Romania

Important industries in Romania include electronics, textiles, mining, timber, and food processing and it has also become a hub for mobile technology, information, and security hardware research.

Need more information about payroll, compliance and social security in Romania?

Talk to a specialist

Our free global insight guide to Romania offers up-to-date information on international payroll, income tax, social security, employment law, employee benefits, visas, work permits and key updates on legislative changes and more in 2024.

Basic Facts about Romania

The territory, which became known as Romania, was founded in 1859, as a union of the two principalities of Moldavia and Wallachia.

Ruled by a variety of successive European powers, the country eventually gained independence from the Ottoman Empire and began to be recognised by a variety of international political powers.

With a rich cultural heritage and home to areas of natural beauty, Romania is a popular tourist destination: forests and rivers are scattered across the country while the spectacular Carpathian Mountains tower over its central region.

Temperate and continental, Romania experiences warm, hot summers, and mild, cold winters. Its proximity to the Black Sea also plays a part in Romania’s international appeal as a tourist destination.

General Information

- Full Name: Romania

- Population: 19,047,009 Million (World Bank 2022)

- Capital: Bucharest

- Primary Language: Romanian

- Monetary Unit: Romanian Leu (RON), divided into 100 bani

- Main Exports: Electric machinery and equipment, textiles and footwear

- GNI Per Capita: $40030 (World Bank 2022)

- Internet Domain: .ro

- International Dialing Code: +40

How Do I Say in Romanian?

- Hello: Buna

- Good morning: Bună Dimineața

- Good evening: Bună Seara

- Do you speak English?: Vorbiți Engleză?

- Good bye: La Revedere

- Thank you: Multumesc

- See you later: Ne Vedem Mai Târziu

Dates and numbers

Dates are usually written in the day, month and year sequence. For example: 1 July 2020 or 1/7/20.

Numbers are written with a period to denote thousands and a comma to denote fractions. For example, RON 3.000,50 (three thousand RON and fifty bani).

Doing Business in Romania

Romania joined the European Union on 1 January 2007 and began the transition from communism in 1989 with a largely obsolete industrial base and a pattern of output unsuited to the country’s needs. The country emerged in 2000 from a punishing three-year recession thanks to strong demand in EU export markets.

Why Invest in Romania?

There are plenty of reasons to regard Romania as an investment target, including:

- Economic strength: Romania’s economic growth rate (around 5.2% in 2017) is outpacing many European competitors. Growth has been driven by industrial strength and forecasts predict the trend will continue.

- Government reforms: To transform the economy, Romania’s government introduced a series of reforms in the early 21st century designed to boost business and attract investment. These reforms include a flat 16% corporate tax rate, 0% tax on reinvested income, and a minimal regulatory environment.

- Market potential: Romania’s domestic market holds around 21 million potential consumers. These consumers form part of a young, sophisticated population - which hosts a growing middle class with a rising per capita income.

- Skilled labour: Romania’s labour force is skilled and embodies a cultural dedication to hard work. Enrolment in education has been rising steadily in the 21st century at both the high school and university levels - where the most popular disciplines are business, administration, and law. Many Romanians speak multiple languages.

- Strategic location: Romania’s location, at the crossroads of the East and West, offers numerous lucrative trade connections - including access to the EU’s free trade area and a market of around 500 million consumers. A modern, efficient transport infrastructure of road, rail, air, and sea links serves regional and international locations.

Business Banking in Romania

It is mandatory to have an in-country company bank account to make employee salary payments and third-party authority payments.

Banks are generally open Monday to Friday, from 09:00 to 17:00. Some banks are also open on Saturday from 09:30 to 12:30.

Registering a Company and Establishing an Entity in Romania

Both foreign individuals and legal entities can establish corporate presence in Romania.

Companies need to have their own patrimony, registered capital, management, registered offices, assets, names and bank accounts. All companies must be registered with the National Trade Registry Office, organized under the Romanian Ministry of Justice. Companies should register with the Trade Registry at the local level, at one of the 42 territorial offices, depending on the address chosen for registering its office.

The National Trade Registry Office is a public institution which has the function to maintain statistical information on business activities in Romania. Thus, in Romania it is required that a company specifies its main activity and is allocated a NACE code which relates to that particular activity, such as ‘Property Investment’ when using the formation of the company to buy land in Romania.

In Romania you can register a foreign entity for payroll purposes.

Documents and Information

To start incorporating a company in Romania, the following are required:

- Company name which must be reserved at the Trade Registry;

- The director/s full name, date and place of birth, PIN (personal identification number), ID documentation details (such as validity of ID card/passport, no., issuing authority), domicile address and nationality;

- The shareholder/s full name, date and place of birth, PIN/registration no. in the relevant public registers, domicile address and nationality for natural persons and name, headquarters, nationality, registration number or sole identification code for legal entities;

- Company’s scope of activity;

- A registered office in Romania;

- Bank at which the share capital/operational capital account will be opened;

Main documents required:

- Proof of checking the availability and/or the reservation of the Company’s name, issued by the Trade Registry; The Company’s name must not be confused or similar with the name of other companies or previously registered names; it must be available and distinguishable - reservation of the name to the Trade Register is valid for 1 (one) month. The consent to use the Company’s name is also required in certain situations, for example when the words "national", "Romanian", "institute" or their derivatives are used in the name of the Company.

- Articles of incorporation

- Resolution of Shareholders' General Assembly, if at least one shareholder is a legal entity, approving the participation in the new company to be incorporated and the mandate of the person authorized to sign the Articles of incorporation in the name and on behalf of the shareholder, legal entity

- Proof of having a legally registered office in Romania, which is constituted by:

- A sale purchase agreement, a lease or a free lease agreement depending on the company’s needs

- Documents concerning the space chosen as registered office (Excerpt from the Land Registry Office, cadastral sketch), the documents certifying the ownership rights over the property for the presumed owner (if the company chooses to use a lease or a free lease agreement)

- Statement from the Owners’ Association in the building and from the neighbors located immediately next to the chosen headquarters, in which such agree with the use of the location for the stated purposes, unless the Company’s director/s shall give an own liability statement declaring that no activities are carried out at the registered office

- Statement regarding the activities that the Company shall carry out

- Ownership documents for in-kind contributions, subscribed and fulfilled upon incorporation; the certificate of status, in case real estate is involved in such contributions, attesting to the fees entailed thereupon

- Affidavit of the foreign citizen natural person, in his/her own name or by a representative of the foreign legal person which is not fiscally registered in Romania, attesting that there are no fiscal debts, in original and translated by an authorized translator whose signature is authenticated by a notary public, if applicable

- Affidavit of the founders, administrators and financial auditors or of the natural persons representing the legal person appointed as shareholder, administrator or financial auditor, attesting that they meet the legal conditions to hold such capacity, if applicable

- Proof of identity for the General Manager or Director/s (as legal representative) and the Shareholders, either a passport or the national identity card - in case of a natural person and the registration document of the Company under the national law – in case of a legal entity, comprising all identity details and the domicile/registered office address

If case, prior notices stipulated under special laws regarding the activity authorization (such as accounting activity) - Statement regarding the beneficial owners of the Company, mandatory:

- Proof of legal fee(s) payment;

- If you do not travel to Romania, an original authenticated power of attorney with Hague Apostil (if the case) will be required to allow your lawyer or fiscal representative to set up the Company and act on your behalf for the following steps:

- Incorporation and registration of the Company;

- Opening a bank account (first as a share capital bank account which will be converted to a full operational bank account upon the registration of the Company);

- Obtaining the VAT number.

After registration of the Company to the Trade Registry and Tax Authorities, the Company must be registered at the Labor Inspectorate when the first employment contract is issued.

Legal Authorities for payroll are Ministry of Finance, Ministry of Labor and Ministry of Health. Please note that, based on the Company's activities, other authorities must be notified before or after the Company's registration.

Visas and Work Permits in Romania

A Non-EU citizen will require a work permit to legally work in Romania.

The Romanian Government has applied a yearly quota system, which regulates the number of foreign employees allowed in the country each year. Work permits are granted according to the quota system and upon presentation of a number of mandatory documents.

Local employment

A work permit is issued by the General Inspectorate for Immigration for a Non-EU citizen that will work in Romania.

In order to hire a Non-EU citizen, Romanian employers must prove to the government that they are a legitimate business in Romania. They will also need to show that the company is not in debt and that they have made every effort to find a Romanian national to fill the position that they are now offering to an expat.

Romanian employers must also prove that the proposed employee has had suitable education and training (the studies of a non-EU citizen must be recognized by the Romanian Ministry of Education, only in case of highly skilled workers and assignees) for that specific position, and that they have suitable work experience in the relevant field. This is usually done through the presentation of a CV and experience reference documents. As a granting condition, Non-EU citizens will need to obtain a criminal clearance certificate for the work permit and a medical certificate for the residence permit (fit for employment).

The employment of a Non-EU citizen that is working without a Work Permit or the maintaining of the employment of a foreigner who does not have a valid Work Permit, shall constitute a contravention and the company shall be sanctioned with fine amounting RON 10,000 – 20,000 for each identified expat in the condition above.

The sanctioned employer will be banned from obtaining work permits for other Non-EU citizens for a period of up to 3 (three) years.

Assignment of a non-EU citizen

The work permit for the assignment is issued by the General Inspectorate for Immigration and can be extended through the residence permit, which is valid for 1 (one) year only and cannot be prolonged.

The Intra-company transfer (ICT) assignment may be up to 3 (three) years for specialists and managers, and for 1 (one) year in the case of trainee employees.

The statement concerning the trans-national assignment should be submitted to the Local Labour Office by the Home Employer, with at least 1 (one) day before the assignment starts – in maximum 5 days since start date of assignment. The fine for not submitting the statement in due time is between the amount of RON 1,000 and 2,000 - RON 5,000 and 9,000..

Income Tax in Romania

The tax year in Romania runs from 1st January to 31st of December.

Annual tax (financial statements: balance sheet, P/L sheet, trial balance) returns are due by 25th May of each year for the previous year in Romania, but in certain cases, such as for employment income derived from non-Romanian employers, tax returns are due on a monthly basis by the 25th day of each month for the previous month.

Where foreign individuals are employed by a Romanian entity, both salary tax and social contributions are applicable, except for the case when a certificate for social security coverage is available, such as the A1 form used for assigned European citizens.

Income Tax in Romania

Both Romanian nationals and Romanian companies must pay tax on any income within Romania and any income from outside of Romania. Non-residents that are declared Romanian fiscal residents are required to pay tax on their total income, the income obtained in Romania and the income obtained abroad.

For tax purposes, an individual who resides in Romania for more than 183 days within a 12-month period, should submit to the local tax authority the “questionnaire to establish the fiscal residence of an individual upon arrival in Romania”. Following the submission and the review/assessment of the file, the tax authority will issue a notification regarding the fiscal residence of the individual (the individual will be declared fiscal resident in Romania, or he/she will remain tax resident in the country of origin/residence).

An individual does not have to be present in Romania for 183 consecutive days, but the total number of days must not exceed 183 days in any 12 consecutive months.

The “questionnaire to establish the fiscal residence of an individual upon departure from Romania” has to be submitted by the individual with at least 30 days prior to his/her departure from Romania. The tax authority will issue a notification regarding the fiscal residence of the individual (the individual will be kept fiscal resident in Romania or not).

Romania has double taxation agreements in place with most countries.

Employers are required to deduct tax payments on behalf of their employees through the payroll.

The tax system in Romania is a great incentive for expats wishing to relocate to Romania with flat tax-rates of 10% on individual income and 16% on corporate income. Some smaller companies, i.e. microenterprises, pay smaller taxes. A tax rate of 1% is paid if the company has just one full-time employee, with a contract agreement for unlimited period or for at least 12 months. If the company has at least one full time employees and exceeds 60,000.00 Euro turnover, the tax rate is 3% of the annual turnover.

New categories of non-taxable salary income have been introduced:

- The employee/employer can pay contributions to voluntary pension funds and private health insurance authorized by the Romanian Financial Supervisory Authority, up to the equivalent of €400 per year each

- Food rights granted by employers to employees, where specific legislation prohibits employees from bringing their own food to the premises

- Personal deductions are available for an income of up to RON 5300 per month, if the taxpayer has dependents the deducted amount will increase

- Starting with 1st of January 2024 maximum non-taxable ceiling for gym membership provided by supplier authorized with NACE Codes 9311, 9312 or 9313 is 100 EUR/year for each employee

- new amounts can be considered for within the 33% monthly threshold of non-taxable employees incentives that may granted thereof, as follows:

- The amounts borne by the employer for placing their employees’ children into early education centres (i.e. kindergarten, nursery or day-care centres) – the maximum non-taxable ceiling is of RON 1,500/month/child. Note: this amount is provided only to one of the parents – employee, only by one employer, based on a statement on own liability of the parent. The parent-employee working for more employers is obliged to declare that he/she does not benefit from such payment from another employer. Also, in case the employee pays directly the amounts to the early education center and the employer reimburse him/her, such reimbursement is carried out based on supporting documents submitted by the parent – employee with the employer. This incentive is also considered as limited tax deductibility social expense when calculating the employer’s corporate income tax.

- The positive difference between the preferential interest set by negotiations and the market interest, for loans and deposits.

Income tax changes in effect from 1st January 2024

The following amounts exceeding the 33% monthly threshold will be considered as income for the months they have been paid for/the month during which their payment has been made/ the month during which the corresponding expense report has been approved:- Touristic or treatment services (including transportation), during the leave, for the employees and their family member

- Contributions to optional pension funds borne by the employers for their employees; 3. optional healthcare premiums or subscriptions borne by the employers for their employees;

- The positive difference between the preferential interest set by negotiations and the market interest, for loans and deposits

- Gym membership

- The amounts borne/provided by the employers to their employees for placing their employees’ children into early education centres

For all these amounts, tax is calculated and withheld by accumulating them with the salary and other income assimilated to salary for the month for which they are deemed as income. The income tax for these amounts is paid monthly or quarterly.

For the calculation and implementation of IT Income Tax Exemption, if during the same month, the employee earns income from salary for a fraction of the month, at the workplace where the basic function is located, with one or, as the case may be, several employers successively, for the application of the exemption, each employer will determine the part of the RON 10,000 monthly threshold corresponding to this period and will grant the exemption for the gross monthly income earned, within the limit of the threshold pro-rata thus determined,

For the employees working in IT, agri-food or construction, it may be reverted on the option for paying the full social contribution for Pillar II, the rules on this option being set by employers under their internal regulations or other internal document.

Also, starting from 1st January 2024 amounts for teleworking given to employees are fully taxable.

Social Security in Romania

All employed and self-employed persons must pay social security contributions (pension and health insurance), with contributions paid by each employee and employer, as required by fiscal legislation.

The employees’ contributions are computed, withheld and paid to the State Budget by the employer. This must be completed by the 25th of the month following the reporting month. Social security contributions are paid by employers for employees.

As of 1 January 2018, when the social security shifted from the employer to the employees, the contributions are the following:

- The pension contribution - 25% due by employees as well as other individuals required by law to pay the pension contribution

- The health insurance contribution - 10% due by employees or by individuals required by law to pay the health insurance contribution

- The work insurance contribution applied to employment and employment assimilated income - 2.25% due by employers, individuals or companies

Where individuals are employed by a Romanian entity, both salary tax and social contributions are applicable. In case of secondment from Europe to Romania, if a certificate for social security coverage (A1 form) is available, the assignee will be exempted from the mandatory SSC.

Social security contributions are mandatory and must be paid by the 25th of the next month.

|

Social Contributions |

Employer |

Employee |

|

Social Security Contributions |

0 % |

35 % |

|

Pension Contribution |

0 % |

25 % |

|

Health Insurance |

0 % |

10 % |

|

Income tax (applied after deduction of social security contributions) |

0 % |

10% |

|

Work Insurance Contribution |

2.25 % |

N/A |

|

TOTAL |

2.25 % |

41,5 % |

Starting with 1st January meal tickets are taxable with Health Insurance (10%) and Income tax (10 %).

Reporting Tax in Romania

Monthly reporting

D112 Statement

Submitted by employers for all the individuals under work contracts or assimilated with employees (information regarding employer, employees, income and taxes).

Online registration on the website of Ministry of Finance, based upon a digital certificate is mandatory.

Can be submitted on behalf of the client by the legal representative.

The legal representative needs to have a digital certificate issued by the tax authority.

D224 Statement

For employment income derived from Non-Romanian Employers, tax returns (D224 tax return) are due by the assignee's, on monthly basis by the 25th day of each month, for the previous month payment.

Subsequently, D222 is submitted for the same category of employees, but only upon assignment start and assignment end. The host employer has the obligation to submit this statement.

Yearly

Annual tax reports are submitted at the end of the financial year to the tax authorities. In Romania, annual tax returns are due by 25th May each year for the previous fiscal year.

By 28th of February, the informative declaration D402, must be submitted by EU residents for salary and assimilated incomes (including the allowances for company administrators).

Additionally, the D224 return submitted in December must include the tax incomes for the whole year (for all previous months from January until November).

New Employees in Romania

All employers in Romania must comply with the Romanian labor law, whether they employ Romanian citizens or foreign nationals and regardless of the size of business. The Romanian Labor Code (“Codul Muncii”), which was enacted in 2003, governs the relationship between employers and employees, and covers local employees working for Romanian employers in Romania and abroad, as well as foreign citizens working in Romania.

All new employees are required to be registered with the Labor Inspectorate and in specific software for evidence of all employees, called Revisal, 1 (one) day before starting their working contract at the latest.

All new employees must be issued with an employment contract which should include the following information:

- The identity of the parties

- The workplace or, in the absence of a permanent workplace, the possibility of working in several places

- The headquarters or, as appropriate, the domicile of the employer (in case of remote work, the place of performing activities based on a schedule)

- The position/occupation according to the Romanian Classification of Occupations

- The criteria to evaluate the professional activity of the employee

- The job-specific risks

- The date when the contract is starting to take effect

- In the case of an employment contract of limited duration, its respective length

- The length of the annual leave the employee is entitled to

- The conditions under which the contracting parties may give notice and its length

- The basic pay, other components of earned income, and the payment frequency for the wage the employee is entitled to

- The normal length of work, expressed in hours per day and hours per week

- The length and the condition of the probationary period

- The level at which the applicable collective bargaining agreement was concluded

- The procedure regarding the use of the electronic signature, the advanced electronic signature and the qualified electronic signature is carried out in accordance with the provisions of the normative acts, the Internal Regulation, the applicable collective bargaining agreement (if the case)

- The professional training is carried out in accordance with the provisions of the normative acts, the Internal Regulation/the applicable collective labor contract (if the case)

- The employer's bearing of private medical insurance, of additional contributions to the employee's private pension or occupational pension, under the law, as well as the granting, at the employer's initiative, of any other rights, when they constitute advantages in money granted or paid by the employer as a result of the employee professional activity, if the case

- Notice period in case of resignation and dismissal

- To inform the Employee of the obligation to join a private pension fund

- Job responsibilities (job description – annex to the employment contract).

The reference to the collective labour agreement governing the working conditions of the employee, if applicable. Only employers with more the 10 (ten) employees are due to start the collective negotiations with the employees/ employees’ representatives with respect to concluding a collective labour agreement at unit level, according to the law.

Internal regulation is mandatory for all employers.

Non - EU citizens

The mandatory documents required for hiring a Non-EU citizen are:

- Passport

- Work Permit obtained from the Immigration Office

- Employment visa issued by the Romanian Missions abroad in the country of origin/residence

- Signed Labour Contract and payroll documents

- Valid lease agreement for a residence address in Romania (the domicile address is considered the one in the country of origin)

Non-EU citizens have the legal right to stay and work on the Romanian territory only upon obtaining the employment visa.

EU citizens benefit from the same treatment as Romanian citizens and can be hired without a work permit.

Leavers in Romania

The notifications should be made to the local authorities when there is a leaver. The termination must be recorded in the specific software Revisal, at the latest on the date of termination of the individual employment contract/on the date of employer becoming aware of the event that determined, under the law, the termination of the individual employment contract.

Payroll in Romania

It is legally acceptable in Romania to provide employees with online pay-slips. Starting from January 1, 2023, the salary statements for which the employer has an informative statement regarding the tax withheld at source, on income beneficiaries, according to the legal provisions or for which the employer has the legal obligation to submit the statement regarding the obligations to pay social contributions, income tax and the nominal records of insured persons, at the National Tax Administration Agency, are kept for 5 years.

Reports

Payroll reports must be kept for at least 50 years.

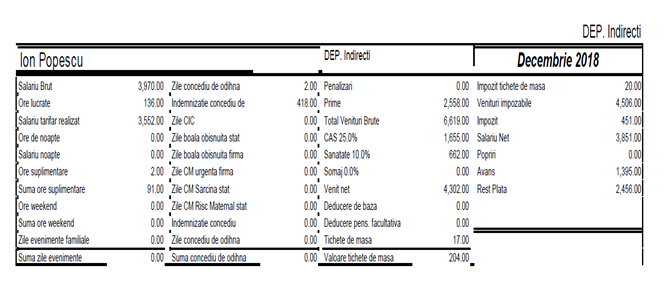

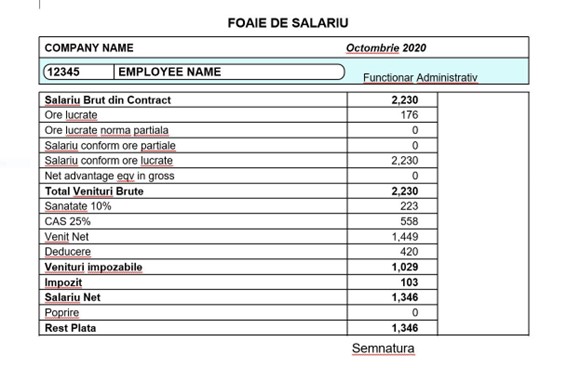

Romanian payslip example

Working Days and Working Hours in Romania

The Romanian working week is typically Monday to Friday.

The work week for full-time employees is generally limited to no more than five days (eight hours per day) and a maximum number of 40 hours per week, with 2 consecutive days of rest, usually Saturday and Sunday. According to law, unless there are exceptional circumstances, the maximum legal length of working time may not exceed 48 hours per week, including the overtime.

Employment Law in Romania

The labor force regulations are mainly comprised in the Labor Code that stipulates all the rights and obligations for both Employers and Employees.

Holiday Accrual / Calculations

For each Employee, the annual holiday leave is of minimum 20 working days.

The right to annual leave cannot be subject to any waiver, assignment or limitation.

The official holidays, as well as the paid days off, stipulated in the applicable collective labor agreement are not included in the annual leave.

Maternity Leave

The employee is entitled to 126 calendar days of paid maternity leave (before and after birth). The arrangement of such a leave remains at the sole option of the Employee, but being obliged to consider a mandatory minimum of 42 calendar days leave after birth.

The allowance for maternity leave (the period of 126 days) is fully paid by the social security funds. The employee shall receive a monthly maternity allowance, established as 85% from the calculation basis, which is usually calculated as the average of gross monthly income from the last 6 months of the 12 months from which the contribution period is constituted, up to the limit of 12 minimum gross salaries per country per month, on the basis of which the insurance contribution for work is calculated.

The Employer cannot dismiss the Employee during the maternity leave. The only legal exception is in the case of dismissal due to reasons related to the legal reorganization or bankruptcy of the employer, under the terms of the legislation in force.

Note: Starting with 01.01.2024, for sick leave indemnity granted under the Government Emergency no. 158/2005 on social health insurance leave and allowances, the 10% health insurance contribution is due.

Paternity Leave

Paternity leave is granted for the father of the child. The maximum period for the paternity leave is 15 working days.

Paternity leave includes a period of 10 (ten) working days of paid leave that the father is entitled to demand after the birth of the child and a period of 5 working (five) taken for the father who followed Puericulture course. Both types of leave are granted in the first 8 (eight) weeks after the birth of the child.

The paternity leave must be declared and submitted to Tax Authorities (through REVISAL application), at least one day before entering to force.

Child care Leave

Both parents can be eligible for child care leave, but the leave is only granted to one of the parents - namely the parent who will stay at home for raising and caring for the child.

According to the law in force, any of the parents has the right to ask for a child care leave, under the condition that he/she obtained taxable income for at least 12 months in the last 2 (two) years prior to the child's birth.

The childcare leave is granted for a period of 2 (two) years, as a paid leave. The amount paid as a monthly allowance will be calculated as a percent of 85% applied to the average net amount for the last 12 months of the last 2 years prior to the child's birth. The minimum amount of the monthly allowance cannot be less than the amount resulting from the application of a multiplication coefficient of 2.5 to the value of reference social indicator, and its maximum amount may not exceed the value of RON 8,500.

In the case of a disabled child, the childcare leave and the corresponding monthly allowance are granted for a period of 3 (three) years.

In this period of two years of childcare leave, the other parent, if he/she is eligible - obtains taxable income for at least 12 months, he/she must require a childcare leave for at least two months (while the parent that was in childcare leave until then, will start he’s / she’s activity at the employer). If the latter parent does not request the granting of leave to raise the child for at least 2 months, although he/she meets the requirements set forth under the law, the other parent (the one who was already in childcare leave) cannot benefit from this right in his/her place.

The other parent is not eligible if he/she does not obtain taxable income for at least 12 months, or is single parent.

Sickness

In case of illness, the sick leave days are paid as follows:

- Typically, the Employer will support the first 5 (five) calendar days of illness (the Employer will pay only the working days);

- FNUASS fund supports the difference of sick leave days starting with the sixth calendar day of illness.

The payment rates are between 75-100% from the average amount for the gross revenues of the last 6 (six) months, depending on the illness category.

Starting from 1st January 2024, for sick leave indemnity granted under the Government Emergency no. 158/2005 on social health insurance leave and allowances, the 10% health insurance contribution is due.

National Service

There is no mandatory National Service in Romania, compulsory military service was suspended in 2006.

Minimum wage in Romania in 2024

The national minimum wage in Romania for 2024, it is 2,079 Ron NET (3,300 Ron BRUT), which is approximately 418 Euros. The average salary in Romania for the same year is 4,427 Ron NET (7,567 Ron BRUT), approximately 945 Euros.

Statutory National Holidays in Romania 2024

There are multiple statutory holiday schedules within Romania. Below are the statutory national holidays in Romania for 2024.

|

Date |

Day |

Holiday |

|

2024-01-01 |

Monday |

New Year's Day |

|

2024-01-02 |

Tuesday |

Day after New Year's Day |

|

2024-01-06 |

Saturday |

Epiphany |

|

2024-01-07 |

Sunday |

Synaxis of St. John the Baptist |

|

2024-01-24 |

Wednesday |

Unification Day |

|

2024-05-01 |

Wednesday |

Labor Day |

|

2024-05-03 |

Friday |

Orthodox Good Friday |

|

2024-05-05 |

Sunday |

Orthodox Easter Sunday |

|

2024-05-06 |

Monday |

Orthodox Easter Monday |

|

2024-06-01 |

Saturday |

Children's Day |

|

2024-06-23 |

Sunday |

Orthodox Whit Sunday |

|

2024-06-24 |

Monday |

Orthodox Whit Monday |

|

2024-08-15 |

Thursday |

Assumption Day |

|

2024-11-30 |

Saturday |

St. Andrew's Day |

|

2024-12-01 |

Sunday |

National Day |

|

2024-12-25 |

Wednesday |

Christmas Day |

|

2024-12-26 |

Thursday |

Second Day of Christmas |

Employee Benefits in Romania

There are numerous Employee benefits, which are made available to all staff members or just for some of them, in accordance with internal policies and the legislation in force.

Any expenses paid by the Company to/on behalf of the Employee as a benefit are considered taxable income.

Other items in this category include:

- Personal private life insurance

- Private medical insurance

- Use of Company’s assets for personal purpose (car, phone)

- Rent

- Personal trips

Two of the benefits granted to the Employees are the meal tickets and the gift-tickets.

There is no minimum value for the meal tickets, as the Employer can establish the desired value, but there is a legal maximum value of RON 40.

The value of a meal ticket often used is RON 30.

A maximum of 1 meal ticket for each day worked can be given. The exception is for days when the Employee is travelling (employee is receiving a per diem), holiday leave, medical leave or any other absence.

The value of meal tickets are taxable with 10% (Income tax) and starting with 01.01.2024 are taxable with Health Insurance (10%). Employees and children of employees may receive gifts or gift vouchers from the Employer. Employers can provide gifts/gift vouchers at Easter, June 1st (Children’s Day), Christmas and March 8th (Women’s Day, for women only).

The gift/gift voucher received for the above occasions is not taxable if the value does not exceed RON 300, but any value exceeding RON 300 will be fully taxable with the income tax and social contributions.

Expenses

The maximum level of deductible per diem is RON 57,5 /day/employee. This value is for internal travel (in Romania).

The employee isn’t obliged to provide justification documents for per-diem expense. This amount is considered to be allocated for food and drink and any additional expenses in these categories will be considered as nondeductible for the company.

For external travel (Romania to another country) the limits of a per diem allowance is as per the specific legislation (e.g. EUR 30-40/day in Europe, depending on the country).

The amounts exceeding the above values multiplied with 2.5 become benefit in kind, for which tax and social contributions must be calculated.

All amounts hereinabove cannot exceed a ceiling of 3 basic salaries/month (for employees), respectively 3 remunerations/month (for directors).

All amounts and provisions related to the per-diem expenses are provided under the Romania legislation for public functions, however, in practice, they are also considered applicable in the private sector as well.

Key updates for 2024 in Romania

In Romania, there have been significant changes to personal income tax, social security, and employment law effective from 2024. Here's a summary of the key changes:

- Tax on Income from Unidentified Sources: From 1 July 2024, any income ascertained by the Romanian tax authority, which cannot be traced back to a known source, will be taxed at a high rate of 70%, increased from the previous 16% rate.

- Value Added Tax (VAT) Adjustments: Starting 1 January 2024, VAT rates will see adjustments for various categories. For instance, the VAT rate for certain high-quality foods, installation of photovoltaic panels, social housing, and sports and cultural events will increase from 5% to 9%. Additionally, the VAT rate for non-alcoholic beer and foods with added sugar will be raised from 9% to 19%.

- Special Tax on High-Value Assets: A new tax is being introduced on high-value immovable and movable assets. This includes a tax on residential buildings with a taxable value exceeding RON 2.5 million and a tax on cars registered in Romania with a purchase value exceeding RON 375,000.

- Changes to Tax Exemptions in Specific Sectors: The tax exemption for salary income in certain sectors such as IT, construction, agriculture, etc., will be limited. For example, in the IT sector, the exemption will be limited to a gross monthly wage of up to RON 10,000.

- Corporate Income Tax Adjustments: Companies with a turnover of more than EUR 50 million will be required to pay a minimum turnover tax from 1 January 2024, if their calculated corporate income tax is lower than this minimum level.

- Health Insurance Contributions: Law No. 296/2023 introduces changes to the basis for calculating health insurance contributions, which will now include the value of meal and holiday vouchers, effective from January 2024. Additionally, the exemption from health insurance contributions for employees in construction, agriculture, and the food industry has been removed.

These changes reflect Romania's efforts to increase tax compliance, address budget deficits, and adjust tax policy to the current economic environment.

Notes

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

Want to learn more about payroll, tax, social security and more?

Register free today to get the latest up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Let’s Partner

Talk to a specialist today and find out how we support the growth of over 500 businesses with a range of activpayroll solutions designed to help your global payroll and people operations succeed.