opportunities in green and sustainable manufacturing practices.

- Infrastructure and Transportation: Significant investments are needed in road, sea, and air transport infrastructure, as well as urban mass transit systems, to support Indonesia’s growing economy and population.

- Energy and Mining: Opportunities in renewable energy projects, including solar, wind, and hydro, in response to Indonesia’s commitment to renewable energy sources. The mining sector also offers prospects in nickel, bauxite, and tin mining, crucial for global electronics and battery production.

- Agriculture: With its vast agricultural potential, Indonesia seeks investments in food processing and agriculture technology to enhance productivity and sustainability.

- Digital Economy: The booming digital market in Indonesia, especially in fintech, e-commerce, and startup incubation, presents vast opportunities for innovative digital investments.

- Tourism and Hospitality: The government is keen on developing its tourism sector beyond Bali, promoting investments in new destinations and supporting infrastructure.

Government Incentives for FDI in Indonesia

To attract FDI, the Indonesian government offers a range of incentives, making the investment process more appealing and financially viable for foreign businesses:

- Tax Incentives: These include tax holidays for investments in certain sectors or regions, reduced corporate income tax rates, and allowances for investment in designated priority sectors.

- Customs Incentives: Exemptions or reductions on import duties for machinery, equipment, and raw materials for use in production or for investment in specific industries.

- Investment Allowances: Additional deductions from taxable income, based on the amount invested in certain sectors or regions.

- Ease of Doing Business Reforms: Continuous efforts to streamline business registration, licensing, and land acquisition processes to reduce the time and cost of setting up operations in Indonesia.

- Special Economic Zones (SEZs) and Industrial Estates: Offering enhanced infrastructure, simplified administrative processes, and additional fiscal incentives to businesses setting up in these zones.

- Research and Development (R&D) Incentives: Support for R&D activities, including tax deductions and grants, especially for development of new technologies and sustainable practices.

Facilitating FDI in Indonesia

Indonesia has established several government agencies to streamline the investment process, facilitate foreign direct investment (FDI), and support investors throughout their investment journey. These agencies play a crucial role in enhancing the ease of doing business in Indonesia, offering guidance, regulatory assistance, and incentives. Here's an overview of the key agencies and their functions:

Investment Coordinating Board (BKPM)

The BKPM serves as the primary interface between the government and investors. It's responsible for promoting investment opportunities, facilitating foreign investment, and ensuring the investment process is as smooth as possible. The BKPM offers a range of services, including investment registration, providing information on investment procedures and policies, facilitating necessary licenses and permits, and assisting with land acquisition issues. It also acts as a problem solver for investors facing bureaucratic hurdles.

Ministry of Trade

The ministry on trade in Indonesia is responsible for formulating and implementing trade policies and regulations. It plays a significant role in creating a conducive trade environment for both domestic and foreign businesses. The minister of trade offers services related to export and import licensing, trade promotion, and international trade negotiations. The ministry also works on enhancing Indonesia's trade relations with other countries, opening up more opportunities for investors.

Ministry of Finance

The Ministry of Finance in Indonesia manages the country’s fiscal policy, including taxation matters relevant to foreign investors. It plays a crucial role in designing tax incentives for FDI. They provide information and services related to taxation for businesses, including corporate income tax, VAT, and import duties. The ministry also administers fiscal incentives for investment in specific sectors or regions.

Ministry of Industry

The ministry of industry in Indonesia focuses on the industrial sector's development, working towards increasing competitiveness, innovation, and investment in the industry. They offers support for industrial development, including facilitating access to industrial areas, providing information on industry standards, and managing industrial incentives.

Ministry of Energy and Mineral Resources

The ministry or energy and mineral resources in Indonesia is responsible for the energy and mineral sectors, crucial areas for Indonesia’s economy and attractive sectors for foreign investment. The ministry regulates and promotes investment in the energy and mineral sectors, offering information and assistance related to energy policies, mining licenses, and related incentives.

Directorate General of Customs and Excise

Part of the Ministry of Finance, the Directorate General of Customs and Excise in Indonesia is a body that manages customs services, including the importation of goods and related duties. They offer guidance on customs procedures, tariffs, and exemptions for investors, especially those importing machinery, equipment, and raw materials for production purposes.

Indonesian Agency for Creative Economy (BEKRAF)

Before being merged into the Ministry of Tourism and Creative Economy, BEKRAF was dedicated to fostering the creative economy sector, including arts, media, and design, which is increasingly significant for Indonesia’s economic diversification. Although now part of a larger ministry, the focus remains on promoting and facilitating investment in the creative economy, providing support for startups, and innovating in creative sectors.These government agencies collectively create a supportive ecosystem for foreign investment in Indonesia, offering comprehensive services from pre-investment information to post-investment support.

Indonesia’s rich opportunities, supported by targeted government incentives, positions the country as a compelling destination for foreign direct investment in Southeast Asia. The strategic focus on key growth sectors, coupled with a commitment to improving the ease of doing business, underscores Indonesia’s openness to global investors. For businesses looking to expand their footprint and tap into the growing ASEAN market, Indonesia represents a frontier replete with potential and promise.

Business Banking in Indonesia

In Indonesia it is not mandatory to make payments to employees and the authorities from an in-country bank account; however in Indonesia, it is highly recommended that an in-country bank account is used to make the payments for book-keeping and tax audit purposes.

Banks in Indonesia are open Monday to Friday 8 AM to 3 PM and closed on weekends for most branches and banking transactions.

Registering A Company and Establishing an Entity in Indonesia

Establishing a business entity in Indonesia, particularly for foreign investors, involves navigating the country’s regulatory framework, which is designed to support both domestic and international economic growth while safeguarding national interests. The most common form of business entity for foreign investors is the Foreign Direct Investment Company, known locally as Perseroan Terbatas Penanaman Modal Asing (PT PMA). Here’s an expanded overview of the process, including types of entities and steps to establish a business in Indonesia.

Types of Business Entities in Indonesia

Foreign Direct Investment Company (PT PMA)

The PT PMA is the preferred entity for foreign investors intending to conduct full-scale operations in Indonesia. PT PMAs are allowed in most sectors but must adhere to the regulations set forth in the Negative Investment List, which specifies sectors that are restricted or closed to foreign investment.

- Ideal for long-term and full-scale commercial operations in Indonesia.

- Requires thorough planning to navigate sector-specific restrictions and capital requirements.

- Offers the potential for direct market access and the ability to generate revenue within Indonesia.

Local Company (PT)

A local limited liability company (Perseroan Terbatas or PT) is an entity that can be established by Indonesian citizens or entities. While foreign investors typically invest in PT PMAs, they may also invest in a PT under certain conditions if the investment is not restricted by the Negative Investment List.

- Suitable for businesses that can align with local ownership regulations or for foreign investors partnering with Indonesian entities.

- Offers flexibility in domestic operations and access to all sectors not restricted by the Negative Investment List.

- Subject to Indonesian corporate governance and regulatory environment, similar to PT PMA.

Representative Office

Foreign companies looking to explore the Indonesian market without establishing a full-fledged company can set up a Representative Office. This entity cannot engage in sales transactions but can conduct market research and other preparatory activities.

- Best suited for market exploration and networking before committing significant resources to establish a PT PMA.

- Easier and faster to set up, allowing foreign companies to quickly establish a presence and begin market research and liaison activities.

- Limited operational scope means it's not a long-term solution for businesses intending to conduct sales in Indonesia.

Establishing a PT PMA in Indonesia

- In-Principle Approval from BKPM: Foreign investors must obtain In-Principle Approval from the Investment Coordinating Board (BKPM). The approval process involves submitting a comprehensive application along with required documents, such as a business plan and evidence of financial capability. BKPM will issue approval approximately 5 to 10 working days after receiving a completed application and required supporting documentation, although satisfying BKPM’s requirements often mean approvals take longer than this.

- Deed of Establishment: Once BKPM approval is received, the next step is to draft and notarize the Deed of Establishment, which includes the company's articles of association. This document must be approved by the Ministry of Law and Human Rights.

- Company Registration: With the notarised Deed of Establishment, the company can then be registered with the Ministry of Trade to obtain a Company Registration Certificate (TDP).

- Tax Registration: The newly established company must obtain a Taxpayer Identification Number (NPWP) and register for Value Added Tax (VAT) if applicable.

- Business License: Following tax registration, the company must apply for a business license from BKPM, which allows it to commence its business activities. The specifics of the license depend on the company's field of business.

- Additional Licenses: Depending on the sector, further licenses from relevant ministries or local government bodies may be required, especially for sectors like mining, oil and gas, and education.

PT PMAs are subject to minimum capital requirements, which must be demonstrated to BKPM during the application process.

Investment Methods

Investment must be made by way of establishing new or purchasing shares in an existing limited liability company. A PT PMA must satisfy the requirements of the Negative Investment List (DNI) and have an approved deed of establishment or articles of association, which must be signed before an Indonesian notary.

For certain lines of business (e.g., mining, oil and gas, education), the recommendation of the relevant government regulating institution must be obtained before BKPM will issue its approval.

Once BKPM approval has been obtained, the foreign company may establish or invest in a PT PMA. Establishing a new PT PMA usually takes approximately 4 to 8 weeks. Payroll can be set up in parallel with company establishment, but hiring employees and reporting to statutory bodies are recognized after the company is officially incorporated and registered.

Negative Investment List (DNI) in Indonesia

Daftar Negatif Investasi (DNI) or the Negative Investment List in Indonesia is a list of business sectors in which foreign investment is either prohibited, permitted, or conditionally permitted. This list also details sectors that are either fully open, conditionally open, or closed to foreign investment. It's crucial to consult this list before planning an investment to ensure the business field is open to foreign ownership.

It is important to note that the DNI is subject to change at any time. The Indonesian government has announced plans to further liberalise the DNI in the future, but it is not clear when these changes will take effect.

Visas and Work Permits in Indonesia

Indonesia offers a range of visa and work permit options tailored to meet the needs of foreign nationals looking to engage in business activities or employment within the country. Here's an overview of the key types of visas and work permits relevant to businesses in Indonesia:

Business Visa

Designed for foreign nationals intending to conduct business negotiations, attend meetings, seminars, conferences, or conduct short-term business activities in Indonesia. It does not permit employment/ Typically valid for up to 60 days and can be extended with approval from Indonesian immigration authorities.

Social-Cultural Visa

Suitable for those engaging in social-cultural activities, including educational programs or family visits, which may indirectly relate to business activities, such as cultural exchange or networking events. Initially granted for 60 days, with the possibility of extensions for up to 6 months.

Limited Stay Visa (VITAS) and Limited Stay Permit (KITAS)

Required for foreign nationals planning to work, conduct research, or engage in long-term projects in Indonesia. It's the most common visa for expatriates employed in Indonesia. Issued for periods ranging from 6 months to 2 years, depending on the employment contract or project duration, and can be extended.

Multiple Entry Business Visa

Allows for multiple entries into Indonesia for business purposes, such as establishing a business or conducting regular business activities, without the intention of taking up employment. Valid for one year, with each stay not to exceed 60 days.

Investor KITAS

Specifically designed for foreign investors who are shareholders or directors in Indonesian companies. Can be issued for 1 or 2 years, depending on investment size, and is extendable.

Work Permit (IMTA)

Foreign nationals employed in Indonesia must obtain an IMTA from the Ministry of Manpower. The IMTA is applied for by the employer and is a prerequisite for obtaining a KITAS. Matches the period of the KITAS, and must be renewed alongside the KITAS renewal.

Retirement Visa

Although not directly related to business activities, this visa option is available for retired foreign nationals who wish to live in Indonesia, potentially allowing for informal business consultations or advisory roles. Issued for one year and is renewable for up to 5 years.

Compliance and Application Process

Obtaining the appropriate visa or work permit involves navigating the Indonesian immigration system, which requires thorough documentation, including sponsorship letters from Indonesian companies, proof of qualifications, and evidence of financial capability. The process can vary based on the specific visa or permit, with applications submitted either domestically within Indonesia or at Indonesian embassies or consulates abroad.

There is no formal obligation for investors to hire Indonesian citizens, however, expatriate employees may only hold certain positions. A foreign worker is required to have a contract with the company that is providing the job in Indonesia. The duration of the contract depends on the company and can be 1 year, with extension possibility. The processing at the Indonesian embassy or representative office can take around 1 week or more.

It is advisable for companies to have local staff in management that is familiar with the Indonesian rules & regulations and can sign off the statutory reports, especially the annual employee tax withholding forms.

Income Tax in Indonesia

The Tax Year in Indonesia runs from 1st January to 31st December.

Income Tax

All individual tax residents (including expatriates) have to register with the Tax Office and obtain a Tax ID number.

The employees with non-taxable income should also register to obtain a Tax ID for reporting their annual income to tax office (in order for the tax office can easily track and record their income).

Taxation in Indonesia is determined based on residency.

Resident taxpayers are defined as individuals who:

- Are domiciled in Indonesia or

- Stay in Indonesia for more than 183 days in any 12-month period or

-

Are present in Indonesia during a tax year and intend to reside in Indonesia

A foreigner who qualifies to be a resident taxpayer becomes a tax resident from the date of arrival in Indonesia until the date of final departure from Indonesia.

An Indonesian national is considered a tax resident from birth, unless he or she leaves Indonesia permanently. If an Indonesian national is leaving Indonesia temporarily, for example, for a working assignment to another country for a period of 6 months or more, then he/she can be considered as a non-resident during the assignment period and will be taxed only on Indonesian sourced income.

Resident individual taxpayers without a tax ID number/NPWP are subject to a surcharge of 20% in addition to the standard Article 21 Income Tax rates.

Regulation 58 of 2023 (GR 58/2023).

In 2024, Indonesia introduced a significant update to its income tax structure for individual taxpayers through Government Regulation 58 of 2023 (GR 58/2023). This regulation, effective from January 1, 2024, aims to streamline the process of monthly withholding tax calculation by introducing an 'effective tax rate' (ETR) system, while maintaining the progressive income tax rate for annual calculations in December as per Article 17(a) of the Income Tax Law. The final tax underpayment will be based on the December recalculation amount minus the tax that has been withheld from January to November.

Monthly Income Tax Calculation

Under GR-58, the Effective Tax Rate (ETR) is calculated based on the individual's monthly gross income, without the need for annualisation or subtracting specific deductions from this income. This approach incorporates considerations for standard deductions, including non-taxable income thresholds, work-related expenses, and contributions to pension schemes, directly within the ETR calculation. This simplifies the tax calculation process by integrating deductions directly into the tax rate applied to gross income, facilitating a more straightforward calculation for taxpayers each month.

Taxpayer Categories and Effective Tax Rates (ETR)

Taxpayers are categorised based on their marital status and the number of dependents and monthly income received. The monthly ETR is applied on all income received by an individual on a monthly basis.

The categories are as follows:

Category A for individuals with a marital status of:

- Single with no dependent (S/0)

- Single with one dependent (S/1)

- Married with no dependent (M/0).

Category B for individuals with a marital status of:

- Single with two dependents (S/2)

- Single with three dependents (S/3)

- Married with one dependents (M/1)

- Married with two dependents (M/2)

Category C for individuals with a marital status of:

- Married with three dependents (M/3)

Daily ERT

For non-permanent workers who earn their income on a daily, weekly, per unit, or piece-rate basis, the Effective Tax Rate (ETR) under GR-58 is calculated using the income these workers receive within these periods. When income is not distributed daily, the ETR calculation uses the average daily earnings, determined by the total income divided by the number of workdays.

The ETR for daily incomes under GR-58 is as follows:

- A 0% tax rate applies to daily incomes of up to IDR 450,000.

- A tax rate of 0.5% is applied to daily incomes exceeding IDR 450,000 and up to IDR 2,500,000.

- GR-58 currently does not specify the ETR for daily incomes above IDR 2,500,000

ERT Tax Rate by Category in Indonesia 2024

Category A |

||

|

Monthly Gross Income (IDR) |

Monthly Gross Income (USD) |

ETR (%) |

|

Up to 5,400,000 |

Up to 345 |

0 |

|

5,400,001 - 5,650,000 |

345 - 361 |

0.25 |

|

5,650,001 - 5,950,000 |

361 - 380 |

0.5 |

|

5,950,001 - 6,300,000 |

380 - 403 |

0.75 |

|

6,300,001 - 6,750,000 |

403 - 431 |

1 |

|

6,750,001 - 7,500,000 |

431 - 479 |

1.25 |

|

7,500,001 - 8,550,000 |

479 - 547 |

1.5 |

|

8,550,001 - 9,650,000 |

547 - 617 |

1.75 |

|

9,650,001 - 10,050,000 |

617 - 643 |

2 |

|

10,050,001 - 10,350,000 |

643 - 662 |

2.25 |

|

10,350,001 - 10,700,000 |

662 - 684 |

2.5 |

|

10,700,001 - 11,050,000 |

684 - 707 |

3 |

|

11,050,001 - 11,600,000 |

707 - 742 |

3.5 |

|

11,600,001 - 12,500,000 |

742 - 800 |

4 |

|

12,500,001 - 13,750,000 |

800 - 880 |

5 |

|

13,750,001 - 15,100,000 |

880 - 966 |

6 |

|

15,100,001 - 16,950,000 |

966 - 1,085 |

7 |

|

16,950,001 - 19,750,000 |

1,085 - 1,264 |

8 |

|

19,750,001 - 24,150,000 |

1,264 - 1,542 |

9 |

|

24,150,001 - 26,450,000 |

1,542 - 1,693 |

10 |

|

26,450,001 - 28,000,000 |

1,693 - 1,791 |

11 |

|

28,000,001 - 30,050,000 |

1,791 - 1,923 |

12 |

|

30,050,001 - 32,400,000 |

1,923 - 2,073 |

13 |

|

32,400,001 - 35,400,000 |

2,073 - 2,265 |

14 |

|

35,400,001 - 39,100,000 |

2,265 - 2,500 |

15 |

|

39,100,001 - 43,850,000 |

2,500 - 2,803 |

16 |

|

43,850,001 - 47,800,000 |

2,803 - 3,057 |

17 |

|

47,800,001 - 51,400,000 |

3,057 - 3,287 |

18 |

|

51,400,001 - 56,300,000 |

3,287 - 3,601 |

19 |

|

56,300,001 - 62,200,000 |

3,601 - 3,980 |

20 |

|

62,200,001 - 68,600,000 |

3,980 - 4,390 |

21 |

|

68,600,001 - 77,500,000 |

4,390 - 4,958 |

22 |

|

77,500,001 - 89,000,000 |

4,958 - 5,695 |

23 |

|

89,000,001 - 103,000,000 |

5,695 – 6590 |

24 |

|

103,000,001 – 125,000,000 |

6,950 – 7,997 |

25 |

|

125,000,001 – 157,000,000 |

7,997 – 10,004 |

26 |

|

17,000,001 – 206,000,000 |

10,044 – 13,179 |

27 |

|

206,000,001 – 337,000,000 |

13,179 – 21,561 |

28 |

|

337,000,001 – 454,000,000 |

21,561 – 29,046 |

29 |

|

454,000,001 – 550,000,000 |

209,046 – 35,182 |

30 |

|

500,000,001 – 695,000,000 |

35,182 – 44,457 |

31 |

|

695,000,001 – 910,000,000 |

44,457 – 58,214 |

32 |

|

910,000,001 – 1,400,000,000 |

58,214 – 89560 |

33 |

|

1,400,000,001 and over |

89,560 and over |

34 |

Category B |

||

|

Monthly Gross Income (IDR) |

Monthly Gross Income (USD) |

ETR (%) |

|

Up to 6,200,000 |

Up to 396 |

0 |

|

6,200,000 – 6,500,000 |

396 – 415 |

0.25 |

|

6,500,000 – 6,850,000 |

415 – 438 |

0.5 |

|

6,850,000 – 7,300,000 |

438 – 467 |

0.75 |

|

7,300,000 – 9,200,000 |

467 – 588 |

1 |

|

9,200,000 – 10,750,000 |

588 – 687 |

1.5 |

|

10,750,000 – 11,250,000 |

687 – 719 |

2 |

|

11,250,000 – 11,600,000 |

719 – 742 |

2.5 |

|

11,600,000 – 12,600,000 |

742 – 806 |

3 |

|

12,600,000 – 13,600,000 |

806 – 870 |

4 |

|

13,600,000 – 14,950,000 |

870 – 956 |

5 |

|

14,950,000 – 16,400,000 |

956 – 1,049 |

6 |

|

16,400,000 – 18,450,000 |

1,049 – 1,180 |

7 |

|

18,450,000 – 21,850,000 |

1,180 – 1,398 |

8 |

|

21,850,000 – 26,000,000 |

1,398 – 1,666 |

9 |

|

26,000,000 – 27,700,000 |

1,666 – 1,771 |

10 |

|

27,700,000 – 29,350,000 |

1,771 – 1,877 |

11 |

|

29,350,000 – 31,450,000 |

1,877 – 2,011 |

12 |

|

31,450,000 – 33,950,000 |

2,011 – 2,171 |

13 |

|

33,950,000 – 37,100,000 |

2,171 – 2,373 |

14 |

|

37,100,000 – 41,100,000 |

2,373 – 2,628 |

15 |

|

41,100,000 – 45,800,000 |

2,628 – 2,930 |

16 |

|

45,800,000 – 49,500,000 |

2,930 – 3,166 |

17 |

|

49,500,000 – 53,800,000 |

3,166 – 3,442 |

18 |

|

53,800,000 – 58,500,000 |

3,442 – 3,742 |

19 |

|

58,500,000 – 64,000,000 |

3,742 – 4,093 |

20 |

|

64,000,000 – 71,000,000 |

4,093 – 4,541 |

21 |

|

71,000,000 – 80,000,000 |

4,541 – 5,117 |

22 |

|

80,000,000 – 93,000,000 |

5,117 – 5,949 |

23 |

|

93,000,000 – 109,000,000 |

5,949 – 6,971 |

24 |

|

109,000,000 – 129,000,000 |

6,971 – 8,251 |

25 |

|

129,000,000 – 163,000,000 |

8,251 – 10,425 |

26 |

|

163,000,000 – 211,000,000 |

10,425 – 13,495 |

27 |

|

211,000,000 – 374,000,000 |

13,495 – 23,926 |

28 |

|

374,000,000 – 459,000,000 |

23,926 – 29,364 |

29 |

|

459,000,000 – 555,000,000 |

29,364 – 35,496 |

30 |

|

555,000,001 – 704,000,000 |

35,496 – 45,026 |

31 |

|

704,000,001 – 957,000,000 |

45,026 – 61,212 |

32 |

|

957,000,001 – 1,405,000 |

61,212 - |

33 |

|

1,405,001 and over |

|

34 |

Category C |

||

|

Monthly Gross Income (IDR) |

Monthly Gross Income (USD) |

ETR (%) |

|

Up to 6,600,000 |

Up to 396 |

0 |

|

6,600,000 – 6,950,000 |

396 – 444 |

0.25 |

|

6,950,000 – 7,350,000 |

444 – 470 |

0.5 |

|

7,350,000 – 7,800,000 |

470 – 498 |

0.75 |

|

7,800,000 – 8,850,000 |

498 – 566 |

1 |

|

8,850,000 – 9,800,000 |

566 – 626 |

1.25 |

|

9,800,000 – 10,950,000 |

626 – 700 |

1.5 |

|

10,950,000 – 11,200,000 |

700 – 716 |

1.75 |

|

11,200,000 – 12,050,000 |

716 – 770 |

2 |

|

12,050,000 – 12,950,000 |

770 – 828 |

3 |

|

12,950,000 – 14,150,000 |

828 – 904 |

4 |

|

14,150,000 – 15,550,000 |

904 – 994 |

5 |

|

15,550,000 – 17,050,000 |

994 – 1,090 |

6 |

|

17,050,000 – 19,500,000 |

1,090 – 1,247 |

7 |

|

19,500,000 – 22,700,000 |

1,247 – 1,452 |

8 |

|

22,700,000 – 26,600,000 |

1,452 – 1,702 |

9 |

|

26,600,000 – 28,100,000 |

1,702 – 1,797 |

10 |

|

28,100,000 – 30,100,000 |

1,797 – 1,925 |

11 |

|

30,100,000 – 32,600,000 |

1,925 – 2,085 |

12 |

|

32,600,000 – 35,400,000 |

2,085 – 2,264 |

13 |

|

35,400,000 – 38,900,000 |

2,264 – 2,488 |

14 |

|

38,900,000 – 43,000,000 |

2,488 – 2,752 |

15 |

|

43,000,000 – 47,400,000 |

2,752 – 3,036 |

16 |

|

47,400,000 – 51,200,000 |

3,036 – 3,279 |

17 |

|

51,200,000 – 55,800,000 |

3,279 – 3,574 |

18 |

|

55,800,000 – 60,400,000 |

3,574 – 3,868 |

19 |

|

60,400,000 – 66,700,000 |

3,868 – 4,272 |

20 |

|

66,700,000 – 74,500,000 |

4,272 – 4,771 |

21 |

|

74,500,000 – 83,200,000 |

4,771 – 5,327 |

22 |

|

83,200,000 – 95,600,000 |

5,327 – 6,121 |

23 |

|

95,600,000 – 110,000,000 |

6,121 – 7,045 |

24 |

|

110,000,000 – 134,000,000 |

7,045 – 8,582 |

25 |

|

134,000,000 – 169,000,000 |

8,582 – 10,824 |

26 |

|

169,000,000 – 221,000,000 |

10,824 – 14,156 |

27 |

|

221,000,000 – 390,000,000 |

14,156 – 24,981 |

28 |

|

390,000,000 – 463,000,000 |

24,981 – 29,660 |

29 |

|

463,000,000 – 561,000,000 |

29,660 – 35,921 |

30 |

|

561,000,000 – 709,000,000 |

35,921 – 45,398 |

31 |

|

709,000,000 – 965,000,000 |

45,398 – 61,794 |

32 |

|

965,000,000 – 1,419,000,000 |

61,794 |

33 |

|

Over 1,419,000,001 |

34 |

|

Social Security in Indonesia

In Indonesia The National Social Security System (Sistem Jaminan Sosial Nasional or "SJSN") mandates participation for all employees, including expatriates and their dependents, ensuring broad coverage across various facets of social security. The administration of these programs is divided between two main organisations:

-

The Social Security Administrator for Health (BPJS Kesehatan) managing healthcare needs

-

The Workers Social Security (BPJS Ketenagakerjaan) focusing on socio-economic protections

Workers Social Security Scheme Contributions in Indonesia

The Workers Social Security Scheme outlines specific areas of coverage, with contributions calculated as a percentage of the employees' monthly wages. Employers are responsible for a significant portion of these contributions, ensuring comprehensive coverage for their workforce. The scheme's structure and contribution is as follows:

| Areas Covered | Employer contributions (%) | Employee contributions (%) |

|---|---|---|

| Life insurance | 0.2 | - |

| Accident insurance | 0.10 – 1.60 | - |

| Old age benefits | 3.7 | 2 |

| Pension plan** | 2 | 1 |

| Healthcare* | 4 | 1 |

* BPJS Kesehatan (Healthcare Scheme)

- The premium is calculated with a salary cap of 12 million rupiah (approximately US$821), while the basis for other premiums is capped at a six months' salary of 5 million rupiah (approximately US$352). The cap usually increase annually.

- The mandatory premium will cover husband, wife, and up to three children. Additional family members can be covered with additional premium payments borne by the employee.

** BPJS Ketenagakerjaan

- There is a cap on regular salaries/wages for calculating the pension insurance contribution, which the cap usually increase annually.

Job Loss Security program (JLS) in Indonesia

The Indonesian government, through Government Regulation 37 of 2021 (GR 37/2021), has inaugurated the Job Loss Security program (JLS), marking the country's first initiative toward providing unemployment benefits. The JLS scheme is available exclusively to employees who participate in the Workers Social Security program. Qualified employees who have been laid off will benefit from monetary support for up to six months, alongside access to skill enhancement training and career advisory services. Beneficiaries of the JLS program are entitled to a cash allowance—receiving 45% of their monthly salary (up to a maximum of 5 million rupiah or approximately US$352) for the initial three months, followed by 25% for the subsequent three months. Moreover, the scheme facilitates career counseling and offers a blend of online and offline vocational training opportunities.

This benefit is given to participants who have been terminated, have not returned to work, and have a commitment to return to the job market, provided that the participant has had a contribution of Unemployment Benefit for at least 12 months in 24 months and has paid a contribution for at least 6 consecutive months.

Funding for the JLS program comes from contributions amounting to 0.46 % of the monthly payroll costs, shared between the government and employers. Specifically, the government contributes 0.22%, with employers covering the additional 0.24%.. This employer portion is reallocated from the existing allocations for life insurance and work compensation within the pension scheme.

Reporting Tax in Indonesia

Books and records should be maintained in Rupiah and in the Indonesian language, and kept for 5 years in Indonesia.

Foreign investment companies, certain entities with foreign affiliations or taxpayers that prepare their financial statements in US Dollars as the functional currency in accordance with the Indonesian financial accounting standards may maintain English language and US Dollar bookkeeping, subject to approval from the Minister of Finance. While for contractors of oil and gas cooperation contract and companies operating under Mining Contracts of Work, only a notification is required.

Compliance Reporting Time Table in Indonesia

|

Type of Tax |

Monthly Payment Deadline |

Monthly Filing Deadline |

Annual Filing Deadline |

Reported By |

|

Corporate Income Tax |

N/A |

N/A |

End of the 4th month after the tax year ends |

Payroll provider or client |

|

Individual Income Tax |

N/A |

N/A |

End of the 3rd month after the tax year ends |

Individual employee |

|

Employee Withholding Tax |

10th of the following month |

20th of the following month |

N/A |

Payroll provider |

|

Other Withholding Taxes |

10th of the following month |

20th of the following month |

N/A |

Usually client but payroll provider also can |

New Employees in Indonesia

Companies are required to register for a tax ID number, during the incorporation process, and with BPJS Health and BPJS Manpower, after this has been completed. As per law, companies with a minimum of 10 employees must register with BPJS Manpower. However, it is recommended that multinational companies with less than 10 staff also register all their employees as the benefits outweigh the costs.

Currently, the individual taxpayer is legally responsible for ensuring that they've registered with the tax office and comply with the regulations and payment of the taxes due. Some companies, as per contract, for expatriates may have agreed to pay taxes on their behalf; however they are still personally liable for annual tax withholding reporting. The company will provide employees with their annual tax withholding form by early the following year.

Documents required for registering a new worker in Indonesia:

- A Completed Registration Form

- Photocopies of all the pages of the passport

- Photocopy of Work Permit

- Certificate of Domicile for employee and employer

- Photocopy of Employer's NPWP

- Letter of Authorization, authorising the company representative to register and handle the companies tax matters

- While the registration form only asks for a copy of the ID page of the passport and does not request the other items mentioned above, the bureaucrats at the Tax Office ask for them as a matter of course.

For new starts, according to the regulations, failure to secure an NPWP could mean imprisonment for a maximum of six years and a maximum fine of four times the total amount of tax due.

Leavers in Indonesia

Usually leaving employees must give minimum one month’s notice to their employer. This allows the employer proper time to prepare deactivation to all statutory bodies and for internal final payroll processing.

Permanent Employee Leavers in Indonesia

If a permanent employee resigns voluntarily or the permanent employee is absent for 5 working days or more in a row without a written statement accompanied by valid evidence and has been summoned by the employer 2 times properly and in writing, then the employee will eligible to get the separation money and compensation (untaken annual leave, transportation costs for the employee and his/her family to the place where the employee was recruited, and other matters as stipulated in the relevant employment agreement, company regulations or collective labour agreement).

Contract Employee Leavers in Indonesia

Compensation money is a form of severance that contract employees (PKWT) receive when their work contract is completed or ends. Companies are obligated to provide compensation payment to contract (PKWT) employees.

Compensation money is given to employees with a minimum of 1 month of continuous service. If the employment contract is extended, the money will be given before the extension. Then, the next compensation is given after the extended contract is completed. Compensation does not apply to foreign workers who are employed on a PKWT basis.

The Formula for calculating the amount of compensation for contract employee :

PKWT compensation money = (years of service / 12) x 1 month wage*

*) Wages (Salary or Fixed Salary & Allowances)

Payroll in Indonesia

The payroll cycle in Indonesia is normally monthly and is paid on the last working day of the month or as agreed in the employment contract.

Payroll Reports in Indonesia

Payroll reports must be kept for at least 5 years (for documents dated 2009 and after) and a minimum of 10 years is required for all documents proceeding 2009.

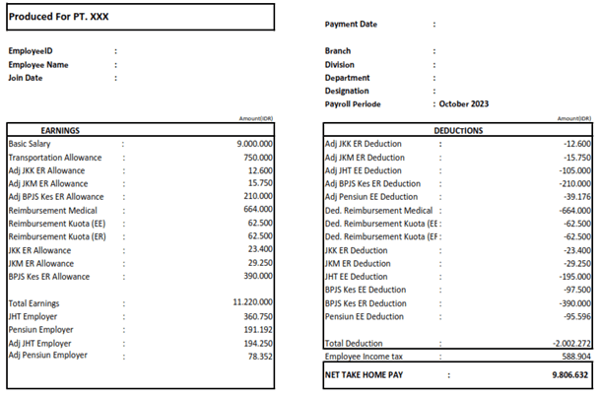

Indonesian Payslip Example

Employment Law in Indonesia

Holiday Accrual and Calculations in Indonesia

In Indonesia, employees are granted a statutory entitlement to 12 days of paid annual leave following a year of continued service.

Beyond annual leave, Indonesian labour laws mandate employers to offer additional paid leave for various personal reasons, ensuring employees have the necessary time to attend to significant life events. The entitlements for such personal leave are as follows:

|

Reason for Leave |

Days of Paid Leave |

|

Marriage of the Employee |

3 days |

|

Marriage of the Employee’s Child |

2 days |

|

Son’s Circumcision |

2 days |

|

Child’s Baptism |

2 days |

|

Birth or Miscarriage by the Employee’s Wife: |

2 days |

|

Death of Close Family Members |

2 days |

|

Death of a Member of the Employee’s Household |

1 day |

Tunjangan Hari Raya – THR (Religious Holiday Allowance in Indonesia)

In Indonesia, the provision of a religious holiday allowance (Tunjangan Hari Raya – THR) by employers to their employees is a legal requirement. This allowance represents an annual bonus that must be disbursed to employees at least one week before their respective religious holiday, based on the employee's faith, amounting to one month's wages (dependent on the length of service). The holidays recognised for the THR include:

- Eid-il-Fitri for Muslims

- Christmas for Catholics and Protestants (acknowledged separately)

- Nyepi for Hindus

- Vesak for Buddhists

Traditionally, businesses across Indonesia have aligned the payment of THR for non-Muslim employees with the Christmas season and for Muslim employees in anticipation of Eid-il-Fitri.

THR Eligibility and Calculation

Employers are required to pay the THR (Tunjangan Hari Raya) to employees who have completed a minimum of three months of continuous service. Additionally, former permanent employees whose employment was terminated within 30 days before the religious holiday are still eligible for the THR. However, former contract employees whose contracts were terminated before the religious holiday are not eligible for the THR.

Payment

Employers must pay the THR once a year in accordance with the employee’s religion. The payment must be made at least seven days before the respective religious holiday, unless there is an agreement between the employee and employer for a different payment schedule. Typically, many companies make the payment 14 days before the religious holiday, while a few companies opt to pay one month in advance. The religious holidays in Indonesia considered for THR payment are: Eid al-Fitri for Muslims, Christmas for Christians, Waisak (Vesak) for Buddhists, and Nyepi for Hindus.

Amount

The minimum amount of THR is equivalent to one month's salary or wages, which includes the basic salary and other fixed allowances, for workers who have completed a minimum of 12 months of service. For workers with more than three months but less than 12 months of service, the THR amount is proportionately calculated based on the number of months worked (months of service/12 x one month’s salary).

Business Penalties for Non-Payment of THR

Employers who neglect the THR payment are subject to a fine amounting to 5% of the total THR due, which is allocated for the welfare of the employees. This penalty does not exempt the employer from the responsibility of disbursing the THR.

Non-compliant businesses also face administrative sanctions, including limitations on business operations, and either the permanent or temporary closure of production facilities, or a halt to business activities. These measures underscore the importance of the THR in safeguarding employee welfare and promoting fair labour practices in Indonesia.

Maternity Leave in Indonesia

Employers are required to provide healthcare coverage for pregnant employees, covering prenatal care, delivery, and postnatal care. This is part of the broader mandate for employers to ensure the health and safety of their employees at work.

Indonesian law grants female employees a total of 3 months (12 weeks) of maternity leave, with at least six weeks post-delivery. A maximum of 6 weeks can be taken pre-delivery.

The payment for maternity leave in Indonesia is the responsibility of the employer. Female employees are entitled to their full salary during the 12-week maternity leave period, which is split equally before and after childbirth.

Employers are required to continue all employment benefits during the maternity leave period, including healthcare coverage that encompasses prenatal care, delivery expenses, and postnatal care. This comprehensive support reflects the commitment of Indonesian law to protect working mothers and their children.

In the event of a miscarriage, the employee is entitled to 1.5 months of paid maternity leave or as certified by an obstetrician.

Female employees who return to work after maternity leave have the right to breastfeeding breaks. These breaks are in addition to the regular rest periods and are provided until the child reaches the age of two years.

Paternity Leave in Indonesia

The father is entitled to two days paid leave once the baby is born . Businesses may wish to offer additional paternity allowances.

Sick Leave in Indonesia

Employees are entitled to paid sick leave in case of illness or injury that is evidenced by a medical certificate or official doctor’s note.

Female employees are also entitled to two days of menstrual leave (the first and second day of menstruation).

Employees are also entitled to long-term paid medical leave provided that such leave is recommended in writing by a doctor and lasts for a period greater than one year. An employee who is experiencing a prolonged sickness continues to be entitled to the payment of wages, as follows:

- First four months: 100% of the wages

- Second four months: 75% of the wages

- Third four months: 50% of the wages

- Subsequent months: 25% of the wages

National Service in Indonesia

Indonesia has a form of national service, known as compulsory military service, although it operates differently compared to many other countries. Indonesia does not enforce mandatory military service for all citizens upon reaching a certain age, instead, Indonesia's approach to national service is more voluntary in nature, with the Indonesian National Armed Forces (Tentara Nasional Indonesia, TNI) consisting largely of volunteer professionals.

Indonesia has implemented regulations that allow for the possibility of conscription during times of war or if the country faces a shortage of military personnel. The Indonesian government maintains the right to enact conscription under specific circumstances outlined in its national defence and military laws.

National Minimum Wage in the Indonesia in 2024

In Indonesia, minimum wages is conducted on a regional basis (including regions and cities) and not nationally .

The provincial minimum wages for 2024 were established in November.

|

Province in Indonesia |

Monthly minimum wage rate (rupiah) |

|

Aceh |

3,460,672 (US$222) |

|

North Sumatra |

2,809,915 (US$180) |

|

West Sumatra |

2,811,449 (US$180) |

|

Riau |

3,294,625 (US$211) |

|

Riau Islands |

3,402,492 (US$218) |

|

Jambi |

3,037,121 (US$195) |

|

South Sumatra |

3,456,874 (US$221) |

|

Bangka Belitung |

3,640,000 (US$233) |

|

Bengkulu |

2,507,079 (US$161) |

|

Lampung |

2,716,497 (US$174) |

|

Banten |

2,727,812 (US$175) |

|

DKI Jakarta |

5,067,381 (US$325) |

|

West Java |

2,057,495 (US$132) |

|

Central Java |

2,036,947 (US$130) |

|

Special Region of Yogyakarta |

2,125,897 (US$136) |

|

East Java |

2,165,244 (US$139) |

|

Bali |

2,813,672 (US$180) |

|

West Nusa Tenggara |

2,444,067 (US$157) |

|

East Nusa Tenggara |

2,186,826 (US$140) |

|

West Kalimantan |

2,702,616 (US$173) |

|

South Kalimantan |

3,282,812 (US$210) |

|

Central Kalimantan |

3,261,616 (US$208) |

|

East Kalimantan |

3,360,858 (US$215) |

|

North Kalimantan |

3,361,653 (US$215) |

|

Maluku |

2,949,953 (US$189) |

|

North Maluku |

3,200,000 (US$205) |

|

Gorontalo |

3,025,100 (US$194) |

|

North Sulawesi |

3,545,000 (US$227) |

|

Southeast Sulawesi |

2,885,964 (US$185) |

|

Central Sulawesi |

2,736,698 (US$175) |

|

South Sulawesi |

3,434,298 (US$220) |

|

West Sulawesi |

2,914,958 (US$187) |

|

Papua |

4,024,270 (US$258) |

|

West Papua |

3,393,000 (US$217) |

It is crucial for employers, especially those with operations spanning multiple regions, to stay updated on the applicable minimum wages for their specific locations to ensure compliance with the law.

Hourly Wages for Part-Time Workers

Indonesia has made significant changes to its labor laws through the Omnibus Law, which led to the elimination of the sectorial minimum wage via Government Regulation 36 of 2021. This regulation, as an implementation of the Omnibus Law, introduced an hourly wage system for part-time workers.

The method for calculating the hourly wage is:

Hourly Wage Calculation:

Hourly wage = Monthly wage / 126

For daily wage calculations, the formulas differ based on the number of working days per week:

For Six Working Days Per Week:

Daily wage = Monthly wage / 25

For Five Working Days Per Week:

Daily wage = Monthly wage / 21

Employers and employees can negotiate the final salary, but it must not fall below the amount calculated using these formulas.

Working Week and Working Hours in Indonesia

The standard working week in Indonesia is set at a maximum of 40 hours, which can be arranged according to one of the following schedules:

- Five-day Work Week: Employees work for eight hours per day across five days, totaling 40 hours.

- Six-day Work Week: In this arrangement, employees work for seven hours per day across six days, also totaling 40 hours.

Employers have the flexibility to adopt either schedule, depending on the nature of their business operations and the agreement with their employees.

Overtime in Indonesia

Overtime work is permissible when employers require employees to work beyond the standard working hours. The rules for overtime are as follows:

- Overtime is limited to a maximum of 4 hours in a single day and 18 hours in a week. This limit is in place to ensure the well-being and health of employees.

- Employees who work overtime are entitled to additional compensation. The first hour of overtime is compensated at 1.5 times the hourly rate, and subsequent hours are compensated at 2 times the hourly rate. This formula ensures that employees are fairly remunerated for the extra hours worked.

Statutory National Holidays in Indonesia 2024

There are multiple statutory holiday scheduled within Indonesia. Below are the national holidays in Indonesia for 2024.

|

Holiday Name |

Weekday |

Date |

|

New Year's Day |

Monday |

1 January |

|

The Prophet Muhammad's Isra Mikraj |

Thursday |

8 February |

|

Chinese New Year |

Saturday |

10 February |

|

Bali Hindu New Year (Nyepi) |

Monday |

11 March |

|

Good Friday |

Friday |

29 March |

|

Eid al-Fitr |

Wednesday |

10 April |

|

Labour Day |

Wednesday |

1 May |

|

Ascension Day of Jesus Christ |

Thursday |

9 May |

|

Vesak Day |

Thursday |

23 May |

|

Pancasila Day |

Saturday |

1 June |

|

Eid al-Adha |

Monday |

17 June |

|

Islamic New Year |

Sunday |

7 July |

|

Indonesian Independence Day |

Saturday |

17 August |

|

The Prophet Muhammad's Birthday |

Monday |

16 September |

|

Christmas Day |

Wednesday |

25 December |

Employee Benefits in Indonesia

Expenses

Depending on internal policy, some companies prefer the form of a taxable travel allowance, especially with the new benefits-in-kind tax regulations that came into effect in 2023; other forms of reimbursement based on verified receipts, including provision of company transport, will need to meet the tax office’s conditions on non-taxable status.

All allowance and fringe benefits are taxable.

Reimbursement or company cars expenses can become company expenses if they don’t go through payroll, but may also be taxable due to the new benefits-in-kind tax regulations. It is best to check with the company’s tax specialist to ensure proper classification, book-keeping and tax payment (if applicable) as the regulations are based on specific conditions.

Key Updates in 2024 in Indonesia

In 2024, Indonesia embraces significant adjustments in its labour and employment law, income tax, and social security frameworks, reflecting the government's commitment to fostering a balanced working environment, promoting inclusive economic growth, and ensuring the welfare of its workforce.

Social Security

The Indonesian Government introduced the second amendment to Government Regulation No. 44 of 2015 concerning the Work Accident Benefit Program – “JKK”) and the Life Insurance Program – “JKM” through Government Regulation No. 49 of 2023 (GR 49/2023). The changes aim to increase protection for workers from socio-economic risks support the government’s job loss security program, as well as clearly define the category of employees eligible for the JKK and the JKM programs.

Indonesia Core Tax System

Starting in July 2024, the Indonesian government is launching a new tax system that allows the tax authorities to integrate corporate bank accounts directly into its systems. While its primary objective is to simplify tax recording, it also aims to prevent companies from evading taxes.

New income tax regulations

Indonesia’s government has introduced Government Regulation 58 of 2023 (GR 58/2023) on new income tax deduction rates for individual taxpayers. GR 58/2023 became effective on January 1, 2024.

GR 58/2023 aims to simplify the monthly withholding tax calculation to the income received by individuals. The regulation also provides the categories of taxpayer and the deduction rate for their income bracket.

Gold Visa Scheme

Indonesia is introducing a ‘golden visa’ program to attract quality, high-net-worth individual and corporate foreign investors. Under this new visa scheme, foreign investors can receive a resident permit of between five and 10 years, depending on the value of their investment.

Individual investors must establish an Indonesian company worth US$2.5 million to receive the five-year visa or a US$5 million investment for the 10-year visa. Further, individuals who do not wish to establish a local entity can invest at least US$350,000 into shares of a local public company, deposit or savings accounts, or Indonesian government bonds, to be eligible for the five-year visa, or US$700,000 for 10 years.

Directors and commissioners of businesses can obtain a five-year visa if their company invests at least US$25 million, or US$50 million for the 10-year visa.

Notes

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

Want to learn more about payroll, tax, social security and more?

Register free today to get the latest up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Let’s Partner

Talk to a specialist today and find out how we support the growth of over 500 businesses with a range of activpayroll solutions designed to help your global payroll and people operations succeed.