As it deals with the coronavirus outbreak, the Danish government has announced a range of measures for payroll.

Danish Prime Minister Mette Frederiksen has announced emergency measures to manage the spread of coronavirus. Many of the measures are designed to help businesses in Denmark and specifically affect tax payments and payroll administration.

While the measures are not yet in legal effect, employers in Denmark should ensure they understand their responsibilities and how their businesses will be affected when legislation is passed.

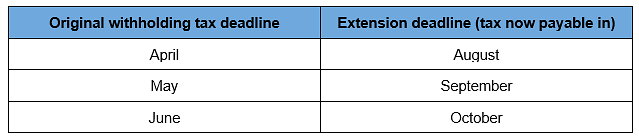

Extension of withholding tax deadlines:

Danish withholding tax is normally due at the end of the month, or on the 10th of the following month depending on a business’ size. Under the incoming emergency measures, the withholding tax deadline will be extended by 4 months:

VAT payment extension:

Large companies, that make monthly VAT payments, will have an extension of 30 days for the payment periods of March, April and May.

Corporation tax payments:

A preliminary corporation tax payment for Danish businesses is due on 20 March. The payment rate will be based on projected 2020 profits. Given the significant disruption that coronavirus will bring to the business landscape, those projections may no longer be accurate.

Accordingly, the government has announced that it will be possible for Danish businesses to adjust their projections and rates to manage the impact of the virus.

Further business measures

Beyond those specifically affecting payroll, further measures for businesses have been and will be introduced. On 11 March, Denmark experienced a significant jump in confirmed coronavirus cases which, according to the Danish Patient Safety Authority, reached 442 with 1,303 people in quarantine.

In response, the Prime Minister announced that all public sector employees in Denmark not performing critical functions would be sent home from Friday 13 March. Similarly, private sector employees were advised to work from home as much as possible. All kindergartens, schools, and universities in Denmark have been closed for two weeks, and all indoor events with more than 100 participants have been banned.

To help Denmark’s businesses manage the consequences of the coronavirus outbreak, the government has already agreed an aid package of tax breaks worth around $20 billion.

Frederiksen has acknowledged that the coronavirus measures are dramatic, but emphasised the importance of following government advice during the crisis to help mitigate the virus’ impact: “This will have huge consequences, but the alternative would be far worse. Under normal circumstances, a government would not present such far-reaching measures… but we are in an extraordinary situation.”

For more information on Denmark’s payroll system, explore activpayroll’s Global Insight Guide to Denmark.