Switzerland

Switzerland, provides a wealth of opportunities for businesses due to its rich legacy of economic resilience with a forward-looking, innovative spirit. The nation's robust economy, powered by a dynamic financial sector and diversified industries, provides a fortress of stability for investors and entrepreneurs alike.

Need more information about payroll, compliance and social security in Switzerland?

Talk to a specialist

Our free global insight guide to France offers up-to-date information on international payroll, income tax, social security, employment law, employee benefits, visas, work permits and key updates on legislative changes and more in 2024.

Basic Facts About Switzerland

The existence of a sovereign state in the territory known as Switzerland dates back to the medieval period, but modern Sweden was established in 1848, with the adoption of the Swiss Federal Constitution.

Switzerland’s well-known status as a militarily-neutral country is also historically-established: the country hasn’t been in an armed conflict since 1815, but instead engages in international diplomacy as a way to influence world events.

Since it is not a member of the EU, Switzerland is broadly unrestricted by the associated financial and political regulations, but has bilateral trade agreements with the bloc and other global trading partners.

The geography of Switzerland is varied, and takes in the Alps, the Swiss Plateau, and the Jura Mountains.

The country’s temperate European climate and abundant natural beauty spots means it is a popular international tourist destination throughout the year.

General Information on Switzerland

- Full Name: Swiss Confederation

- Population: 8.775 million (World Bank, 2022)

- Capital: Bern Primary Language: German, French, Italian, Romansch

- Main Religion: Christianity

- Monetary Unit: 1 Swiss Franc (CHF) = 100 Rappen

- Main Exports: Machinery and electronics, chemicals, precision instruments, watches

- GNI per Capita: US $89,450 (World Bank, 2022)

- Internet Domain: .ch

- International Dialing Code: +41

How Do I Say in Swiss?

German (predominantly spoken in the central and eastern regions):

- Hello: Hallo

- Good Morning: Guten Morgen

- Good Evening: Guten Abend

- Do you speak English?: Sprechen Sie Englisch?

- Goodbye: Auf Wiedersehen

- Thank you: Danke

- See You Later: Bis später

French (predominantly spoken in the western part of Switzerland):

- Hello: Bonjour

- Good Morning: Bonjour (same as hello)

- Good Evening: Bonsoir

- Do you speak English?: Parlez-vous anglais?

- Goodbye: Au revoir

- Thank you: Merci

- See You Later: À plus tard

Italian (predominantly spoken in the southern part of Switzerland):

- Hello: Ciao

- Good Morning: Buongiorno

- Good Evening: Buonasera

- Do you speak English?: Parla inglese?

- Goodbye: Arrivederci

- Thank you: Grazie

- See You Later: A dopo

Romansh (spoken in some parts of the Canton of Graubünden)

- Hello: Allegra (informal) or Buna di (formal)

- Good Morning: Bun di

- Good Evening: Buna saira

- Do you speak English?: Discuorrast Vus englais? (formal) / Discuorras ti englais? (informal)

- Goodbye: A revair

- Thank you: Grazia (informal) / Grazia fitg (formal, means 'thank you very much')

- See You Later: A pli tard

Dates and Numbers in Switzerland

Dates can be written in the day, month and year sequence separated by a point. For example: 1 July 2012 or 01.07.2012

Numbers are written with an apostrophe to denote thousands and a point to denote fractions. For example: CHF 3’000.50 (three thousand Swiss Francs and fifty cents)

Doing Business in Switzerland

Switzerland stands as a premier destination for businesses seeking a strategic location in the heart of Europe, known for its economic stability, innovative environment, and high quality of life. As a country with a robust economy, Switzerland is known by its low unemployment rate, highly skilled labor force, and strong financial sector. Renowned for its precision engineering and high-quality manufacturing, Switzerland is home to a myriad of industries including pharmaceuticals, machinery, and chocolate.

The Swiss market is distinguished by its competitive tax rates and business-friendly regulatory environment, making it an attractive destination for international investors and corporations. With its multilingual workforce and a strong emphasis on research and innovation, Switzerland offers a conducive environment for businesses looking to drive growth and innovation. The country's commitment to maintaining a high standard of living, coupled with its strategic location providing easy access to European markets, makes Switzerland an ideal choice for businesses aiming to establish or expand their presence in Europe.

Why Invest in Switzerland?

Switzerland, provides a wealth of opportunities for businesses due to its rich legacy of economic resilience with a forward-looking, innovative spirit. The nation's robust economy, powered by a dynamic financial sector and diversified industries, provides a fortress of stability for investors and entrepreneurs alike. This stability is a bedrock for businesses, fostering a secure landscape where ventures can flourish and grow.

Strategically positioned in the heart of Europe, Switzerland is more than just a picturesque destination, it's a pivotal hub connecting businesses to the vast European market. The nation's top-notch transport and logistics network acts as your springboard, ensuring your business stays connected and agile, ready to leap into international markets.

Innovation isn't just a buzzword in Switzerland, it's the lifeblood that courses through the Swiss industries. From groundbreaking pharmaceutical breakthroughs to precision manufacturing and cutting-edge tech, Switzerland is a melting pot of global corporations and vibrant startups. The government's staunch support for research and development adds another layer of strength to this already dynamic ecosystem.

But it's not all about the work. Switzerland knows the value of a good balance, offering a quality of life that's as impressive as its mountain landscapes. With its commitment to environmental sustainability, safety, and high living standards, it's a place where talent thrives, and businesses can attract and retain the best in the field.

Choosing Switzerland for your business is more than an investment, it's a partnership with a nation that values economic stability, fosters innovation, and cherishes quality. It's where your business can set strong roots and grow, branching out into the European market and beyond.

Foreign Direct Investment in Switzerland

Switzerland is known for its liberal and open economic policy, creating an environment that is highly conducive to foreign investment. The Swiss government maintains a favorable stance towards foreign investment, offering a framework that encourages economic growth and international collaboration. Here's is an overview of some of the key foreign investment directives in Switzerland.

Non-Discriminatory Policy in Switzerland

Switzerland generally does not discriminate between foreign and local investors. Both are subject to the same conditions, promoting a fair and competitive business environment.

Regulatory Environment in Switzerland

The country has a transparent and reliable legal and regulatory framework. This provides clarity and predictability for foreign investors, ensuring that they can operate with confidence.

Investment Incentives in Switzerland

While Switzerland does not offer extensive investment incentives, the tax system is designed to be competitive and attractive for businesses. Certain cantons offer tax advantages for specific types of investments or operations, particularly those that are innovation-driven or can contribute significantly to the local economy.

Free Movement of Capital in Switzerland

Switzerland supports the free movement of capital, making it easy for investors to transfer funds in and out of the country. This is particularly beneficial for multinational companies that require flexibility in managing their finances across borders.

Property Ownership in Switzerland

Foreign investors have the right to own property and real estate in Switzerland, although there are some restrictions and regulations, particularly for residential properties.

Focus on Innovation and Research FDI in Switzerland

The Swiss government actively supports research and development activities. Foreign companies investing in R&D can benefit from a well-established infrastructure and collaboration opportunities with leading universities and research institutes.

Business Banking in Switzerland

In Switzerland, it is not mandatory to make payments to both employees and the authorities from an in-country bank account.

Salary payments and 3rd party payments can be made on behalf of the client.

Payments are usually made using bank transfers.

If transfers are being made within the same bank payment is usually within the same day, for any other bank within Switzerland transfers will usually complete within 2 days.

International transfers will take between 1 and 3 working days.

Registering a Company and Establishing an Entity in Switzerland

In Switzerland, establishing a legal entity is a key step for companies looking to operate within its borders, including the acquisition of all necessary insurances. The Swiss legal system recognises several types of corporate structures, each catering to different business needs and objectives. These include:

- Entreprise Individuelle (EI) - Ideal for sole proprietors, offering simplicity in setup and management.

- Société à Responsabilité Limitée (SARL) - Similar to a limited liability company, providing protection to its owners' personal assets.

- Société Anonyme (SA) - Known as a corporation, suitable for larger enterprises with a focus on public investment.

- Société en Nom Collectif (SNC) - A general partnership, perfect for small to medium-sized business partners seeking joint operation.

- Société en Commandite - A limited partnership, allowing for both active and silent partners.

Switzerland offers a notable provision for businesses that allows them to employ personnel without the need to establish a Swiss-based company. This flexibility is particularly advantageous during the preliminary stages when a company is exploring the business landscape and assessing the market potential in Switzerland. It offers a streamlined approach for international businesses to initiate operations and gauge market receptiveness without committing to full-scale operational setup immediately.

However, employing individuals under this arrangement necessitates the registration of employees as Non-Employer-Bearing Occupational Benefits (ANOBAG). This designation is crucial as it pertains to individuals who are employed in Switzerland by an employer not based in the country and thus, are responsible for their own social security contributions.

The implication of employing staff as ANOBAG is significant because it could lead to the business being considered as having a permanent establishment in Switzerland. This status is critical as it may subject the company to Swiss Value Added Tax (VAT) and profit tax obligations for the revenue generated within the country. The determination of a permanent establishment is a key factor in Swiss tax law, influencing how foreign companies are taxed and regulated, particularly in terms of their local economic engagement.

While this framework provides an agile method for businesses to test the Swiss market, it also introduces specific regulatory considerations. Companies must navigate the requirements of registering employees as ANOBAG and understand the tax implications of such arrangements. This complexity underscores the importance of comprehensive planning and consultation with tax and legal professionals familiar with Swiss regulations. These experts can offer invaluable guidance on establishing a compliant and effective operational framework, ensuring that businesses can explore Swiss opportunities while managing their regulatory obligations effectively.

For businesses considering entry into the Swiss market, understanding these nuances is crucial. Selecting the appropriate legal form not only aligns with strategic business goals but also ensures regulatory compliance and operational efficiency. As such, consulting with legal and tax professionals like activpayroll's Global Tax and Mobility Division familiar with Swiss corporate law is highly recommended to navigate these considerations effectively.

This approach ensures a comprehensive understanding of the Swiss business environment, facilitating informed decision-making and strategic planning for successful market entry and long-term operation.

Visas and Work Permits in Switzerland

In Switzerland, individuals who are citizens of a country within the European Union (EU) or European Free Trade Association (EFTA) do not require a work permit.

Foreign nationals do not require a residence permit if they’re employed in Switzerland for up to 3 months or 90 days per calendar year. However, employers must register the employee’s paid employment through the notification procedure for short-term work at least 1 day before employment is due to begin.

There is a temporary cap on the number of short-term permits and new residence permits that can be issued to Croatian nationals for 2024.

Foreign nationals who are employed for more than 3 months must apply for a residence permit from the Swiss commune in which they’re living before they start work. Employees must submit:

- A valid identity card or passport.

- Confirmation of employment from your employer or a certificate of employment (e.g. an employment contract).

Types of Work Permits in Switzerland

Permit B |

|

Permit C |

|

Permit L |

|

Permit G |

|

Tax System in Switzerland

Swiss Tax System and Corporate Taxation

The tax year runs from 1st January to 31st December.

Federal Taxation, Cantonal Taxation and Municipal Taxation in Switzerland

In Switzerland, taxes on LLCs and Corporations are collected by three different entities:

- The confederation: The Confederation levies a direct federal tax (IFD) on company profits.

- The cantons: Swiss cantons impose a cantonal tax. This is calculated both on the profit and capital of companies and varies from canton to canton.

- The municipalities: Municipalities levy a municipal tax, which also varies from one municipality to another.

Corporate Profit Tax in Switzerland

Like most OECD countries, Switzerland taxes LLCs and Corporations on the profits they make within its territory.

The profit tax is divided into two categories:

- Federal Profit Tax (IFD): This 8.5% tax is for the Confederation. It is the same in all Swiss cantons. It is collected by the cantons on behalf of the Confederation when the company files its annual tax return.

- Cantonal and Municipal Profit Tax (ICC): This tax is determined by each canton and municipality. It varies according to the cantons and municipalities. For example, in Geneva, the ICC rate on profits is 7.8%.

In Switzerland, taxes are a deductible expense for the company. This means that the profit tax rates apply to the net result. Switzerland also offers flexibility in accounting through hidden reserves which can help optimize taxation. Therefore, to make a comparison with other European countries, one must use the gross profit tax rate. In Geneva, the gross profit tax rate is 14% which is the net profit tax rate.

Capital Tax in Switzerland

The capital tax is levied only by the cantons. There is no federal levy on capital. This tax complements the cantonal and municipal profit tax. As this tax is levied at the cantonal level, its rate varies according to the cantons.

This tax is levied on all LLCs and Corporations. It is calculated based on their capital and the reserves built up over the years (capital contribution reserves, reserves from profit, carried forward profits).

Income Tax in Switzerland

Everyone who works in Switzerland with a salary that reaches the minimum threshold must pay income tax and if applicable wealth tax too, based on installments determined by the relevant tax authority.

However, there are two different ways to pay these taxes in Switzerland:

1. Through the employer

2. By the employee himself, depending on several criteria.

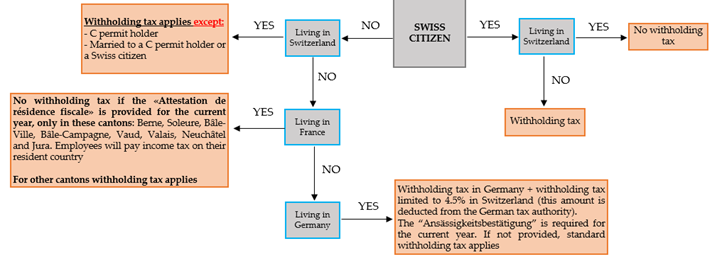

The situation of the employee, the employer will have to taxed him at source, so withholding tax applies in the payroll.

At the beginning of the following year, a reconciliation is done by tax authority when previous tax return is submitted.

Exceptions still apply - please see below:

The amount of tax depends (but is not limited to) the following:

- Place of residence (tax tariffs vary strongly within Switzerland)

- Civilian status

- Number of children

- Religion

- Income/wealth

For example: A single person with an annual income of CHF 120,000 in the canton of Geneva will be taxed at around 20% of their income. If they are married and have the same household income, they will be taxed at 12.25%.

In the canton of Zug, a single person with the same income will be taxed at around 8% of his or her income, and if the couple has the same income of CHF 120,000, the tax rate will be at 4%.

The employer must send to the tax authority a list of all the tax amount deducted on the employees’ salaries concerned and then the instance will send the invoice. Indeed, the employer must pay these amounts deducted to the tax authority.

The payment date for tax at source by the company is different among the cantons and depends on the authority. In most cases, the tax at source has to be paid around 30 days after receipt of the invoice. Filing deadlines are usually within less than thirty days after end of the reporting period. The penalty for late payment is normally up to 5%/year of the outstanding/due amount.

Social Security in Switzerland

- Old-Age, Survivors’ and Disability Insurance (The Three-Pillar System)

- Insurance Coverage in Case of illness And Accident

- Income Compensation Allowances in The Event of Compulsory Service And In Case Of Maternity,

- Paternity, Caring of a Seriously ill child or adoption

- Unemployment Insurance

- Family Allowances

Social security contributions are a set of dues and taxes borne by employees and employers, paid by the latter, and calculated on the total gross salary paid in Switzerland. There are several mandatory social security contributions in Switzerland that affect both employers and employees.

Below is a summary table of the social security contribution rates for employers and employees for the year 2024 in Switzerland.

|

Type of Social Insurance |

Employer Rate |

Employee Rate |

|

Old Age and Survivors' Insurance (AVS) |

4.35% |

4.35% |

|

Disability Insurance (AI) |

0.7% |

0.7% |

|

Income Compensation Allowances (APG) |

0.25% |

0.25% |

|

Unemployment Insurance (AC) |

1.1% |

1.1% |

|

Occupational Pension Plan (LPP) (average rate) |

6.5% |

6.5% |

|

Loss of Earnings Insurance due to Illness (non-mandatory - average rate) |

0.9% |

0.9% |

|

a) Professional Accident Insurance (AP) (average rate) |

0.8% |

0% |

|

b) Non-Professional Accident Insurance (ANP) (average rate) |

0% |

1.3% |

|

Total (subject to variations according to non-mandatory insurances) |

16.99% |

15.14% |

The AVS, AI and APG (1st Pillar) are social security charges paid jointly by companies and their employees, including ones with work permit, living in Switzerland or at the cross-border. They are billed monthly, quarterly or annually to companies by AVS funds. These form the first pillar of professional providence.

The total social security contribution rate for AVS, AI, and APG in 2024 is 10.6%, paid equally by the employer and the employee. The 1st Pillar is based on the principle of redistribution: the contributions of active workers are used to pay the pensions of retirees.

Old Age and Survivors Insurance (AVS) in Switzerland

The purpose of the Old Age and Survivors’ Insurance (AVS) is to guarantee a basic minimum income for individuals who retire as well as for survivors (widows, widowers, and orphans). AVS is a mandatory insurance that applies to all individuals residing in Switzerland as well as those working in the country.

All individuals aged 65 receive an AVS pension until their death. AVS is a social insurance in the true sense of the term: contributions are proportional to income, but pensions are capped at a relatively low level, 2,450 CHF per month max.

AVS contribution rates are paid equally by the employer and the employee. The AVS contribution rate in 2024 is 8.7%, which is 4.35% for the employer and 4.35% for the employee.

Disability Insurance (AI) In Switzerland

Just like the old age and survivors’ insurance, the disability insurance (AI) is mandatory for anyone residing in Switzerland or engaged in gainful activity there. It is part of the first pillar.

The purpose of the Disability Insurance is to ensure a means of subsistence for people who become disabled, through in-kind benefits or financial support in the form of pensions or allowances.

The contribution rate for the AI is 1.4%, paid equally between the employer and the employee, meaning 0.7% each. The AI contribution is collected at the same time as the AVS.

Income Compensation Allowances (APG) in Switzerland

The income compensation allowances (APG) cover loss of earnings related to military service as well as income loss related to maternity leave and paternity leave.

The contribution rate for the APG is 0.5%, paid equally between the employer and the employee, meaning 0.25% each. The APG contribution is collected at the same time as the AVS and AI.

2nd pillar: Occupational pension plan (LPP) in Switzerland

The 2nd Pillar, also known as occupational pension, aims to complement the benefits of the 1st Pillar, with the goal of reaching about 60% of the last paid salary. The legal basis for the 2nd pillar is the Swiss Federal Law on Occupational Retirement, Survivors' and Disability Pension Plan (BVG).

Throughout their career, each person builds up their own retirement capital, which will serve as the basis for generating future pensions.

The 2nd Pillar is based on the principle of capitalization. It is possible for an employee to make buy-ins into their 2nd Pillar throughout their career to increase their future pension.

The coordinated salary is the portion of the gross salary that is subject to mandatory insurance once the access threshold is reached.

The pension fund rates depend on age (older employees contribute more) as well as on the benefits offered by the employer who has subscribed to a provident pension fund.

The legal LPP rates are as follows:

- 25 – 34 years: 7%

- 35 – 44 years: 10%

- 45 – 54 years: 15%

- 55 –65 years: 18%

These rates are at a minimum shared between the employer and the employees. Some employers may decide to take on a larger portion of the LPP contributions, or even cover it 100%. That is why the pension fund contract is very important for the payroll implementation.

Unemployment Insurance (UI) in Switzerland

Unemployment insurance (UI) is a mandatory social insurance. All employees affiliated with the AVS as well as their employers are required to contribute to the UI. The employee and their employer each pay half of the contributions.

Unemployment Insurance is funded by the social contributions of employees and employers. Up to a limit of CHF 148’200, the contribution rate to the UI is 2.2% of the determining annual salary.

Workers who have already reached retirement age do not contribute to the UI.

Family Allowances (AF) in Switzerland

Employers are required to affiliate with a family allowance compensation fund in each canton where they have their headquarters or a branch. Branches are subject to the canton in which they are established, not the canton where the main office is located.

The rate for family allowances varies by canton, between 0.7% and 3.5%. Only the canton of Valais requires a contribution from employees of 0.3% of their salary. Contributions to family allowances specifically allow for the payment of monthly allowances as well as birth allowances paid at the birth of a child.

The family allowances contributions are 100% the responsibility of the employer.

Accident Insurance (LAA) in Switzerland

Accident insurance is mandatory for all employees working in Switzerland according to the federal law on accident insurance (LAA). The purpose of accident insurance is to help repair health damage and compensate for the loss of income suffered by individuals who are victims of an accident or an occupational disease.

All employees working in Switzerland are mandatorily insured against accidents. A person is considered an employee when they perform dependent gainful activity in the sense of the AVS. All employers must insure their employees, depending on the field of activity, with SUVA or another authorized insurer such as a private insurance company.

The premiums for mandatory accident insurance (also known as professional accident insurance) are 100% covered by the employer. The amount of the contributions is calculated on the LAA salary but up to a maximum of CHF 148’200 depending on the sector and the operational risks. ¨

In summary, the mandatory social security contributions in Switzerland for an employer employing employees are as follows:

- AVS/AI/APG with a rate of 10.6% of the gross salary (shared between employer and employee),

- Unemployment insurance (UI) with a rate of 2.2% of the gross salary (shared between employer and employee),

- Family allowances (AF) borne by the employer, with a rate varying by canton,

- Occupational pension plan (LPP) with a rate varying between 7% and 18% of the gross salary (shared between employer and employee),

- Professional accident insurance (LAA) covered by the employer, and non-professional accidents, covered by the employee, with the rate varying according to the company’s sector of activity.

The average social security contribution rate on a salary in Switzerland varies depending on the age and the canton where the company is located. Overall, the total social security contributions range between a rate of 20% and 40% of the salary.

Since these contributions are most often shared between the employer and the employee (AVS/AI/APG, UI, LPP), it is reasonable to say that the employer’s contribution rate on a Swiss salary ranges between 10% and 20% of the salary.

Reporting Tax in Switzerland

In Switzerland the 26 tax authorities (for 26 cantons) and approximately 100 governmental social security carriers (AVS/OASI/AHV) have their own forms and some variations in the specific data and reporting requirements.

Returns of tax at source must be filed to the tax authorities on a monthly or quarterly basis depending on the number of employees and canton. The data (income, tax code, tax deducted, and social security number) is usually required by individual employee. The deadline for this data is usually 10th of the next month.

At year end, the AHV needs two returns:

- A return of the total salary subject to the contributions (described in paragraph 3), to be filed by 30 January of the subsequent year.

- An estimate for the next year of total salaries subject to the contributions to be filed by year-end. (To avoid late interest, it is important to amend the total annual salaries amount during the year if this amount is over 20% compared with the amount at the beginning of the year)

Required reporting data also includes employment start date, employment end data (for leavers) and social security number to be filed by 30 January of the subsequent year or within 30 days for joiners respectively.

The documents have to be signed by the client (or a payroll provider where Power Of Attorney is available). After the return of the signed documents, the payroll company will submit them to the respective authority.

All of the documents mentioned above require the client’s signature (in case Power Of Attorney is not available) and the service provider then performs all filing.

New Employees in Switzerland

In Switzerland new employees must have the contract signed by the employer and the employee must include at least the following information:

- The name of the employee and the name of the employer.

- The date of commencement of the employment relationship.

- The employee’s function.

- The salary and any allowances.

- The weekly working hours.

By law, the first month of an open-ended employment relationship is considered a probationary period. This period can be excluded or extended up to a maximum of three months by written agreement.

The health insurance card or the personal insurance certificate must be presented to the new employer when changing jobs, and to the appropriate administration office when filing claims for benefits.

Leavers in Switzerland

For leavers in Switzerland a registered letter is the most recommended way to terminate employment for employers and must be include the following information:

- The complete and correct information (name, address) of employee and employer.

- The details of the employment contract to be terminated.

- The date which the employment relationship will terminate (taking notice period into account).

Employee’s must provide the following notice periods by law:

|

Years of Service |

Notice period |

|

During probation period |

7 calendar days |

|

After the probation period in the 1st year |

1 month |

|

2nd – 9th year |

2 months |

|

10th year or above |

3 months |

The date of cancellation is always rounded to the end of a month. Notice periods can only be reduced to less than one month by means of a CCL and only in the first year of service.

Payroll in Switzerland

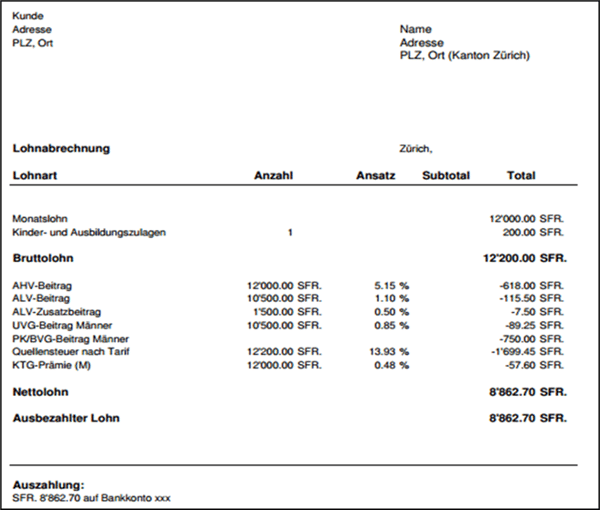

In Switzerland, payslips are usually distributed by ordinary mail or e-mail. If the payslips are available online, regulations of data security has to be observed.

Reports

Payroll reports must be kept for at least 10 years.

Swiss Payslip Example

Employment Law in Switzerland

Holiday Accrual and Calculations in Switzerland

In Switzerland, the regulations governing holiday accrual and calculations provide employees with a minimum entitlement to four weeks of paid annual leave per year, which applies regardless of whether the employee works full-time or part-time.

For younger employees, specifically those aged up to 20, the minimum entitlement increases to five weeks of annual leave. It's common for companies to offer at least five weeks of vacation annually to all employees, not just younger ones, as part of their employment packages .

Holiday entitlement and calculations expected to come into effect in 2024, reforms aim to simplify the process, particularly concerning the calculation of holiday pay and the accrual method for irregular hours and part-year workers. Definitions for irregular hours workers and part-year workers have been clarified to ensure accurate application of the law.

One of the significant changes is the introduction of "rolled-up" holiday pay from April 2024 for irregular hours or part-year workers. This method allows holiday pay to be calculated as an additional 12.07% of all pay for work done, with the requirement that this amount is clearly identified on the worker’s pay slip. This reform is designed to accommodate the unique employment patterns of irregular and part-year workers by providing a statutory basis for calculating holiday pay.

Maternity Leave in Switzerland

In Switzerland maternity leave regulations maintain a strong support system for expectant and new mothers in the workforce.

Mothers are entitled to 14 weeks of paid maternity leave upon the birth of their child. During this period, they receive compensation equivalent to 80% of their average earnings, capped at CHF 220 per day. To qualify for this benefit, employees must have been insured under the Swiss OASI/AHV scheme for nine months prior to the birth and must have worked for at least five months during their pregnancy. This ensures a broad coverage for both employed and self-employed women, as well as those receiving daily allowances from unemployment, invalidity, health, or accident insurance schemes based on previous employment.

In addition to the national regulations, the canton of Geneva offers an extended period of 16 weeks of maternity leave. It's important to note that if an employee chooses to return to work before the completion of the 14-week leave, their entitlement to further maternity benefits ceases. During pregnancy and up to 16 weeks following childbirth, employment termination protections are in place to safeguard the rights and well-being of mothers.

Maternity leave is designed to begin on the day of the baby's birth, with certain provisions allowing for flexibility in its commencement. For instance, should the newborn require hospitalisation for longer than 14 days immediately after birth, the maternity benefit period may be extended by up to 56 days, contingent upon the mother returning to work post-maternity leave.

Employers are mandated to adhere to specific protective measures for pregnant employees to ensure a safe and healthy work environment. These measures include restrictions on working hours, prohibitions on night work close to the birth date, and adjustments to work duties to mitigate health risks. Additionally, the law mandates provisions for breastfeeding mothers upon their return to work, including paid breaks for breastfeeding and expressing milk.

Paternity Leave in Switzerland

In Switzerland, paternity leave provisions have been established to support new fathers or the second parent in the family, reflecting the country's commitment to promoting work-life balance and parental involvement in early childcare. Eligible employees are entitled to take up to two weeks of paternity leave, which must be used within the first six months following their child's birth.

Eligibility criteria for paternity leave:

- Legal recognition: The individual must be recognised as the child's other parent under the law, or be eligible for such recognition within six months of the child's birth.

- Social insurance: The individual must have been insured under the Old Age and Survivors' Insurance (OASI) scheme for at least nine months preceding the child's birth.

- Employment requirement: The individual must have been in employment for at least five months within the nine months leading up to the birth.

Eligible employees receive paternity benefits equivalent to 80% of their average earnings prior to taking leave, subject to a maximum daily allowance of CHF 220. The OASI Compensation Office disburses paternity benefits directly to employers, who then forward the payments to the employees, substituting their regular salary during the leave period. As these benefits are considered income, contributions to OASI, Disability Insurance (DI), and Income Compensation (IC) schemes are duly deducted, ensuring that employees' social security coverages are maintained throughout their leave.

Sick Leave in Switzerland

In Switzerland, sick leave entitlement is designed with a focus on employee protection, ensuring employees are supported during illness with continued salary payments and protection against dismissal for specified periods.

Sick leave entitlement depends on the number of years’ service in Switzerland and an employee must be continuously employed for 3 months to qualify for payment.

Generally, employers need to obtain a medical certificate after 3 days off work. Mostly employers subscribe to a daily sickness benefit insurance which give a right to 80% of the employee’s salary for 720 or 730 days within 900 days.

If an employer doesn’t have sickness benefit insurance, employer must continue to pay an employee’s 100% salary, with regional entitlements detailed below:

|

Years of Service |

Basel – BS, BL |

Bern – BE, AG, OW, SG, West CH |

Zurich – ZH, GR |

|

1 |

3 weeks |

3 weeks |

3 weeks |

|

2 |

2 months |

1 month |

8 weeks |

|

3 |

2 months |

2 months |

9 weeks |

|

4 |

3 months |

2 months |

10 weeks |

|

5 |

3 months |

3 months |

11 weeks |

National Service in Switzerland

Switzerland requires every Swiss man to serve in the military or in an alternative civilian service. Men must complete basic training between the ages of 19 and 25, typically lasting 18 weeks.

Swiss women can serve on a voluntary basis.

Working Days and Working Hours in Switzerland

The working week in Switzerland is Monday to Friday.

According to article 9 of the Federal Labor Law the maximum working hours are 45 hours per week for the industrial companies, office staff, technical employees and other employees, including sales staff in large retail companies but 50 hours for all other sectors.

Overtime must be remunerated by a 25% wage supplement but there is an exception for sales, office and technical staff, who only receive this remuneration after 60 hours of overtime per year.

National Minimum Wage in Switzerland 2024

Unlike most European countries, there is no national minimum wage in Switzerland.

These differences are due to the Swiss federalist system, where each canton has significant autonomy in social and economic policy.

Instead of a legal minimum wage, Switzerland relies on wage negotiations between employers and employees, and on Collective Labor Agreements (CCT), which set minimum wages in certain sectors.

In 2024 in Switzerland, only these cantons have a Minimum Wage:

- Geneva: CHF 24.32 per hour (4'215,46 for 40 hours/week)

- Basel-City: CHF 21.70 per hour (3’761.33 for 40 hours/week)

- Neuchâtel: CHF 21.09 per hour (3’655.60 for 40 hours/week)

- Jura: CHF 20.60 per hour (3’570.66 for 40 hours/week)

- Tessin: CHF 19.50 per hour (3’380.- for 40 hours/week)

Employee Benefits in Switzerland

Expenses

Effective payments (including effective car mileage) may not be included in the payroll.

Lump sum payments have to be included into the salary and social security as well as tax at source must be deducted (if the company has no expense reimbursement policy approved by the tax authority).

If the employee has a company car, 9.6% per year of the purchase price of the car (0.9% per month of the net list price of the car) has to be included into payroll and social securities as well as tax at source have to be deducted.

Key Updates in Switzerland in 2024

In 2024, businesses and employees in Switzerland should be aware of several updates and changes to taxes, social security, and employment law.

Swiss Social Security Contributions Updates 2024

- The solidarity percentage for unemployment insurance contributions, previously applied to salary components exceeding a certain threshold, will be removed. Consequently, contributions will no longer be due on parts of the salary exceeding CHF 148,200 per year.

- The standard contribution rate up to this limit will remain at 2.2%, shared equally between employers and employees.

Swiss Income Replacement Regulations Updates 2024

- The maximum amount of compensation under the income replacement regulations, which includes maternity, paternity, care, and adoption compensation, is set to increase.

- This adjustment will raise the daily maximum compensation, affecting various groups, including mothers, fathers, and individuals adopting a child under four years old.

Swiss Maternity and Paternity Leaves Updates 2024

- If the mother dies within 14 weeks of the birth, the father or wife will be entitled to two weeks' paternity leave in addition to a further 14 weeks' leave. This additional leave must be taken uninterruptedly immediately after the death, ending in the event of resumption of gainful employment.

- If the father or wife dies within six months of the birth, the mother is entitled, in addition to 14 weeks' maternity leave, to an additional two weeks' leave, taken under the same terms as paternity leave.

Swiss Holiday Accrual and Calculations Updates 2024

- The upcoming 2024 reforms in Switzerland are set to streamline holiday pay and accrual for workers with irregular hours or those working part of the year. These reforms include clearer definitions for these types of workers, ensuring laws are applied correctly. A key update is the allowance of "rolled-up" holiday pay starting April 2024, where holiday pay will be a calculated additional 12.07% of wages, clearly itemized on pay slips, tailored to suit the varied working patterns of irregular and part-year employees.

Swiss Retirement Age Updates 2024

- Following the AVS21 reform accepted by the Swiss people, the same reference age for retirement should now apply to women and men. Women and men should now retire at the age of 65

- The reform, in force since 1 January 2024, allow to draw full AVS pension as early as two years before the age of 65. Employees can go into early retirement, but this reduces their pension in accordance with how early they went into retirement/started drawing your pension.

- From 2025, the government will begin to raise the retirement age for women to equal that of men at 65 years old. The change will be made gradually in four steps, starting with women born in 1961. By 2028, the retirement age will be 65 for everyone in Switzerland.

Swiss Professional Expense Allowances and Compensation in Kind Updates 2024

- The maximum deduction for travel expenses will see a slight increase due to compensation for the cold progression. However, the standard deductions for other professional expenses and the valuation of benefits in kind are expected to remain unchanged.

Swiss Tax Tables Updates 2024

- Personal income tax tables for both single and married individuals are updated annually.

- The tax rates and thresholds vary, ensuring a progressive tax system. The rates range from 0% for lower income brackets to higher rates for upper income brackets, ensuring a fair distribution of tax burden.

Swiss Salary Certificate Updates 2024

- In Switzerland, at the end of each calendar year, employers are obligated to provide their employees with a salary certificate. The salary certificate is a specific feature of Swiss payroll and salaries.

- Employers are obligated to provide a salary certificate annually to all their employees, whether they live in Switzerland or are cross-border workers.

- This certificate is generally sent out during the month of January or the beginning of February. The employer’s goal is to issue the salary certificate as quickly as possible to prevent employees from having to request an extension for their tax return.

- In cases where an employee holds multiple jobs at once or if they change employers during the year, they must receive a salary certificate for each job.

- The salary certificate is a document that certifies the compensation received by an employee during a calendar year.

- It is issued by the employer and includes numerous details, notably the annual income (salaries and bonuses), benefits, social security contributions, and allowances paid by the employer (maternity or paternity allowance).

- Accounting and payroll software offer the possibility to generate salary certificates for each employee. These certificates have barcodes to automate processing by the administration.

- Many specifics rules need to be understood to elaborate a salary certificate (some amounts and information have to be mentioned and some not). For example: Employers are not required to record the level of employment of their employees on the salary certificate.

Swiss Home Office Days and Cross-Border Commuters Updates 2024

- Employers are not required to record the home office days of their employees on the salary certificate. However, proper documentation is recommended, especially in international contexts or for cross-border commuters, to ensure correct social security deductions and withholding tax calculations.

- There are a lot of specific rules for the cross-border commuters and an agreement was signed by 20 countries, as of the 1st January 2024. Indeed, some impact on withholding tax or social security contributions could appear, depending on the rate of the remote work. For example:

- French cross border with remote work > 40% but < 50 % (annual rate), pro rata temporis for part time workers: the employee will be taxed at source in Switzerland even with the “attestation de residence fiscale” for the cantons related but exception for Geneva. The salary corresponding to all of remote work is taxed in the resident country and the salary that are not submitted to the remote working days will be taxed at source in Switzerland.

Notes

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

Want to learn more about payroll, tax, social security and more?

Register free today to get the latest up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Let’s Partner

Talk to a specialist today and find out how we support the growth of over 500 businesses with a range of activpayroll solutions designed to help your global payroll and people operations succeed.