Turkey

Turkey’s modern business environment is keen, dynamic and competitive, and the country enjoys a liberal trade relationship with the European Union and other key international partners.

Need more information about payroll, compliance income tax and social security in Turkey?

Talk to a specialist

Our free Global Insight guide to Turkey offer up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits, key legislation changes in Turkey in 2024 and more.

Basic Facts About Turkey

Turkey lies at the south-eastern edge of Europe, bordered by the Mediterranean and Black Seas, and represents a gateway to the Middle East.

The territory known as modern-day Turkey was inhabited for thousands of years by the Greek, Assyrian, Roman and Byzantine Empires - until the Ottoman Empire rose to power in the 14th century and ruled until the early 20th century.

After the First World War, the Republic of Turkey was formed in 1923, and the country emerged as a political presence on the world stage as a member of NATO, the UN and the OECD (amongst other international organisations).

Proximity to the Mediterranean brings warm, rainy summers to Turkey, and cold, rainy winters, while the eastern edge of the country can experience extreme cold and harsh winters.

Turkey’s coastline and beach resorts are beautiful and popular holiday spots, and draw millions of tourists each year.

General Information

- Full Name: Republic of Turkey

- Population: 8 million (World Bank, 2022)

- Capital: Ankara

- Major Language: Turkish

- Monetary Unit: Turkish Lira

- Main Exports: Clothing and textiles, fruit and vegetables, iron and steel, motor vehicles and machinery, fuels and oils

- GNI per Capita: US $10,674.5 (World Bank, 2022)

- Internet Domain: .tr

- International Dialling Code: +90

How Do I Say in Turkish?

- Hello: merhaba

- Good morning: sabah iyi

- Good evening: iyi geceler

- Do you speak English?: İngilizce biliyor musunuz?

- Good bye: elveda

- Thank you: teşekkür ederim

- See you later: sonra görüşürüz

Dates & Numbers

The date is written in the format year/month/day, for example, 2024 July 1 or 24/07/1.

Numbers are written with a comma to denote fractions, for example, ₺150,000.75. or 150,000.75 TRY.

Why Invest in Turkey?

The Turkish government welcomes inward investment from foreign multinational corporations. Government policy including low levels of taxation and attractive incentives provide a welcoming environment for investors. Turkey has a developed infrastructure and stable political environment that further supports investment opportunities.

Foreign Direct Investment in Turkey

The Turkish government welcomes inward investment from foreign multinational corporations.

Government policy including low levels of taxation and attractive incentives provide a welcoming environment for investors.

Turkey has a developed infrastructure and stable political environment that further supports investment opportunities.

Doing Business in Turkey

Between the Black Sea and the Mediterranean Sea, Turkey represents a gateway to Europe and Asia, with no less than 8 international neighbours - including Greece, Bulgaria and Georgia, and Iran, Iraq, and Syria.

While a historic political power in the region, Turkey emerged economically in the early 21st century: by 2010 a period of strong growth and modernisation had made it the 16th-largest economy in the world.

Turkey’s modern business environment is keen, dynamic and competitive, and the country enjoys a liberal trade relationship with the European Union and other key international partners.

Important industries in Turkey include textiles, energy and utilities, construction, tourism, and automotive manufacturing (in fact, the country accounts for over 7% of Europe’s total car production).

With strong economic growth over the past decade, and ongoing restructuring of the banking sector, Turkey is emerging as a business hub: it is a charter-member of the UN, a member of NATO, and an associate member of the European Economic Community.

In 2018, Turkey was ranked 60 on the World Bank’s Ease of Doing Business Survey.

Business Banking in Turkey

Employee salaries must be deposited into employee bank accounts no later than the agreed pay date. If the foreign bank has a branch in Turkey, it will be easier for the transmission of payment.

Banks are open Monday to Friday and closed on weekends.

Registering a Company and Establishing an Entity in Turkey

The main goal of the New Turkish Commercial Code (TCC) is to develop a corporate governance approach that meets international standards; to foster private equity and public offering activities; to create transparency in managing operations; and to align the Turkish business environment with EU legislation, as well as for the accession process.

A legal entity must be established in Turkey in order to process a payroll.

Turkey's regulatory environment is extremely business-friendly. You can establish a business in Turkey irrespective of nationality or place of residence.

Company Establishment in One Day

It is possible to establish a company in a single day by applying to the relevant trade registry office with the required documents. The company is established once the founders declare their intent to set up a joint stock company in the articles of association, which have been issued in accordance with the law, and where they, with their notarized signatures, unconditionally acknowledge and undertake to pay the whole capital. The company receives its “legal entity” status upon registration with the trade registry.

Types of Companies

Incorporated companies include:

- Joint-stock company (A.Ş.)

- Limited Liability Company (Ltd. Şti.)

- Commandite company

- Collective company

- Cooperative company

Joint Stock Company: The company’s stock capital is divided into shares and the liability of the shareholders is limited to the subscribed capital and paid by the shareholder. At least one shareholder (real person or legal entity) and a minimum capital of TRY 50,000 are mandatory. The mandatory company shall include a general assembly and a board of directors.

Limited Liability Company: A company established with at least one shareholder (real person or legal entity) and the liability of the shareholders is limited to the subscribed capital and paid by the shareholder. A minimum capital of TRY 10,000 is mandatory.

Commandite Company: A company established to operate a commercial enterprise under a trade name. Whereas the liability of some shareholders is limited to the capital subscribed and paid by the shareholder (commanditer), for some shareholders there is no limitation of liability. Legal entities can only be commanditer. No minimum capital is required. The rights and obligations of the shareholders are determined by the articles of association.

Collective Company: A company established to operate a commercial enterprise under a trade name and, the liability of none of the shareholders is limited only to the capital subscribed and paid by the shareholder. No minimum capital is required. It is mandatory that all the shareholders be real persons. The rights and obligations of the shareholders are determined by the articles of association.

Company Establishment Procedures

Three copies of articles of association (one copy original) which are notarized are prepared. Following the notarization of articles of association, within 15 days at the latest and application to the relevant trade registry office with the documents set below is needed.

Documents for the Company Establishment

- A company establishment petition and a notification form duly filled in and signed by persons authorized to represent the company. The list of the documents to be procured, and forms to be filled can be downloaded at sanayi.gov.tr and https://www.turkiye.gov.tr/hazine-ve-maliye-bakanligi

- Articles of association including notarised signatures of founders and notary certification proving that all shares constituting the registered capital have been subscribed by the founders in the articles of association

- Founders’ statement signed by the founders

- The bank letter proving that the share capital has been deposited

- The bank receipt indicating that 0.04% of the company capital has been deposited to the account of the Turkish Competition Authority at a state bank

- Permit or letter of compliance for companies whose corporation is subject to the permit or letter of compliance issued by the relevant ministry or other official institutions

- Notarized copy of signatures of persons with the authority to represent and bind the company

- Application number indicating that the trade name to be used has been checked and confirmed by the Trade Registry Office

- Company establishment statement form (3 original copies)

- Certificate of residence of founding partners

- Notarized translation of passport in the case of the foreign shareholder being a real person; apostilled and notarized translation of registry document issued by the competent authority in case the foreign shareholder is a legal entity

Registration with the Tax Office

Please note, corporate entities require an office address to be registered with the tax office on the same day or before the registration date. A tax registration number is received and legal books are certified by a Public Notary. The rent contract must be certified by the Notary Public as well as the notarised Circular of Signatory which should be submitted to the related Tax Office.

The registrations of the company for payroll purpose with the Tax and Social Security Institute are completed during the legal entity establishment process.

It is worth mentioning that having the “umbrella service” which some payroll provider’s offer can be a solution for processing payroll without a legal entity in Turkey.

Visas and Work Permits in Turkey

Should an individual wish to work in Turkey, they must apply for a work permit and visa at the nearest Turkish diplomatic mission no later than a month before they are scheduled to arrive in Turkey.

To apply, an individual will have to provide the following documentation:

-

Passport

-

Visa application form

-

Letter from the employer you intend to work for

The employer should submit various additional documents to Turkey's Ministry of Labour and Social Security (MLSS) within three working days after the individual applies for their work permit and visa. Applications are finalised by the MLSS within ninety days at the latest.

An individual must register with the police in Turkey near where they intend to live to acquire the necessary Residence Permit. This must be done before starting work in Turkey, and one month after arrival in Turkey at the latest.

It may take as long as two months for a Residence Permit to be sent to the individual once they have applied for it. Until an individual has received the Residence Permit, they may not leave Turkey. It is illegal to leave Turkey without having the Residence Permit, if an individual does leave without first having obtained their Residence Permit the consequence is generally a substantial fine.

A valid work permit, as well as the Work Permit Exemption Confirmation Document, is considered as residence permit.

Income Tax in Turkey

Monthly income tax contributions are due on the 26th of the following month (the same day the declarations are due). Late payments are subject to penalties.

Tax is withheld from employee gross income (cash or in kind) earned by the employee in return for employment in any given calendar year. Taxable gross income brackets and 2021 rates are shown below (Liaison (representative) offices of companies based abroad are exempt from tax)

Tax rates

|

taxable Income bracket |

Tax Rate |

|

0 and up to 110,000 TRY |

15% |

|

110,001 TRY and up to 230,000 TRY |

20% |

|

230,001 TRY and up to 870,000 TRY |

27% |

|

870,001 TRY and up to 3,000,000 |

35% |

|

3,000,001 TRY and above |

40% |

Social Security in Turkey

Monthly social security contributions (E-Declaration) must be submitted as per above method by the 26th of the following month and premium contribution amounts must be paid by the last day of the following month. SSI contributions are paid to the SSI office.

Late submissions and payments will be penalised.

Percentage of SSI contributions by employee and employer can be seen below:

|

Insurance branch |

Employee Ratio (%) |

Employer Ratio (%) |

Total |

|

% |

|||

|

Disability, Old Age and Survivor's Insurance |

9 |

11 |

20 |

|

Short Term Insurance (Insurance of Occupational Accidents and Professional Diseases, Illness, Maternity Insurance) |

- |

2 |

2 |

|

General Health Insurance |

5 |

7,5 |

12,5 |

|

Unemployment Insurance |

1 |

2 |

3 |

|

TOTAL |

15 |

22.5 |

37.5 |

A government incentive of 5% is given to companies for the continued employment of regular employees under law number 5510. Companies who do not pay their premiums by the due date will lose this incentive for the month of the late payment.

Reporting Tax in Turkey

Monthly

All reporting in Turkey is done monthly. There are no additional quarterly or year-end procedures.

- New Social Security Institution (SSI) registrations

- Declaration of missing days

- E-Declarations (Social Security – 26th of the month)

- Reports (common reports i.e. Payroll Reports, GL, Payroll Summaries, Pay slips etc.)

New Employees in Turkey

The employer must notify authorities of new starts immediately by submitting a notice of employment. The registration for a new start should be filed online on the SSI (Social Security Institution) registration website. The new employee should be registered one day before their start date (working day) at the latest. The employees cannot be paid legally without registration; it can take up to a month and a half for all of the registrations to be completed.

The table below outlines the information required to set up a new start:

|

General Information (English) |

Bank Information |

|

Name/Surname |

Bank Name-Branch |

|

Work Place/Location |

Bank Branch Code |

|

Department/Job Title |

Bank Account No |

|

Commencement Date |

Identity Information |

|

Agreement Type (Full Time/ Part Time) |

Birth Place |

|

Normal/Retired |

Birth Date |

|

State of Disability/Disablement Degree |

Nationality |

|

SSI No. |

Gender |

|

Turkish ID Number |

Marital Status Education Status |

|

Salary |

Contact Information |

|

Monthly Salary |

Address |

|

Salary Type (Gross/Net) |

City/County |

|

Cumulative Income Tax Base from Previous Workplace |

Home Phone |

|

Recurring Payments |

Cell Phone |

Expat new starts

Expat new starts are required to provide the following documentation:

- Passport

- Permit residence (original and copy, this should be taken from the Foreign Branch of the District Police Headquarters)

- Six small passport style photographs

- Diploma

- Contract

- Application form from Labour Ministry

- Employer address from General Directorate of Population and Citizenship Affairs

- Copy of employer’s ID card

- Employers’ e-state code

Leavers in Turkey

All leavers should receive their final pay on their termination dates. Some employers form an agreement with their departing employees to make the final payment on a date other than termination. Whilst this is generally frowned upon, it is a common practice among employers.

Employee terminations must be reported within 10 days by filling in the online form on the SSI portal.

Employer terminations incur a termination indemnity depending on the duration of the employee’s time with the employer. The payment is calculated as taking the latest salary as the base and making 1 month’s salary worth of payment to the employee for each year the employee fulfilled. However, there is a maximum termination indemnity amount decided for each 6-monthly period. The amount for the first half of 2021 is 7638,96 TRY.

By mutual agreement, both parties can terminate the employment if it is an open-ended employment contract, under the condition that the required notice period is given. The notice period will depend on the number of months the employee has worked for a company, as shown below:

|

number of months worked |

Notice period |

|

Less than 6 |

2 weeks (14 days) |

|

6 months to 1.5 years |

4 weeks (28 days) |

|

1.5 years to 3 years |

6 weeks (42 days) |

|

More than 3 years |

8 weeks (56 days) |

Notice periods can be substituted by payment in lieu. The employer may terminate the employment contract by paying in advance the wages corresponding to the term of notice.

During the term of notice the employer is obligated to give the employee at least two working hours per working day as job searching leave, as well.

Under certain circumstances, the employer and employee can terminate the employment agreement without notice.

Payroll in Turkey

It is legally acceptable in Turkey to provide employees with online payslips upon the receipt of written approval from the employee.

Reports

The retention period for payroll data is 10 years.

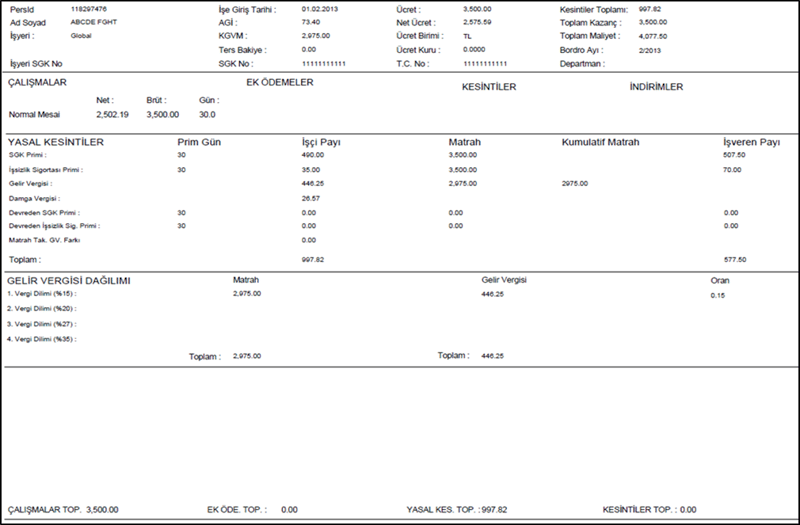

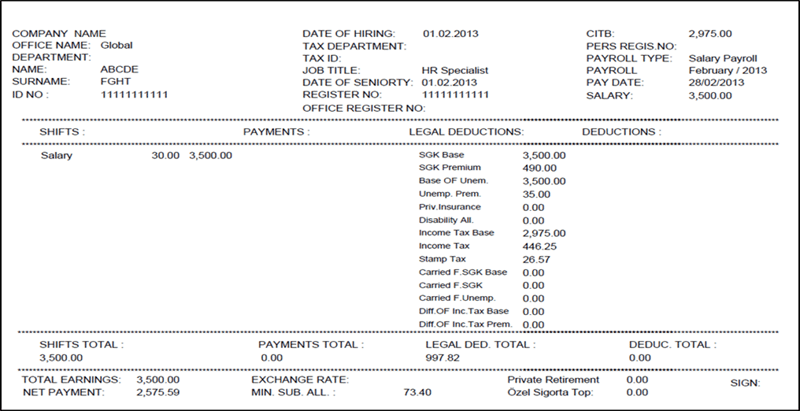

Payslip Example

Local language - Turkish payslip example:

English language payslip example for turkey:

Employment Law in Turkey

Annual leave and Holiday Entitlement in Turkey

Turkish employees are entitle to annual paid leave and holidays. Annual leave allowance is based on the length of employment and is as follows:

- 5-15 years = 20 days

- More than 15 years = 26 days

Those aged 18 and younger and those aged 50 and older are entitled to a minimum of 20 days, regardless of how long they have worked for a company.

In addition, employees are also allowed to take up to four days’ leave without pay, on the condition that the employee provides evidence that they are spending their annual leave at a place other than where the work place is located.

Maternity Leave

The maternity leave period is 16 weeks. In case of multiple pregnancies, the leave is increased to 18 weeks. Upon request, the employee may be granted unpaid leave of up to six months after the 16 weeks expire. When the mother starts working, she has the right to use 1.5 hours per day for breast-feeding. The breast-feeding leave period is for the 1st year of the child and this leave may be used as total (by adding the hours/ working hours).

Once maternity leave has ended, working women (or the male/female adopter of a child under 3) can reduce their working time by half for up to 60 days for the first child, 120 days for the second child and 180 days for the third child. All non-worked hours will be compensated by the state.

Any one of the working parents can reduce their working hours by half until the child begins school. The same rights are granted to adopting parents.

If the mother dies during or after childbirth, the father can use any remaining unused leave.

Adoptive parents who adopt a child under the age of three will receive eight weeks of maternity leave starting from the date the child is handed over to them.

The right of the mother to have six months unpaid leave after the childbirth will be granted to one of the married couple or the adopter of a child under the age of three.

Paternity Leave

An employee is entitled to 5 days paternity leave with pay, should their spouse give birth.

Sickness

The medical report has to be assigned onto the SSI portal the day after the report finishes and payment is taken from the SSI. In order to claim sickness benefits, the claimant must be in insured employment, be a dependent of the insured person or a pensioner. Medical treatment is provided until the insured person is back to full health.

For accidents at work, the employer should pay the first 15 days and all additional days will be paid by government pension. As it is a work-related incident, if the employee is on leave for over 15 days, he/she shall be entitled to a year of work stability.

Other Leave of Absences with Pay

Employees shall be allowed to take a leave of absence with pay in the event of the below.

|

Event |

Length of absence |

|

Employee’s marriage |

3 days |

|

Employee’s adoption of a child |

3 days |

|

Death of the employee’s mother, father or spouse |

3 days |

|

Brother and sister, and child |

3 days |

|

Employee’s spouse giving birth |

5 days |

|

Employed parents whose child has at least seventy percent disability or chronic disease based on a medical |

10 days |

Remuneration of above leaves shall be paid by the employer, and such leaves shall be regarded as worked in computation of the length of service required to qualify for paid annual leave.

National Service

In Turkey, national service is compulsory only for men. In 2024, compulsory military service is 6 months. Paid military service is 28 days, and this military service can be completed by receiving basic military training.

Minimum Wage in Turkey in 2024

The national minimum wage in Turkey for 2024 is as follows:

- Net monthly minimum wage 17,002 Turkish lira

- Gross amount is 20,002.50 Turkish lira

Working Days and Working Hours in Turkey

Employees in Turkey can work a maximum of 45 hours per week, generally spread over six days of the week so as not to exceed seven and a half hours per day.

By mutual consent, weekly working time may be divided differently.

Sunday is rest day in Turkey, however some workplaces allow employees to work on Sundays with a permit.

Lunch breaks are usually one hour.

The official work week in Turkey is between Monday-Saturday.

Statutory National Holidays in Turkey 2024

Turkish national public holidays in Turkey in 2024 when banks, offices and businesses are closed are as follow:

|

Date |

Day |

Holiday |

|

2024-01-01 |

Monday |

National Holiday |

|

2024-04-09 |

Tuesday |

Half Day |

|

2024-04-10 |

Wednesday |

National Holiday |

|

2024-04-11 |

Thursday |

National Holiday |

|

2004-04-12 |

Friday |

National Holiday |

|

2024-04-23 |

Tuesday |

National Holiday |

|

2024-05-01 |

Wednesday |

National Holiday |

|

2024-05-19 |

Sunday |

National Holiday |

|

2024-06-15 |

Saturday |

Half Day |

|

2024-06-16 |

Sunday |

National Holiday |

|

2024-06-17 |

Monday |

National Holiday |

|

2024-06-18 |

Tuesday |

National Holiday |

|

2024-06-19 |

Wednesday |

National Holiday |

|

2024-07-15 |

Monday |

National Holiday |

|

2024-08-30 |

Friday |

National Holiday |

|

2024-10-28 |

Monday |

Half Day |

|

2024-10-29 |

Tuesday |

National Holiday |

Islamic Holidays

Two Islamic religious festivals are also important national holidays in Turkey:

- Ramazan Bayramı following the holy month of Ramazan

- Kurban Bayramı

Both of these holidays are celebrated according to the traditional Islamic Hijri lunar calendar, so their Common Era calendar dates change each year.

Employee Benefits in Turkey

Expenses

The expenses such as general expenses, car mileage and company cars are not entered into the payroll. The accounting department is responsible for processing expenses.

Other common expenses:

-

Expenses that are associated with meetings (transportation, meal, everything that is charged to the company)

-

Telephone (receipts should have the name of the company)

-

Computers

-

Everything that is done on behalf to the company is an expense and it is not processed via payroll but by the accounting department.

Minimum Wage Tax Exemption

With the new regulation, the minimum living allowance will not be applied to wage payments made as of January 1, 2022. According to the this regulation, the determined minimum wage amount will be subjected only SSI deduction, income tax and stamp tax will not be deducted.

Employees who earn over the minimum wage will not be subject to income and stamp tax on their wages corresponding to the minimum wage.

|

Family Status |

Amount |

|

Single or employed spouse – no children |

268.31 TRY |

|

Single or employed spouse – 1 child |

308.56 TRY |

|

Single or employed spouse – 2 children |

348.81 TRY |

|

Single or employed spouse – 3 children |

402.47 TRY |

|

Single or employed spouse – 4 children |

429.30 TRY |

|

Single or employed spouse – 5 children |

456.13 TRY |

|

Married with unemployed spouse – no children |

321.98 TRY |

|

Married with unemployed spouse – 1 child |

362.22 TRY |

|

Married with unemployed spouse – 2 children |

402.47 TRY |

|

Married with unemployed spouse – 3 children |

456.13 TRY |

Key updates for 2024 in Turkey

In Turkey, the key changes to personal income tax, social security, and employment law for 2024 include:

- Increase in Social Security minimum gross and net wage amounts: The minimum gross wage for Social Security has been raised to TRY 20,002.50 and the net amount to TRY 17,002.12. The monthly Social Security Insurance ceiling amount has also been increased to TRY 150,018.90.

- Changes in Income Tax Brackets and Exemptions: The income tax brackets have been adjusted. For example, a 15% tax rate is applicable for income up to TRY 110,000, with higher rates for larger income brackets. There are also adjustments in exemptions for various allowances such as meal, transportation, and disability.

These changes are expected to have significant implications for payroll processing and employee net income in Turkey.

Notes

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

Want to learn more about payroll, tax, social security and more?

Register free today to get the latest up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Let’s Partner

Talk to a specialist today and find out how we support the growth of over 500 businesses with a range of activpayroll solutions designed to help your global payroll and people operations succeed.