Spain

The Spanish government actively welcomes inward investment in the country as foreign investment is essential to the Spanish economy.

Need more information about payroll, compliance and social security in Spain?

Talk to a specialist

Our free global insight guide to Spain offers up-to-date information on international payroll, income tax, social security, employment law, employee benefits, visas, work permits and key updates on legislative changes and more in 2024.

Basic Facts about Spain

General Information

- Full Name: Kingdom of Spain

- Population: 47.78 million (World Bank, 2022)

- Capital: Madrid

- Primary Language: Spanish (local languages in Catalonia, Basque Country & Galicia)

- Main Religion: Christianity

- Monetary Unit: Euro

- Main Exports: Transport Equipment, Agricultural Products

- GNI per Capita: US $46,550 (World Bank, 2022)

- Internet Domain: .es

- International Dialing Code: +34

How Do I Say in Spanish?

- Hello: Hola

- Good morning: Buenos Dias

- Good evening: Buenos Tardes

- Do you speak English?: Habla Ingles?

- Good bye: Adios

- Thank you: Gracias

- See you later: Hatsa Luego

Investing in Spain

The Spanish government actively welcomes inward investment in the country as foreign investment is essential to the Spanish economy. Spain has a young and highly qualified workforce, and fairly low labour costs. Spain is a brilliant gateway to accessing the growing markets of the EMEA region (Europe, Middle East and North Africa) and Latin America. After the US, Spain is the second biggest and most important foreign investor in Latin America. Spain has excellent transport links to the rest of the world with an extensive network of roads, railways, rapid transit, air routes, ports and a central time zone positon ideally placed between Eastern and Western markets.

Doing business in Spain

Duis lobortis massa imperdiet quam. Nunc egestas, augue at pellentesque laoreet, felis eros vehicula leo, at malesuada velit leo quis pede. Vivamus elementum semper nisi. In ac felis quis tortor malesuada pretium. Nulla facilisi.

Business Banking in Spain

Generally, banks are open to the public from 0800 to 1400 hours, Monday to Friday. Banks will also be open on Saturdays during the autumn – winter period (October until the end of March) and some banks may be open on Thursday afternoons when they are closed on a Saturday.

Registering a Company and Establishing an Entity in Spain

It is not necessary to have a legal entity established in order to process a payroll, there are various alternatives:

- You can create a Spanish company; once the company is registered for tax and social security, you can set up the payroll for the employees.

- If you have a well-established business outside of Spain, but you don't plan on having a physical office in Spain, then you should consider registering your foreign business with the Social Security Office.

Spanish Branch of a Foreign Company

A branch is legally defined as a secondary establishment that has been granted certain management autonomy and permanent representation, which entirely or partially develops its parent company’s activities. Branches are establishments of a fixed nature, set up by a non-resident parent company with the purpose of carrying out its economic activities on Spanish territory. They are subordinated to their parent company. Therefore, a branch does not constitute an independent and separate entity, but a mere extension of its parent company on Spanish territory.

The main characteristics of a branch can be summarized as below:

- It is an establishment which lacks its own legal personality. The parent company keeps hold of the legal personality.

- It is a secondary establishment subordinate to the main or parent company, even though it has certain management autonomy, meaning that it has its own organization and management body with enough powers to carry out economic activities and attend its own clientele.

- The social purpose of the parent company and its branch are identical, albeit the latter usually carries out only certain specific activities of its parent company.

- The liability of a branch is not independent from its parent company. The latter can unrestrictedly be held liable for all contracted obligations of its branch.

- A branch does not require a minimum share capital, unlike a subsidiary.

- The legal representative or representatives appointed by a parent company act as agents and manage the branch. However, there are no formal administrative bodies, as in a subsidiary.

- A branch must keep its own accounting for the activities it carries out. It will also be subject to file Spanish taxes (VAT, CIT, withholding tax etc.)

Additionally, the foreign parent company is obligated to record in the Spanish Commercial Register its annual accounts prepared according to the applicable foreign legislation.

Visas and Work Permits in Spain

According to Spanish regulations on foreigners, anyone who is not a Spanish national is deemed a foreigner. Foreigners’ fundamental rights and freedoms in Spain are regulated in Organic Act 4 of 11thJanuary 2000 and Royal Decree 557/2011 of 20 of April, which approved the regulation of the Organic Act.

While the rights of nationals of EU Member States to work in Spain are not limited in any way, nationals of non-EU countries have to apply to the Spanish authorities for a work permit.

The Requirements for Authorizing Temporary Residence and Work Permit:

- With some exceptions, the National Labour Market situation must allow the hiring of foreign non-EU workers, either because the occupation is included in the National Occupation Shortage List or by presenting a certificate issued by the Regional Public Employment Service

- That the employer is registered with Social Security and up to date with SS payments and tax; they must guarantee the worker continuous employment and have adequate economic, material, and human resources to carry out their business project. The employment contract must comply with the current Labour laws

- That the worker status in Spain is not illegal, does not have a criminal record and, if applicable, has the titles or qualifications required to exercise the profession in Spain.

Responsibility of an Employer

The employer must apply for a residence and work permit for the employee, either in person or through a legal representative, to the competent body in the province where the activity will be carried out.

Documents required:

- The employer’s National ID or Tax ID Number. If the employer is a legal entity, then the public deed granting legal representation for the person making the application

- If applicable, then the evidence of exemption from consideration of the national labour market

- The original employment contract and a copy

- Proof of economic, material and HR for the business project

- A copy of the worker’s passport or valid travel document, and training or professional qualifications, if applicable for the job

The initial permit is valid for 1 year and may be restricted to a particular geographical area and activity. It is conditional on the foreigner obtaining a visa, entering Spain, and registering with the Social Security system.

Responsibility of an Employee

Once the permit is granted, the employee must present the visa application in person (notwithstanding exceptions) at the relevant diplomatic mission or consulate, in the month following notification to the prospective employer, together with:

- A copy of the employment contract, stamped by the Foreigners’ Office.

- A passport or travel document, valid in Spain and with a minimum validity period of four months

- A criminal record certificate issued by the authorities in the worker’s country of origin or countries of residence over the past five years, which must not include any acts considered a criminal offence under Spanish law

- A certificate stating that the applicant does not suffer from any disease that could have a severe impact on public health according to International Health Regulations

Sometimes the applicant may be required to appear in person to attend an interview.

Any foreigner who is in an irregular situation in Spain will not be eligible to apply for a visa.

Once the visa has been issued, the employee must enter Spain within the period stated on the visa (no more than three months). Within 3 months after entering Spain, the employer requesting the permit must register the employee with Social Security system. Within 1 month of being registered with Social Security in person, for a Foreigner's Identity Number (NIE).

If the established period to do so has elapsed and the foreigner is not registered with Social Security, they will be obliged to leave Spain. Failure to do so constitutes a serious offence, of being in the country illegally.

Income Tax in Spain

The tax year runs from 1 January to 31 December. Employment is highly regulated in Spain, and labour/tax inspections do occur.

The steps for registering a company to the tax/social security authorities are:

- File for Tax ID Number; (prior sharing documents that our ICP will claim)

- Obtain a Fiscal Identification Number (CIF) for the company

- Register the company on local Chamber of Commerce (Registro Mercantil)

- Register the company on the business tax roll & the VAT roll (036 form)

- Obtain the company digital signature (FNMT)

- File for social security authorization

Upon registration of the company with social security, a state supervisory number is issued and assigned to the company. The required documents are:

- The corresponding form

- A copy of the Public Deed of Incorporation

- A photocopy of the applicant’s National Identity Document or Power of Attorney (PoA)

- The Company Tax Identification Number

- A special PoA to obtain the Digital Signature

Registration of the company must be made before starting any business activity.

In Spain, the agent is required to be licensed by the tax and social security authorities to make payments to authorities on behalf of a client (Agencia Tributaria and Seguridad Social). Some professional qualifications are required.

The Fundamental Law governing this area is the Workers’ Statute (Royal Legislative Decree 1 of 24 March 1995), which sets out the respective rights of workers and employers, the general terms and conditions of employment contracts, the procedures to be followed when dismissing personnel and the rules for collective bargaining, among others.

Furthermore, specific regulations are applicable to different industries and certain worker groups and special labour relations groups.

Other important aspects of labour law are Collective Company Agreements, which may be negotiated at the company level or at the nationwide industry level, and employment contracts that set out individual relationships between the parties.

Under the General Social Security System, contributions are shared between the employer and employee. Employees are classified into professional groups or professions to determine the corresponding contribution.

|

Contribution (%) |

|||

|

Contingencies |

Employer |

Employee |

Total |

|

General |

23.6 |

4.7 |

28.3 |

|

MEI |

0.58 |

0.12 |

0.7 |

|

Unemployment (*) |

5.5 |

1.55 |

7.05 |

|

Other (**) |

0.80 + % depending on the activity |

0.1 |

2.1 |

|

*These percentages may differ slightly depending on your work contract |

|||

|

**Salary guarantee in case of bankruptcy: Professional Training; Additional amount based on the employee’s professional classification |

|||

There are maximum and minimum bases for each category that are usually revised every year. There are 11 contribution groups into which employees are classified, depending on their professional categories.

Further information can be obtained via the following government departments:

Instituto Nacional de la Seguridad Social (Social Security)

Calle Cedaceros,11

28014 MADRID (MADRID)

Phone: 34 91 4296661/ 34 91 4297926

Client Service: 901 106570

Fax: 34 91 4291460

Agencia Tributaria (Tax Authorities)

Calle Guzmán el Bueno,139, 28003 Madrid

Phone : 91 5826767

Client Service: 901 33 55 33

https://www.agenciatributaria.gob.es/

Income Tax

Monthly personal income tax contributions are paid on the 20th of the following month, or quarterly.

Penalties and other surplus are fixed case by case.

Social Security in Spain

Monthly social security contributions are paid on the last day of the following month (i.e. March social security is paid on 30th April).

The penalty for late payment is 10% of the outstanding/due amount if only one month late, or 20% if more. Penalties and other charges are fixed case by case.

The state pension scheme is part of the social security system in Spain. There are 2 categories of pension in Spain: contributory and non-contributory. The pension system is financed by a payroll tax on salaries.

The following pensions are included under the protective action of the General Scheme and the Special Schemes of the social security:

Retirement Pension: Ordinary retirement is at 67 years of age (men and women). Early retirement may be possible through being a member of a mutual. Early retirement without being a member of a mutual, early retirement due to a reduction of the minimum age for performing hazardous, toxic or harmful work, early retirement for disabled workers, partial retirement, flexible retirement and special retirement is at 64 years of age.

For Permanent Disability: Total, Absolute and Severe Disability.

For Death: Widowhood, Orphanage and Family Pensions.

Reporting in Spain

Monthly

- Payroll, Summary Cost and Bank Transfers (Company)

- Social Security Payment (Bank account). Form RLC & RNT

Quarterly / Monthly

- Form 111 (AEAT – Tax authority)

- Form 216, if applies, related to none tax resident employees (AEAT – Tax authority)

Yearly

- Form 190/296 (AEAT – Tax authority)

- Personal Income Certificates (employees)

- Form 345 (Annual summary of Pension Plan contributions if they exist

New Employees in Spain

The labour contract has to be registered electronically with the Spanish Social Security. It can be done by the company or/and authorised professional.

Registration of each employee with the Spanish Social Security System is required by submitting the following documentation upon hire:

- Corresponding Form (signed by both the company and the employee);

- A copy of the employee's National Identity Document (such as DNI, NIE, or passport);

- Form 145 (family status) for tax purposes

New hires can be registered up to 60 calendar days prior to the start of the employment relationship, but not later than the first day of employment.

Expat new starts must obtain relevant working visas/permits before commencing work in Spain.

Trial Period for Temporary Contracts

Temporary contracts (for special services, temporary because of the nature of production), the duration of which is less than 6 months may have a trial period of 1 month (unless some other condition is declared in the collective agreement) are very unlikely to be accepted. They are minimizing their use, and it needs to be clearly proven that the need is temporary.

Leavers in Spain

Relevant authorities must be notified of a leaver within 3 days of the termination. Payment for leavers is usually made on the termination day.

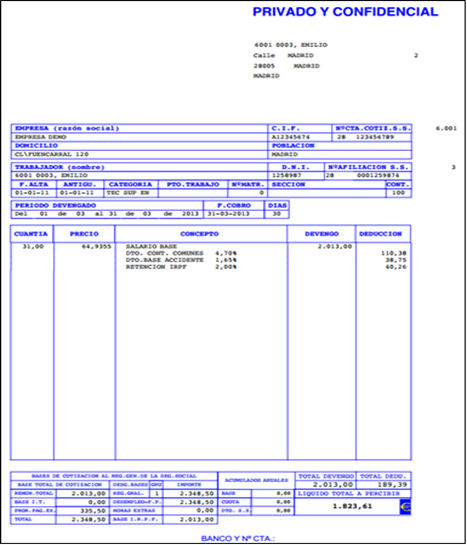

Payroll in Spain

It is legally acceptable in Spain to provide employees with online payslips.

Reports

Payroll reports must be kept for at least 4 years.

Spanish Payslip Example

Working Week in Spain

The working week in Spain is Monday to Friday. As a rule, the maximum working hours are 40 per week. Overtime is permitted but only up to 80 hours per year.

Employment Law in Spain

A Royal Decree Law 16/2013 was approved on 20th December 2013 and addresses measures to favour stable contracting and to improve the employability of workers.

Trial period for temporary contracts

Temporary contracts (for special services, temporary because of the nature of production), the duration of which is less than six months may have a trial period of one month (unless some other condition is declared in the collective agreement).

Modifications in part-time contracts

-

Return to the previous situation on overtime. The Labour Reform allowed the possibility that workers on part-time contracts could work overtime hours. The situation prior to that Reform now applies again and overtime is prohibited under this type of contract.

-

Complementary hours. From now on, this type of hours can only be undertaken when the worker has a contract with a minimum of ten hours per week as an annual average. Moreover, the prior notice time has been reduced from the seven days previously applicable to three days. The latest change creates two different types of complementary hour contracts (before only one existed): hours agreed (this type already existed) and voluntary hours (a new type applicable only to contracts for undefined time periods).

-

Daily hours register. An obligation is established to register the ordinary working day or complementary hours undertaken by workers under part-time contracts to allow a better control by the Labour and Social Security Inspectors.

-

Employers’ contribution for unemployment. Will be the same for temporary part-time contracts as for full-time temporary contracts.

Reduction of work day due to legal custody of children up to 12 years of age.

The current limit of 8 years of age is extended up to 12 years of age for minors that create the right to a reduced work day because of legal custody.

Irregular distribution of the work day, beyond a calendar year.

The differences in the number of hours derived from an irregular distribution of hours during the work day may be compensated up to 12 months after the fact (for example, if they occur in December 2014, they can be compensated up to December 2015). This fills a gap that had previously existed.

Undefined work contract in support of entrepreneurs, also at part-time.

The possibility is available to establish as part-time (not only full-time) the contracts of support for entrepreneurs (that can be agreed in companies with less than 50 employees). In this case, the reduction that this type of contract enjoys will be applied proportionally to the work hours of the employee.

Temporary Employment Agencies (ETTs): these may also issue training contracts

The possibility of issuing training contracts is now available to these companies to offer to their clients.

Groups of companies for the purposes of paying the economic contribution in case of dismissals

Companies that dismiss employees of 50 years of age or more, under the present norm must pay an economic contribution to the Public Treasury. The Royal Decree now determines expressly that a group of companies exists when one company exercises or can exercise, directly or indirectly, control of the other or others (the concept established under article 42.1 of the Commerce Codes is applied).

Holiday Accrual and Calculations

Each employee is entitled to a minimum of 30 calendar days of holidays per year. In the case of any leavers / joiners, the number of day’s holiday will be pro-rated as per the employees working time. Collective agreements or individual contracts can improve this entitlement or substitute it for an equivalent working days entitlement. The employee cannot “sell” unused leave back to the employer & receive monetary compensation if they do not use all their holiday entitlement. The only exception is when an employee leaves the company, and then unused vacation days can be paid.

More information regarding holidays can be found in the Workers’ Statute (Royal Legislative Decree 1 of 24 March 1995).

Maternity Leave

Maternity leave in Spain lasts 16 weeks for your first child with two additional weeks per subsequent child. These 16 weeks can be taken as full days or part days and the mother can choose when to take them, either before or after the birth but a minimum of six weeks must be taken after the birth.

In this way, it is possible for the mother to take leave from up to 10 weeks prior to giving birth.

State maternity benefits are paid by the Seguridad Social. This system covers Spanish citizens who live and work in Spain as well as foreigners who are official residents in Spain with a residence permit.

Self-employed mothers to be or mothers to be employed by others, meeting the necessary requirements are entitled to maternity leave. These requirements include the fact that you need to have been paying into the social security system for a certain period of time prior to giving birth.

If you are a mother under 21, there is no contribution period, if you are aged between 21 and 26 this period is minimum of 90 days’ worth of contributions in the previous 7 years, or minimum 180 days over the working lifetime, or, as a mother over age 26, the contribution period is a minimum of 180 days during the previous years, or a total of 360 days during their working lifetime.

Birth Leave

Paternity leave in Spain lasts 16 weeks. It is financed by Social Insurance Contributions from employers and employees.

The 6 weeks of Paternity Leave must be used immediately after the birth.

Fathers can use paternity leave part time with employer’s agreement. Regional or local variations applies in the leave policy.

Sickness

A worker, being registered with the Social Security Office, may receive subsidized pay if they are unable to work for reasons of sickness. There are a number of scenarios that revolve around how the illness arose and the length of time necessary before the worker can return to his place of employment:

|

Reason for sickness |

Time Off Work |

Responsible Party for Payment |

|

Common Illness |

0 - 3 Days |

No payment |

|

Common Illness |

4 -16 Days |

Employer |

|

Common Illness |

17 Days + |

Social Security |

The employer is liable to pay the subsidized rate of pay only in the scenario where the illness was a common illness unrelated to work and then only between the 4th and 15th days of the illness when the Social Security will pay.

Where a collective agreement established the obligation to cover an amount exceeding the statutory illness subsidies, the employer will cover certain percentages which can be 100% of the employee’s salary.

In the event of a work accident or professional illness, the employer is liable to pay a subsidized rate of 75% from the day following the event, the whole period will also be covered by Social Security. Collective agreements can also improve these subsidies.

The Social Security will pay the subsidized rate of pay until the worker is healthy enough to work again up to a maximum of 1 year, this may be extended by 6 months if the doctor feels that the worker will recuperate after this time.

At the end of 18 months, typically the doctor will either consider the patient to be permanently incapable of working or will approve discharge from Sickness Benefit.

National Service

There is no mandatory national military service in Spain.

Minimum Wage in Spain in 2024

The national minimum wage in Spain in 2024 has been raised by 4.5%, setting the new monthly salary for full-time workers at €1,134.

This increase will affect approximately two million workers in the country.

The Ministry of Labour and trade unions agreed on this new rate, which marks the highest ever minimum wage in Spain. Businesses had initially pushed for a 3% minimum wage increase, with an additional 1% to reflect inflation, but the final agreement settled at a 4.5% increase

Statutory National Holidays in Spain in 2024

There are multiple statutory holiday schedules within Spain. Below are the statutory national holidays in Spain for 2024.

|

Holiday |

Date |

Weekday |

|

New Year's Day |

2024-01-01 |

Monday |

|

Epiphany |

2024-01-06 |

Saturday |

|

Good Friday |

2024-03-29 |

Friday |

|

Labour Day |

2024-05-01 |

Wednesday |

|

Assumption of Mary |

2024-08-15 |

Thursday |

|

National Day of Spain |

2024-10-12 |

Saturday |

|

All Saints' Day |

2024-11-01 |

Friday |

|

Constitution Day |

2024-12-06 |

Friday |

|

Immaculate Conception |

2024-12-08 |

Sunday |

|

Christmas Day |

2024-12-25 |

Wednesday |

On top of National Public Holidays, Autonomous Communities are untitled to fix two additional Regional Public Holidays and Local Councils fix another two. Therefore, the total number of Public Holidays are fourteen.

Employee Benefits in Spain

Expenses

General expenses are normally reimbursed outside of the payroll.

Car mileage not greater than 0.19 euros per kilometer is not taxed. Only amounts above that are taxed.

Company car cost is included in the payroll as benefit in kind.

Royal Decree Law 16/2013 was approved on 20th December 2013 and addresses measures to favour stable contracting and to improve the employability of workers.

One of the measures taken that affects the payroll process is that which regulates the concepts included in the quotation base. Below is a breakdown of the concepts to be included and a copy of the Royal Decree Law.

The only concepts that are not included in the calculation of the base are as follows:

-

Amounts assigned for travel expenses

-

Meal payments if these are generated outside the municipality in which the work is habitually done

-

Indemnities for bereavement, transfers, suspension or dismissal

-

Social security payments, improvements on temporary handicap benefits granted by the company and amounts designed to cover study expenses for personnel preparation, updating or recycling

-

Overtime payments

Therefore, from now onwards the following remuneration concepts will be included in the calculation of the base and will increase it by the monthly amounts assigned to the benefits:

-

Urban transport plus

-

Distance plus

-

Free granting of shares or at a price below market value of shares even when these are below 12,000 Euros per year. Some conditions applied.

-

Canteens, company restaurants, company discount stores and indirect benefits, such as, meal cheques (restaurant Tickets) even when these are below 11 Euros per working day

-

Insurance policy payments for work-related accidents or third-party responsibility for workers

-

The provision of pre-scholar child education services (also includes cheques for kindergarten), primary, obligatory secondary, high school and professional training in authorised centres for employees ‘children, that are of a free nature or at prices below the normal market prices

-

Improvements in Social Security benefits other than Temporary handicap including the contribution to pension plans

The employer will need to provide all of the monthly amounts paid for these benefits to the payroll processor so they can be included in the calculation of base amount for social security purposes.

Key Updates for 2024 in Spain

In 2024, Spain has introduced several significant changes to its tax, social security, and employment laws (Royal Decree Law 8/2023). Here are the key regulations and legislation changes:

Income Tax Changes

- Reduced VAT Rates Extension: The reduced rates of Value Added Tax (VAT) for basic food products (0%) and for olive and seed oils and pasta (5%) have been temporarily extended.

- Electricity and Natural Gas VAT: The VAT rate for deliveries of electricity has been increased to 10% until 31 December 2024, and for natural gas until 31 March 2024.

- Special Tax on Electricity Increase: The rate of the special tax on electricity (IEE) has been increased to 2.5% and 3.8% during the first and second quarters of 2024, respectively.

- Tax on Large Fortunes: A temporary solidarity tax on large fortunes for individuals whose assets exceed €3m has been introduced, with varying tax rates depending on the asset value.

- Capital Income Tax Increase: The tax rate for capital income tax between €200,000 and €300,000 is increased to 27%, and for income above €300,000, it rises to 28%.

- Income Tax Reductions: Income tax has been reduced for people earning between €18,000 and €21,000, and the income exempt from personal income tax is increased from €14,000 to €15,000.

Social Security and Employment Law Changes

- Electric Vehicle Tax Credit: A 15% tax credit in personal income tax for the acquisition of new electric vehicles and the installation of battery charging systems in real estate owned by the taxpayer.

- Incentives for Housing Tenancy Contracts: Positive real estate income will be reduced by varying percentages based on several factors like location in a stressed residential market area, rental to people aged between 18 and 35 years, or use as social housing.

- Real Estate Tax Surcharge Increase: The surcharge that can be applied in local real estate tax to dwellings that have been empty for more than two years may be increased to 150%.

These changes reflect Spain's commitment to environmental sustainability, social welfare, and the restructuring of its tax system to ensure a fairer contribution from different income groups and asset holders.

Notes

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

Want to learn more about payroll, tax, social security and more?

Register free today to get the latest up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Let’s Partner

Talk to a specialist today and find out how we support the growth of over 500 businesses with a range of activpayroll solutions designed to help your global payroll and people operations succeed.