In 2019, Egypt made a number of changes to its social security system: what should employers and payroll teams know?

Following the political transitions of the last decade, Egypt enacted a number of social and economic reforms, including changes to the country’s social security system. Some of the most recent changes, introduced from the beginning of 2019, affect social security contributions for both employers and employees.

If you are an international employer with business interests in Egypt, or are thinking of taking your first business steps into the country, it’s important that you understand how the country’s social insurance system works, and how your payroll should handle your obligations to it...

Social Security in Egypt

After its emergence as a republic in 1953, Egypt’s social insurance system became one of the most comprehensive in the Middle East. Although Egypt faced social challenges throughout the 20th and early 21st centuries, its social protections nonetheless expanded to cover all citizens working in both the private and public sectors. Today, social security for employees in Egypt covers:

● Pension funds

● Disability and death insurance

● Occupational accident insurance

● Sickness and injury insurance

● Unemployment insurance

● Social care for pensioners and the elderly

Changes to Egyptian Social Security in 2019

In 2019, the Egyptian government introduced two significant changes to its social security system concerning the mandatory monthly contributions due from employees and employers. Contributions to social security are made up of two components - fixed contributions for salaries under a certain earnings threshold, and variable contributions for salaries above that threshold.

Monthly Variable Cap: From 1 January 2019, the monthly cap for variable social security contributions was raised by 20%, to EGP 4,040. Both employees and employers contribute to variable social security at a rate of 11% and 24% respectively.

Monthly Fixed Cap: From 1 July 2019, the cap for the fixed basic salary contribution rate was raised to EGP 1,670 (from EGP 1,510). Employee and employer contributions at the fixed basic rate are 14% and 26% respectively.

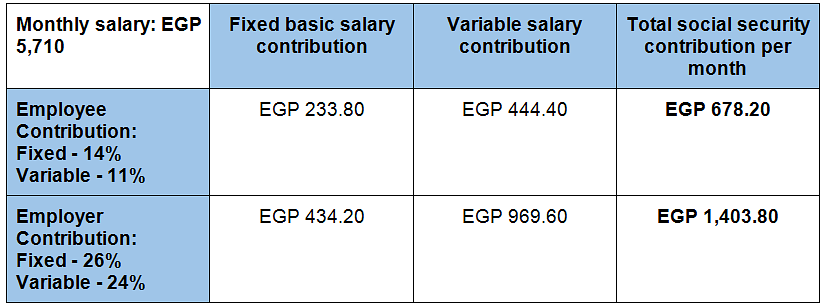

Accordingly, social security contributions due from a total monthly salary of EGP 5,710 - broken down between the EGP 1670 basic cap and the EGP 4,040 variable cap - are as follows:

Employers in Egypt are required to withhold social security contributions during payroll and remit that money to the Social Insurance Organisation.

International Businesses

International Employers with expatriate employees in Egypt should be aware of exceptions to the social security contribution regulations. Foreign employees working in Egypt only contribute to the country’s social insurance if:

● A bilateral agreement exists between the foreign employee’s origin country and Egypt which allows them to participate in the social security system.

Or,

● The foreign employee is contracted to work for longer than one calendar year.

With both the change to the variable cap (1 January 2019) and the change to the fixed cap (1 July 2019) now in effect, it is important that foreign employers ensure their payroll has adapted to, and is operating in compliance with, the new regulations going forward.

For more information on Egypt’s tax and social security regimes, browse activpayroll’s dedicated Egypt Global Insight Guide.