Malaysia

An important gateway to lucrative regional markets, Malaysia has a developed economy that has grown over the past half century at an annual rate of around 6.5%. In 2022, that trend continued as Malaysia’s GDP reached an estimated $406 billion.

Need more information about payroll, compliance and social security in Malaysia?

Talk to a specialist

Our free global insight guide to Malaysia offers up-to-date information on international payroll, income tax, social security, employment law, employee benefits, visas, work permits and key updates on legislative changes and more in 2024.

Basic Facts about Malaysia

Bordered by Thailand to the north, and Singapore to the south, and separated into two territories by the South China Sea, Malaysia is one of southeast Asia’s most diverse and populous countries.

Established in 1946 as the Malay Union, the country went through a series of territorial restructurings to become Malaysia in 1963.

Malaysia’s population spans many ethnicities and cultures, including Malays, Chinese, Indians and indigenous peoples.

Although it is an elective monarchy, with the current king chosen from a hereditary line, Malaysia operates under a parliamentary government, based on the UK’s Westminster system.

The diversity of Malaysia is reflected in its geography and climate: hot tropical regions see cooler periods and monsoon rainfall at periods throughout the year, while the South China Sea brings humidity and changeable weather to both territories.

General Information

- Full name: Federation of Malaysia

- Population: 34.3 million (World Bank, 2022)

- Capital: Kuala Lumpur

- Major languages: Malay (official), English, Chinese dialects, Tamil, Telugu, Malayalam

- Monetary unit: 1 ringgit = 100 sen

- Main exports: Electronic equipment, mineral fuels, machinery, semi-conductors, electronic gadgets, animal/vegetable fat oil, rubber and palm oil

- GNI per capita: US $11,780 (World Bank, 2022)

- Internet domain: .my

- International dialling code: +60

How Do I Say in Malay?

- Hello: Hello

- Good morning: Selamat Pagi

- Good evening: Selamat Petang

- Do you speak English?: Adakah anda bertutur Bahasa Inggeris

- Good bye: Selamat Tinggal

- Thank you: Terima Kasih

- See you later: Jumpa lagi

Dates and Numbers in Malaysia

Dates are usually written in the day, month and year sequence. If you're referring to the 7th of June 2024, it would typically be written as 7 June 2024 or 07/06/2024 in a more numerical format.

In Malaysia, numbers are often formatted using a comma to separate thousands and for decimals, a period is used to denote fractions. An example is 15,750.25 MYR (fifteen thousand, seven hundred and fifty Ringgit and twenty five Sen)

Doing Business in Malaysia

Malaysia, a vibrant economic hub located in the heart of Southeast Asia. Known for its diverse culture, strategic location, and dynamic economy, Malaysia offers a wealth of opportunities for businesses looking to expand in the Asia-Pacific region. Whether you're considering starting a new venture or expanding your existing operations, Malaysia provides a conducive environment for business growth and innovation.

A constitutional elective monarchy, with a robust parliamentary system friendly to foreign investment interests, Malaysia was a founding member of ASEAN, EAS and the OIC.

Situated at the crossroads of major Asian trade routes, Malaysia offers unparalleled access to ASEAN markets and beyond. Its modern infrastructure and ports facilitate efficient logistics and global trade.

With a diverse economy that spans manufacturing, services, and commodities, Malaysia offers stability and growth potential. The government's pro-business policies and incentives further support investment and entrepreneurship.

Malaysia's workforce is highly skilled, multilingual, and culturally diverse, providing a rich talent pool for businesses across industries. The country's education system, with a focus on technology and innovation, continually produces graduates equipped to meet the demands of a global business environment.

Recognised for its ease of doing business, Malaysia offers straightforward procedures for company registration, licensing, and compliance. The Malaysian Investment Development Authority (MIDA) and other agencies provide comprehensive support for foreign investors.

With its promising economic outlook, supportive business environment, and strategic location, Malaysia is your ideal partner for growth in Asia. From technology startups to manufacturing giants, businesses of all sizes can find their place in Malaysia's thriving economy.

Why Invest in Malaysia?

Investing in Malaysia offers a multitude of advantages for foreign investors, underpinned by the country's strategic geographic position, economic stability, and a government committed to fostering a conducive investment climate.

Malaysia's location at the heart of Southeast Asia provides unparalleled access to ASEAN markets, serving as a gateway to a regional market of over 650 million people. Its well-developed infrastructure, including world-class airports, seaports, and connectivity, facilitates easy access to major Asian markets, making it an ideal base for regional operations. Malaysia boasts a well-educated, multilingual, and skilled workforce, with competencies in various industries ranging from manufacturing to services. The workforce's proficiency in English, among other languages, facilitates easy communication and business operations for international companies. Malaysia offers a high quality of life with affordable living costs, excellent healthcare facilities, and a rich cultural and natural environment. This makes it not only an attractive location for business but also for expatriates and their families.

The Malaysian government actively encourages foreign investment through a variety of incentives, streamlined regulations, and continuous efforts to improve the ease of doing business. Policies are tailored to support investments in key growth sectors and technologies, ensuring that businesses can thrive. The country's advanced infrastructure supports business activities effectively, with extensive road networks, efficient public transportation systems, reliable telecommunications, and high-speed internet access. Malaysia's continuous investment in infrastructure development ensures that businesses operate smoothly and efficiently.

With a growing middle class and high consumer spending, Malaysia offers a dynamic domestic market for a wide range of products and services. The country's economic development plans are focused on moving up the value chain, creating opportunities in high-technology industries, digital economy, and innovation-driven sectors The Malaysian government is keen on promoting technology and innovation across various industries. Special incentives and support structures are in place to encourage research and development (R&D), digital transformation, and the adoption of new technologies, positioning Malaysia as a hub for innovation in the region. Malaysia is a party to numerous bilateral and multilateral trade agreements, providing preferential access to key global markets. These agreements enhance the country's attractiveness as an investment location by reducing trade barriers and opening up new opportunities.

Strategic Support from MIDA

The Malaysian Investment Development Authority (MIDA) plays a pivotal role in the country's investment landscape, acting as the primary government agency under the Ministry of International Trade and Industry (MITI) to drive investments into the nation. MIDA's contributions are multifaceted, focusing on the manufacturing and services sectors, which are key pillars of Malaysia's economic strategy.

MIDA assists companies intending to invest in Malaysia by providing a comprehensive range of services. This includes offering detailed information on investment opportunities, facilitating project implementation, and assisting in the search for local joint venture partners. Through MIDA, investors gain access to streamlined procedures for approvals, licensing, and other regulatory requirements, significantly reducing the time and effort needed to kickstart projects.

Foreign Direct Investment in Malaysia

Malaysia is recognised as an attractive destination for Foreign Direct Investment (FDI) due to its stable political environment, progressive economic policies, strategic location within ASEAN, and access to regional markets. The country offers a conducive environment for foreign investments in various sectors, including manufacturing, services, and primary industries, with a focus on high-value, high-technology, and high-impact projects.

Government Incentives for FDI in Malaysia

The Malaysian government, through agencies like the Malaysian Investment Development Authority (MIDA), provides a range of incentives designed to attract and retain foreign investors. These incentives include:

- Tax Incentives: Reduced corporate tax rates, investment tax allowances, and exemptions on import duties and sales tax for certain industries and projects, especially those that contribute to the country's economic development and technological advancement.

- Pioneer Status: Companies in promoted activities or industries can enjoy a 5- to 10-year partial exemption from income tax, depending on the level of value-added, technology used, and industrial linkages.

- Research and Development (R&D): Incentives for R&D activities, including grants for technology acquisition and R&D project funding, to encourage innovation and development of new technologies.

- Special Economic Zones (SEZs) and Industrial Parks: Benefits such as infrastructure-ready sites, streamlined business processes, and logistical advantages to investors setting up in these zones, which are often tailored to specific industries.

- Halal Industry Incentives: Given Malaysia's position as a leader in the halal industry, there are specific incentives for businesses in halal production, processing, and services.

Sectors Open to FDI in Malaysia

Malaysia encourages FDI across a broad spectrum of sectors, with particular emphasis on:

- Manufacturing: Especially in electronics, automotive, chemicals, and machinery & equipment.

- Services: Including financial services, information and communication technology (ICT), environmental services, and healthcare.

- Primary Industries: Such as palm oil, rubber, and other agricultural products, with a focus on sustainable and environmentally friendly practices.

- Emerging Technologies: Including biotechnology, digital economy, and renewable energy, reflecting the country's commitment to innovation and sustainable development.

For businesses considering expanding into Malaysia, the country's robust FDI incentives, strategic location, and dynamic economy make it an attractive investment destination. By leveraging these advantages and aligning with the government's economic priorities, foreign investors can find significant opportunities for growth and success in Malaysia.

Business Banking in Malaysia

It is mandatory to make payments from an in-country bank account to employees unless there is a written notice from employee and approval from Government Official Authorities. Generally, banks are open to the public from 09:00AM to 4:30PM, and closed on Saturdays, Sundays and public holidays.

Registering a Company and Establishing an Entity in Malaysia

Companies are required to register as an employer for tax, Employees Provident Fund (EPF), Social Security Organisation (SOCSO), Employment Insurance System (EIS) and Human Resource Development Corporation (HRD Corp) if applicable based on the industry.

Employers must register with the EPF, SOCSO and EIS when the employee first begins at the company. The principal and immediate employer who employs one or more employees is required to register and contribute monthly to EPF, SOCSO and EIS. Employers must register at the EPF and SOCSO office or through online within 7 days and 30 days respectively from the date the new employee was employed.

Typical implementation timeline will be two months including a one-month payroll parallel run. However, implementation duration will vary depending on the complexity of payroll requirements and the headcount to be implemented.

Visas and Work Permits in Malaysia

Foreign Nationals in Malaysia can obtain Permanent Residence (PR) status from the Malaysian authorities. The most common category for corporate transfers is the standard Employment Pass.

Professional Visit Pass (PVP) – for assignments of less than 12 months remaining on home payroll.

Employment Pass (EP) – For assignments up to 60 months duration period and salary must be paid by the local sponsoring entity in Malaysia.

Visit (Temporary) Employment Pass – for assignment between 6 months to a maximum of 1-year duration and salary must be paid by the local sponsoring entity in Malaysia

The following are registration forms are for the employer to submit (if applicable):

- Notice of New Employee Income Tax Registration Form (CP22) for Income Tax

- Employee Provident Fund – KWSP 3 (Applications for members’ registration and amendment of members’ particulars)

For Expat New Employees:

The payroll records must contain the following details in order to set up new employees and maintain payroll records.

- Personal details form

- A copy of passport (the page containing the portrait and bio data)

- A copy of EP / PVP / PR

- TP3 if employed in Malaysia within commencing year

- A copy of the Employment Contract

Income Tax in Malaysia

The tax year runs from 1st January to 31st December.

Income Tax in Malaysia

For employment income, a monthly tax deduction (MTD) system is in operation, whereby employers deduct monthly tax payments from the employment income of their employees. Employers, who do not use computerised payroll software, can calculate the MTD using the Schedule of Monthly Tax Deductions, issued by Inland Revenue Board of Malaysia (IRBM) using Computerised Calculation Method, computerised payroll system, or in-house/customise payroll system, which has been verified by the IRBM. Employers rely on employee’s personal data, submitted in order to compute monthly MTDs. Therefore, these monthly deductions are net of personal relief, relief for spouse with no income, child relief, EPF relief and zakat payments (if any).

Employers are responsible for submitting a monthly withholding tax return, and make MTD payments to the Inland Revenue Board of Malaysia by the 15th day of following the month of payroll. Failure to do so will result in a penalty fine of RM200 – RM20,000 or 6-months imprisonment or both.

Malaysia follows a progressive tax rate, from 0% to 30%. A non-resident individual is taxed at a flat tax rate of 30% on income earned/received from Malaysia.

Progressive Income Tax Rates 2024

| Chargeable Income (RM) | Tax (RM) | % on excess |

| 0 – 5,000 | 0 | 0 |

| 5,001 – 20,000 | 150 | 1 |

| 20,001 – 35,000 | 600 | 3 |

| 35,001 – 50,000 | 1,500 | 6 |

| 50,001 – 70,000 | 3,700 | 11 |

| 70,001 – 100,000 | 9,400 | 19 |

| 100,001 – 400,000 | 84,400 | 24 |

| 400,001 – 600,000 | 136,400 | 26 |

| 600,001 – 2,000,000 | 528,400 | 28 |

| Exceeding 2,000,000 | + (RM 30 for every RM 1,000) | 30 |

Note: % on excess: This indicates the percentage of tax applied to the portion of your income exceeding the lower limit of the bracket.

Special tax rates

Global Services Hub

Non-citizen individuals holding key or C-suite positions with a monthly salary of at least RM35,000 appointed by a new company approved with the Global Services Hub tax incentive are eligible for a 15% special income tax rate for three consecutive years.Qualified Knowledge Workers in Iskandar Malaysia

Individuals who fulfil specific criteria and are employed in designated companies within Iskandar Malaysia are taxed at a flat rate of 15% on their employment income for a period of five consecutive AYs.Returning Experts Programme

Approved individuals under this program who are residents in Malaysia are taxed at 15% on their employment income for five consecutive AYs.Non-Resident Individuals Malaysian Income Tax

Generally, an individual is a non-resident, under Malaysian tax law, if he/she stay less than 182 days in Malaysia in a year, regardless of his/her citizenship or nationality.#

Non-resident individuals are generally subject to a flat tax rate of 26% on their Malaysian-sourced income. This applies to income derived from various sources, including:

- Employment exercised in Malaysia

- Pensions, annuities, and other periodic payments arising in Malaysia

- Business profits or gains accruing in or derived from Malaysia

- Rental income from Malaysian property

- Interest income from Malaysian sources

- Royalties or other payments for the use or right to use any property in Malaysia

Individuals with an annual taxable income exceeding RM34,000 after EPF deductions must file an income tax return. This also applies to income earned from part-time jobs, freelance work, or any other sources within Malaysia. Each employee will need to do his/her own tax filing (BE Form) for the calendar year which has to be submitted before 30th April (without business income) and before 30th June (with business income) of the subsequent year.

Employees can claim allowable deductions and rebates via Form TP1, resulting in lower tax deductions. Please note that it is the employee’s responsibility to ensure the accuracy of these claims and keep records and receipts for up to 7 years. The employer is obliged to process the amount submitted by the employee and is not responsible for the veracity or accuracy of figures submitted by the employee

Social Security, Employee Provident Fund (EPF) and Employment Insurance Scheme (EIS) in Malaysia

Employee Provident Fund (EPF), Social Security (SOCSO) and Employment Insurance System (EIS)

There are three mandatory statutory contributions:

EPF

The Employees Provident Fund manages the compulsory savings plan and retirement planning for employees in Malaysia. Membership of the EPF is mandatory for Malaysian citizens, and voluntary for non-Malaysian citizens. The EPF is a social security institution formed according to the Laws of Malaysia, Employees Provident Fund Act 1991 (Act 452) provides retirement benefits for members through management of their savings in an efficient and reliable manner and that such contributions are payable to the employees in full on reaching the age of 55.

The EPF also provides a convenient framework for employers to meet their statutory and moral obligations to their employees. Expatriates; domestic servants – who are from the private account of the employers, self-employed persons, and employees under age of 18 are excluded from the above. A pension fund is available for civil servants and some private voluntary schemes for employees.

A contribution constitutes the amount of money credited to members' individual accounts in the EPF. The amount is calculated based on the monthly wages of an employee. The current contribution rate is in accordance with wage/salary received. Generally, for employees who receive wages/salary of RM5,000 and below, the portion of employee's contribution is 11% of their monthly salary while the employer contributes 13%. For employees who receive wages/salary exceeding RM5,000 the employee's contribution of 11% remains, while the employer's contribution is 12%. However, the employee’s contribution rate might change to a lower rate depending on announcement made by the government from time to time to suit current economic situation in order to ease the people’s economic well-being. Employees can now choose to contribute more than 11% however terms and conditions apply.

For more information, please refer EPF website at https://www.kwsp.gov.my.

SOCSO

The Social Security Organisation (SOCSO) is an organisation set up to administer, enforce and implement the Employees’ Social Security Act, 1969 and the Employees’ Social Security Regulations 1971. The organisation provides social security protection by social insurance including medical and cash benefit, provision of artificial aids and rehabilitation to employees to reduce the suffering and to provide financial guarantees and protection to the family.

SOCSO administer two types of social protection schemes:

-

Employment Injury Scheme

-

Invalidity Scheme

An employer who employs one or more employees is required to register and contribute monthly to SOCSO for all employees under the Employees’ Social Security Act, 1969 (henceforth refer as Act). From January 2022, there is an income tax relief of MYR 350.00 per annum for combined SOCSO and EIS contribution. Only employers are required to contribute to SOCSO for foreign workers, including expatriates. Employees are not required to make a contribution. Employers are expected to contribute 1.25% of an employee’s monthly wage to SOCSO on a monthly basis (subject to the insured wage ceiling of MYR 5,000 per month).

The employer is liable to pay monthly contributions within 15 days of the following month. For example, January contributions should be paid not later than February 15th. Interest on the late payment of contributions will be charged at the rate of 6% per annum for each day of late payment contributions. If late payment interest is calculated to be less than RM5, then interest is charged at RM5 per month.

For more information, please click here.

Employment Insurance System (EIS)

The Employment Insurance System Act 2017 (Act 800), an Act to provide for the Employment Insurance System administered by the Social Security Organization to provide certain benefits and a re-employment placement programme for insured persons in the event of loss of employment which will promote active labour market policies, and for matters connected therewith. The EIS doesn’t just provide money upon retrenchment, it also comes with a number of benefits such as:

-

Job-hunting assistance

-

Re-employment allowance

-

Reduced income allowance

-

Training allowance

-

Career counselling

An employer who employs one or more employees is required to register and contribute monthly to EIS for all employees aged 18 to 60 years old.

Contributions to the Employment Insurance System (EIS) are set at 0.4% of the employee’s assumed monthly salary. 0.2% will be paid by the employer while 0.2% will be deducted from the employee’s monthly salary. Contribution rates are capped at an assumed monthly salary of RM4,000.00.

Reporting Tax in Malaysia

Monthly

Income Tax Payment – Deadline 15th of the following month

- CP39 – Statement of Monthly Tax Deduction (MTD)

- CP22 – Notification of New Employee (applicable for new joiner of the month)

Retrenchment / Retirement / Leaving Country

- CP21 – Notification of Departure from Country

- CP22A – Notification of termination / retrenchment / lay-off being paid a substantial termination amount

EPF Payment – Deadline 15th of the following month

- In addition to employer registration, employer will need to register as a user for i-Account (Employer) in order to facilitate online transactions and manage with ease employees’ EPF contributions. i-Account registration is mandatory.

- New employer: Register for i-Account by filing up Form KWSP 1(i) when register as a new employer on top of Form KWSP 1.

- For existing employer: Register for i-Account by filing up Form KWSP 1(i) only.

SOCSO Payment – Deadline 15th of the following month

- Perkeso Assist Portal https://assist.perkeso.gov.my/employer/login

- Form 2 – New Employee Registration (need to enclose a copy of Identity Card of new hire)

EIS Payment – Deadline 15th of the following month

- Perkeso Assist Portal https://assist.perkeso.gov.my/employer/login

- SIP 2 Form: New Employee Registration (Applicable for the new joiner of the month, new SIP member)

- SIP 2A Form: Notification of Employee (Applicable for the new joiner of the month, existing SIP member)

HRD Levy Payment – Deadline 15th of the following month

Yearly

Income Tax

Employer

- Form E – Employer Year End Tax Filing - Deadline 31st March of the following year

- This is used to report annual returns to the government for all employees. This must be submitted to the Inland Revenue Department by 31st March via the tax authority portal. Visit https://ez.hasil.gov.my for more details.

- Form CP8A (EA) – Employment Remuneration Statement - Deadline 28th February of the following year

- Used to facilitate employee tax filing and provided to each individual by the 28th February of each year. Electronic copies are provided and do not require employer signatures.

Employee

- Form BE (Resident individuals, without business income) - Deadline 30th April of the following year

- Form B (Resident individuals, with business income) - Deadline 30th June of the following year

- Form M (Non-resident individuals) - Deadline 30th April and 30th June of the following year, without business income and with business income respectively)

New Employees in Malaysia

To set up a new employee, the employer must submit SOCSO Form 2, Form SIP 2, and Form CP22 to inform SOCSO, EIS and Inland Revenue Board (IRB) on the new hire.

The following information is required when setting up a new start:

- Personal details form

- A copy of Identity Card

- TP3 if employed in Malaysia within commencing year

Leavers in Malaysia

Employee final payment should be withheld by the employer for tax clearance purpose. The employer will release the money upon receiving a tax clearance letter from IRB.

The employee is required to complete tax clearance prior to leaving the country by submitting Form CP21. Upon receiving the clearance from the tax authority, the employer will be given an approval to release all the monies (final payment) after deducting the tax clearance amount (if any) to the employee.

Payroll in Malaysia

Reports

Employer must keep and retain payroll records for seven (7) years and make it readily accessible to the Inland Revenue Board of Malaysia and other statutory bodies when needed commonly for audit purpose.

PTPTN (National Higher Education Fund Corporation)

The National Higher Education Fund Corporation (PTPTN) was established in 1997. The PTPTN Education Financing Scheme was established to provide finance to students that are perusing studies in local institutions of higher education. The funding provided will enable students to pay for all or some of their course fees and their cost of living throughout their studies.

The main functions of PTPTN are;

- To manage funds for higher education purposes and collecting repayments of financing

- To provide and manage education savings schemes

- To perform any other duties as per written law

The recipient of the finance is responsible for repaying the total amount disbursed by PTPTN, including other costs such as fees, insurance coverage, stamp duty and miscellaneous payments as stated in the Letter of Offer. Repayment of the loan will begin twelve months after the completion of the student’s studies.

Zakat

Zakat is a charitable donation to assist the less fortunate; all of the collected payments will be distributed to different channels and handed to those that need it most. Zakat is only applicable to Muslim employees and it is not compulsory via payroll deduction. It is also eligible for monthly tax (MTD) net off.

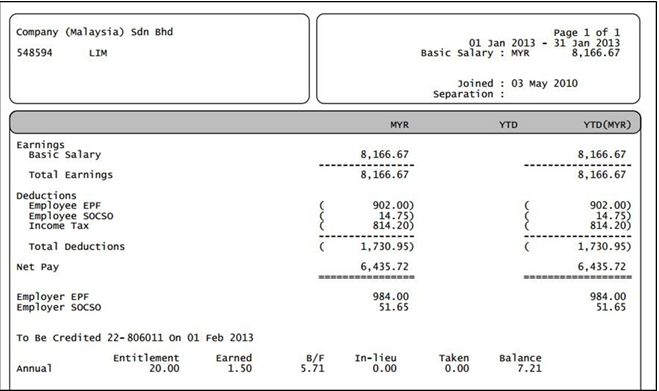

Malaysian Payslip Example

The issuance of payslip is mandatory as per the Malaysia Employment Act 1955. All employers shall furnish every employee employed by him in a statement relating to the details of earnings and deductions during the wage period.

It is legally acceptable to provide employees with payslips in either hard copy or online.

Employment Law in Malaysia

Holiday Accrual and Calculations

Employees in Malaysia earn annual leave based on the duration of their service with an employer, as follows:

- Less than 2 years of service: Employees are entitled to eight days of annual leave for every twelve months of continuous service.

- 2 to less than 5 years of service: The entitlement increases to twelve days of annual leave for every twelve months of continuous service.

- 5 years of service and above: Employees who have demonstrated long-term commitment by serving the same employer for five years or more are rewarded with sixteen days of annual leave for every twelve months of service.

The calculation of annual leave pay is based on the ordinary rate of pay, utilizing a formula that divides the basic monthly salary by 26 (assuming 26 working days in a month) and multiplies by the number of days or hours of leave taken. This approach ensures a fair and standardized calculation of leave entitlements.

Maternity Leave in Malaysia

Female employees are entitled to 98 consecutive days maternity leave.

Maternity leave can commence at any time within 30 days before confinement, if the doctor has duly advised the employee that her leave is required to begin within 14 days prior to her confinement.

A female employee shall not be entitled to any maternity leave or allowance if at the time of her confinement she has five or more surviving children.

Paternity Leave in Malaysia

In Malaysia, fathers can take 7 days of paid paternity leave for the first 5 births, as long as they have been employed by the same employer for at least 12 months and notify the employer at least 30 days before the expected confinement. This is part of the amendments to the Employment Act 1955 that came into force at the start of 2023.

Sick Leave in Malaysia

Employees are entitled to sick leave with full pay, which accrues as follows:

(a) Where no hospitalisation is necessary:

- Length of Service Paid Sick Leave

- Less than 2 years 14 days

- 2 to 5 years 18 days

- 5 years and above 22 days

(b) sixty days in the aggregate in each calendar year if hospitalisation is necessary.

National Service in Malaysia

There are no national service obligations in Malaysia.

Working Days and Working Hours in Malaysia

The working week in Malaysia is Monday to Friday. The normal number of hours worked per day in a commercial office is eight hours.

National Minimum Wage in Malaysia in 2024

The minimum wage in Malaysia stands at MYR 7.21 per hour, which equals a minimum monthly salary of MYR 1,500.

National Statutory Holidays in Malaysia in 2024

There are multiple statutory holiday schedules within Malaysia. Below are the statutory national holidays in Malaysia for 2024.

| Holiday Name | Weekday | Date |

|---|---|---|

| New Year's Day | Monday | 1 January |

| Chinese New Year | Saturday | 10 February |

| Chinese New Year Holiday | Sunday | 11 February |

| Nuzul Al-Quran | Friday | 22 February |

| Labour Day | Wednesday | 1 May |

| Wesak Day | Friday | 24 May |

| Hari Raya Puasa | Tuesday | 9 July |

| Hari Raya Puasa Holiday | Wednesday | 10 July |

| Hari Raya Haji | Sunday | 17 July |

| National Day | Sunday | 31 August |

| Malaysia Day | Monday | 16 September |

| Prophet Muhammad's Birthday | Wednesday | 9 October |

| Deepavali | Monday | 2 November |

| Christmas Day | Wednesday | 25 December |

Employee Benefits in Malaysia

Employee who has Benefits-in-Kind (BIK), Value of Living Accommodation (VOLA) and allowable tax deductions and rebates through submission of Form TP1 to the employer, can be subject to monthly tax deduction (MTD) calculation, instead of year end declaration of the employees’ earnings [via Form BE (without business income) or Form B (with business income)].

Expenses

Employee expenses can be integrated into payroll in a form of allowances. It is at the discretion of the employer to identify what kind of allowance will apply.

Notes

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

Want to learn more about payroll, tax, social security and more?

Register free today to get the latest up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Let’s Partner

Talk to a specialist today and find out how we support the growth of over 500 businesses with a range of activpayroll solutions designed to help your global payroll and people operations succeed.