USA

The United States of America, often referred to as the "land of opportunity," is renowned for its dynamic economy, innovative spirit, and business-friendly environment. As the world's largest economy, the U.S. offers unparalleled opportunities for businesses looking to expand, innovate, and compete on a global scale.

Need more information about payroll, compliance and social security in the USA?

Talk to a specialist

Our free global insight guide to America (USA) offers up-to-date information on international payroll, income tax, social security, employment law, employee benefits, visas, work permits and key updates on legislative changes and more in 2024. Our guide to America in 2024 is currently being updated and will be published soon.

Basic Facts About the USA

The United States of America, or the United States, is located in North America, with most of its land mass bordered by Canada to the north and Mexico to the south. The US consists of 50 states, 16 territories and the District of Columbia. The island state of Hawaii lies in the Pacific Ocean.

The US government consists of a bicameral legislature, a judicial branch headed by the US Supreme Court and an elected president, all of which oversee the nation’s employment-related tax, labor and compensation and benefits laws. States, territories and localities also are given significant authority to enact laws affecting employment.

General Information

- Full Name: United States of America

- Population: 333.2 million (World Bank, 2022)

- Capital: Washington DC

- Major Language: English

- Major Religion: Christianity

- Monetary Unit: United States Dollars ($)

- Main Exports: Computers and Electrical Machinery, Vehicles, Chemical Products

- GNI per Capita: US $76,370 (World Bank, 2022)

- Internet Domain: .us

- International Dialling Code: +001

Dates

Dates are usually written in the month, day and then year sequence. For example, July 1 2024 or 7/1/2024 Numbers are written with a comma to denote thousands and a period to denote fractions. For example, $ 3,000.50 (three thousand dollars and fifty cents).

Doing Business in USA

The United States of America, often referred to as the "land of opportunity," is renowned for its dynamic economy, innovative spirit, and business-friendly environment. As the world's largest economy, the U.S. offers unparalleled opportunities for businesses looking to expand, innovate, and compete on a global scale.

The U.S. economy is renown for its diversity, with significant contributions from technology, finance, healthcare, consumer goods, and manufacturing sectors. This economic diversity not only provides stability but also offers multiple avenues for business ventures and investments. The U.S. is home to some of the world's most successful companies and brands, reflecting its status as a global leader in innovation and entrepreneurship.

America is at the forefront of technological advancement and innovation. The country's emphasis on research and development (R&D), coupled with its world-class universities and institutions, fosters an environment where innovation thrives. Silicon Valley, for instance, is globally recognised as the epicenter of technology and startups, making the U.S. a prime destination for tech entrepreneurs and investors.

The U.S. boasts a well-established legal and regulatory framework that protects businesses, intellectual property, and investments. This framework provides a level of certainty and security for entrepreneurs and businesses, making it an attractive environment for domestic and foreign investments. The rule of law, transparency, and a fair judicial system are hallmarks of the American business landscape.

America's workforce is diverse, skilled, and highly innovative. The country's education system and policies aimed at attracting global talent contribute to a labor pool that is adaptable and capable of driving growth across industries. The cultural diversity within the U.S. also offers businesses a unique perspective, enhancing creativity and problem-solving abilities.

Doing business in the U.S. provides strategic access not only to the domestic market but also to global markets. The country's trade agreements and international partnerships facilitate cross-border trade and investment, allowing businesses to tap into new markets and customer bases.

Doing business in America offers a blend of opportunities for growth, innovation, and global expansion. The combination of a robust economy, a culture of innovation, access to capital, and a supportive legal framework makes the U.S. an attractive destination for businesses of all sizes.

Why Invest in the USA?

Investing in the United States of America presents a unique proposition for global investors, combining a robust economic landscape with unparalleled market opportunities. As the world's largest economy, the U.S. is synonymous with innovation, offering a fertile ground for growth across diverse sectors.

The sheer scale of the U.S. economy provides a vast and dynamic market for businesses of all sizes. From cutting-edge technology to manufacturing, healthcare, and services, the U.S. market is diverse, offering numerous investment opportunities. Its economic stability, supported by strong institutions and a resilient financial system, further enhances its attractiveness as an investment destination.

The U.S. stands at the forefront of global innovation, home to Silicon Valley and numerous other tech hubs across the country. It leads in research and development (R&D), digital technology, biotechnology, and renewable energy, among other sectors. This culture of innovation is supported by world-class universities and research institutions, fostering a competitive edge for businesses operating within its borders.

The U.S. offers unrivaled access to funding, with its sophisticated and liquid financial markets. From venture capital for startups to extensive options for public financing, businesses can find the necessary capital to grow and expand. This ecosystem of financial support is a significant draw for entrepreneurs and established companies alike. Investors in the U.S. benefit from a robust legal framework that protects intellectual property rights, enforces contracts, and provides mechanisms for dispute resolution. This legal environment, rooted in the rule of law, offers security and predictability for foreign and domestic investors, safeguarding their interests.

The U.S. offers a high quality of life, with advanced infrastructure, healthcare, and education systems. This environment not only attracts global talent but also contributes to a stable and productive living and working environment for employees and their families.

Investing in America offers a strategic advantage to global investors, characterized by its economic leadership, innovation ecosystem, and access to capital. The U.S. market's scale, combined with its legal protections and skilled workforce, provides a strong foundation for business growth and expansion.

Foreign Direct Investment in the USA

Foreign Direct Investment (FDI) in the United States presents a compelling growth avenue for global investors, driven by the country's unparalleled market size, innovative ecosystem, and robust economic fundamentals. The U.S. consistently ranks as one of the top destinations for FDI, reflecting its status as an economic powerhouse and a beacon of innovation.

The United States welcomes FDI across all sectors, with no general restrictions on foreign ownership or control. The U.S. government provides various resources and services to support foreign investors, including the SelectUSA program, which offers investment facilitation, information sharing, and ombudsman services. The legal and regulatory environment is designed to ensure transparency, fairness, and predictability for foreign investors.

Investing in the U.S. offers strategic advantages, including access to the world's largest consumer market, a culture of innovation and entrepreneurship, and a highly skilled workforce. The U.S.'s extensive trade agreements and global economic influence further enhance its attractiveness as an investment destination.

The U.S. provides a range of incentives to encourage FDI, which may vary by state and locality, including:

- Tax Incentives: Many states offer tax credits, exemptions, or deductions to foreign investors to stimulate economic growth and job creation.

- Grants and Financing: Foreign investors may qualify for grants, loans, and other financing mechanisms, especially in sectors like renewable energy, technology, and infrastructure development.

- Customs and Duty Benefits: Programs like Foreign Trade Zones (FTZs) allow businesses to reduce, defer, or eliminate customs duties on imported goods used in manufacturing.

Key Sectors for FDI in America

- Technology and Innovation: The U.S. is a global leader in technology and R&D, attracting significant FDI in software, IT services, biotechnology, and clean energy technologies.

- Manufacturing: The manufacturing sector, from automotive to aerospace and pharmaceuticals, benefits from America's advanced production capabilities and extensive supply chains.

- Real Estate: The U.S. real estate market, including commercial, residential, and industrial properties, offers diverse opportunities for foreign investment.

- Financial Services: America's mature financial markets, encompassing banking, insurance, and investment services, draw substantial foreign capital.

- Energy: The energy sector, including traditional, renewable, and emerging technologies, is a significant FDI recipient, supported by the country's vast natural resources and commitment to energy innovation.

Business Banking in the USA

It is mandatory to make payments to both employees and the authorities from an in-country bank account.

Generally, banks are open to the public from 0900 to 1700 hours Monday to Friday, and 0900 to 1400 hours on Saturdays.

Registering a Company and Establishing an Entity in the USA

This information is currently being updated for 2024.

All companies are required to have a legal entity established in order to process a payroll.

An employer must have an Employer Identification Number (EIN) before remitting forms and withheld taxes to the IRS.

Employers can apply for an EIN online using the IRS website, by calling 800-829-4933, or by faxing or mailing Form SS-4, Application for Employer Identification Number, to the IRS.

Employers must also register to pay federal taxes electronically through the Electronic Federal Tax Payment System.

Federal Income Tax in America (USA)

This information is currently being updated for 2024.

The tax year runs from 1 January to 31 December.

Employers in the U.S. are responsible for withholding federal income taxes, social security and Medicare taxes as well as state and local income taxes where applicable. While some states also require withholding from employees for unemployment taxes, the large majority of unemployment taxes are borne by the employer. Most states, territorial governments and some localities may also collect employer taxes and have their own labor-related ordinances as well as rules for providing workplace protections and benefits for employees.

Foreign workers in the U.S. are generally taxed on income sourced in the U.S., may be covered under the U.S. Social Security and Medicare programs, and are covered by federal labor law.

The tax year for employment taxes is the calendar year, from Jan. 1 to Dec. 31. Tax amounts reported below are in U.S. dollars.

Federal Income Tax

The Internal Revenue Service administers federal income taxes in the U.S. The set of laws governing income tax assessments and collections is called the Internal Revenue Code.

Coverage: Employers must withhold federal income tax from their employees. Generally, a person, business, or other entity is considered an employer for purposes of the federal income tax withholding (FITW) laws and rules if it is the recipient of services performed by one or more employees and has the right to direct or control the performance of these employees. A parent corporation that pays the wages of a subsidiary’s employees is the employer of those workers for purposes of federal income tax withholding, even though the employees work only for and under the direction and control of the subsidiary.

Employees: Employees are to provide to employers their social security number (SSN). Generally, U.S. citizens and residents pay U.S. income tax on their worldwide income, with any double taxation addressed with foreign tax offsets. Nonresidents generally can be subject to income taxes on amounts sourced in the U.S., but this may be dependent on any valid treaty exemption and visa status.

Rates and Thresholds: Tax rates range from 10 percent to 37 percent. Withholding tax amounts are based on income earned at graduated levels, taking into account filing status and allowances for spouse and dependents. Employees are to complete federal Form W-4, Employee’s Withholding Allowance Certificate, to indicate marital status and dependent or other allowances claimed, and provide that form to their employer. Employers use the information on Form W-4 to calculate the income taxes to be withheld each pay period. Employees who do not provide a completed Form W-4 have their taxes withheld based on the filing status of single with 0 allowances.

For supplemental wages or pay generally not occurring on a regular basis, such as bonuses, employers may have the option of withholding taxes based on filing status or using a flat 22 percent rate. For supplemental wage amounts exceeding $1 million in a year, employers have no option and must withhold federal taxes at a flat 37 percent rate at time of payment.

Taxable Amounts: Wages subject to federal income taxes include salaries, vacation allowances, bonuses, commissions, and fringe benefits. These payments may be in cash or other forms. In general, all tangible and nontangible items received by employees related to services for an employer are considered taxable unless specifically excepted from tax by the federal Internal Revenue Code or Treasury Regulations.

Employer-sponsored retirement plans, including certain deferred compensation plans under Section 401(k) of the Internal Revenue Code allow employees to reduce initial taxable wages by deferring amounts up to an annual threshold amount into a the plan. Employer contributions also can be made without initial tax consequences up to certain limits. Employer and employee contributions to IRC Section 125 cafeteria plan benefits generally are not taxable unless the employee elects to receive the benefit in cash.

Employer-provided health care plans are required for many employers and can be provided without tax consequences to employees. Adoption assistance payments up to certain amounts per year also can be excluded from income taxation. The cost of group-term life insurance coverage of up to $50,000 is excluded from tax.

Certain fringe benefits, such as educational assistance, employer-provided mobile phones, qualified transportation fringe benefits, and some meals, up to certain amounts, generally are not subject to federal income tax withholding.

Withholding Methods: Employers generally use the federal percentage method to determine the amount of withholding for each pay period, applying employee allowances included on Form W-4 to the figure tax to be withheld each pay period. The percentage method provides eight tables organized by payroll period and marital status, and withholding of tax occurs at the time payment is made.

Nonresident Income Tax

Nonresident aliens usually are subject to U.S. income tax only on income from sources within the U.S. Investment income is taxed at a flat rate of gross income. Business income is taxed on a net basis— income minus any allowable deductions—at the graduated rates that apply to U.S. citizens or residents. Most nonresident aliens are not allowed to claim exemptions of allowances from tax as U.S. citizens and resident aliens can using Form W-4. Employers are to use special withholding methods to compute income taxes on the wages of nonresident aliens in the U.S.

Employees from certain countries, such as India and Canada, may qualify for different tax treatment than employees from other countries.

Social Security in America (USA)

This information is currently being updated for 2024.

Employers are required by the Federal Insurance Contributions Act (FICA) to withhold Social Security and Medicare taxes from their employees’ wages and pay an equal amount as a tax on employers. The amount of FICA taxes owed by both the employer and individual workers is calculated by applying the current FICA tax rate to a worker’s wages. FICA taxes are split into two components: Old Age, Survivors, and Disability benefits (OASDI), and hospital insurance (HI) or Medicare. The OASDI tax portion is applied to a worker’s wages up to a maximum taxable wage base.

The Internal Revenue Service oversees collection of the FICA tax while employers are required to report individual covered wage amounts and FICA tax withheld annually to the U.S. Social Security Administration (SSA). The SSA administers the benefit program. A Social Security number (SSN), issued after an individual applies to SSA, generally can allow for work eligibility in the United States.

Coverage: An employer for FICA coverage purposes is the person or organisation that has the right to control a worker’s performance in terms of both the methods used and results accomplished.

Rates and Thresholds: Generally, employers and employees (through payroll withholding) pay a flat percentage, an equal amount of covered wages, to finance the OASDI or Social Security portion.

The total OASDI tax is 12.4 percent. Employers withhold 6.2 percent of each employee’s wages and other compensation up to $147,000 in 2022 and contribute a matching amount.

The Medicare or Health Insurance (HI) portion of the FICA tax also is a flat percentage: 2.9 percent of an individual’s wages up to $200,000 in a year, paid in equal portions (1.45 percent) from employee wages through withholding and matching employer contributions.

Employers are to withhold an extra 0.9 percent of wages in additional Medicare taxes from individual employee wages that exceed $200,000 a year. There is no employer match for that additional Medicare tax, and employers continue to contribute their 1.45 percent portion on all wage amounts.

Taxable Amounts: Include wages and all tangible and nontangible items received by employees related to services for an employer unless specifically accepted from tax by the federal Internal Revenue Code or Treasury Regulations.

Returns and Remittance: Employers are to withhold taxes from employees and include their contributions to FICA according to the Internal Revenue Service deposit schedule. FICA taxes are included with federal income taxes due in determining deposit frequency.

Employers are responsible for filing annual Forms W-2, Wage and Tax Statement, for each person employed during the calendar year, along with Form W-3, Transmittal of Income and Tax Statements, to the Social Security Administration no later than Jan. 31. Also on Jan. 31, employers are to file Forms W-2 with employees that had reportable wages in the previous year.

Other Taxes

Under the Federal Unemployment Tax Act, employers have the additional obligation to contribute to states and the federal government to fund unemployment trusts. While contributions for the FUTA tax are collected by the Internal Revenue Service, the U.S. Department of Labor, or Labor Department, oversees the nation’s unemployment insurance program, coordinating administration with the states.

Coverage: Unless specifically excluded by law, any services for wages performed on a full or part-time basis are subject to federal unemployment tax, including services provided by most individuals qualifying as employees. Payments for an independent contractor’s services are not subject to taxation.

Rates and Thresholds: Employers are taxed on wages paid to employees up to the federal unemployment taxable wage base of $8,500. All amounts paid that are greater than the wage base are exempt from federal unemployment tax, although most states and other jurisdictions have higher wage bases.

The federal unemployment tax rate is 6 percent enabling the effective FUTA rate to be as low as 0.6 percent.

Registration: The IRS and the Labor Department do not require employers to file separate registration forms. The employer identification number assigned by the IRS is used.

Taxable Amounts: The FUTA taxable wage base refers to the first $8,500 paid in compensation that is taxable under federal unemployment law; the wage base does not refer to the first $8,500 paid regardless of the taxability of the types of compensation received.

Returns and Remittance: Employers generally are required to quarterly remit their federal unemployment taxes to the IRS and annually submit Form 940, Employer’s Annual Federal Unemployment Tax Return to report their federal unemployment tax paid over the course of the year on wages received by each of their employees.

Unlike most of the states and other jurisdictions, for the purpose of federal unemployment tax, there is no form filed quarterly to accompany tax deposits.

Form 940 is filed annually and is due by Jan. 31 of the year after the year for which the form is due. Employers that deposited all FUTA tax when due can file the form by Feb. 10.

Nonresident Social Tax

Some nonresidents can be relieved of social tax contributions depending on visa status and whether the nonresident’s home country has a Social Security totalisation agreement with the U.S.

Reporting Tax in America (USA)

This information is currently being updated for 2024.

For federal taxes, employers file a quarterly Form 941 to reconcile all wages and taxes paid during the three-month periods of Jan-Mar, Apr –Jun, Jul-Sep and Oct-Dec. An annual Form 940 is filed to report and pay Federal Unemployment Taxes due.

Monthly, Quarterly and Year-End processes for state and local jurisdictions vary by Taxing authority. Go to the American Payroll Association website at www.americanpayroll.org and click on Web Links, State & Local Links for more details.

Should corrections have to be made to the W-2, the IRS will typically charge a penalty of $100.00 per corrected W-2. If there is a high volume of corrected W-2 the interest amount may not be as high.

New Employees in America (USA)

This information is currently being updated for 2024.

In the United States, the requirements for new hire reporting are defined under the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) of 1996. Employers are required to report certain information about their new hires to a designated state agency. The primary objectives of this requirement include the enhancement of child support enforcement programs and the reduction of fraudulent unemployment and workers' compensation payments. According to the detailed information provided, the data elements needed for new hire reporting are:

- Employee's name

- Employee's address

- Employee's Social Security number (SSN)

- Date of hire (the date the employee first performs services for pay)

In addition to these federally required elements, it is beneficial to note that employers are encouraged to report the payroll office address if it differs from the Federal Employer Identification Number (FEIN) address

Employers must submit this information for each new hire or rehire. The significance of this reporting extends beyond record-keeping, as the state uses these reports to track down parents who owe child support. Adherence to new hire reporting requirements is crucial for employers to remain compliant with federal and state laws.

All U.S. employers are required to examine and verify the eligibility of each employee to be lawfully employed in the U.S., regardless of the immigration status of the employee. This includes U.S. citizens, permanent residents, and temporary foreign workers. To verify an employee’s status and to show that an employer has complied with the law, Form I-9, Employment Eligibility Verification must be completed for every employee.

Leavers in America (USA)

This information is currently being updated for 2024.

The process for employee turnover (leavers) in the U.S is not as strictly regulated as new hire reporting, but still required precision and adherence to best practices to ensure compliance and protect both the employer and employee.

The key steps typically involve:

- Notification: An employee should provide notice of their departure as specified in their employment contract or company policy

- Final Pay: Ensure accurate calculation of the final paycheck, including any remaining salary, accrued vacation, or paid time off, and any other owed compensations. State laws may dictate the timing for delivering this final pay

- Benefits and Pensions: Address any outstanding benefits, such as health insurance, and contributions to pension schemes. COBRA information must be provided if applicable

- Return of Company Property: Arrange for the employee to return any company-owned equipment, keys, badges, or documents

- Exit Interview: Conduct an exit interview to glean insights that can be used to improve retention and the employee experience

- Revocation of Access: Methodically remove the employee’s access to company systems, buildings, and networks to maintain security

- Document Processing: Finalize any paperwork, such as tax forms or employment termination documents, to formally capture the termination of the employment relationship

- Regulatory Reporting: While there is no federal requirement to report leavers like there is for new hires, it's essential to update your records and report any changes that impact payroll taxes or filings

Some states may require a final wage payment to be issued within a certain timeframe.

Termination Pay

Under federal law, there is no requirement to pay a worker any more than the hours worked at termination of employment. Many states mandate that amounts accrued under paid leave plans must be included in payouts at termination.

In addition, some states require same-day payment of wages to workers terminated from employment for cause, others have a 24-hour period under which employers must calculate and payout the employee’s final pay amount.

Payroll in the USA

It is legally acceptable in the US to provide employees with online payslips.

Reports

There are many rules in place regarding record retention requirements for payroll. The types of records required for retention include Employee Personnel Files, Banking Records for employee payment validation as well and Tax Returns and Tax Payment information submitted to the taxing authorities. Each record type will have its own specific requirement regarding the retention period. Some jurisdictions, such as the Federal Government, also have specific guidelines for maintaining and storing documents electronically.

Recordkeeping

For nonexempt workers, records must show each employee’s full name as used for Social Security purposes, home address, date of birth, sex and occupation, the workweek, the regular rate of pay and any exclusions, the hours worked, straight time earnings, overtime earnings, pay period covered and other details.

Employers generally must retain payroll records and other documents relevant to FLSA compliance for a minimum of three years. However, certain supplementary records such as time cards and work schedules need only be retained for a period of two years.

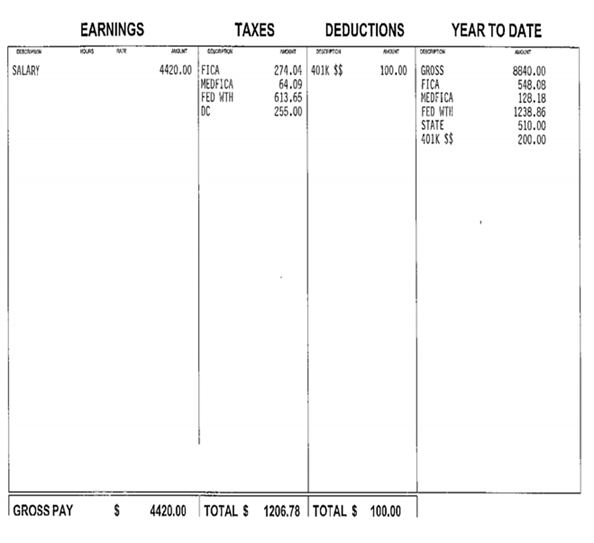

American Payslip Example

Working Days and Working Hours in America (USA)

The working week in the US is Monday to Friday; however, specific workdays and hours can vary based on the nature of the business.

The working day for commercial offices is usually eight hours, typically from 0800 or 0900 hours to 1600 or 1700 hours. Lunch breaks typically range from 30 minutes to one hour.

There is no general maximum number of hours workers can be allowed to work under federal law. Workers in several types of industries, such as long-haul freight truck drivers, have daily hour restrictions set for safety purposes.

Visas and Work Permits in America

This information is currently being updated for 2024.

Resident aliens are treated no differently than U.S. citizens when it comes to withholding and paying payroll taxes on their wages. Nonresident aliens are taxed only on their income derived from U.S. sources.

The terms “immigrant” and “nonimmigrant” and “resident alien” and “nonresident alien” are similar-sounding, but they refer to distinct concepts under U.S. tax and immigration law. A foreign national is classified as an immigrant or nonimmigrant depending on the type of visa issued authorizing the individual to come to the United States.

An individual with an immigrant visa— or green card—has permanent residency status, is permitted to work in the U. S. and is subject to all the various tax requirements. Immigrants who are granted such visas receive a permanent resident card or alien registration receipt card (Form I-551), which is commonly referred to as a green card. Immigrants who are awaiting receipt of their green card have a passport stamped “Temporary I-551. Valid Until [Date].” Green cards must be renewed every 10 years, and immigrants who have held green cards for a certain period can apply for U.S. citizenship.

A nonimmigrant visa is issued to foreign nationals seeking to enter the U.S. for a specific purpose and on a temporary basis. Individuals with nonimmigrant visas may or may not be authorized to work in the U.S. There are numerous types of visas granted to foreign individuals that allow for work, study, and other activities while present in the U.S.

US Working Visa

For professionals there are three main categories.

H1B - Each year the congress announces a quota of how many people can be issued this type of Visa. This quota can often cause controversy as it can run out early in the fiscal year. If it wasn’t for this issue the H1B would be the most used and useful.

L1 - This is the second main type of visa used to bring foreign employees to America. The L1 visa can be used to transfer staff who have been employed for at least one year in the last three by the parent, subsidiary or affiliated companies outside the US.

The table below provides an 'at a glance' summary:

|

Visa |

Designation |

Uses |

Max. Stay |

|

B1 |

Business Visitor |

For business people making sales, conducting negotiations, attending meetings and seeking investments. |

6 months |

|

H1B |

Speciality Occupation Worker |

For individuals having the equivalent of a US bachelor degree (Foreign degrees and/or work experience may be found to be equivalent to a US bachelor degree). |

6 Years |

|

L1A |

Intra Company Transferee |

For executives or managers who have worked for at least one year in the past three for a foreign parent, subsidiary, affiliate, or branch office of the US company that will employ them. |

7 Years |

|

L1B |

Intra-Company/ Transferee |

For specialized knowledge employees who have worked for at least one year in the past three for a foreign parent, subsidiary, affiliate, or branch office of the proposed US employer. |

5 Years |

|

E1 |

Treaty Trader |

For staff to direct and develop import / export trade between the US and the treaty country. |

Indefinite (2 - year increments) |

|

E2 |

Treaty Investor |

For staff to direct and develop investments made in the US by a treaty country national/company. |

Indefinite (2 - year increments) |

|

Permanent residence |

First Preference Priority Worker |

For international managers and executives. Also for aliens with extraordinary ability and outstanding Professors/Researchers. |

Permanent |

|

Permanent residence |

Second Preference Priority Worker |

Professionals with advanced degrees or those with exceptional ability in the sciences, arts or business. |

Permanent |

|

Permanent Residence |

Third Preference Worker |

Professionals with basic degrees, and skilled workers. Also "other workers" who have less than two years of relevant experience. |

Permanent |

|

'TN1' |

Canadian Professional |

For Canadian professionals and managers. |

Indefinite (1 year increments) |

Workers from certain countries are eligible to work in the U.S. under H-2B visas, which cover labor or services of a temporary or seasonal nature in occupations other than agriculture or registered nursing. The number of H-2B visas issued each year is limited by U.S. law.

Certain countries are eligible for the visa waiver program for business visitors, which allows foreign citizens to travel to the U.S. for 90 days or less for business-specific purposes without having to obtain a B-1 business visa. Stays longer than 90 days will require a visa. Individuals may return to the U.S. under the visa waiver program if a “reasonable length of time” has passed. The determination for reasonable length of time is at the discretion of the Department of Homeland Security.

Employment Law in America (USA)

This information is currently being updated for 2024.

The federal Fair Labor Standards Act (FLSA) applies to most workers nationally; separate state labor laws often apply most elements of the FLSA, which is administered by the U.S. Department of Labor, or Labor Department. When there are differences between federal and state provisions, the law that benefits workers the most is to be followed.

In addition to mandating a minimum wage and overtime for certain non salaried, nonexempt workers, the FLSA and Labor Department regulations address special wage rates for tipped workers, compensable time, and the fair and consistent treatment of workers with regard to agreed-upon pay.

The federal Family Medical Leave Act and child labor requirements fall under the FLSA. The Labor Department also oversees the nation’s unemployment insurance system, which involves state labor and employment agencies in its implementation.

The Employee Benefits Standards Administration, also a branch of the Labor Department, oversees the application of mandated and non-mandated health and retirement plans sponsored are arranged through employers.

Employers with 50 or more full-time equivalent employees are required to provide health care coverage that meets a minimum standard of value and that have employee contributions lower than a certain threshold. Penalties for failure to provide adequate health care coverage to full- time workers are in effect.

Fair Labor Standards Act

The Fair Labor Standards Act establishes overtime, minimum wage, and other work-related requirements for employers to uphold. Employers with employees covered by FLSA are required to display a special poster that describes FLSA’s minimum wage, overtime, and equal pay requirements. Many states have separate wage and hour requirements and also require certain notices to be posted at work sites regarding employee wage and hour rights and benefits.

Coverage: The FLSA specifies that covered employment includes arrangements in which one party “suffers or permit” another person to work, although some volunteers may not qualify as covered employees under the act. Independent contractors are not considered employees under the act.

Certain employees qualifying as executive, administrative, professional, outside sales, and computer professionals are exempted from most coverage provisions of the act, specifically for the overtime pay requirement. These workers also are known as “exempt” workers. Those not qualifying as exempt from FLSA provisions remain covered by the law and can be referred to as “nonexempt” employees.

Employees in interstate transportation or shipping also can be exempted from provisions of the FLSA.

Holiday Accrual and Calculations in America (USA)

There is no federal requirement to provide paid leave to workers.

The Family Medical Leave Act requires employers to allow workers to take up to 12 weeks off generally to deal with certain personal qualified medical issues or qualified medical conditions of defined family members. Those workers are allowed to return to their jobs after taking such leave without penalty or retribution. Some states and localities require more time off under their own versions of family leave, or require paid sick leave.

Maternity Leave in America (USA)

Maternity leave in the United States is governed by the Family and Medical Leave Act (FMLA), which entitles eligible employees to take up to 12 weeks of unpaid, job-protected leave per year for specified family and medical reasons, including the birth of a child. Benefits must be maintained during the leave, such as group health insurance coverage under the same terms as if the employee had not taken leave.

The FMLA applies to certain employers and employees only:

- Employers need to have at least 50 employees within a 75-mile radius.

- Employees must have worked for the employer for at least 12 months and have clocked at least 1,250 hours during the 12 months prior to the start of the FMLA leave.

In addition to FMLA, some individual states offer additional benefits. For example, California, Rhode Island, and New Jersey offer paid maternity leave, along with a few other states. The conditions and durations may vary from one state to another.

For federal employees, the Federal Employee Paid Leave Act (FEPLA) provides paid parental leave to Federal employees covered by Title 5 for the birth or placement (for adoption or foster care) of a child.

For employees not covered by the FMLA or state-mandated leave, maternity leave policies may depend on the employer's discretion or may be negotiated as part of employee contracts or benefits packages.

Paternity Leave in America (USA)

In the United States, paternity leave policies aim to support fathers in taking time off work to care for their newborn, adopted, or foster child. The Federal Employee Paid Leave Act (FEPLA) is particularly noteworthy, as it extends paid parental leave benefits to Federal employees covered under Title 5. This legislation is pivotal in allowing eligible federal employees to take leave in connection with the birth or placement of a child for adoption or foster care.

The Family and Medical Leave Act (FMLA) also plays a crucial role in paternity leave, granting eligible employees up to 12 weeks of unpaid leave for various family and medical reasons, including the birth or adoption of a child. To be eligible for FMLA leave, an employee must have worked for a covered employer for at least 12 months and for 1,250 hours during the 12 months preceding the leave. It's important to note that the employer must have at least 50 employees within a 75-mile radius.

Some companies offer paternity leave policies that may vary in terms of eligibility, duration, and whether the leave is paid or unpaid.

Sick leave in America (USA)

Sick pay entitlements are based on the individual employer’s sick pay benefit plans.

Wage Payment

There is no standard pay frequency under federal law and many states have requirements to pay workers on a biweekly or at least on a semimonthly basis.

A basic requirement of the white-collar exemption for executive, administrative, and professional personnel is that employees be paid on a salary or fee basis. Generally, these employees must receive a full week’s pay for a week in which they perform any work, regardless of the number of days or hours worked. Federal regulations also require the amount of pay to be predetermined, and it must not be subject to reduction because of variations in the quality or quantity of the work performed.

Many states have enacted more stringent wage payment laws governing the means and manner the pay is disbursed, with specific requirements on notifying legal deductions from pay along with the disbursement in a pay advice.

National Service

In the United States, there is no mandatory National Service. The youngest US nationals may volunteer is 18 years of age (17 years of age with parental consent) for male and female.

National Minimum Wage in America in 2024

This information is currently being updated for 2024.

The federal minimum wage is $7.25 an hour and remains unchanged since 2009.

For tipped employees, employers only have to pay $2.13 an hour in wages to these workers provided the workers can show and the employer can prove they received at least the balance of the minimum wage ($7.25 an hour) as tips.

Certain subminimum hourly wage rates are allowed in other cases.

While some states and jurisdictions follow the federal minimum wage standard, most have enacted their own minimum wage requirements that are higher than the federal minimum, and many do not allow for a lower rate of cash pay for tipped employees. In those instances, employers are required to pay the higher rate set by the state or local jurisdiction.

National Statutory Holidays in America in 2024

The U.S. has 10 national holidays, but there are no federal or state requirements to pay workers who do not work on those days. States or territories can add to these holidays or substitute others in their places.

Some states require special additional pay to those that are required to work on the holiday.

Below are the statutory national holidays in America for 2024.

|

Holiday Name |

Day |

Date |

|

New Year's Day |

Wednesday |

1 January |

|

Martin Luther King Jr. Day |

Monday |

Third Monday of January |

|

Presidents' Day |

Monday |

Third Monday of February |

|

Memorial Day |

Monday |

Last Monday of May |

|

Independence Day |

Thursday |

4 July |

|

Labor Day |

Monday |

First Monday of September |

|

Columbus Day |

Monday |

Second Monday of October |

|

Veterans Day |

Monday |

11 November |

|

Thanksgiving Day |

Thursday |

Fourth Thursday of November |

|

Christmas Day |

Wednesday |

25 December |

Please note that these dates are typical public holidays observed in the USA and are based on federal holiday schedules.

Employee Benefits in America

This information is currently being updated for 2024.

The United States does not mandate employers to provide bonus payments to employees.

Transportation

Transportation benefits are offered to many employees in larger urban areas where Mass Transit and Van Pooling are offered as an alternative to driving. These rules also cover employer-provided parking.

Expenses

Typically, general expenses would not be integrated in payroll, although some payroll systems may be used to issue reimbursements to employees for some general expenses they have incurred during the course of performing their job. Car mileage reimbursements and Company Cars are subject to specific tax rules and regulations and may require updates to an employee’s tax record.

Retirement Plans

Employers are not required to provide employees with access to retirement or pension plans.

Employers that provide retirement benefits are subject to strict regulation by the Labour Department and the Internal Revenue Service.

Popular deferred compensation retirement plans, which allow employees to contribute to a retirement plan sometimes tax-free, along with tax-free employer contributions, fall under the governance of the Employee Retirement Income Security Act. These plans, allowed under Internal Revenue Code Section 401(k) and others, generally use contributions as investments in various equity (stock) arrangements that do not guarantee a return.

More traditional defined benefit pension plans make up a small percentage of the overall retirement plan offerings by employers. Under these systems, employers designate funds to accounts on behalf of employees, with more likely a guarantee of return at retirement for employees. The government’s Pension Benefits Guaranty Corporation (PBGC), a quasi- government organization established by ERISA, ensures pensioners receive at least a portion of this benefit if companies can no longer adequately fund the plan.

Worker’s Compensation

All states require employers to provide insurance to cover incidents of workplace injury. Employer rates and benefit amounts are determined by the state.

Key updates in 2024 in America

In America (USA), there have been several key changes to income tax, social security, and employment law that came into effect in 2024:

Income Tax

The IRS continues to make improvements in managing individual tax returns. The 2024 tax filing season will begin on January 29th of the year, with the IRS accepting and processing the 2023 tax returns. An important announcement for the tax year 2024 is that the maximum Earned Income Tax Credit amount increases to $7,830.

Social Security

Improvements in the financial situation of the Social Security Program are ongoing, with one such strategy being the repeal of federal taxation on benefits. Another noteworthy change is that the maximum taxable earnings for Social Security will rise to $168,600 in 2024, from $160,200 in 2023. This is part of ongoing adjustments to keep up with changes in price and wage levels.

Social Taxes

On a related note, the changes in Social Security also reflect on social taxes. The increase in maximum taxable earnings for Social Security means a heightened cap for Social Security taxation in 2024.

Employment Law and Employee Benefits

The information provided does not cover specific updates about Employment Law and Employee Benefits for 2024. For this, it's recommended to check with authoritative sources like the Department of Labor, the IRS, or an employment law attorney for the most accurate, current information.

Notes

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

State Income Taxes in America (USA)

This information is currently being updated for 2024.

Forty-one states, Puerto Rico and the District of Columbia (Washington, D.C.) require employers in those jurisdictions to withhold income taxes on earnings by employees.

Only Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming have no state income tax. Nevada and New Hampshire impose payroll-related taxes on employers.

Coverage: Most states with income taxes have adopted the federal definition of employer. Commonly, an employer required to withhold state income tax is an entity that does business within the state, pays wages to one or more persons for services rendered in the state, maintains an office or other place of business within the state, and derives income from within the state.

State coverage extends to state residents working inside and outside the state and to nonresidents performing services in the state.

Rates and Threshold: Tax rates and thresholds are set by the states.

Registration: Each state has separate registration requirements for employers. Many states allow registration online. Often, the employer’s federal tax identification number is used as the state identification number.

Returns and Remittance: Each taxing state sets its own schedule for remittances—some generally follow the federal tax remittance schedules. Virtually all states will accept payment by EFT, and some mandate electronic tax payments.

All taxing states have quarterly and annual reporting requirements. Employers must provide statements to employees showing amounts paid and amounts withheld. Most states that have income taxes generally accept the federal Form W-2, Wage and Tax Statement. There are boxes on that form specifically designated for state and local wage and tax reporting. Many states allow employers to report online, and some states combine quarterly income tax reporting with their unemployment insurance reports. Forms W-2 usually must be distributed to employees by Jan. 31 of the next year.

Penalties: Employers can be found personally liable for income tax that should have been withheld from employees’ wages and can be subject to civil and criminal penalties for failing to withhold taxes as required, or for failing to make required reports and pay withheld taxes. In addition to any other penalties, interest is charged on taxes that are not paid on time.

State Unemployment Insurance Taxes

All states, the District of Columbia, Puerto Rico and the U.S. Virgin Islands are required to participate in the nation’s unemployment insurance system. Provisions of the Federal Unemployment Tax Act.

State unemployment compensation laws are largely dictated by FUTA requirements, especially in regards to coverage provisions. However, state laws vary in their tax structure, benefit qualifying requirements, benefit amounts, disqualification provisions, and charging provisions. Unlike the federal unemployment program, employers must pay state contributions quarterly, and employer tax rates may vary each quarter depending on social cost factors and funding charges.

Coverage: Most states have adopted similar coverage standards to those under FUTA to meet requirements necessary for federal approval of state laws. Employers in states having federally- approved laws can get credit against the tax imposed under FUTA for taxes paid to the state.

Generally, if services are performed entirely within one state, the services are covered by that state. In cases where an employee works in “multiple states” the following steps are followed to determine the correct unemployment state; 1) state where Base of Operation is located; 2) state where employee takes direction and control. If the employee does not perform work in either of the states noted in 1) or 2), then his/her state of resident would be the covered state for unemployment.

Additionally, all states extend coverage to U.S. citizens performing services outside the United States (except Canada, see Treaty Arrangements below).

Rates and Thresholds: State taxable wage bases or limits must be equal to or exceed the federal taxable wage base of $7,000. Most states have wage bases that exceed the federal amount.

Taxable Amounts: The states vary in the types of payments they exclude as taxable wages. Most states exclude certain group insurance payments that an employer may make on behalf of employees and their dependents because of sickness or accident disability, medical or hospitalization expenses, or death. Most of the payments excluded are also excluded under federal law.

Returns and Remittance: Payment and reporting obligations vary according to individual state and jurisdictional requirements, but all states require quarterly wage reports listing individual workers and their wages earned for that period.

Separation reports are also required when an employee leaves the employer.

Want to learn more about payroll, tax, social security and more?

Register free today to get the latest up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Let’s partner

By scaling your team, streamlining it, or simply ensuring your people are taken care of, we bring absolute clarity to your global business. Click below and find out what a partnership with activpayroll looks like.