India has further extended its income tax deadlines for AY 2021-22: what should taxpayers know about the new dates?

The Indian government has extended its tax filing deadlines for the second time in 2021. The decision to extend the deadlines was made in response to financial challenges created by the Covid-19 pandemic and as a result of significant glitches in India’s electronic filing system. Those glitches involve difficulties logging into the platform, data retrieval failures involving older tax returns, password generation problems, and a range of calculation and identity verification errors.

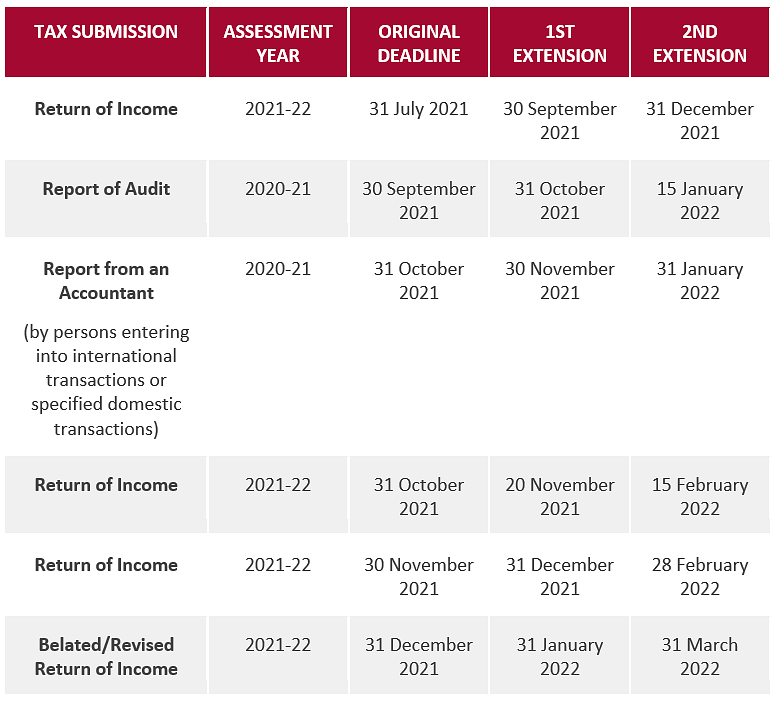

What Are India’s New Tax Deadlines?

The deadlines for the adjusted tax submissions are as follows:

The new deadlines were set out in India's Income Tax Department Circular publication - specifically No.9/2021 dated 20.05 2021.

Tax penalties: Taxpayers that miss the new deadlines will have to pay a penalty upon making their belated submission.

Persons with income that does not exceed the exemption limits set out under Section 234F of the income tax regulations will not incur a penalty. The applicable exemption limit depends on the Indian tax regime that a taxpayer has chosen:

- Under the new tax regime, the limit is up to Rs 2.5 lakh

- Under the old tax regime, exemption limits depend on age

- For taxpayers under 60 years of age, the limit is up to Rs 2.5 lakh

- For taxpayers aged from 60 to 79 years of age, the limit is up to Rs 2 lakh

- For taxpayers aged 80 years and over, the limit is up to Rs 5 lakh

It is important to bear in mind that certain taxpayers must submit income tax returns regardless of their income amount. These individuals are set out in Section 139(1) of the income tax regulations and include:

- Individuals that have deposited amounts collectively exceeding Rs 1 crore in their bank accounts

- Individuals who have incurred an expenditure of over Rs 23 lakh for themselves or anyone else for travel to a foreign country

- Individuals who have incurred an expenditure of over Rs 1 lakh in relation to the consumption of electricity

- Individuals who fulfil any other conditions prescribed in Indian law

For more information on India’s tax and payroll system, browse activpayroll’s Global Insight Guide to India.