Further to the proposed changes to resident individual income tax rate as tabled in Revised Malaysia Budget 2023 on 24 February 2023, the Inland Revenue Board of Malaysia (IRBM) has announced that the new income tax rates for monthly tax deduction calculation is now effective starting 1 June 2023.

This is in line with the gazette of Finance Act 2023 on 31 May 2023. The Act amends the Income Tax Act 1967, the Real Property Gains Tax Act 1976, the Stamp Act 1949, the Petroleum (Income Tax) Act 1967 and the Finance Act 2018.

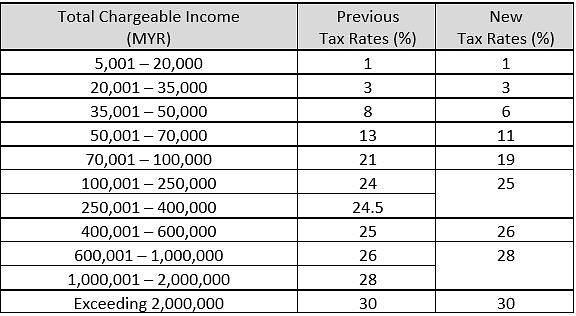

Changes to the rate are as follows:

Updated guideline of ‘Specification for MTD Calculations Using Computerised Calculation for 2023’ as of 1 June 2023, is available on IRBM official website at https://www.hasil.gov.my.

Please be advised that the new rate will be reflected in June 2023 wages computation, while for payroll finalized before the IRBM announcement the tax calculation shall be adjusted accordingly in July 2023 wages.

If you’ve got any questions on income tax in Malaysia or are interested in doing business in the country contact us for more information and advice.