Slovakia

This beautiful country, known for its rich cultural heritage and stunning landscapes, also boasts a dynamic business environment. Slovakia's EU membership ensures access to a vast market and adherence to European standards, making it a secure and predictable place for business operations.

Need more information about payroll, compliance and social security in Slovakia?

Talk to a specialist

Our free global insight guide to Slovakia offers up-to-date information on international payroll, income tax, social security, employment law, employee benefits, visas, work permits and key updates on legislative changes and more in 2024.

Basic Facts about Slovakia

General Information

- Full Name: Slovak Republic

- Population: 5.43 million (World Bank 2022)

- Capital: Bratislava

- Major Languages: Slovak (Official), English

- Monetary Unit: Euro (1 euro = 100 cents)

- Main Exports: Automotive, electrical machinery, iron, steel, mineral fuels including oil and plastics

- GNI Per Capita: US $ 22,060 (World Bank, 2022)

- Internet Domain: .sk

- International Dialling Code: +421

How Do I Say in Slovak?

- Hello: Ahoj

- Good Morning: Dobré ráno

- Good Evening: Dobrý večer

- Do You Speak English?: Hovoríš po anglicky?

- Goodbye: Zbohom

- Thank You: Ďakujem

- See You Later: Vidíme sa neskôr

Dates

Dates are usually written in the day, month and year sequence. For example, 1 June 2022 or 1/6/22.

Numbers are written with a period to denote thousands and a comma to denote fractions. For example, €1.234, 56 (one thousand, two hundred and thirty-four euros and fifty-six cents). The euro symbol appears before the numbers.

Doing Business in Slovakia

Slovakia, nestled in the heart of Europe, offers a strategic location that serves as a gateway to both Eastern and Western European markets.

This beautiful country, known for its rich cultural heritage and stunning landscapes, also boasts a dynamic business environment. Slovakia's EU membership ensures access to a vast market and adherence to European standards, making it a secure and predictable place for business operations.

The Slovak economy is diverse and robust, with strong sectors including automotive manufacturing, electrical engineering, and information technology. The government supports business activities through incentives such as a straightforward tax system, investment grants, and innovation support programs. Slovakia's workforce is highly skilled, with a strong focus on technical education and multilingual proficiency, ensuring that businesses have access to the talent they need to thrive.

Slovakia's well-developed infrastructure, including advanced transport and logistics facilities, coupled with a commitment to digitalisation and innovation, makes it an attractive destination for businesses looking to expand their footprint in Central Europe. Whether you're an entrepreneur seeking a vibrant start-up ecosystem or an established enterprise looking to leverage Slovakia's strategic position and skilled workforce, this country offers a welcoming and growth-oriented business landscape.

Why invest in Slovakia

Investing in Slovakia means tapping into a stable, growth-oriented economy with a strategic location at the crossroads of major European trade routes.

The country's investment climate is bolstered by its EU membership, offering transparency, a stable currency, and access to a large market. Key sectors that attract investment include automotive, electronics, energy, and information technology, all supported by a tradition of technical expertise and innovation.

The Slovak government is committed to fostering investment, providing various incentives such as tax relief, financial grants for specific projects, and support for research and development activities. Investors benefit from a well-established legal framework, protection of property rights, and a straightforward business registration process.

Special Economic Zones (SEZs) and industrial parks offer additional advantages, including ready-to-use infrastructure, administrative support, and further financial incentives. These zones are designed to attract foreign investment, particularly in manufacturing and high-tech industries, promoting economic growth and job creation.

Foreign Direct Investment in Slovakia

Slovakia's open economy and pro-investment policies create a conducive environment for foreign direct investment (FDI). The country's strategic location, coupled with its membership in the EU, provides foreign investors with a stable platform for accessing European and global markets.

The types of FDI prevalent in Slovakia include:

-

Greenfield Investments: Slovakia's industrial parks and SEZs are prime locations for setting up new operations, especially in manufacturing and technology sectors. The government supports these investments with various incentives, including tax breaks and financial support for infrastructure development.

-

Mergers and Acquisitions (M&A): The stable and growth-oriented Slovak economy makes it an attractive destination for M&A activities, allowing foreign companies to quickly establish a presence and gain access to local expertise and markets.

-

Joint Ventures and Strategic Partnerships: Collaborating with Slovak companies can offer strategic benefits, particularly in industries where local knowledge and networks are crucial. Slovakia's strong industrial base and focus on innovation provide ample opportunities for successful partnerships.

-

Real Estate Investment: The country's growing economy and urban development present opportunities for investment in commercial and residential real estate, supported by a transparent legal framework and property rights protection.

-

Slovak Investment and Trade Development Agency (SARIO): Offers comprehensive services to foreign investors, including investment support, assistance in finding the right location, and guidance on incentive schemes. SARIO also facilitates connections with local suppliers and partners, ensuring a smooth and successful investment journey.

Slovakia presents a dynamic and supportive environment for doing business, investing, and attracting foreign direct investment. With its strategic location, commitment to innovation, and supportive policies, Slovakia stands out as a prime destination for companies and investors aiming for sustainable growth and success in the European market.

Registering a Company and Establishing an Entity in Slovakia

A company is typically required to have a legal entity established in order to carry out business in Slovakia. All businesses must be registered with the Slovak Commercial Register, the legal forms available are:

- Enterprise or Branch Office of a Foreign Company

- Joint Stock Company

- Limited Liability Company

- Limited Partnership

- General Partnership

- Cooperative

The above business entities must be registered to the Slovak Commercial Register and must have the following documents in order to register:

- Trade license issued by the local trade authority, including the name of the person who meets the qualification criteria for engaging in that trade (if applicable)

- Foundation deed and the company’s Article of Association (if applicable)

- Compliance with any minimum capital requirements (if applicable)

Foreigners are required to hold a temporary residence permit before they can be entered as a statutory representative in the Commercial Register.

Visas and Work Permits in Slovakia

When businesses look to establish operations in Slovakia or hire international talent, understanding the visa and work permit requirements is crucial. Slovakia, being a member of the European Union, has its specific regulations that govern the entry and stay of foreign nationals. Here's an overview of the key visas and work permits that businesses should be aware of when considering doing business in Slovakia.

Short-Stay Schengen Visa (C Visa)

For business visits or short-term engagements (up to 90 days within a 180-day period), non-EU nationals may require a Schengen Visa. This visa allows travel within the Schengen Area, including Slovakia. It's suitable for business meetings, conferences, or short training sessions.

National Visa (D Visa)

For longer stays (over 90 days), a national visa (D Visa) is necessary. This type of visa is suitable for those who need to stay in Slovakia for a specific purpose, such as long-term business engagements, but do not yet qualify or intend to apply for a temporary residence permit.

Temporary Residence Permit

If a non-EU national plans to stay in Slovakia for more than 90 days for business purposes, they must apply for a temporary residence permit. This permit is often required for longer-term business activities, employment, or conducting entrepreneurial activities in Slovakia.

Blue Card

Highly qualified non-EU nationals looking to engage in high-skilled employment in Slovakia can apply for the EU Blue Card. This permit is designed for those with a university education or significant professional experience in their field. The Blue Card offers several benefits, including mobility within the EU after a certain period.

Single Permit (Residence and Work Permit)

Slovakia offers a single permit that allows non-EU nationals to reside and work in the country. This combined permit simplifies the process, as applicants don't need to apply separately for a residence permit and a work permit. The permit is typically tied to a specific employer and position.

Business Visa for Entrepreneurs

Entrepreneurs from non-EU countries who plan to start a business or invest in Slovakia can apply for a specific type of visa or residence permit tailored for business purposes. This option often requires proof of the investment, a business plan, and other documentation.

It's important for businesses to note that visa and work permit requirements can vary based on the individual's nationality, the purpose of the stay, and the duration of the stay in Slovakia. Additionally, regulations can change, and it's advisable to consult with Slovak embassies, consulates, or a professional immigration lawyer for the most accurate and personalised advice.

Business Banking in Slovakia

It is not mandatory to make payments to both employees and the authorities from an in-country bank account.

Banks are generally open to the public from Monday to Friday, 8am – 5pm. Most banks are closed on a Saturday.

Income Tax in Slovakia

The Slovak tax year runs from 1st January to 31st December.

Income Tax

In Slovakia, the personal income tax system is structured to ensure a fair contribution from individuals based on their level of income.

For the year 2024, the income tax rates for individuals are progressive, reflecting the country's commitment to a balanced and equitable tax policy. Here's a breakdown of the income tax rates applicable to individual taxable income derived in 2024:

Annual Taxable Income up to EUR 47,537.98

- Individuals with an annual taxable income of up to EUR 47,537.98 will be taxed at a rate of 19%.

- This rate is designed to support individuals and families, ensuring that lower to middle-income earners are taxed at a reasonable rate that allows for financial stability and growth.

Annual Taxable Income above EUR 47,537.98

- For individuals whose annual taxable income exceeds EUR 47,537.98, the income tax rate increases to 25%.

- This progressive rate structure ensures that higher earners contribute a proportionately larger share of their income in taxes, reflecting their greater financial capacity.

The personal income tax system in Slovakia aims to balance the need for government revenue with the financial well-being of its citizens. It's crucial for individuals to understand these tax rates and plan their finances accordingly, especially when budgeting for the year 2024.

Social Security in Slovakia

Social security is mandatory for all employees working in Slovakia, unless they have an exemption under the EU rules or under a social security treaty between Slovakia and the country in which they pay contributions. Employers in Slovakia are responsible for deducting income tax and social security contributions from the employee’s wage.

|

Contributions for |

Maximum base per month in eur |

Employee |

employer |

sole ENTREPRENEUR |

|

Pension Insurance |

9,128 |

4.00% |

14.00% |

18% |

|

Disability Insurance |

9,128 |

3.00% |

3.00% |

6% |

|

Reserve Fund |

9,128 |

- |

4.75% |

4.75% |

|

Sick Leave Insurance |

9,128 |

1.40% |

1.40% |

4.4% |

|

Accident Insurance |

No maximum |

- |

0.80% |

- |

|

Unemployment Insurance |

9,128 |

1.00% |

1.00% |

|

|

Guarantee Fund |

9,128 |

- |

0.25 |

- |

|

Health Insurance |

No maximum |

4.00% |

11.00% |

14% |

|

Total |

|

13.4% |

36.2% zmena |

49,15% |

Reporting Tax in Slovakia

Monthly

Monthly reporting is required to:

- Social insurance

- Health insurances Generall

- Dôvera

- Union

- Tax Office

New Employees in Slovakia

You may work in Slovakia with no restrictions provided you are a citizen of the countries within the European Economic Area and Switzerland (EEA citizens). If the worker stays in Slovakia for longer than three months, they must register with the Slovak Foreigner police office. Anyone else wishing to work in Slovakia must apply for a work permit and temporary residence before arriving in Slovakia.

Employers are responsible for registering a new employee. The employer must inform the healthcare authorities within eight working days of the commencement of employment. The employee must be registered with the social authority before their first day of official employment.

Leavers in Slovakia

An employee’s position can be terminated due to a number of reasons, these include immediate termination (if the employee is proven guilty of any deliberate criminal offences or found to be in serious breach of work discipline), by mutual agreement or during probation.

If an employee chooses to leave a company, a minimum of one months’ notice must be given if the employee has worked for the company for less than one year, a period of two months must be given for employees employed for longer than one year.

The social and health authorities must be notified of any leavers.

Payroll in Slovakia

It is legally acceptable in Slovakia to provide employees with online payslips.

Reports

Payroll reports must be kept for 5 – 50 years.

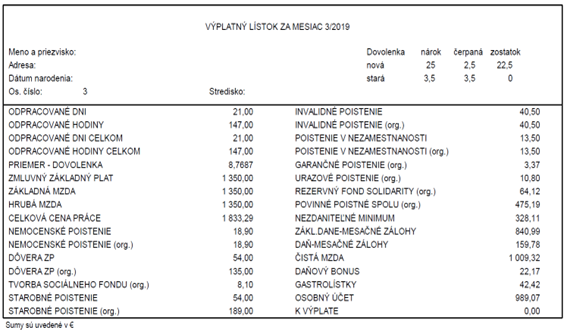

Slovakian Payslip Example

Employment Law in Slovakia

Holiday Accrual

If an employee has worked for the same company for at least 60 days in the calendar year, they are entitled to four weeks (20 workdays) paid leave per calendar year. If an employee is 33 years old or older, they are entitled to an extra week of holiday with full pay.

Maternity Leave

Maternity Leave entitlement is 34 weeks, with the government paying 75% of the workers’ wage during her leave. If the mother is a single parent, she is entitled to a maternity leave of 37 weeks. If the mother gives birth to two or more children at the same time, she is entitled to 43 weeks of maternity leave.

The start date of maternity leave is set by the attending physician, usually 6 weeks before the expected date of the childbirth. In connection with the care for a newborn child, men are also entitled to a paternity leave of the same length from the date of birth of the child of whom they take care.

Paternity Leave

Slovakia has introduced paternity leave to support new fathers. Fathers are entitled to two weeks of paid leave (14 calendar days), which must be taken no later than six weeks after the birth of the child. This leave can be extended in cases where the child or mother is hospitalised.

The average daily benefit per father is estimated at 41.50 EUR in 2024.

Paternity leave is not paid by the employer but is covered by the Sociálna Poisťovňa social insurance company from the insurance for ill health.

Parental Leave

Parental leave is granted to parents until the child reaches the age of three years. In the case of a child with long-term unfavourable health conditions requiring special care, parental leave can be extended until the child reaches the age of six.

During parental leave, parents are entitled to a parental allowance to support them financially while they are caring for their child.

As of January 2024, the amount of the parental allowance is set at 345.20 EUR per month or 473.30 EUR per month if the entitled person who applied for the parental allowance was previously receiving a maternity benefit or similar benefit in the EU/EEA states.

Sickness

The first 10 days of sick leave are paid by the employer, thereafter any additional sick days are paid by social insurance.

National Service

Slovakia abolished compulsory national service in January 2006.

Minimum wage in Slovakia in 2024

The national minimum wage in Slovakia for 2024, has been set at 750 euros per month, with an hourly minimum wage of 4.310 euros.

Working Days and Working Hours in Slovakia

The working week in Slovakia is Monday to Friday, working 8 hours per day.

Employees are entitled to a 30-minute break after working 4 hours, this break is not paid for.

Statutory National Holidays in Slovakia 2024

There are multiple statutory holiday schedules within Slovakia. Below are the statutory national holidays in Slovakia for 2024.

|

Holiday Name |

Weekday |

Date |

|

New Year's Day |

Monday |

1 January |

|

Epiphany |

Saturday |

6 January |

|

Good Friday |

Friday |

29 March |

|

Easter Monday |

Monday |

1 April |

|

Labour Day |

Wednesday |

1 May |

|

Victory over Fascism Day |

Wednesday |

8 May |

|

St. Cyril and Methodius Day |

Friday |

5 July |

|

Slovak National Uprising Day |

Thursday |

29 August |

|

Constitution Day |

Sunday |

1 September |

|

Day of Our Lady of Sorrows |

Sunday |

15 September |

|

All Saints' Day |

Friday |

1 November |

|

Freedom and Democracy Day |

Sunday |

17 November |

|

Christmas Holiday - Štedrý deň |

Tuesday |

24 December |

|

Christmas Holiday |

Wednesday |

25 December |

|

St. Stephen's Day |

Thursday |

26 December |

Employee Benefits in Slovakia

Employee benefits in Slovakia include Expenses, Vacation Pay and Christmas Bonus

Vacation Pay - 13th Payment

In Slovakia, the 13th payment, commonly known as vacation pay, is an additional salary payment that employers may provide to their employees.

While not mandatory by law, many companies offer this benefit as part of their compensation package, especially in certain industries or for specific job positions.

The 13th payment is typically given before the main vacation season, often in June or July, and is intended to support employees' leisure and recreation expenses.

The amount and conditions of the 13th payment are usually defined in the employment contract or collective agreements and may vary based on the company's policy, the employee's length of service, and other factors

Christmas Bonus - 14th Payment

The Christmas bonus, or the 14th salary, is another customary but not legally required benefit in Slovakia.

It is usually paid at the end of the year, around Christmas time, as a token of appreciation and to support employees with holiday-related expenses.

The specifics of the Christmas bonus, including the amount and eligibility criteria, are typically outlined in the employment contract, collective bargaining agreements, or the company's internal policies.

The 14th payment is a common practice in many Slovak companies, its provision is at the employer's discretion, and it may be linked to the company's financial performance, the employee's individual performance, or other predetermined conditions.

Key updates for 2024 in Slovakia

As of 2024, Slovakia has implemented several key changes to its income tax, social security, and employment laws. Below is a summary of the most significant changes:

Income Tax Changes

- Increase in annual taxable income from up to EUR 41,445,46 in 2023 to up to EUR 47,537,98 in 2024 and is taxed at 19%

- Increase in annual taxable income from above EUR 41,445,46 in 2023 to above EUR 47,537,98 in 2024 and is taxed at 25%

Social Security

- Employer health contribution up from 10% in 2023 to 11% in 2024

Notes

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

Want to learn more about payroll, tax, social security and more?

Register free today to get the latest up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Let’s Partner

Talk to a specialist today and find out how we support the growth of over 500 businesses with a range of activpayroll solutions designed to help your global payroll and people operations succeed.