This guide highlights all the recent updates of interest to employers.

Defined Benefit Schemes Delay Transfers

The Pension Regulator (TPR) has released new guidance which will allow employers to temporarily cease their defined benefit (DB) responsibilities for a period of up to three months. DB schemes will also be able to delay member requests to transfer out of the scheme for the same period.

The moves aim to provide trustees with a longer timeframe in which to calculate Cash Equivalent Transfer Values (CETVs), due to the economic uncertainty caused by coronavirus. There have been significantly more requests for CETVs which has placed pressure on the teams responsible for providing such calculations. It is hoped that the three-month delay will give schemes sufficient time to focus on other tasks such as pension payroll and retirement quotations.

Rules on Carrying Over Annual Leave Relaxed for Key Industries

On Friday 27 March 2020, Business Secretary Alok Sharm, introduced new measures regarding the carrying over of annual leave. Workers who have not taken all of their statutory annual leave entitlement due to COVID-19 will now be able to carry it over into the next two leave years.

As it currently stands, almost all workers in the UK are entitled to 28 days holiday (including bank holidays) every year. However, most of this entitlement cannot be carried between leave years, meaning workers lose their holiday if they do not take it.

Employers are obliged to ensure their workers take their statutory entitlement in any one year, failure to do so could result in a financial penalty.

The regulations will allow up to four weeks of unused leave to be carried into the next two leave years, easing the requirements on business to ensure that workers take the statutory amount of annual leave in any one year. This will mean staff can continue working in the national effort against the coronavirus without losing out on annual leave entitlement. The changes will also ensure all employers affected by COVID-19 have the flexibility to allow workers to carry over leave at a time when granting annual leave could leave them short-staffed in some of Britain’s key industries, such as food and healthcare.

Which Expenses are Taxable for Employees Working from Home Due to Covid-19?

HMRC has published guidance that discusses which equipment, services or supplies are taxable if employees are working from home due to coronavirus.

Who is Affected?

You may be affected if any of your employees are working from home due to coronavirus, either because:

- your workplace has closed

- they are following advice to self-isolate

Who is Not Affected?

Furloughed workers who are eligible for the Coronavirus Job Retention Scheme.

Type of Equipment, Service or Supply

Mobile phones and SIM cards (no restriction on private use)

If you provide a mobile phone and SIM card without a restriction on private use, limited to one per employee, this is non-taxable.

Broadband

If your employee already pays for broadband, then no additional expenses can be claimed.

If a broadband internet connection is needed to work from home and one was not already available, then the broadband fee can be reimbursed by you and is non-taxable.

In this case, the broadband is provided for business and any private use must be limited.

Laptops, tablets, computers, and office supplies

If these are mainly used for business purposes and not significant private use, these are non-taxable.

Reimbursing expenses for office equipment your employee has bought

This is taxable and should be reported on your PAYE Settlement Agreements.

Additional expenses such as electricity, heating or broadband

Payment or reimbursement to your employees of up to £4 a week (£6 a week from 6 April 2020) is non-taxable for the additional household expenses incurred when your employee is working from home.

If the claim is above this amount, then your employee will need to:

- check with you beforehand to see if you will make these payments

- keep receipts

Employer provided loans

A salary advance or loan to help your employee at a time of hardship counts as an employment-related loan.

Loans provided with a value less than £10,000 in a tax year are non-taxable.

Temporary accommodation

If your employee needs to self-isolate but cannot do so in their own home, you can reimburse hotel expenses and subsistence costs, these are taxable.

Further information on accommodation expenses.

Employees using their own vehicle for business

You can pay approved mileage allowance payments of 45p per mile up to 10,000 miles (25p per mile thereafter) free of tax and National Insurance contributions.

If you do not pay mileage allowance, your employee can claim tax relief through their Personal Tax Account.

Further information on approved mileage allowance payments.

Significant Private Use

For items which are taxable, exemptions for work related benefits must show that there is no significant private use.

HMRC accepts that where:

- your policy about private use is clearly stated to your employee and sets out the circumstances in which private use may be made (this may include making the conditions clear in employment contracts or asking employees to sign a statement acknowledging company policy on what use is allowed and any disciplinary consequences if the policy is not followed)

- any decision of the employer not to recover the costs of private use is a commercial decision, rather than rewarding your employee

Significant private use should not be based on the time spent on different uses. It should be based on your employee’s duties and the need for them to have the equipment or services provided so they can do their job.

Record keeping

You do not have to keep detailed records of every instance of private use to prove a claim for exemption.

The Coronavirus Business Interruption Loan Scheme (CBILS)

The following information is taken from the British Business Bank CBILS webpages.

The Coronavirus Business Interruption Loan Scheme (CBILS) provides financial support to smaller businesses (SMEs) across the UK that are losing revenue, and seeing their cashflow disrupted, as a result of the COVID-19 outbreak.

The scheme is part of a wider package of government support for UK businesses and employees.

How it Works

British Business Bank operates CBILS via its accredited lenders. There are over 40 of these lenders currently working to provide finance. They include:

- high-street banks

- challenger banks

- asset-based lenders

- smaller specialist local lenders

A lender can provide up to £5 million in the form of:

- term loans

- overdrafts

- invoice finance

- asset finance

CBILS gives the lender a government-backed guarantee for the loan repayments to encourage more lending.

The borrower remains fully liable for the debt.

The Big Four banks have agreed that they will not take personal guarantees as security for lending below £250,000.

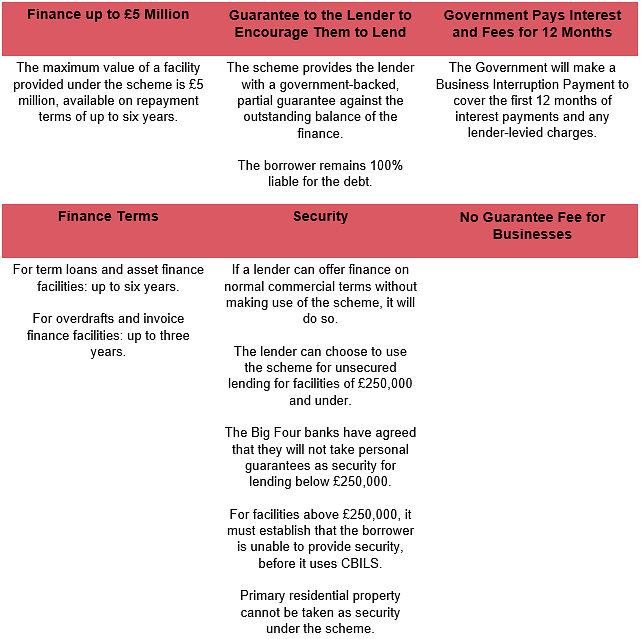

Key features of the scheme can be found in the table below: